Closing Bell: Friday takes a bite out of ASX, even as biotech and lithium small caps run amok

Via Getty

- The ASX has ended the week lower, down 0.55pc on Friday

- Healthcare Sector remains defiant

- Small caps led by medtech names and Lake Johnston lithium hunters

The fickle Aussie sharemarket has given back on Friday all that it has made this week. In fact the Aussie benchmark has closed out the week 0.55% lower on broad-based losses.

A downbeat session on Wall Street put a hit on local sentiment, with equities whacked by the return of surging US Treasury yields inspired by a hawkish few words from the US Fed Chair Jay Powell overnight.

At match out on Friday November 10, the S&P/ASX 200 (XJO) index was down about 38 points, or -0.55% at 6,976.

Local traders have also been sent askew on Friday by fresh fears around China’s economic outlook following Thursday’s tepid consumer and producer inflation reads.

All the signs of Chinese deflation reared their ugly heads in October as the drag from the Chinese property sector persists, consumer and business mood remains weak, and headwinds from local government debts linger.

At 2pm in Sydney, the Reserve Bank of Australia (RBA) dropped its quarterly Statement on Monetary Policy – with the sneaky central bank lifting the outlook for inflation over the next two years – after recent economic data releases showed there “was likely to be less progress” in bringing inflation down over the next several quarters.

The RBA has forecast a significant increase in its inflation peg through to June 2024, from 3.25 to 4 per cent for June 2024.

On Tuesday the Bank of Bullock hoisted the official cash rate by 25 basis points to 4.35%.

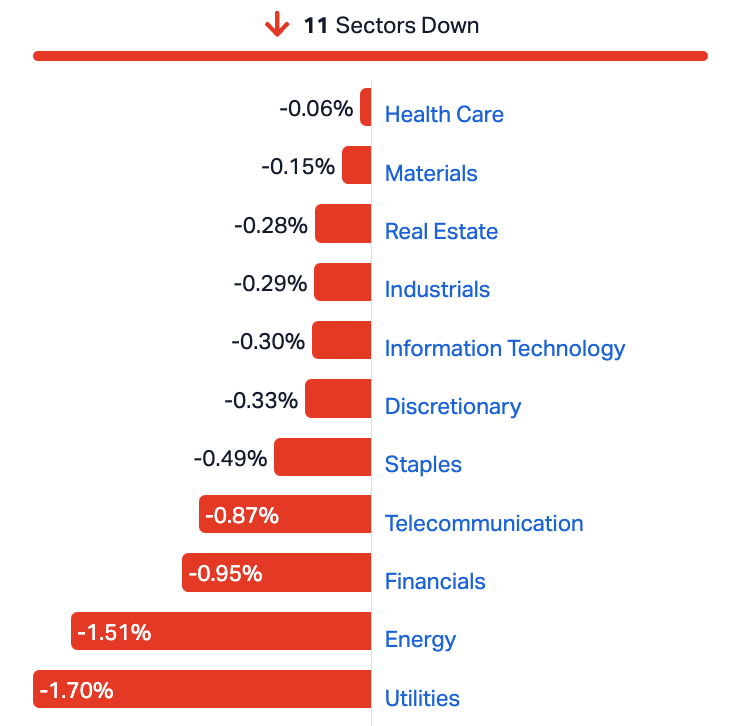

ASX SECTORS ON FRIDAY

Aside from a remarkable Healthcare Sector (flat), all the ASX sectors are lower on Friday – Utilities, the Consumer Sectors and Tech stocks leading the losses.

The main drain and lingering stain on the ASX on Friday were the biggest caps.

The Frustrating Four: National Australia Bank (ASX:NAB), Westpac (ASX:WBC), Commonwealth Bank (ASX:CBA) and Australia and New Zealand Banking Group (ASX:ANZ) are all about -1% lower.

And scattered large caps like Origin Energy (ASX:ORG) (-2.5%), IGO (ASX:IGO) (-2.6%), James Hardie (ASX:JHX)(-2.7) and the often underwhelming Pilbara Minerals (ASX:PLS) (-4.5%).

