Closing Bell: Flat as on Aussie markets, but underground things are moving fast for Tempus Resources, up 60%

Via Getty

- Aussie markets are flat, flat, flat (actually the benchmark found 0.1%)

- Banks are lower, consumer names higher

- Explorers Devex and Tempus have found big things in the ground

There’s about 15 minutes of trade on the ASX and I’m calling both benchmark ASX 200 and the Emerging Companies (XEC) indices as flat, flat, flat and flat.

(Ed: okay, the ASX200 is 0.1% up, the XEC 0.078% higher)

The small cap index has been a volatile swinging thing from the open, but the benchmark rose steadily and then fell steadily, as is its wont, frankly. The banks are lower, the Industrials, the Communication and the Consumer Discretionary stocks are all higher.

Around the region, Japan’s Nikkei leads losses in mixed Asian trade. SoftBank shares are 6% lower after sharp earnings losses. In Hong Kong, the Hang Seng is ahead by 1% with shares in tech giant Alibaba surging almost 3%.

The sharp part of the economic week is arriving as Wall Street braces for a CPI read stateside which could very well plot the course for the US Federal Reserve’s mission to turn the screws on an over-charged economy, frazzled by treadmill inflation, which has stayed at near 40 year highs.

US investors fear The Fed’s inflation fight could spill out and drag markets into a broader economic recession.

