Closing Bell: Flat benchmark, lower small cap index cop free lesson from OpenLearning, up 50% by hump day

Via Getty

- ASX 200 ends flat as

- Small caps s wee bit lower

- OLL investment sparks share price surge

We’re pretty flat on Wednesday. I am, the benchmark is and so is Australia as a nation and a continent.

Luckily Gregor Stronach, my trusty fiend on the scene has been given a blank piece of paper and had his grown man’s passion for the factual and the absurd unlocked and let out to play upon the rich soft garden that is the Emerging Companies XEC index.

For all that exists between the cracks on small cap companies, there he is in his own twilight universe, recording the funny bits.

Gregor’s doing it here, everyday… on as little food, drink and silver coins as News Ltd can get away with.

In the meantime…

The S&P/ASX 200 was pegged to parity give or take a few points since the open, at around 2pm it found a little wind beneath the wings, before terminal deflation occurred ending +2.5 points, or some 0.038% ahead. Sigh.

Congratulations Aussie benchmark, this one’s for you:

The small caps (XEC) Emerging Companies index fell in early trade didn’t pretend it could, and closed 0.3% at 4.15pm Sydney time.

For a rare moment in this column, we laud a good day at the office for the ASX banking stocks, led by the Bank of Queensland (ASX:BOQ) which came out of a tough year with 15% more NPAT(net profit after tax) than last.

The major banks all took courage from that, the rate cycle chalking up margin wins that investors are now starting to bank.

BOQ was the best blue chip among the top 200, while the Financial sector was ahead 2%.

It was the site of antsy, volatile trade overnight in New York, the S&P 500 index and the Nasdaq Composite dropped 0.6% and 1.2% respectively while the Dow Jones frothed its way to the slightest 0.1% gain.

US 10-year bond yields rose to 3.96% while 2-year yields inched below 4.29%.

Oil prices, metals and iron ore made small concessions.

The Hang Seng index in Hong Kong has fallen hard for a second straight session, down 2%, while the Shanghai Composite is short 1% and the Nikkei in Japan is slightly higher.

In Singapore, the iron ore futures (SGX:TSI) 62% Iron Ore November contract stands at US$94.57 a tonne, down 2.5%.

Stimulative policies in China have taken some effect, with domestic lenders dishing out 2.47 trillion RMB (US$345 billion) of new loans in September, according to the People’s Bank of China. The central banks has been central to loosening the purse strings, opening the credit taps from around July by incrementally lowering rates.

What’s left of the Aussie dollar is around US62.75 cents.