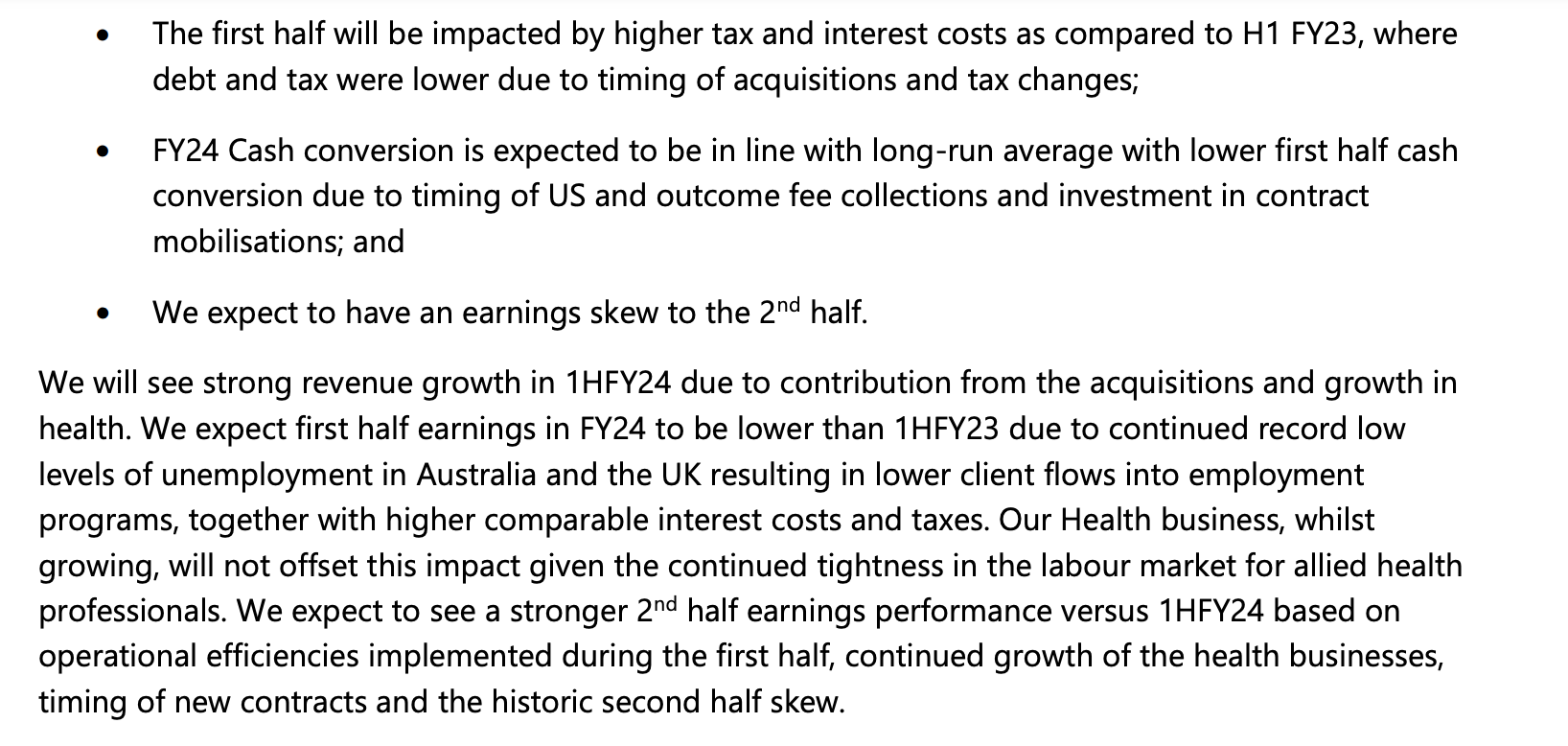

Worst of all – APM Human Services (ASX:APM) – down about -20.5%, after this sneaky admission:

Despite wallowing a little in the red this morning, support for the healthcare names remains strong and the sector lifted after lunch to be the only ASX sector in the green.

