Closing Bell: Gold stocks rally but ASX slumps 0.45pc

ASX gold stocks were doing the heavy lifting on the ASX today, but weren’t able to arrest a 0.45pc dip. Pic: Getty Images

- ASX slides 0.45pc, falling from new 50-day high

- Gold and resources stocks temper losses

- Info Tech sector leads market down

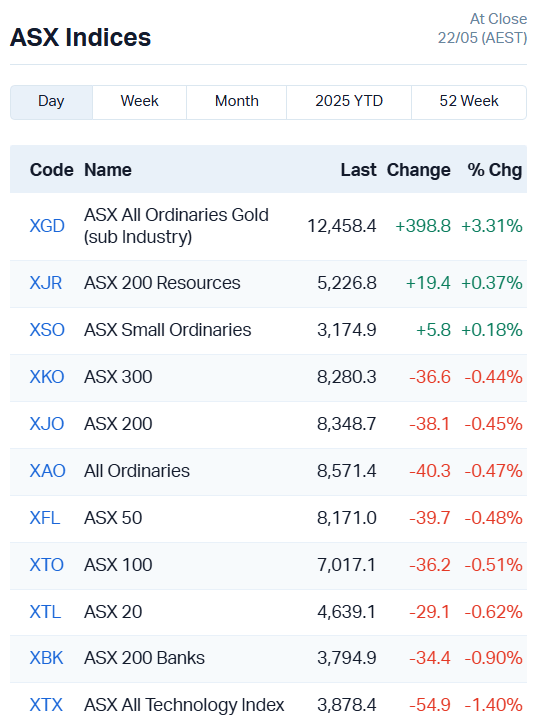

After a month of almost uninterrupted gains, the ASX has taken a dip today, shedding 0.45%.

The combination of Moody’s downgrade and Trump’s big tax cut bill smashed treasury bonds last night, doing real damage to America’s reputation as a safe haven investment with exceptional returns.

Wall Street took a dive and, while European stocks appear to be biding their time, the ASX followed suit.

That said, we certainly haven’t been hit with full percentage+ losses the way the US has, indicating this is more of a measured profit-taking and pullback, rather than a panicked down-selling.

While we’re very exposed to general global market sentiment as a commodity-heavy market and economy, we’ve also got an out-sized exposure to gold prices.

As uncertainty climbs, so does gold (Bitcoin, too for that matter – see today’s Lunch Wrap), giving our market a little support despite the downturn in the global trading mood.

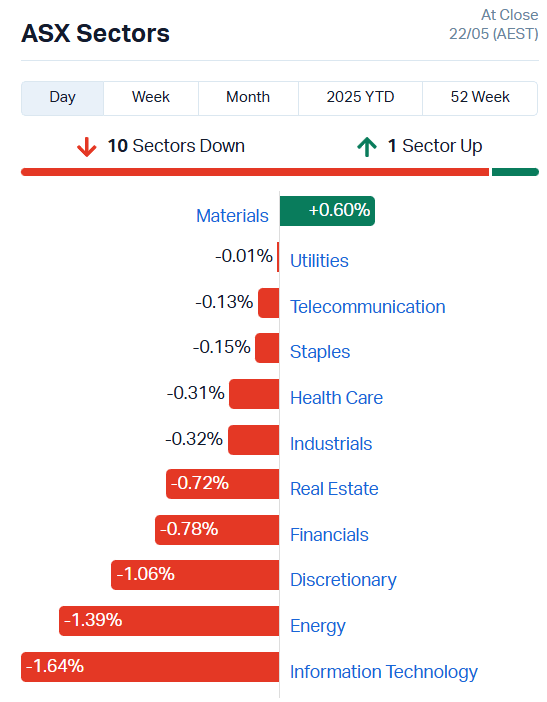

In fact, our resources sector was the only one in the green today, adding 0.60% in a sea of red.

The ASX All Ord Gold index made it pretty clear which commodity stocks were the main drivers of growth, up 3.31% after adding almost 5% yesterday.

While that kept us from suffering greater declines to the broader market, gold stocks alone weren’t enough to push the ASX into the green.

Is this the beginning of a bear market?

It’s hard to say whether current weakness in the US is a new trend, or just an overreaction, but the US bonds market is not offering much optimism.

10-year yields are approaching 5% (currently around 4.594%), nearing heights not seen since the Global Financial Crisis in 2007.

When bond yields approach market gain averages, investors tend to sell securities to buy them. Why take a risk on 7% when you’re all but guaranteed a 5% return?