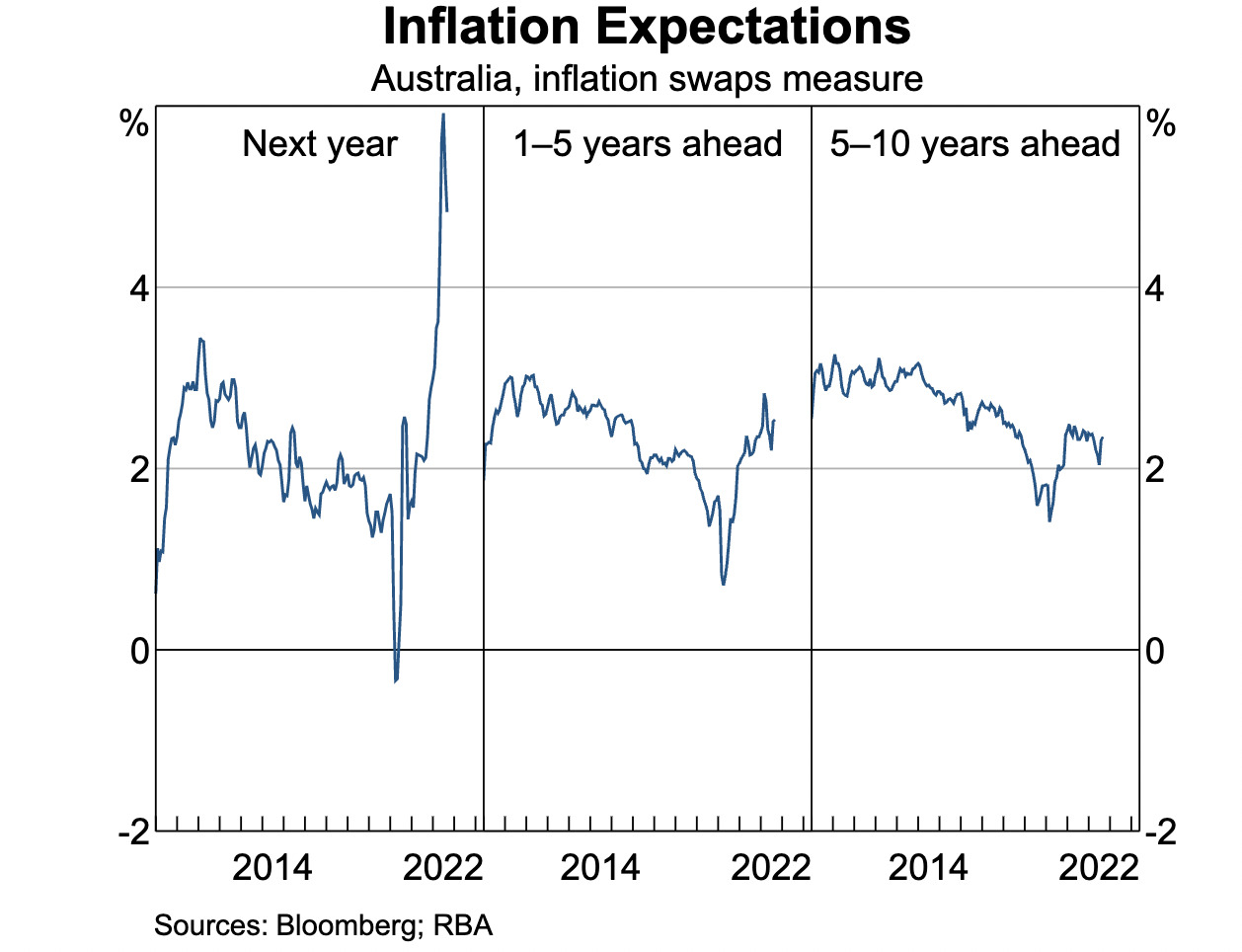

Going through this morning’s latest RBA speech (this one titled “The neutral rate: the pole-star casts faint light” from committee newbie RBA assistant governor Luci Ellis) – fun and fascinating for all the wrong reasons.

In an essentially meaningless circumnavigation around the futility of controlled tightening in a pre-recessionary fiscal environment (ie: being a central bank) Ms Ellis takes her audience along on an incredible exercise in covering your butt when things get real. Check it out:

‘Neutral’, then, is not a destination we necessarily reach, but more a pole-star to guide us. And even then, its location is sufficiently uncertain that we are perhaps better served by paying more attention to the ground as it shifts beneath our feet than to that faraway pole-star. We need to be mindful of the limitations of our instruments, and of the prospect that the stars themselves can realign. But as we navigate the narrow path to our intended goal, we welcome any faint light that those stars may cast.

“People’s decisions depend on their beliefs about the future, not solely on the recent past. And there are times when using past inflation produces very different estimates of current real rates than a trend or forward-looking measure.

“We are definitely in one of those times.”

Terrific. This is the only guidance I took out:

“Current inflation is very high, and expected to stay high in the short term. But beyond the next year, inflation expectations remain well anchored inside the target range, both here and overseas.”

