Closing Bell: Gold and small cap stocks prop up ASX after Powell fuels Wall Street rally

A plucky band of small cap and gold stocks have done the hard work holding up the ASX today, resisting banking losses to end flat. Pic: Getty Images

- ASX ends flat after setting new intraday high

- Gold, small caps prop up market in face of bank losses

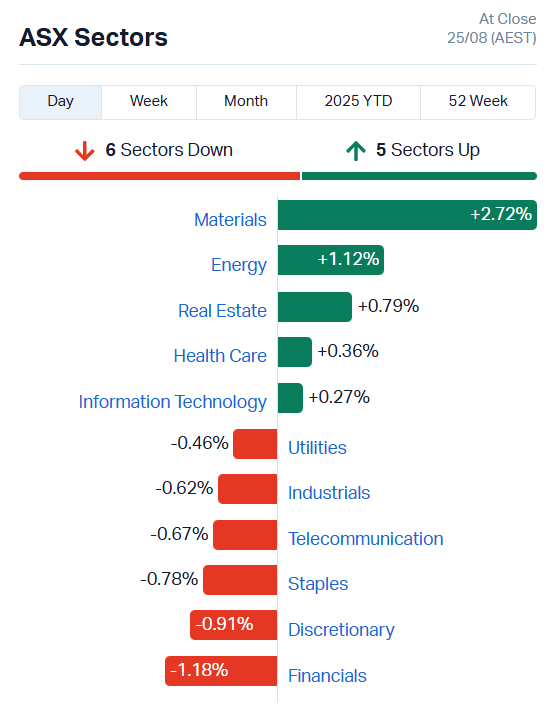

- Materials sector leads gains, up 2.72pc

Dovish Fed comments pump Wall Street higher

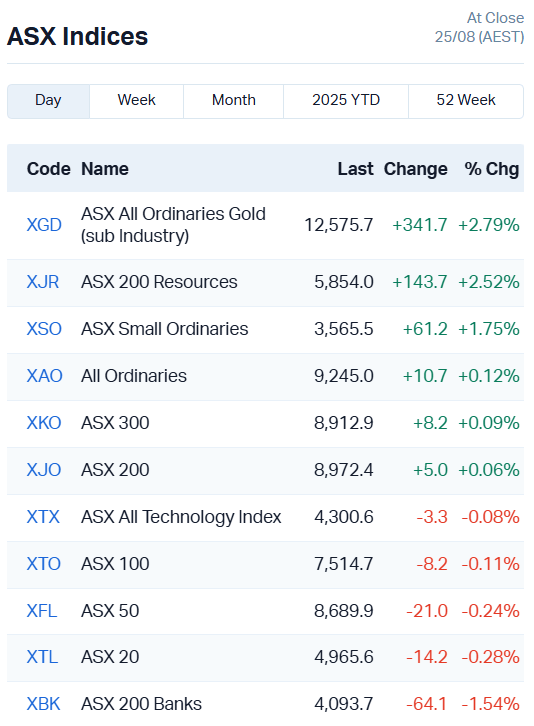

The ASX 200 has finished all but flat today, adding just 5 points or 0.06% to close at 8972.4 points.

That’s despite ripping 1% higher to set a new intraday high at 9054 points in the first hour of trade.

It was a fairly swift descent back toward neutral throughout the day, as disappointing full-year reports and rising warnings of a securities bubble dampened sentiment.

Our major banks weren’t helping any, either – the ASX 200 Banks index shed 1.54%, with all but Macquarie Bank (ASX:MQG) moving anywhere from 1.39% to 2.89% lower.

MQG managed a 0.61% lift to its shares.

Despite the strong undertow current gold and small cap stocks powered higher, fuelled by dovish comments from the US Fed chair Jerome Powell at Jackson Hole.

“With policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance,” he said, referencing rising downside risks to employment.

That slight change in tone had US markets ripping higher immediately, adding more than 1.5% each as the Dow Jones set a new record close.

Gold also jumped 1.1% to US$3418 an ounce on the news, as markets repriced the US September rate cut likelihood from a 74% chance to a 90% chance.

