Closing Bell: Gold stocks limit broad market slide

ASX gold stocks are locked in, putting in a real effort to limit broader market losses as prices hover at all time highs. Pic: Getty Images

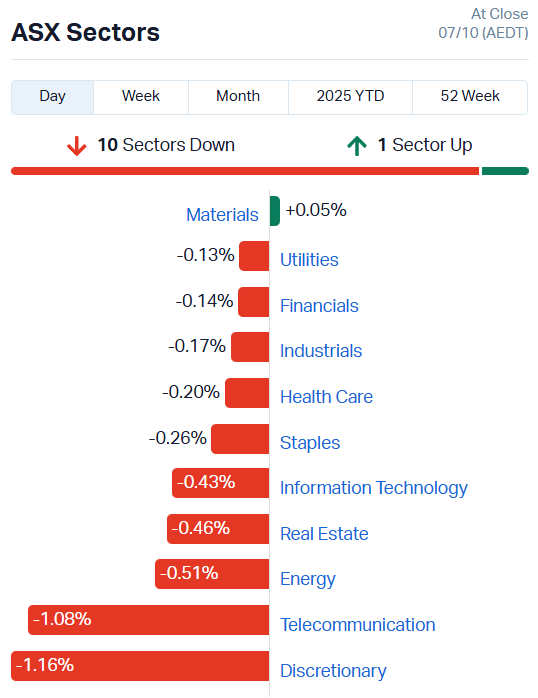

- ASX slides 24.6 points with 10 of 11 sectors lower

- Materials sector squeaks into green on gold gains

- Resources stocks limit broad losses

Gold miners do the hard yards

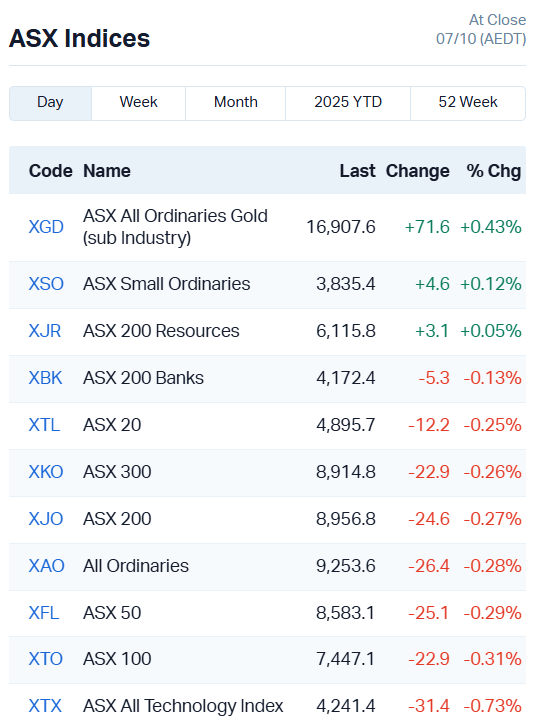

The ASX 200 moved broadly lower today, down 0.27% on general market weakness. This afternoon the market lifted from the worst levels, recovering from a session low of -0.49%.

With 10 of 11 sectors in the red, we have our gold miners to thank that the damage wasn’t far deeper.

Materials was the only sector to keep it positive, with the XGD, resources-heavy Small Ords and ASX 200 Resources the only indices to post gains.

Gold futures have retreated marginally after touching the fabled US$4000 an ounce mark briefly, hovering around US$3984 an ounce at present.

The general market malaise seems to be coming from fears over interest rate cut delays.

The RBA’s less-than-hawkish comments last month plus a Dovish new Japanese Prime Minister and turmoil in French politics threw a little too much chaos into the mix for investors.

At the same time, with ASX all-time highs just over 1% away, the market might not have the momentum to sustain new levels.

Back to our stock movements for the day, there was plenty of it in gold and copper.

Greatland Resources (ASX:GGP) jumped 9.5%, Bougainville Copper (ASX:BOC) 8.9% and Predictive Discovery (ASX:PDI) 8.33%.

Outside of resources, a few stocks managed to shine despite their sectors’ losses.

Weebit Nano (ASX:WBT) climbed 7.11% after releasing a new set of ReRAM test chips to manufacturing yesterday.

Fellow techie ERoad (ASX:ERD) continued its stellar run, up 7.21% today and 154% for the year, and Autosports Group (ASX:ASG) added 7.14% after acquiring Mercedes-Benz Canberra last week.

Bitcoin tests fresh highs

Just last month Stockhead asked the question – Is Bitcoin the 21st century’s digital gold?

It’s certainly looking that way.