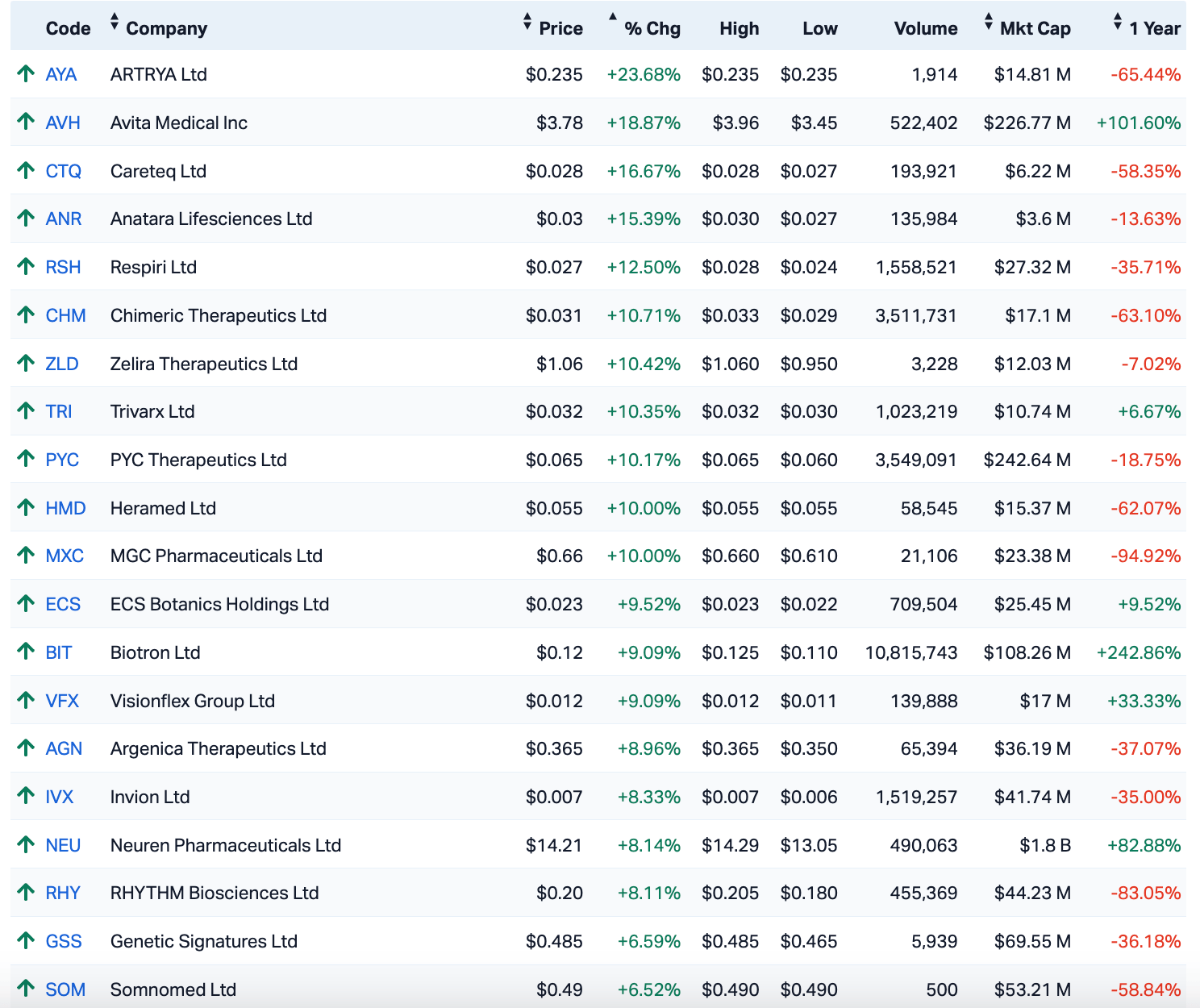

Have a quick look at how the top 20 Healthcare names are doing on a dull day for the benchmark:

Aside from the massively capped blood plasma giant CSL climbing again on Friday, here’s just a few of the smaller capped reasons health and biosciences are attracting support, as per the incredible Eddy Sunarto:

Gastrointestinal-focused biotech, Anatara Lifesciences (ASX:ANR), also jumped 15% after holding its AGM this morning.

Exec chair Dr David Brookes told shareholders the recent company news flow has been dominated by the completion of Stage 1 of the GaRP-IBS trial.

“As you are aware from the ASX updates, the results were considered very encouraging and the interim analysis of Stage 1 successfully met all the intended objectives,” Brookes said.

