Closing Bell: From rags to resources as ASX reverses Friday fortune

Via Getty

- The ASX benchmark takes a right turn to end the day on a high note

- Energy Sector sails over Santos / Woodside merger mumbles

- Small caps led by 92 Energy, as it gets snapped up by a hungry Canadian

Local markets have performed an about turn on Friday with a difficulty level of circa +3% for the week as renewed interest in oversold resource stocks lifted the benchmark.

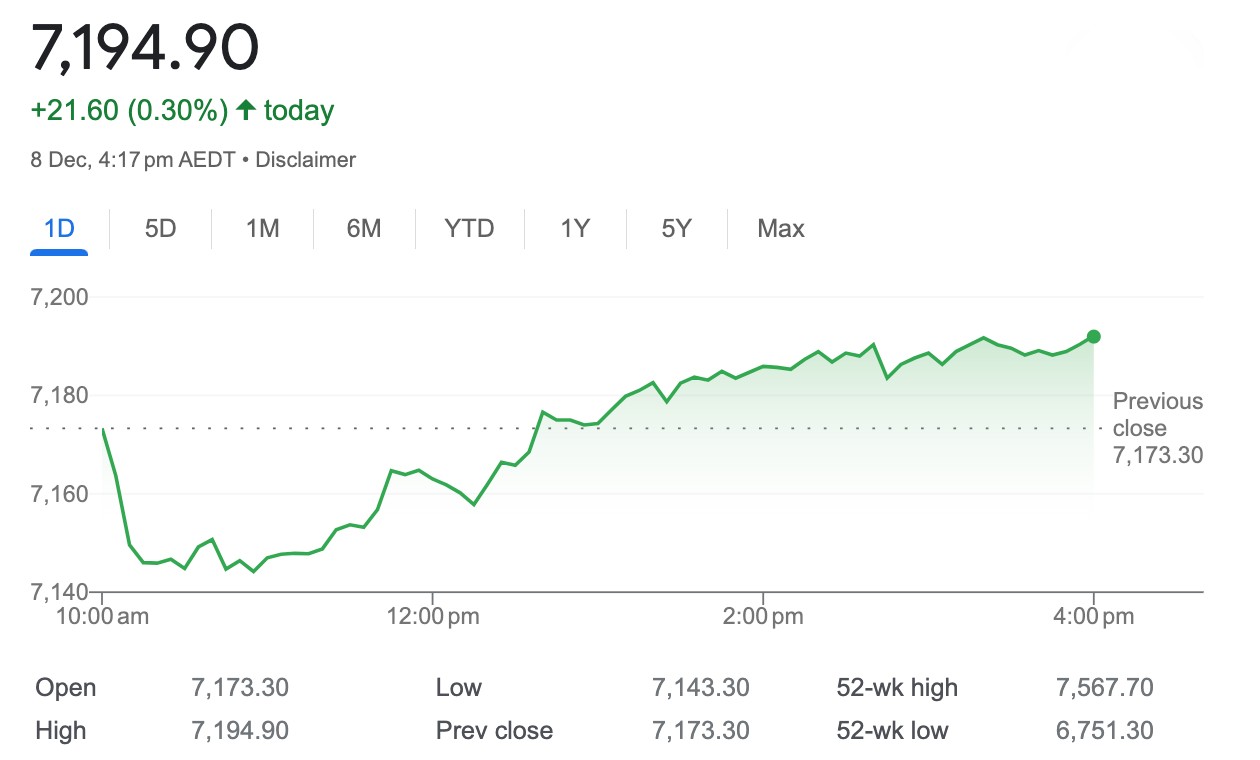

At 4pm on Friday December 8, the S&P/ASX 200 (XJO) index was up 21.6 points, or +0.30%.

The impressive reversal of fortunes at home was largely the brainchild of the major banks recouping Thursday’s losses sharp rally, the uptown iron ore trio who’ve enjoyed the revivifying powers of higher iron ore prices as well as a certain two-minded enthusiasm for the super Santos/Woodside merger.