BTC hit another all-time high today after gaining in the last 9 of 11 sessions. A single Bitcoin was trading at US$126,272 overnight.

The demand paradigm has also undergone an interesting – and bullish – transformation.

Rather than the highly leveraged buys of yesterday, much of today’s price gains are being pushed by institutional demand from the broader stock market.

According to Bitbo, US Bitcoin ETFs added US$1.323 billion in the first week of October alone.

As Market Index’s Kerry Sun pointed out in the ASX 200 Live blog today, it’s a symptom of “genuine buying pressure rather than leveraged speculation, a healthier foundation for sustained price appreciation”.

Bitcoin was trading at US$124,512 each at time of writing.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PFT | Pure Foods Tas Ltd | 0.044 | 91% | 14132530 | $3,229,789 |

| VHM | Vhmlimited | 0.37 | 57% | 2117917 | $60,159,159 |

| DAF | Discovery Alaska Ltd | 0.021 | 40% | 671992 | $3,513,520 |

| KGD | Kula Gold Limited | 0.043 | 39% | 19472392 | $35,698,580 |

| HAS | Hastings Tech Met | 0.535 | 34% | 2344946 | $83,632,718 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 297206 | $9,763,676 |

| LNU | Linius Tech Limited | 0.002 | 33% | 1481031 | $10,690,790 |

| LSR | Lodestar Minerals | 0.038 | 31% | 5216519 | $24,907,237 |

| IXR | Ionic Rare Earths | 0.022 | 29% | 71698538 | $97,215,653 |

| AN1 | Anagenics Limited | 0.005 | 25% | 2339371 | $1,985,281 |

| AUR | Auris Minerals Ltd | 0.01 | 25% | 542659 | $3,813,008 |

| OCN | Oceanalithiumlimited | 0.155 | 24% | 1686233 | $20,812,048 |

| NH3 | Nh3Cleanenergyltd | 0.1 | 23% | 4909063 | $52,330,079 |

| TMB | Tambourahmetals | 0.16 | 23% | 12378369 | $21,707,220 |

| 1CG | One Click Group Ltd | 0.011 | 22% | 3105711 | $10,640,575 |

| CTO | Citigold Corp Ltd | 0.011 | 22% | 24317553 | $27,000,000 |

| SLZ | Sultan Resources Ltd | 0.011 | 22% | 9818082 | $4,166,458 |

| INR | Ioneer Ltd | 0.22 | 22% | 30669391 | $480,205,736 |

| CGO | CPT Global Limited | 0.084 | 20% | 9864 | $2,932,816 |

| ACE | Acusensus Limited | 1.68 | 20% | 598191 | $197,216,036 |

| AJL | AJ Lucas Group | 0.012 | 20% | 1304252 | $13,757,296 |

| CNJ | Conico Ltd | 0.006 | 20% | 1726000 | $1,360,729 |

| CRR | Critical Resources | 0.012 | 20% | 16828859 | $29,604,604 |

| FCT | Firstwave Cloud Tech | 0.012 | 20% | 5918254 | $18,992,020 |

| TMK | TMK Energy Limited | 0.003 | 20% | 407118 | $29,743,458 |

In the news…

Pure Foods Tasmania (ASX:PFT) is branching out to even more Coles stores, with its Tasmanian Pâté brand now being distributed to 700 stores, a more than 100% increase.

PFT’s sales orders are also booming, with September bringing in 10 times more than the previous month’s averages. The company is forecasting annual sales contributions of somewhere in the $500,000-600,000 range, an uplift of about 15% compared to last year’s numbers.

One Click Group (ASX:1CG) is gearing up to roll out its Little Money Cash Advance product after securing commitments to raise $1.25 million in a placement at $0.01 per share, the same as 1CG’s last closing price.

The online tax, wills and private health insurance company is adding a short term $500 cash advance loan to its product offering, to be repaid within 28 days.

NH3 Clean Energy (ASX:NH3) is on track for a major contract win after inking an MoU with Mitsui O.S.K. Lines and Oceania Marine Energy to develop clean ammonia bunkering operations in the Pilbara.