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 6,165,360 | $15,102,574 |

| JAV | Javelin Minerals Ltd | 0.0015 | 50% | 1,337,644 | $9,454,153 |

| MEB | Medibio Limited | 0.0015 | 50% | 693,980 | $3,320,594 |

| SGQ | St George Min Ltd | 0.059 | 48% | 94,399,959 | $28,000,712 |

| CAD | Caeneus Minerals | 0.004 | 33% | 550,752 | $16,036,815 |

| OLL | Openlearning | 0.036 | 29% | 2,492,243 | $6,002,763 |

| MRL | Mayur Resources Ltd | 0.13 | 24% | 208,199 | $25,403,439 |

| SHO | Sportshero Ltd | 0.026 | 24% | 2,798,298 | $11,965,682 |

| AHQ | Allegiance Coal Ltd | 0.067 | 22% | 2,637,732 | $23,090,108 |

| GME | GME Resources Ltd | 0.14 | 22% | 1,082,423 | $69,046,117 |

| RB6 | Rubixresources | 0.14 | 22% | 110,678 | $3,110,750 |

| AUK | Aumake Limited | 0.006 | 20% | 1,731,792 | $3,857,235 |

| RMX | Red Mount Min Ltd | 0.006 | 20% | 210,000 | $8,211,819 |

| YPB | YPB Group Ltd | 0.006 | 20% | 793,576 | $2,032,731 |

| TKM | Trek Metals Ltd | 0.064 | 19% | 726,160 | $16,772,948 |

| REC | Rechargemetals | 0.17 | 17% | 49,870 | $5,770,275 |

| DCN | Dacian Gold Ltd | 0.1225 | 17% | 4,945,301 | $127,764,098 |

| E33 | East 33 Limited. | 0.035 | 17% | 28,580 | $8,278,845 |

| MEI | Meteoric Resources | 0.014 | 17% | 370,773 | $18,315,568 |

| RNX | Renegade Exploration | 0.007 | 17% | 1,245,151 | $5,350,103 |

| CYC | Cyclopharm Limited | 1.51 | 17% | 38,364 | $120,504,705 |

| DRE | Dreadnought Resources Ltd | 0.1 | 16% | 39,055,655 | $261,657,885 |

| GCX | GCX Metals Limited | 0.045 | 15% | 261,802 | $7,245,369 |

St George Mining (ASX:SGQ), which has surged 37.5% on news that it has delivered on its quest to slay the dragon at Mt Alexander and drag home a huge pile of lithium.

St George says drilling has uncovered high-grade lithium in spots like these ones:

- MARK152-2: 1.97% Li 2 O, 715ppm Cs, 166ppm Ta 2O5 and 13,765ppm Rb

- MARK263: 1.15% Li 2 O, 211 ppm Cs, 51ppm Ta 2O5 and 5,825ppm Rb

- MARK267: 1.68% Li 2 O, 164ppm Cs, 104ppm Ta 2O5 and 7,700ppm Rb

- MARK268: 2.72% Li 2 O, 756ppm Cs, 60ppm Ta 2O5 and 11,530ppm Rb

Meanwhile in the educational tech space, and yes there certainly is one, OpenLearning’s (ASX:OLL) escalation continues – stacking on a further 32.1% before lunch to take it to circa 50% better than Monday morning.

After screeching out of a trading halt this week, OLL says it’s secured a strategic investment from the Education Centre of Australia (‘ECA’), a diverse international educational group with over 7,000 students. ECA has invested circa $1.1m in OLL through the issue of 25 million new ordinary shares at A$0.043 per share, which is, like 25% better than OLL’s 30-day volume weighted average price (VWAP) of $0.034 up to 6 October 2022.

CEO Adam Brimo:

“We’re excited to welcome ECA to the register as a strategic investor and we look forward to working with them as we finalise our strategic review and explore a range of growth opportunities.”

SportsHero (ASX:SHO) is up 33.3% or exactly one-third of this morning’s (admittedly pennyworth 1.9 cents).

I don’t know why, can’t stop to check, so here’s the blurb from the sporting hero’s POV:

SHO the world’s leading social sports prediction mobile app. We are a global, fast growing mobile app which looks to become the #1 social network dedicated to sports prediction.

Our mission is to build’s the world’s largest social community dedicated to sports by bringing together sports fans from around the world and providing them with an engaging platform to participate in fantastic prediction games, and the opportunity to win great prizes from our partners.