That whiff of an interest rate cut was enough to drive the small-cap Russell 2000 to its best result for the year yet, adding more than 4%.

Our own ASX Small Ordinaries index seems to be enjoying a similar burst of optimism, adding 1.75% in trade today.

It was one of the bright spots for the market on an otherwise fairly disappointing day, alongside big gains in the All Ord Gold index (+2.79%) and the ASX 200 Resources index (+2.52%).

Earnings season marches on

We’ve reached the final official week of earnings season – hurrah!

There’s sure to be a flurry of last-minute reporting post market session on Friday evening as some companies try to sneak less-than-stellar results past investors noses, but we’ll otherwise be done and dusted come Friday trading close.

Still on the cards for this week will be our two supermarket giants, Coles (ASX:COL) and Woolworths (ASX:WOW), and Fortescue (ASX:FMG) is also due to report tomorrow.

We’ll also be getting the deets on Flight Centre (ASX:FLT), Wesfarmers (ASX:WES), South32 (ASX:S32), Qantas (ASX:QAN), Medibank (ASX:MPL) and TPG Telecom (ASX:TPG), to name a few.

As always, you can check out our Lunch Wrap coverage for the bulk of today’s reporting. Now onto the afternoon’s fare:

Pilbara Minerals (ASX:PLS)

Lithium miner Pilbara Minerals has been on a difficult trajectory in recent months, weathering a downturn in lithium prices.

The Aussie miner’s taken losses of $196m this year, even as production lifted 4% and sales volume 7%.

A 43% cut to realised prices was the main culprit, slashing the company’s revenue even as it shoulders costs from constructing a new plant.

Despite all that, PLS is optimistic this next financial year will be a turning point for the company’s fortunes, calling FY25 a ‘transformational’ year that had positioned it for growth moving forward.

“Current prices are not sufficient to incentivise new supply, which points to tightness ahead,” CEO Dale Henderson said.

The market seems to be buying it – PLS shares rose 2.8% to $2.17 each by end of trade.

Bendigo and Adelaide Bank (ASX:BEN)

Continuing the theme of heavy losses, Bendigo Bank also had a shocker of a full-year result, posting a net loss of $97.1 million for the year.

A good chunk of those losses come from a one-off “goodwill” impairment charge on the bank’s consumer cash generating unit which the bank says reflects a “balanced approach to the heightened level of global uncertainty”.

BEN also spent $9 million on restructuring, cutting about 100 roles and closing 10 branches.

Without the one-off impairment charge, the bank’s cash earnings tipped in at $514.6 million, 8.4% lower than the year before.

BEN offered shareholders a full year dividend of 33c each share, pretty much the same as last year.

That seems to have been enough for its shareholders, which lifted the bank’s stock 2% to $13.26 each despite the greater banks index taking a big hit.

Aussie Broadband (ASX:ABB)

Aussie Broadband was the one stock on this admittedly short list to really hit it out of the park this year.

The internet provider bumped up its full-year net profits 24.5% to $32.8 million and grew sales 19% to $1.2 billion.

It’s even muscled in on some of its rival’s market share, adding 1.1% to take an 8.4% slice of the NBN pie.

More importantly, the telco has inked a deal with wholesalers to provide NBN services to more than 250,000 new connections.

The deal is with More Telecom and its operating company Tangerine. The Commonwealth Bank (ASX:CBA) owns a 40% chunk of both companies, which it uses as its exclusive telecommunications partner.

ABB reckons the new deal will up its EBITDA by $12 million by 2027, expecting a 12% boost to earnings per share over the period. In the meantime, the company is paying a 6.4c per share dividend for the year.