Mitsui, based in Japan, is one of the largest shipping companies in the world, and takes the crown full stop in terms of tanker shipping. The MoU is asking for 300,000 tonnes per annum of clean ammonia capacity via an integrated supply chain on Western Australian shores.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EQS | Equitystorygroupltd | 0.016 | -43% | 3072574 | $4,951,740 |

| EUR | European Lithium Ltd | 0.165 | -34% | 49837224 | $361,675,259 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 7385787 | $7,009,022 |

| FGH | Foresta Group | 0.027 | -27% | 6529017 | $98,157,539 |

| AUH | Austchina Holdings | 0.0015 | -25% | 3623405 | $6,050,767 |

| MRD | Mount Ridley Mines | 0.003 | -25% | 11494587 | $3,962,868 |

| BEL | Bentley Capital Ltd | 0.013 | -24% | 442144 | $1,294,175 |

| CPO | Culpeominerals | 0.014 | -22% | 27574352 | $9,371,920 |

| RKB | Rokeby Resources Ltd | 0.004 | -20% | 4800000 | $9,129,409 |

| ROG | Red Sky Energy. | 0.004 | -20% | 8225221 | $27,111,136 |

| W2V | Way2Vatltd | 0.008 | -20% | 10513195 | $21,299,462 |

| PGM | Platina Resources | 0.035 | -19% | 4621269 | $27,732,004 |

| ERG | Eneco Refresh Ltd | 0.014 | -18% | 180900 | $4,630,092 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 8050993 | $11,143,423 |

| HPC | Thehydration | 0.01 | -17% | 4803902 | $5,169,611 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 8888 | $5,511,260 |

| PLC | Premier1 Lithium Ltd | 0.01 | -17% | 1557452 | $4,416,727 |

| BBL | Brisbane Broncos | 1.4 | -16% | 62003 | $164,218,057 |

| FME | Future Metals NL | 0.032 | -16% | 6399158 | $36,419,231 |

| GRL | Godolphin Resources | 0.017 | -15% | 2967830 | $11,138,499 |

| OEC | Orbital Corp Limited | 0.265 | -15% | 1433197 | $55,510,284 |

| HIQ | Hitiq Limited | 0.018 | -14% | 24679 | $10,181,482 |

| IS3 | I Synergy Group Ltd | 0.018 | -14% | 328856 | $36,448,967 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 1354133 | $25,220,197 |

| BPM | BPM Minerals | 0.12 | -14% | 395468 | $12,222,046 |

In Case You Missed It

TG Metals (ASX:TG6) has secured a third rig capable of drilling deeper holes to start operations at the Van Uden gold project in mid-October.

Red Mountain Mining (ASX:RMX) has acquired the Silver Dollar antimony project, including a mine that produced ore at an average grade of 17.7%.

Andromeda Metals (ASX:ADN) is shifting gears as it begins pilot-scale test work to demonstrate its HPA process can deliver steady, continuous output.

Core Energy Minerals’ (ASX:CR3) reconnaissance hand auger sampling at the Tunas project in Brazil has uncovered encouraging rare earths grades.

Imagion Biosystems (ASX:IBX) has completed manufacturing of its MagSense HER2 breast cancer imaging agent ahead of its planned Phase II clinical trial.

Javelin Minerals (ASX:JAV) is gearing up for a new diamond drilling program at its Eureka gold project in Western Australia.

Aldoro Resources (ASX:ARN) is preparing to confirm the presence of a large carbonatite intrusive prospective for rare earths at the Omuronga project in Namibia.

Western Gold Resources (ASX:WGR) has raised $6.75m at 12c per share to get its Gold Duke project into production by the end of this year.

Buxton Resources (ASX:BUX) has expanded its Centurion project to more than 667 square kilometres of largely untouched territory in WA’s Great Sandy Desert.

Last Orders

Theta Gold Mines (ASX:TGM) is gearing up to build out its TGME gold project in South Africa after securing a combination of equity and debt funding totalling US$33.9 million.

TGM raised US$7.9 million via a placement to investors, US$15 million from private cornerstone investors, US$1 million from NC New Energy Limited and a debt component of US$10 million from said private cornerstone investors.

The company also intends to offer a share purchase plan to eligible shareholders to raise about US$1.3 million, with participants in both the placement and SPP to be offered 1 free attaching option for every 2.38 shares subscribed for.

Trading halts

1414 Degrees (ASX:14D) – material acquisition and cap raise

Bindi Metals (ASX:BIM) – acquisition and cap raise

Dundas Minerals (ASX:DUN) – cap raise

EVE Health Group (ASX:EVE) – cap raise

GBM Resources (ASX:GBZ) – cap raise

Infini Resources (ASX:I88) – exploration update

Moab Minerals (ASX:MOM) – potential acquisition

NH3 Clean Energy (ASX:NH3) – memorandum of agreement

PainChek (ASX:PCK) – FDA regulatory clearance

Tolu Minerals (ASX:TOK) – cap raise

TrivarX (ASX:TRI) – clinical trial update, acquisition and cap raise

At Stockhead, we tell it like it is. While Weebit Nano is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.