They can also host their own competitions and redeem great prizes from our eStore. SportsHero has been launched by the same team behind TradeHero, the number one financial learning app in 91 countries (top 10 in 127 countries) according to App Annie, with over 8 million users.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DAF | Discovery Alaska Ltd | 0.035 | -44% | 5,930,564 | $13,902,551 |

| ANL | Amani Gold Ltd | 0.001 | -33% | 417,000 | $35,540,162 |

| DDD | 3D Resources Limited | 0.0015 | -25% | 1,145,102 | $8,863,744 |

| GGX | Gas2Grid Limited | 0.0015 | -25% | 266,429 | $8,116,204 |

| CLE | Cyclone Metals | 0.002 | -20% | 1,228,905 | $15,291,842 |

| NTL | New Talisman Gold | 0.002 | -20% | 18,400 | $7,818,063 |

| SYN | Synergia Energy Ltd | 0.002 | -20% | 252,819 | $21,044,477 |

| MOZ | Mosaic Brands Ltd | 0.24 | -19% | 219,216 | $31,731,064 |

| AGD | Austral Gold | 0.037 | -18% | 48,302 | $27,554,011 |

| M24 | Mamba Exploration | 0.12 | -17% | 105,931 | $6,115,375 |

| LNYDA | Laneway Res Ltd | 0.2 | -17% | 55,770 | $40,823,072 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 331,788 | $5,620,064 |