Anatara’s GaRP product is a microbiome-targeted medicine that has been designed to address the primary underlying factors associated with chronic gastrointestinal conditions such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD).

“The immediate project for advancement is our Gastrointestinal ReProgramming to become a product for wide-ranging indications via the completion of the IBS trial,” said Brookes.

Meanwhile, Imugene (ASX:IMU) rose 15% this morning after dosing of the first patient in its Phase 1b clinical trial using Azer-cel (an allogeneic off-the-shelf CD19 CAR T, a type of cell therapy). It’s dropped off the table above on some profit taking, to be sure.

Azer-cel is currently being studied in an ongoing multi-centre Phase 1b CAR T clinical trial in patients with blood cancer called non-Hodgkin’s lymphoma (NHL).

This Phase 1b trial is a precursor to a Phase 2 registrational trial (subject to FDA agreement) in 2024.

“It is a great credit to our team that the Phase 1b study has been initiated and the first patient dosed, in under three months since acquiring the technology,” said Imugene CEO, Leslie Chong.

Avita Medical (ASX:AVH) has announced its third quarter financial results with 51% commercial revenue growth on pcp to $13.5 million and gross margin of 84.5% for the quarter.

The regenerative medicine biotech jumped 24% this morning after providing a bullish guidance for Q4 FY23. For more on AVH see below.

Ripped from the headlines

We’re watching gold

So is Vivek Dhar at CBA who says falling safe‑haven demand could pressure gold futures to ~$US1900/oz, after retaining a 7‑8% premium since the Israel‑Hamas war began.

Gold futures rose as high as ~$US2006/oz on 30 October, but have now eased to ~$US1964/oz.

“Safe‑haven demand helps explain the initial surge in gold futures since the war began, but there are credible concerns that the precious metal may see its post‑war premium continue to fade.

One key driver which is likely already playing out, Vivek says, is the impact of a contained Israel‑Hamas war.

“Where gold futures go after safe-haven demand subsides is likely in the hands of the US dollar. The inverse correlation between the US dollar and gold futures has weakened in the 12 months to October 2023 (‑0.73), but still remains strong enough to be relevant.”

The direction of US 10 year nominal yields is another key driver for gold futures, Vivek adds.

“While the inverse relationship between gold futures and the US 10 year nominal yields has broken down recently, higher long‑term US yields has typically meant weaker demand for gold. A sub‑$US1900/oz gold price therefore looks contingent on a higher‑for‑longer US interest rate environment – as this is likely to support both yields and the US dollar. Such an interest rate environment though would require more resilient US labour and inflation data in coming weeks.”

The Reserve Bank of Australia has released its quarterly monetary policy statement

…and I for one, never miss a chance to sample the goods I’ve already purchased.

In short, the RBA sees Aussie inflation returning to the top of its 2-3% goal by the end of 2025 because ‘cost pressure is easing more slowly than previously thought’.

That ‘cos of sticky-icky services inflation.

At the November race meet this week, the RBA lifted our cash rates by yet another 25bps to a 12-year high of 4.35% after holding off for the 4 months prior.

Here’s a hella good summary of where we are today vs. A year ago from the RBA board:

“Headline inflation and the unemployment rate have evolved broadly as expected a year ago. But underlying inflation has been higher than anticipated, as high services inflation has persisted in an environment of strong domestic cost pressures and still-robust levels of aggregate demand.

“Population growth has been substantially stronger than expected following the reopening of the border; however, the net effects on the aggregate inflation outlook and the unemployment rate have been relatively small because the increase in population has added to both aggregate supply and aggregate demand in the economy.”

– RBA Quarterly Statement on Monetary Policy

The RBA noted on Tuesday that it was a more-resilient-than-expected Aussie economy, with strong government infrastructure spend and record high migration supporting the big show.