ABB’s shares surged 19.5% to $5.32 each.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AHK | Ark Mines Limited | 0.3 | 62% | 2,353,193 | $12,239,729 |

| T3D | 333D Limited | 0.015 | 50% | 325,971 | $1,888,538 |

| LKY | Locksley Resources | 0.32 | 42% | 39,148,953 | $55,314,374 |

| CR9 | Corellares | 0.004 | 33% | 3,016,800 | $3,021,809 |

| T92 | Terra Uranium | 0.038 | 31% | 24,214,675 | $3,781,677 |

| CAE | Cannindah Resources | 0.026 | 30% | 3,952,642 | $14,561,599 |

| APC | APC Minerals | 0.009 | 29% | 3,283,670 | $2,050,534 |

| CLA | Celsius Resource Ltd | 0.009 | 29% | 10,187,526 | $21,948,419 |

| ADG | Adelong Gold Limited | 0.005 | 25% | 2,516,484 | $9,267,345 |

| CAV | Carnavale Resources | 0.005 | 25% | 1,000,000 | $16,360,874 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 925,030 | $12,000,000 |

| PEB | Pacific Edge | 0.13 | 24% | 209,795 | $107,258,598 |

| LKO | Lakes Blue Energy | 1.115 | 23% | 192,782 | $61,795,576 |

| PPY | Papyrus Australia | 0.016 | 23% | 1,747,597 | $7,837,463 |

| BCK | Brockman Mining Ltd | 0.022 | 22% | 201,377 | $167,044,178 |

| GLA | Gladiator Resources | 0.017 | 21% | 17,202,052 | $10,616,156 |

| ICE | Icetana Limited | 0.087 | 21% | 595,618 | $38,291,466 |

| GNM | Great Northern | 0.084 | 20% | 53,208,239 | $10,824,035 |

| TAS | Tasman Resources Ltd | 0.018 | 20% | 30,556 | $4,190,291 |

| 8IH | 8I Holdings Ltd | 0.012 | 20% | 9,151 | $3,481,609 |

| CZN | Corazon Ltd | 0.003 | 20% | 3,559,580 | $3,086,431 |

| FRX | Flexiroam Limited | 0.006 | 20% | 500,000 | $7,586,993 |

| RLG | Roolife Group Ltd | 0.006 | 20% | 7,444,860 | $9,392,478 |

| SLZ | Sultan Resources Ltd | 0.006 | 20% | 83,594 | $1,305,418 |

| ABB | Aussie Broadband | 5.295 | 19% | 10,678,547 | $1,278,677,982 |

In the news…

Ark Mines (ASX:AHK) has locked in $4.5m from Queensland’s Critical Minerals and Battery Tech Fund to advance its Sandy Mitchell rare earths project, north-west of Cairns.

Ark says the cash will accelerate drilling, grow its resource base, and strengthen alignment with Queensland’s goal of developing a domestic critical minerals supply chain.

Digital asset management company 333D (ASX:T3D) will use its FY25 R&D tax incentive of $413,772 towards Bitcoin acquisitions in line with its new Bitcoin Treasury Management Policy.

The first step has already been taken – a purchase of 2.018 BTC worth A$370,500. The pivot aligns 333D with a growing number of global companies that see Bitcoin not as speculation, but as a long-term store of value.

Company directors will also head to the Bitcoin Asia 2025 conference this week, where they will meet with leading global Bitcoin and digital asset advocates.

Locksley Resources (ASX:LKY) has launched its US critical minerals strategy through a partnership with Rice University to fast-track antimony processing and new applications for the metal from its Mojave Project.

The binding R&D agreement covers the development of green extraction technology and antimony-based materials for batteries and energy storage. Locksley will contribute US$550k to fund the work, with IP to be jointly owned.

Terra Metals (ASX:TM1) expanded its partnership with Axiom Group to pursue rare earths and antimony projects across the US.

The move comes as US President Donald Trump’s administration ramps up investment in critical minerals, with billions in federal funding flowing into the sector.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DM1 | Desert Metals | 0.017 | -41% | 23,899,948 | $12,826,311 |