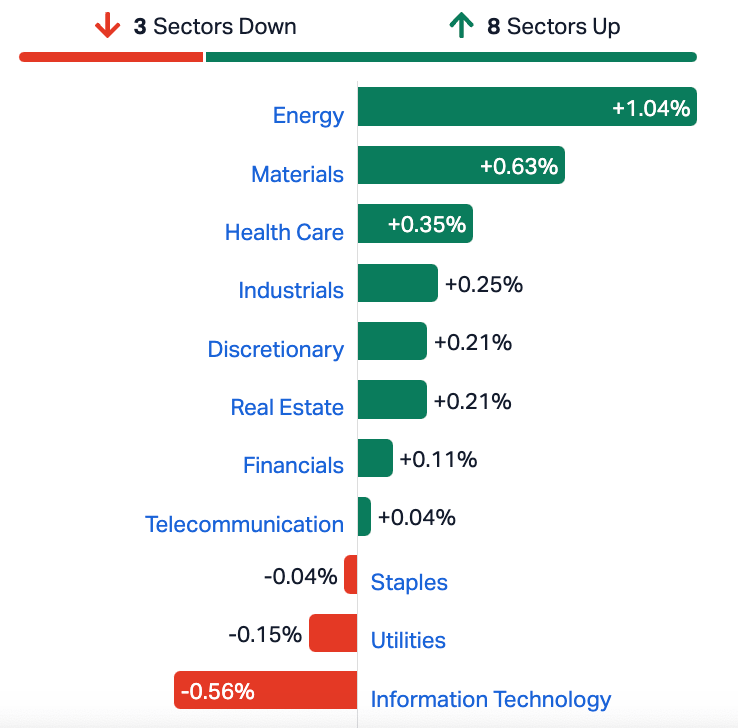

On a sector basis losses for the Utilities were eventually more than offset by gains for energy and materials as local traders clicked to the money on Santos doing well out of any marriage to Woodside.