GDP growth now is expected to expand by 1.5% yoy in Q4 of 2023, stronger than August’s projection of 1.1%, it said.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| TG1 | Techgen Metals Ltd | 0.0940 | 248.15 | 7,677,884 | $2,083,544 |

| NRZR | Neurizer Ltd - Rights 10-Nov-23 | 0.0020 | 100.00 | 3,142,166 | $127,674 |

| MDIR | Middle Island Res - Rights 10-Nov-23 | 0.0050 | 66.67 | 668,028 | $210,987 |

| VPR | Volt Power Group | 0.0015 | 50.00 | 70,954 | $10,716,208 |

| 14D | 1414 Degrees Limited | 0.0350 | 40.00 | 193,022 | $5,954,213 |

| TSL | Titanium Sands Ltd | 0.0110 | 37.50 | 1,021,683 | $14,174,438 |

| ENT | Enterprise Metals | 0.0040 | 33.33 | 129,250 | $2,398,413 |

| AZL | Arizona Lithium Ltd | 0.0370 | 32.14 | 93,005,359 | $92,926,009 |

| BTR | Brightstar Resources | 0.0130 | 30.00 | 37,075,041 | $19,158,334 |

| IXR | Ionic Rare Earths | 0.0260 | 30.00 | 44,249,226 | $79,122,098 |

| SIX | Sprintex Ltd | 0.0130 | 30.00 | 4,734,859 | $3,413,565 |

| RB6 | Rubixresources | 0.1550 | 29.17 | 6,483,898 | $6,546,000 |

| WML | Woomera Mining Ltd | 0.0250 | 25.00 | 40,622,927 | $23,873,891 |

| AUK | Aumake Limited | 0.0050 | 25.00 | 8,929,509 | $5,949,038 |

| BYH | Bryah Resources Ltd | 0.0200 | 25.00 | 8,889,707 | $5,737,685 |

| CHK | Cohiba Min Ltd | 0.0025 | 25.00 | 816,675 | $4,426,488 |

| MSI | Multistack Internat. | 0.0050 | 25.00 | 66 | $545,216 |

| RMX | Red Mount Min Ltd | 0.0050 | 25.00 | 12,474,310 | $10,694,304 |

| SIT | Site Group Int Ltd | 0.0025 | 25.00 | 3,150,000 | $5,204,980 |

| AYA | Artryalimited | 0.2350 | 23.68 | 1,914 | $11,977,319 |

| CBH | Coolabah Metals Limi | 0.0640 | 23.08 | 51,023 | $3,005,600 |

| BOA | Boadicea Resources | 0.0480 | 23.08 | 3,945,151 | $4,800,522 |

| NRX | Noronex Limited | 0.0110 | 22.22 | 526,566 | $3,404,716 |

| PNR | Pantoro Limited | 0.0470 | 20.51 | 31,225,330 | $202,957,190 |

| GMN | Gold Mountain Ltd | 0.0060 | 20.00 | 4,869,773 | $11,345,393 |

| ORG | Origin Energy | 8.6350 | -2.65 | 50,408,929 | $15,280,771,842 |

Leaping late on Lithium Friday is Paul Lloyd’s Arizona Lithium (ASX:AZL) after reporting that pilot plant operations are underway processing brine and producing lithium concentrate from the Prairie Lithium Project.

Pilot plant testing of Prairie brine material will complete the third and final phase of the evaluation on very promising third-party supplied DLE technology.

The location of the first commercial facility has been selected, and the ground prepared for the well pad, allowing AZL “to rapidly advance from pilot operations to commercialisation via the drilling of its initial wells H1 2024.”

Meanwhile, it’s all about Lake Johnston lithium out in the Goldfields Esperance region of WA with several companies up on news about projects in the area.

On Friday morning, Rubix Resources (ASX:RB6) reported a cultural heritage survey will start on November 30 at its Lake Johnston lithium project in WA with a program of works for its maiden drilling program approved.

This Lithium junior Rubix says its also enjoying a bit of ‘pegmatite-poking action’ down in southern WA at Lake Johnston, according to me fellow ex-Canberran mate Rob Badman.

Rubix has announced it’s about to begin a Cultural Heritage Survey at the site, in collaboration with the registered Native Title Holders, the Ngadju People.

“And what this essentially means is the company will be moving ahead on November 30 to review the area for new access track potential and drillholes,” Rob wrote.

A Program of Works for the company’s maiden Lake Johnston drilling has already been approved.

And Bryah Resources (ASX:BYH) is in on the same deal.

BYH says it’s fast-tracking its lithium exploration at Lake Johnston with CEO Ashley Jones saying TG Metals’ (ASX:TG6) recent success has put a strong emphasis again on the area.