| NIM | Nimyresourceslimited | 0.255 | -16% | 359,670 | $16,832,792 |

| B4P | Beforepay Group | 0.35 | -15% | 22,199 | $14,279,979 |

| EDE | Eden Inv Ltd | 0.006 | -14% | 927,815 | $18,978,603 |

| GTG | Genetic Technologies | 0.003 | -14% | 3,200,000 | $32,318,878 |

| HLX | Helix Resources | 0.006 | -14% | 65,606,812 | $16,262,021 |

| RTG | RTG Mining Inc. | 0.043 | -14% | 1,348 | $39,818,015 |

| SGA | Sarytogan | 0.25 | -14% | 3,932,376 | $17,895,071 |

| FCT | Firstwave Cloud Tech | 0.05 | -14% | 10,000 | $96,416,527 |

| TBA | Tombola Gold Ltd | 0.025 | -14% | 4,098,011 | $31,665,469 |

| CAZ | Cazaly Resources | 0.032 | -14% | 3,504,677 | $13,720,406 |

| AUQ | Alara Resources Ltd | 0.033 | -13% | 251,397 | $27,287,327 |

| BUY | Bounty Oil & Gas NL | 0.007 | -13% | 1,664,864 | $10,964,008 |

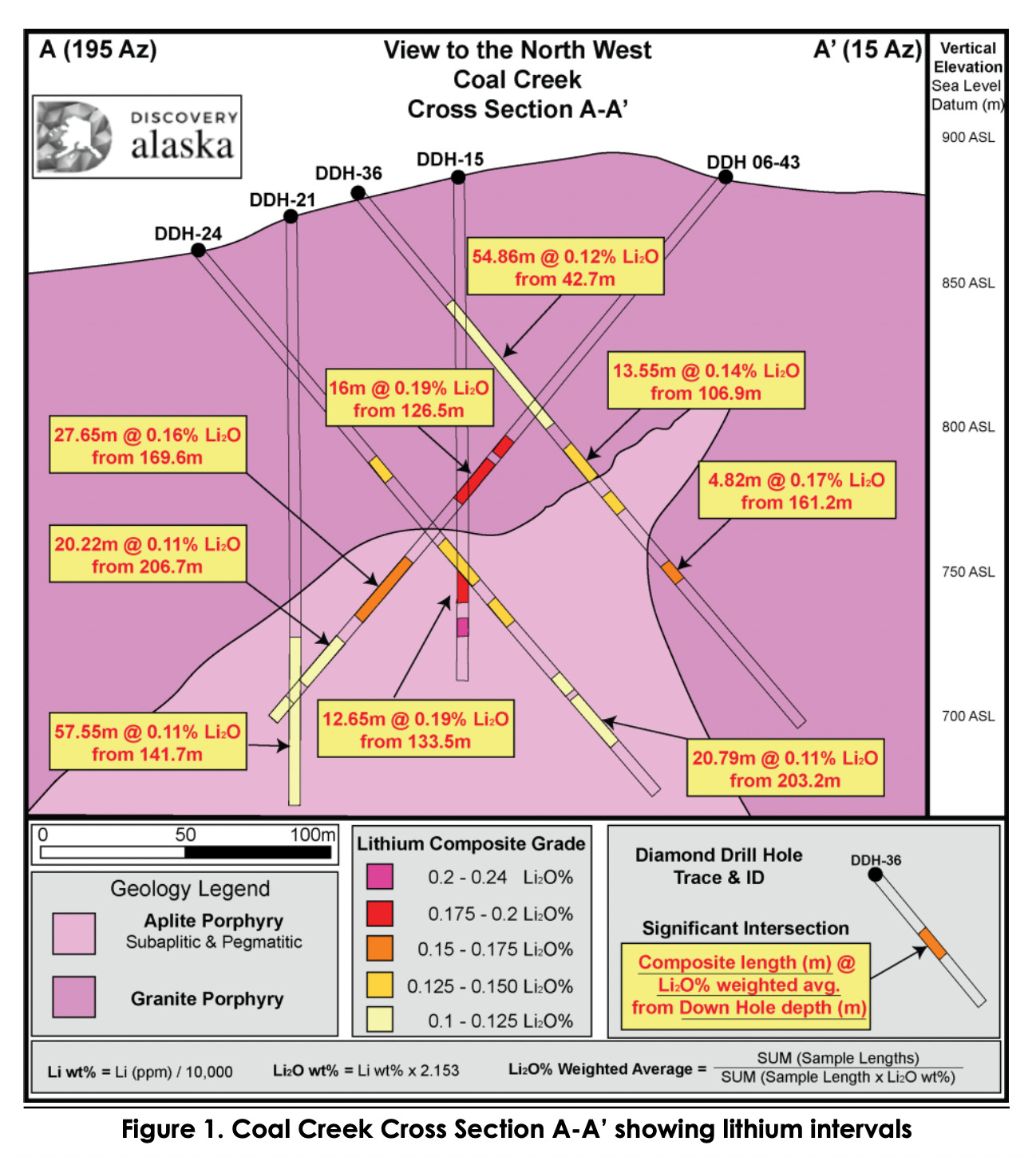

There’s something wrong with this picture:

Reuben’s not nearby so I can’t wave it at him and Bevis won’t talk to me since I criticised the second Peter Jackson Hobbit trilogy.

In any case, we’re looking at this morning’s drilling update from Discovery Alaska (ASX: DAF).

Director, Jerko Zuvela says the company is ‘excited with the first stage lab analysis results, confirming significant broad zones of lithium mineralisation’ at the Coal Creek prospect. Zuvela adds there’s plenty of potential for strike and depth extensions.

“These initial results provide encouragement for continued exploration works. We look forward to realising the lithium potential and advancing works toward delineating a maiden JORC resource at our Coal Creek prospect.”

I’d’ve thought pretty good.

Down 44%.

TRADING HALTS

NIB Holdings (ASX:NHF) – NIB went into a halt this morning, and emerged from it as suddenly as it went in, on news that it’s trying to raise about $150 million, to buy pretty much whatever it wants, because that’s a lot of money.

Larvotto Resources (ASX:LRV) – Larvotto, fresh off the back of securing $3.4 million yesterday, is… doing a capital raise for some obscure reason. Sounds a bit greedy, if you ask me, but if that’s what’s gonna make them happy…

MAKO GOLD (ASX:MKG) – Mako is also launching a capital raise, so it can go “Hey Presto!” and mako more goldo come out of the groundo.

Botanix Pharmaceuticals (ASX:BOT) – This one’s a juicy one… Botanix is in a halt, ahead of results from a clinical trial, which should be out by the end of the week.

Australian Potash (ASX:APC) – Aaand APC is into a halt pending news of an acquisition, which is most likely going to be “loads and loads of jazz cigarettes” so that it can keep on making potash for many years to come.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.