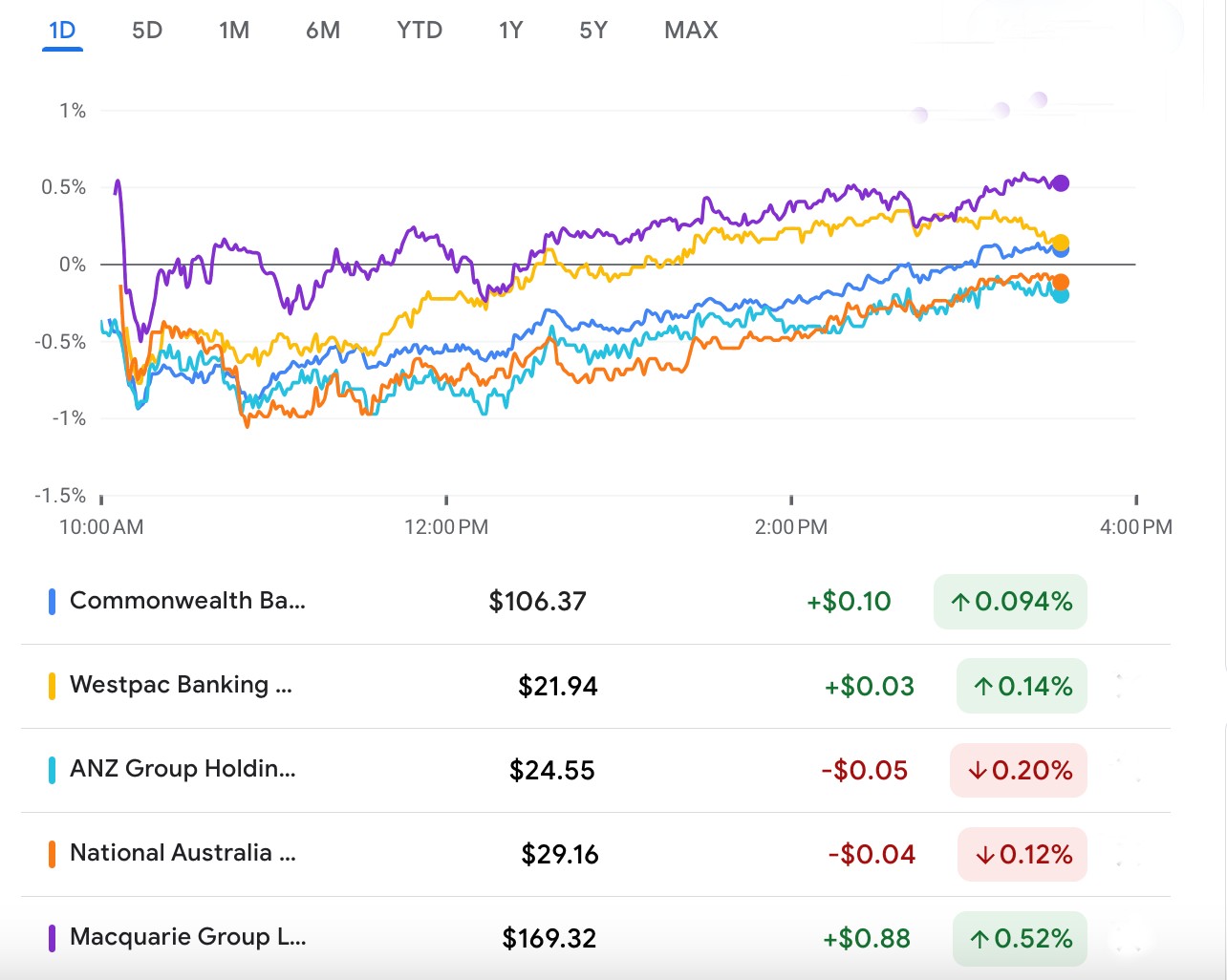

Elsewhere, the big 4 banks and investment bank Macquarie Group (ASX:MQG) showed on Friday exactly why they’re so hard to put down for long. After losing out on Thursday, all five major lenders lost ground on morning sentiment and rose on afternoon fact.

Big 4 + MQG on Friday

One particular advantage the local banks have over everyone else’s financial sector is they’re far more better equipped to deal with the kind of nutso interest rate rises we’ve been privvy to, by simply passing on the costs to us – the borrowers and mortgage who’ve been lucky enough to have a variable-rate loan. And that’s almost all of us.

This distinguishes our guys from the US and the EU for example where most mortgages are either fixed or extremely long-term.

Last night mega-tech bullied US markets into the green again as the tech heavy Nasdaq composite jumped almost 1.5%

The S&P 500 found +0.79% and the Dow Jones Industrial Average collected a +0.21% gain.

Google’s own mothership, Alphabet, did a fair bit of the damage all on its own after gaining +5.3% in Nwe York. (They’ve unveiled some snazzy new AI).

ASX SECTORS ON FRIDAY

Ahead of the US open, all eyes and ears and hopes have fallen into the orbit of tonight’s US jobs data – the gravity of which comes down to this: should the non-farm payrolls miss expectations that might be it for US rate hikes.

Shares in Woodside Energy Group (ASX:WDS) (down 1.2 per cent) and Santos (ASX:STO) (up 6.3 per cent) moved in opposite directions after the companies revealed they were in merger talks to create an $80bn energy mothership.

Citi says a Woodside-Santos merger would allow Woodside to fix its stagnating portfolio and Santos to fix its balance sheet.

The biggest sticking point that Citi sees is Woodside’s board coughing up enough value to appease frustrated Santos shareholders.

However, Woodside has such a large cost of equity advantage that it can afford to pay more than $9 a share for Santos, according to Citi’s James Byrne.

In other more random energy sector news, Elevate Uranium (ASX:EL8) pleased to says it has binding commitments for a single tranche placement of shares to raise circa $10mn at $0.42 a pop.

Elevate MD Murray Hill said the company had received binding commitments as well as strong support from domestic and offshore institutional investors including specialist uranium and natural resources funds

“Demand for the $10M Placement was strong and it was great to see such a tangible endorsement of our strategy.

The placement adds further depth to our register, strengthens our financial position and allows us to press on to aggressively advance our flagship Koppies project in Namibia and explore our other projects in Namibia and Australia. In an increasingly buoyant uranium price environment, we will have five drill rigs operating in Namibia alone.”