Of course, sentiment around US government debt isn’t the brightest right now, either.

Trading results over the next few days – and the fate of Trump’s tax cut bill – will be an interesting study.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NWC | New World Resources | 0.047 | 68% | 1.96E+08 | $99,155,888 |

| CP8 | Canphosphateltd | 0.031 | 55% | 835534 | $6,135,211 |

| EDE | Eden Inv Ltd | 0.0015 | 50% | 272000 | $4,109,881 |

| POD | Podium Minerals | 0.034 | 36% | 4941018 | $17,035,265 |

| OVT | Ovanti Limited | 0.004 | 33% | 3234919 | $8,380,545 |

| MKL | Mighty Kingdom Ltd | 0.012 | 33% | 1291574 | $4,375,275 |

| D3E | D3 Energy Limited | 0.078 | 30% | 288546 | $4,768,500 |

| FNR | Far Northern Res | 0.155 | 29% | 192427 | $4,831,899 |

| FGH | Foresta Group | 0.009 | 29% | 1505107 | $18,570,345 |

| OCN | Oceanalithiumlimited | 0.068 | 26% | 2475888 | $7,424,805 |

| AHN | Athena Resources | 0.005 | 25% | 16926785 | $9,063,828 |

| CR9 | Corellares | 0.0025 | 25% | 350000 | $2,011,213 |

| SHP | South Harz Potash | 0.005 | 25% | 1029710 | $4,410,915 |

| TAS | Tasman Resources Ltd | 0.02 | 25% | 141962 | $2,946,282 |

| RAU | Resouro Strategic | 0.2 | 21% | 37615 | $6,894,990 |

| MGA | Metalsgrovemining | 0.093 | 19% | 279855 | $8,222,760 |

| HIO | Hawsons Iron Ltd | 0.016 | 19% | 10278585 | $13,722,768 |

| THB | Thunderbird Resource | 0.013 | 18% | 8259117 | $4,067,156 |

| XPN | Xpon Technologies | 0.013 | 18% | 570666 | $4,556,785 |

| WEC | White Energy Company | 0.033 | 18% | 100 | $8,725,357 |

| TMG | Trigg Minerals Ltd | 0.054 | 17% | 49275702 | $42,498,015 |

| OMA | Omegaoilgaslimited | 0.245 | 17% | 918317 | $72,056,713 |

| BLU | Blue Energy Limited | 0.007 | 17% | 277500 | $11,105,842 |

| CRR | Critical Resources | 0.0035 | 17% | 1653089 | $7,842,664 |

| GBE | Globe Metals &Mining | 0.028 | 17% | 125000 | $16,671,672 |

Making news…

Bonanza-grade gold from outside the current resource boundary has pushed Far Northern Resources (ASX:FNR) shares higher, after the company hit 3m at 34.71 g/t gold from just 12m of depth in drilling at the Bridge Creek mining lease.

The company has extended the gold footprint at Bridge Creek by 400m to the south and 80m to the north, with plenty of potential to grow the mineral resource of 93,000 ounces of gold.

Tasman Resources (ASX:TAS) shareholders jumped at the chance to invest in a one for one pro rata renounceable entitlement offer today, despite being offered at $0.20 per share, a premium to TAS’s opening price of $0.16 this morning.

TAS wants to use the additional funds for a drilling program at the Parkinson Dam project, host to a variety of iron oxide-copper-gold, epithermal and porphyry mineralisation.

Back in 2007, a discovery hole at Parkinson Dam graded up to 21m at 21g/t gold and 83 g/t silver, with a higher-grade component of 9m at 31g/t and 152 g/t silver.

Now that both gold and silver prices have appreciated significantly, TAS is looking to invest time with the drill bit to find an economically sized deposit on the tenure.

Trigg Minerals (ASX:TMG) hosted a webinar with its executive team today, giving an overview of its acquisition of the Antimony Canyon Project in Utah, US.

With antimony prices up more than 400% from last year, and a non-JORC resource of 100,300 tonnes of the defence-relevant critical mineral, investors seem keen to capitalise on the opportunity.