| MEL | Metgasco Ltd | 0.002 | -33% | 500,000 | $5,511,260 |

| TMX | Terrain Minerals | 0.002 | -33% | 1,330,000 | $7,745,443 |

| ASR | Asra Minerals Ltd | 0.0015 | -25% | 22,608,588 | $8,000,396 |

| BIT | Biotron Limited | 0.003 | -25% | 2,757,654 | $5,308,983 |

| PKO | Peako Limited | 0.003 | -25% | 200,018 | $5,950,968 |

| PRM | Prominence Energy | 0.003 | -25% | 3,245,783 | $3,556,706 |

| SRJ | SRJ Technologies | 0.006 | -25% | 1,917,065 | $8,727,221 |

| CLG | Close Loop | 0.032 | -24% | 8,298,620 | $22,337,694 |

| RMX | Red Mount Min Ltd | 0.007 | -22% | 7,562,448 | $5,224,496 |

| ADN | Andromeda Metals Ltd | 0.011 | -21% | 8,414,616 | $53,433,470 |

| 1AD | Adalta Limited | 0.004 | -20% | 38,415,016 | $5,773,249 |

| FIN | FIN Resources Ltd | 0.004 | -20% | 290,363 | $3,474,442 |

| TKL | Traka Resources | 0.002 | -20% | 3,000,000 | $6,055,348 |

| FEG | Far East Gold | 0.15 | -19% | 1,002,280 | $67,900,079 |

| BNL | Blue Star Helium Ltd | 0.0065 | -19% | 20,126,006 | $26,943,082 |

| VKA | Viking Mines Ltd | 0.0065 | -19% | 959,194 | $10,751,590 |

| NPM | Newpeak Metals | 0.014 | -18% | 1,455,104 | $5,595,437 |

| M2R | Miramar | 0.0025 | -17% | 4,000,000 | $3,029,566 |

| VFX | Visionflex Group Ltd | 0.0025 | -17% | 1,450,000 | $10,103,581 |

| FBM | Future Battery | 0.026 | -16% | 2,030,592 | $20,914,492 |

| EVT | EVT Limited | 14.45 | -16% | 678,352 | $2,785,634,313 |

| REH | Reece Limited | 11.87 | -16% | 4,226,054 | $9,088,997,427 |

| PAT | Patriot Resourcesltd | 0.038 | -16% | 387,732 | $7,426,010 |

In Case You Missed It

Vertex Minerals (ASX:VTX) has started underground blasting at the Reward gold mine, hoping to boost the grade of ore feeding its nearby processing plant.

Metallium (ASX:MTM) has teamed up with Rice University to enhance its Flash Joule Heating tech to maximise individual rare earth extraction.

Magmatic Resources (ASX:MAG) kicks off drilling at its Weebo gold project in Western Australia, with 2,500 metres of aircore and RC planned.

Antipa Minerals (ASX:AZY) has recorded bonanza gold grades up to 395g/t within broad intersections at the Fiama prospect, part of its Minyari gold-copper project.

Legacy Minerals (ASX:LGM) has received approvals for drilling at the Battery gold-copper prospect within the Mt Carrington project in northern NSW.

Odyssey Gold’s (ASX:ODY) test work has returned high initial gold recoveries from fresh rock, expanding the development potential of its Tuckanarra project.

QMines (ASX:QML) has struck early success in drilling at its copper-zinc Develin Creek project, revealing semi-massive and massive sulphide mineralisation.

Last Orders

Star Minerals (ASX:SMS) has welcomed Bain Global resources into the fold as a substantial shareholder. The company increased its holding to 8.18% of Star shares on issue with an on-market purchase.

Bain Global Resources is the finance arm of mine owner and contractor MEGA Resources. Star Minerals and MEGA Resources have a Memorandum of Understanding (MoU) for mine development and mining.

Argent Minerals (ASX:ARD) has drilled its first hole at the Kempfield project’s deposit, testing for silver mineralisation down to 339.2m at the Lode 200 target.

The second diamond drilled hole is underway at Lode 100, targeting a similar depth. The core samples will be sent for metallurgical testing after assay, to determine the viability of several processing routes.

Trading halts

Basin Energy (ASX:BSN) – project acquisition and cap raise

Blackstone Minerals (ASX:BSX) – strategic agreement for Ta Khoa project

Catalyst Metals (ASX:CYL) – Federal Court application re compliance issue

Nimy Resources (ASX:NIM) – cap raise

OMG Group (ASX:OMG) – cap raise

Provaris Energy (ASX:PV1) – cap raise

Pure Hydrogen (ASX:PH2) – cap raise

Savannah Goldfields (ASX:SGC) – cap raise

Victory Metals (ASX:VTM) – cap raise

At Stockhead, we tell it like it is. While Star Minerals, Locksley Resources, 333D and Argent Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.