Upon completion of the Placement, Elevate Uranium will have a strong balance sheet with a cash balance of circa $17.1mn.

Meanwhile, the company reckons strong near-term news flow is in the post with 3 drill rigs currently active at Koppies, while planning is underway for further resource growth and exploration drilling across its Australian and Namibian portfolios.

And the put upon fragrance maker Dusk Group (ASX:DSK) has had to come out and tell everyone that the sun is not going down on it’s future after an article in the AFR suggested there’d be little lingering

The specialty retailer of home fragrance products published a denial on the ASX that it had not received any approaches regarding privatisation or takeover saying there was no potential buyer or advisor which had come knocking on the perfumerie door for just that.

DSK also had to deny involvement in any document supposedly prepared by wealth management company Ord Minnett.

“Ord Minnett are acting on their own initiative and do not have a mandate or arrangement with dusk in relation to this matter.”

Around the ‘hood

Asian-Pacific stock markets were mixed on Friday, defying a strong session on Wall Street overnight where optimism about artificial intelligence-fuelled a rally in the technology sector.

However, in Japan nvestors also reacted to surprise data showing Japan’s economy shrank 0.7% QoQ in the third quarter, compared with preliminary estimates of a 0.5% contraction and after a downwardly revised 0.9% growth in the second quarter.

Meanwhile, the Hang Seng was down over 50 points at lunchtime in Hong Kong on the fastb track to its 3rd straight week-of-shame as the index tussles with more than 12 month lows.

Losses are broad based – consumer stocks are down for a second straight session, while materials, healthcare, tech, and cyclical stocks are all under pressure. The Hong Kong market looks particularly exposed to China’s string of unimpressive economic indicators including a renewed focus on local government debt now that Moody’s Investors Service warned of a downgrade for state-run banks.

Meantime, Chinese CPI data for November will be released Saturday after October’s readings showed consumer prices unexpectedly fell as consumption dropped in the wake of the Golden Week holiday.

South Korea and mainland Chinese markets were higher today at 3.30pm in Sydney.

We’re still watching oil…

Because evidently someone has to.

West Texas (WTI) crude futures crept aboveUS $70 per barrel on Friday but look set to lose more than 5% this week amid signs of increasing global supplies and weakening demand.

US gasoline inventories picked the right moment to pull one of the biggest increases of the year last week – producing a stunning 5.4 million barrels out of nowhere, making the aggregate forecasts of 1 million barrels a supreme gag.

The US Bureau of Economic Data also has crude exports up at a record 6 million barrels a day during October, with European and Asian buyers partaking in something of a frenzy, while economic woes for the world’s biggest crude importer – China – also weighed on the mood of markets. Moody’s helped that by cutting its outlook on China’s government credit rating from stable to negative.

Finally, it really does seem that the OPEC+ cartel is losing cohesion which is pretty much good news for Volvo drivers (other drivers too, I suppose). Last week OPEC+ members came out to announce additional cuts of 2.2 million bpd.

Angola said afterwards that it wouldn’t play ball, despite signing up. And then in came big-hitters Saudi Arabia and Russia to announce they were extending more than 1.3 million of voluntary reductions. ‘Cos they can.

Futures tied to the 3 major US indices are almost at universal parity ahead of the Thursday open in New York:

Looking ahead to next week…

RBA Bullock Speech

On Tuesday, we will hear from the RBA’s Michelle Bullock in what is likely to be one of the last times we hear from the Governor in 2023. Given the current 2024 outlook, this will be a key speech for investors to watch.

The RBA’s decision to keep rates on hold last week was no surprise, but the accompanying dovish statement was, with comments pointing towards progress on inflation and a peak in weak growth, says Josh Gilbert, market analyst at eToro,

“This was a contrast to what we had heard from Michele Bullock just weeks prior, with hawkish rhetoric pointing towards risks on the inflation front. It will be interesting to see what side of the fence she sits on next week, as any dovish tones will undoubtedly excite the market and lift expectations that we have seen the end of the RBA’s hiking cycle.”