“We have already shown that we have LCT type pegmatites on Bryah’s tenements with 403ppm Li2O at the Roundbottom Prospect. So we know the potential,” he said.

Bryah has been keeping one eye very much on its neighbouring competitors, noting it has “further reason to fast track its exploration on Lake Johnston lithium targets following the recent success by TG Metals south of Bryah’s tenure”.

Bryah’s aim is to get cracking on lithium exploration and have a soil program completed by the end of the year with drill targets identified over January and drilling following approvals in Q1 2024.

Next up is TechGen Metals (ASX:TG1), which dropped an update on its projects including stage three drilling approved for its John Bull Gold Project and pegmatite mapping to kick off at Ida Valley with historic data identifying lithium and caesiumin soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault.

TechGen’s Managing Director, Ashley Hood says exploration efforts are ongoing, ‘with a particular focus on multiple projects within our portfolio.’ vis a vis: John Bull, Ida Valley, Station Creek, and Harbutt Range.

At John Bull, all 17 drill holes have successfully intersected gold mineralisation exceeding 1g/t Au, Hood says.

“With approximately 900 meters of unexplored soil gold anomalies, we anticipate that Stage 3 drilling will target the most promising geological and geochemical features revealed through our mapping, geochemistry, and petrology studies.”

John Bull Gold Project: Stage three drilling approval has been green lit – the two key areas to be targeted in stage three; the northern 10g/t Au in soil anomaly and the southern 4.77g/t Au in soil above monzonite anomaly.

Ida Valley Lithium Prospectivity: Pegmatite mapping to commence with historic data identifying lithium and caesium in soils up to 144.5ppm Li (311ppm Li2O) along the Ida Fault. Limited multi-element analysis was completed while gold was the exploration focus.

TG1 says x 3 lithium target areas have been identified for sampling and mapping.

Station Creek Copper Project: Mapping Target PGN09, site of high-grade shear hosted Cu-Au-Ag mineralisation (27% Cu, 6.64g/t Au & 145g/t Ag), close to Norwest Minerals Limited’s Bali Copper Project underway.

Harbutt Range: Ground EM geophysics completed at Snap Dragon Prospect. Geophysics results have not warranted further investigation and Rio Tinto (ASX:RIO) are getting out of the earn-in joint venture.

Pilbara Lithium Project: TG1 has submitted tenement applications.

Charger Metals (ASX:CHR) reports assay results from soil sampling completed earlier this year have identified several new lithium targets at the Mt Gordon tenement of its Lake Johnston lithium project.

That there Badman says the $24m market-capped lithium and base metals exploration company was also… ahem, charging … up the bourse earlier thanks to new lithium targets identified down at the increasingly interesting Lake Johnston.

Assay results from soil sampling completed earlier this year have revealed the targets, which are in the Mt Gordon tenement of its Lake Johnston lithium project, with follow-up planning for AC and RC drilling now in the works, along with diamond drilling at the Medcalf spodumene prospect.

In particular, one soil anomaly (>100ppm Li2O) extends for more than 3km and lies adjacent to the tenement boundary with TG Metals (ASX:TG6), which hosts the recent Burmeister lithium discovery and has been making some pretty big noise of its own lately, having slayed it as a ressie stocks standout in October.

Elsewhere, at its AGM, 1414 Degrees (ASX:14D) reports that after years of delays 14D is ‘confident of securing access to the high voltage transmission line and are now assessing infrastructure and operating partners for the large battery proposed for the site.

‘Our intent at this time is for 1414 Degrees to retain an interest in the project and its cash flow while reducing our contribution to capital costs via strategic deals.’

Finally, among the healthcare small caps, a nod to the regenerative medicine biotech Avita Medical (ASX:AVH) has announced its third quarter financial results with 51% commercial revenue growth on pcp to $13.5 million and gross margin of 84.5% for the quarter.

- Commercial revenue for Q4 will come in between $15.3 to $16.3 million, reflecting a big lower bound of 64% and upper bound of 73% growth over the pcp.

- For the full year FY23, revenue is expected to be in the range of $51 to $53 million, reflecting a lower bound of 50% and upper bound of 56% growth over the pcp.

- Gross margin for the full year is expected to be in the range of 83% to 85%.