Omega Oil & Gas (ASX:OMA) says fresh results from its Canyon-2 well have confirmed a large oil and gas system in Queensland’s Taroom Trough, strengthening the case that it’s sitting on a serious commercial opportunity. High-quality logging has revealed thicker and better-quality reservoir zones than first thought, with both oil and gas intervals now clearly identified.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| BP8 | Bph Global Ltd | 0.002 | -33% | 467992 | $3,152,954 |

| LNR | Lanthanein Resources | 0.001 | -33% | 2200000 | $3,665,454 |

| WEL | Winchester Energy | 0.002 | -33% | 2054526 | $4,089,057 |

| GES | Genesis Resources | 0.007 | -30% | 48446 | $7,828,413 |

| CTO | Citigold Corp Ltd | 0.003 | -25% | 623920 | $12,000,000 |

| SFG | Seafarms Group Ltd | 0.0015 | -25% | 2594198 | $9,673,198 |

| SIS | Simble Solutions | 0.003 | -25% | 200123 | $3,505,321 |

| TMK | TMK Energy Limited | 0.003 | -25% | 5753146 | $40,889,532 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 22572 | $13,153,701 |

| CRI | Criticalim | 0.013 | -24% | 27172022 | $45,703,626 |

| ASR | Asra Minerals Ltd | 0.002 | -20% | 6092595 | $6,916,340 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 4299647 | $15,867,318 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 1003137 | $4,349,768 |

| PFT | Pure Foods Tas Ltd | 0.016 | -20% | 214463 | $2,708,512 |

| ROG | Red Sky Energy. | 0.004 | -20% | 3511822 | $27,111,136 |

| UNT | Unith Ltd | 0.009 | -18% | 15138786 | $13,516,640 |

| BIT | Biotron Limited | 0.0025 | -17% | 565000 | $3,981,738 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 51847 | $9,033,947 |

| FBR | FBR Ltd | 0.005 | -17% | 4300262 | $34,136,713 |

| NES | Nelson Resources. | 0.0025 | -17% | 250000 | $6,515,783 |

| RC1 | Redcastle Resources | 0.005 | -17% | 8426990 | $4,461,401 |

| TEG | Triangle Energy Ltd | 0.0025 | -17% | 1820606 | $6,267,702 |

| IAM | Income Asset | 0.021 | -16% | 1065936 | $23,271,771 |

| RMI | Resource Mining Corp | 0.022 | -15% | 11859912 | $17,300,549 |

| AZ9 | Asianbatterymet PLC | 0.028 | -15% | 1528797 | $12,883,725 |

BPH Global (ASX:BP8) has revealed its intention to manufacture probiotic green seaweed water in an R&D project with Singapore Polytechnic, using kefir fermentation.

The company reckons its probiotic drink could support blood sugar management, improve digestion, gut microbiome balance and immune function. The drink promises to be a fusion of traditional Chinese medicine and science-driven product development.

Critica (ASX:CRI), a mining company with a focus on rare earths, has waved goodbye to managing director Philippa Leggat.

In her year with the company, she oversaw the release of a maiden resource estimate at the Jupiter rare earths project, confirming its position as the largest clay-hosted rare earth deposit in Australia.

Chief geologist and exploration manager Dr Stuart Owen will take over as interim CEO, while CFO and company secretary Jamie Byrde will support the transition as executive director as the company searches for a new MD.

IN CASE YOU MISSED IT

Dimerix (ASX:DXB) has received the green light to continue its ACTION3 clinical trial unchanged, after the completion of a sixth independent data-monitoring committee review.

The IDMC said there were no safety concerns to date, with the next scheduled meeting planned for the fourth quarter of 2025.

“This encouraging recommendation of the IDMC confirms the strong emerging safety profile of DMX-200 and suggests that DMX-200 does not add a burden of side effects to patients, compared to commonly used treatments such as high dose steroids and immunosuppressants,” Dimerix chief medical officer Dr David Fuller said.

HyTerra (ASX:HYT) has officially kicked off drilling into the Blythe 13-20 well at its Nemaha Project in the US state of Kansas.

Anson Resources (ASX:ASN) has had a big win with the Green River City Council in Utah for a Community Benefits Agreement.

New World Resources (ASX:NWC) received a premium $185 million acquisition offer from London-based Central Asia Metals (LON: CAML) to snap up NWC and its Antler copper project in the Grand Canyon State of Arizona.

Trading Halts

OncoSil Medical (ASX:OSL) – cap raise

Nordic Resources (ASX:NNL) – cap raise

Patriot Lithium (ASX:PAT) – cap raise

Horizon Minerals (ASX:HRZ) – cap raise

New Age Exploration (ASX:NAE) – exploration results from the Wagyu Gold project, WA

Jameson Resources (ASX:JAL) – cap raise

Ma Financial (ASX:MAF) – a potential significant transaction

At Stockhead, we tell it like it is. While Dimerix, Hyterra, Anson Resources and New World Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.