“With the next RBA rate call scheduled for the start of February, there will be plenty of speculation on the next rate call either way, given there’ll be plenty of economic data trickling in post-Christmas.”

Unemployment Rate

Data points in recent weeks have moved in the right direction for the RBA, but employment is one key area that continues to show resilience, Josh says.

The Aussie jobess rate was 3.7% in October, with some strong employment growth.

“This continued tightness has affected wages throughout 2023, and it was evident in the wage price index released for the September quarter, rising by 1.3% – the fastest quarterly rise on record,” Josh says.

“In a sign of what might be ahead for the unemployment rate, job advertisements fell by 5% in October and sat at 19.9% lower year-on-year, according to data from Seek. Falling job ads mean less demand for hiring as we head into the new year, which is a firm sign that we may see the unemployment rate rise next week. This, in turn, will further stoke the belief that the RBA’s current hiking cycle is at its end as we head into the new year.”

Fed Interest Rate Decision

Next Thursday’s US Federal Rate Decision may be something of a nothing event, with it widely expected the Federal Reserve will keep rates on hold at 5.25% to 5.5%.

Markets believe we have seen the end of the Fed’s hiking campaign, with pricing for rate cuts as early as March next year.

Although the Federal Reserve has softened its language in recent months regarding further hikes, Josh says J. Powell has done his best to push back on the expectation of cuts in the first half of 2024.

“Before the decision next week, the Fed will receive the latest CPI release, and if we see further progress on inflation, Jerome Powell will then have the undesirable duty of keeping markets in check.”

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SIH | Sihayo Gold Limited | 0.002 | 100% | 400,000 | $12,204,256 |

| YPB | YPB Group Ltd | 0.002 | 100% | 3,749,148 | $790,461 |

| KNM | Kneomedia Limited | 0.003 | 50% | 137,395 | $3,066,543 |

| M2R | Miramar | 0.028 | 40% | 127,282 | $2,977,391 |

| MKR | Manuka Resources. | 0.079 | 34% | 2,064,565 | $33,188,684 |

| AUH | Austchina Holdings | 0.004 | 33% | 6,021,716 | $6,233,651 |

| BP8 | Bph Global Ltd | 0.002 | 33% | 400,800 | $2,423,345 |

| FAU | First Au Ltd | 0.004 | 33% | 4,364,768 | $4,985,980 |

| MCT | Metalicity Limited | 0.002 | 33% | 1,281,616 | $6,376,629 |

| CGR | Cgnresourceslimited | 0.185 | 32% | 281,772 | $12,708,947 |

| NYR | Nyrada Inc. | 0.026 | 30% | 124,548 | $3,120,174 |

| LRS | Latin Resources Ltd | 0.235 | 27% | 26,508,407 | $512,913,647 |

| MPK | Many Peaks Minerals | 0.19 | 27% | 16,705 | $5,456,172 |

| GML | Gateway Mining | 0.03 | 25% | 878,308 | $7,955,581 |

| OAK | Oakridge | 0.075 | 25% | 35,000 | $1,055,965 |

| 92E | 92Energy | 0.455 | 25% | 3,807,693 | $38,826,912 |

| SPT | Splitit | 0.076 | 21% | 6,120,665 | $34,863,194 |

| CNJ | Conico Ltd | 0.006 | 20% | 404,515 | $7,850,475 |

| CTO | Citigold Corp Ltd | 0.006 | 20% | 210,879 | $14,368,295 |

| DGR | DGR Global Ltd | 0.024 | 20% | 32,000 | $20,873,870 |

| ICG | Inca Minerals Ltd | 0.012 | 20% | 64,500 | $5,844,355 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 297,800 | $2,947,430 |

| PPY | Papyrus Australia | 0.019 | 19% | 559,381 | $7,883,081 |

| SCN | Scorpion Minerals | 0.045 | 18% | 2,380,953 | $15,454,835 |

| EYE | Nova EYE Medical Ltd | 0.135 | 17% | 678,033 | $21,922,323 |

There was a lot of microcap movement on Friday, with a number of the ASX’s smaller companies posting some healthy percentage gains – most of them without any news or definitive announcements to pin it on.