AVITA’s flagship product is the RECELL System, a technology platform approved by the FDA for the treatment of thermal burn wounds, and for repigmentation of skin cells harnessed from the patient’s own skin.

Using the RECELL device, a clinician prepares and delivers autologous skin cells from pigmented skin to stable depigmented areas, offering a safe and effective treatment for vitiligo.

AVITA said it’s well funded after securing a debt financing facility for up to $90 million in October.

Together with the cash on hand of $60.1 million as of September 30, the company believes it has sufficient capital to meet its goals and to reach profitability during 2025.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MNS | Magnis Energy Tech | 0.0520 | -35.80 | 36,241,992 | $97,159,350 |

| BP8 | Bph Global Ltd | 0.0010 | -33.33 | 255,628 | $2,423,345 |

| AMD | Arrow Minerals | 0.0015 | -25.00 | 1,085,676 | $6,047,530 |

| CCE | Carnegie Cln Energy | 0.0015 | -25.00 | 1,142,267 | $31,285,147 |

| DTC | Damstra Holdings | 0.1850 | -21.28 | 3,025,703 | $60,602,292 |

| KTA | Krakatoa Resources | 0.0340 | -20.93 | 30,289,262 | $18,700,610 |

| NNG | Nexion Group | 0.0120 | -20.00 | 1,250,000 | $3,034,618 |

| WYX | Western Yilgarn NL | 0.0960 | -20.00 | 85,370 | $5,958,900 |

| E33 | East 33 Limited. | 0.0200 | -20.00 | 282,984 | $12,977,217 |

| IEC | Intra Energy Corp | 0.0040 | -20.00 | 5,075,000 | $8,303,908 |

| APM | APM Human Services | 1.7875 | -19.48 | 8,212,463 | $2,036,143,920 |

| DUN | Dundasminerals | 0.0570 | -18.57 | 498,148 | $3,547,500 |

| TTI | Traffic Technologies | 0.0090 | -18.18 | 226,714 | $8,334,372 |

| KZA | Kazia Therapeutics | 0.0720 | -17.24 | 1,574,952 | $20,562,396 |

| NC6 | Nanollose Limited | 0.0290 | -17.14 | 292,467 | $5,211,023 |

| MKL | Mighty Kingdom Ltd | 0.0150 | -16.67 | 6,765 | $7,566,653 |

| LYK | Lykosmetalslimited | 0.0500 | -15.25 | 46,734 | $3,681,600 |

| WZR | Wisr Ltd | 0.0230 | -14.81 | 918,174 | $36,771,968 |

| NXS | Next Science Limited | 0.2900 | -14.71 | 343,648 | $99,176,335 |

| XAM | Xanadu Mines Ltd | 0.0650 | -14.47 | 4,289,609 | $124,474,639 |

| HVY | Heavymineralslimited | 0.0900 | -14.29 | 295,338 | $6,050,474 |

| IBG | Ironbark Zinc Ltd | 0.0060 | -14.29 | 250,000 | $10,267,490 |

| A1G | African Gold Ltd. | 0.0310 | -13.89 | 973,912 | $6,095,204 |

| JGH | Jade Gas Holdings | 0.0330 | -13.16 | 340,000 | $59,919,698 |

| ORG | Origin Energy | 8.6350 | -2.65 | 50,408,929 | $15,280,771,842 |

TRADING HALTS

Avenira (ASX:AEV) – Pending an application to court by AEV ‘seeking orders in relation to the company’s inadvertent failure to lodge a cleansing notice under section 708A(5)(e) of the Corporations Act 2001 (Cth) within the prescribed 5 day period’ after the issue of securities on 14 April 2023

Armour Energy (ASX:AJQ) – Pending an announcement in relation to Armour Secured Amortising Notes.

Caprice Resources (ASX:CRS) – Pending an announcement regarding a capital raising.

Buru Energy (ASX:BRU) – Pending the release of an announcement in relation to a capital raising.

Cooper Metals (ASX:CPM) – Pending an announcement regarding material exploration results.

MetalsTech (ASX:MTC) – Pending the release of an announcement by the company in relation to the results of its Scoping Study which highlights the robust economics for a high-tonnage, high-value underground-only gold-silver mining operation at the 100%-owned Sturec gold mine, Slovakia.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.