92 Energy (ASX:92E) is moving well this morning, and it definitely has news for investors, as it’s now part of a three-way takeover deal with Canadian-listed resources company ATHA.

ATHA has inked a deal with 92 Energy to snap up 100% of the company, at a whopping 78% premium to the local explorer’s closing price of recent times – shareholders are set to pocket 0.5834 ATHA shares for every 92E share held, giving an implied value of around $0.65 a pop.

It’s not the only shopping that the Canadian firm has been doing, though – it’s also buying up all of the issued and outstanding shares of Latitude Uranium, by way of a Canadian court-approved plan of arrangement.

Holista CollTech (ASX:HCT) is up this morning as well, following news that the judge overseeing the Federal Court stoush between the company and the Australian Securities and Investments Commission pulled the pin on proceedings a day earlier than expected. No decision has been announced.

First Au (ASX:FAU) is moving in the right direction, off the back of a fancy-lookin’ investor presentation that the company released yesterday.

Other big movers included Latin Resources (ASX:LRS), which made a mighty 21%-plus leap after revealing a 56% boost to the company’s global resource, bring the combined total of its JORC-compliant MRE to more than 70Mt.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| EMU | EMU NL | 0.001 | -50% | 4,250,076 | $3,335,043 |

| NZS | New Zealand Coastal | 0.001 | -50% | 256,695 | $3,334,020 |

| POD | Podium Minerals | 0.001 | -50% | 4,231,770 | $161,927 |

| MZZ | Matador Mining Ltd | 0.041 | -34% | 3,067,725 | $24,444,699 |

| AVM | Advance Metals Ltd | 0.002 | -33% | 400,000 | $2,377,897 |

| GTG | Genetic Technologies | 0.002 | -33% | 393,407 | $34,624,974 |

| T3D | 333D Limited | 0.004 | -33% | 2 | $637,863 |

| XPN | Xpon Technologies | 0.022 | -31% | 46,000 | $5,072,881 |

| CL8 | Carly Holdings Ltd | 0.013 | -24% | 742,972 | $4,562,297 |

| 8IH | 8I Holdings Ltd | 0.017 | -23% | 43,279 | $7,861,832 |

| NIM | Nimyresourceslimited | 0.17 | -23% | 960,465 | $30,054,838 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 205,029 | $9,167,534 |

| HLX | Helix Resources | 0.004 | -20% | 3,318,281 | $11,615,729 |

| LSR | Lodestar Minerals | 0.004 | -20% | 1,484,294 | $10,116,987 |

| NES | Nelson Resources. | 0.004 | -20% | 1,000,000 | $3,067,972 |

| NFL | Norfolkmetalslimited | 0.19 | -17% | 1,991,263 | $8,124,749 |

| BCK | Brockman Mining Ltd | 0.024 | -17% | 287,483 | $269,126,732 |

| HMD | Heramed Limited | 0.029 | -17% | 427,275 | $9,782,997 |

| NWF | Newfield Resources | 0.1 | -17% | 10,000 | $105,845,669 |

| AML | Aeon Metals Ltd. | 0.01 | -17% | 87,543 | $13,156,807 |

| RLC | Reedy Lagoon Corp. | 0.005 | -17% | 220,000 | $3,700,102 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 12,230 | $29,019,595 |

| TAS | Tasman Resources Ltd | 0.005 | -17% | 40,000 | $4,276,016 |

| FXG | Felix Gold Limited | 0.041 | -16% | 39,775 | $5,816,614 |

| AHK | Ark Mines Limited | 0.205 | -16% | 77,249 | $11,060,466 |

TRADING HALTS

Iris Metals (ASX:IR1) – pending an announcement to the market regarding a capital raising.

Alterra (ASX:1AG) – pending an announcement to the market in relation to an accelerated rights issue capital raising.

Adveritas (ASX:AV1) – pending release of an announcement regarding a placement.

S2 Resources (ASX:S2R) – pending an announcement by the Company to the market in relation to a proposed capital raising.

Noble Helium (ASX:NHE) – pending an announcement regarding a capital raising.

Opyl (ASX:OPL) – halt called in connection with a proposed capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.