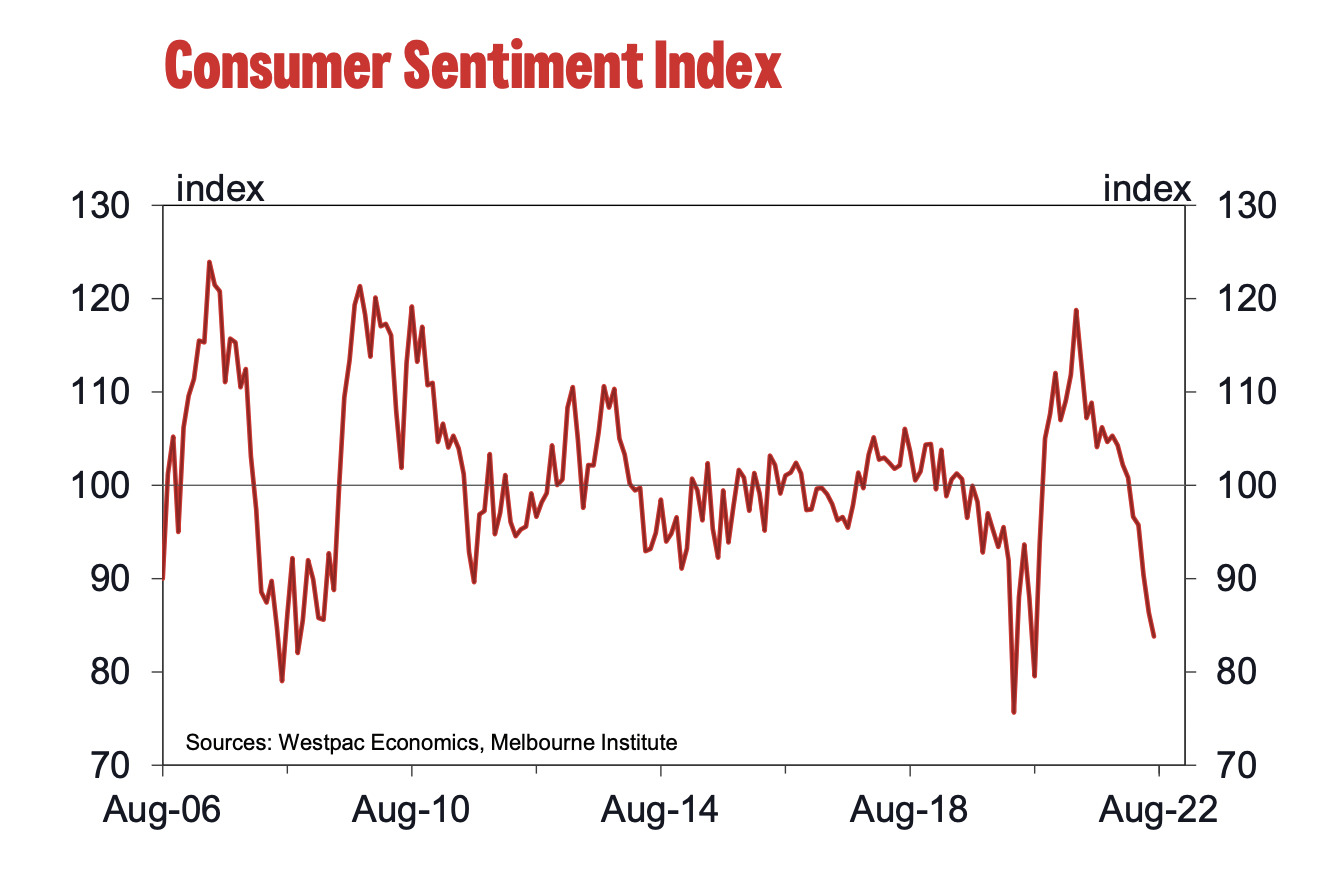

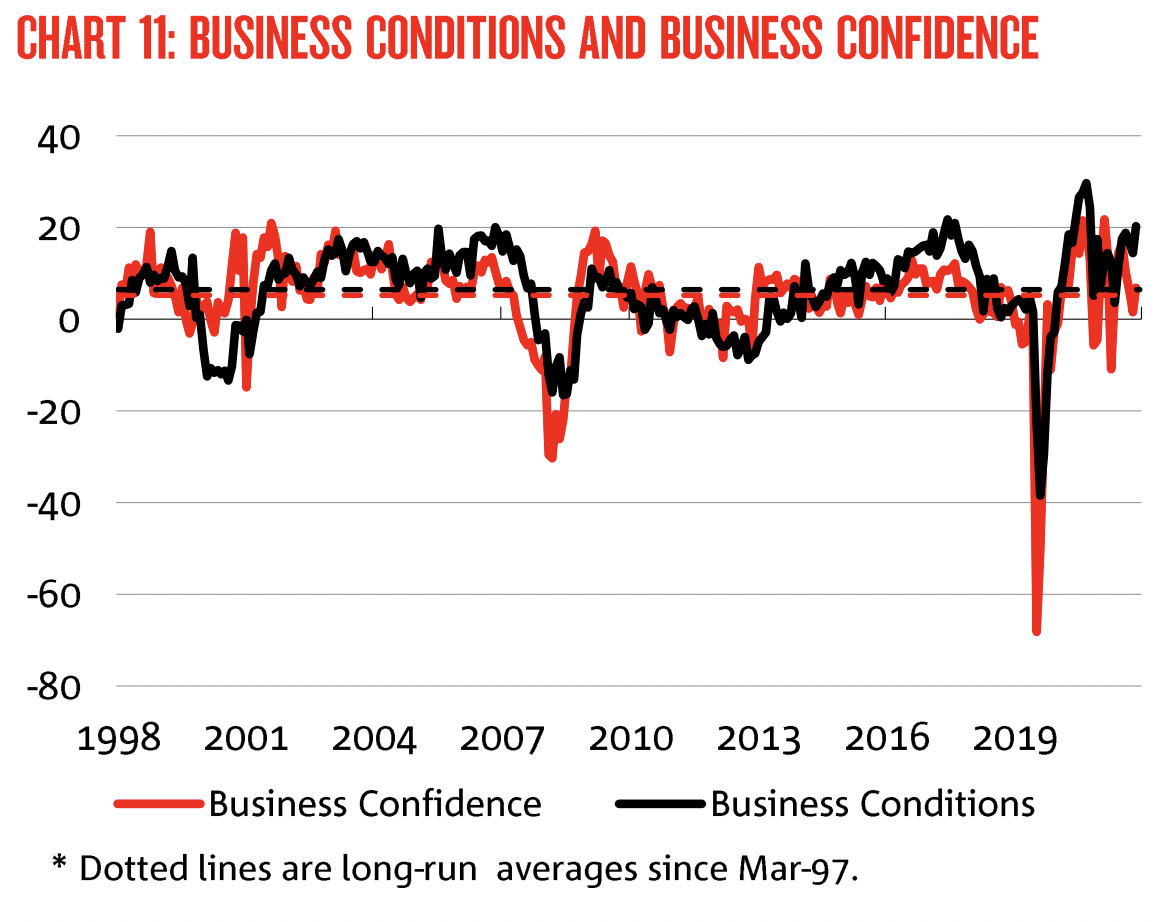

Meanwhile here at home, the usual spam mail of monthly confidence surveys actually revealed something interesting – a yawning chasm opening up between unhappy consumers and happy businesses! (Ed: I’ve been waiting about 96 months for some sentiment index ack-shawn)

Westpac’s read for August has Aussie consumer confidence crashing by 3% and now it’s 22% worse than a year ago and just slumming it around recession-like depression.

In wonderful contrast – business confidence, according to the latest NAB survey, rose to an index of 7, (way on up from 1 last month) while business conditions also jumped to 20 from 13 – which is well above garden variety gladness.

What it means? Something ‘recessionesque’ perhaps. Right now I’ve no idea. But I’m going to check it out.

We do know CBA’s senior economist, Belinda Allen reckons it won’t last – and businesses will soon be as unhappy as their customers what with all the global uncertainty, inflation, monetary tightening and crippled supply lines and so on.

Also a little earlier, the Australian Bureau of Stats says a 10.2% surge in household spending was the 16th straight month of increases in total household spend, with increases in all spending categories a reflection of the deep lows inspired by the pandemic.

Finally, less sense of a recession over at Rupert Murdoch’s News Corp which delivered its biggest ever full year of earnings, just about doubling net income on the back of some very smart acquisitions and investments. Wink.

The media juggernaut lifted revenue by 11% to $US10.4 billion, with net income at $US760 million, almost double FY21.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| DXN | DXN Limited | 0.0105 | 75% | 90,828,618 |

| TMR | Tempus Resources Ltd | 0.087 | 54% | 28,618,886 |

| SIH | Sihayo Gold Limited | 0.003 | 50% | 666,422 |

| KOR | Korab Resources | 0.028 | 40% | 4,154,682 |

| GBR | Greatbould Resources | 0.125 | 34% | 2,640,492 |

| BRX | Belararoxlimited | 0.375 | 34% | 368,421 |

| AOU | Auroch Minerals Ltd | 0.082 | 33% | 3,512,844 |

| ENT | Enterprise Metals | 0.013 | 30% | 16,236,332 |

| DEV | Devex Resources Ltd | 0.385 | 28% | 4,360,860 |

| MGA | Metalsgrovemining | 0.125 | 25% | 1,195,154 |

| VOR | Vortiv Ltd | 0.025 | 25% | 1,639,919 |

| AMD | Arrow Minerals | 0.005 | 25% | 359,674 |

| PRM | Prominence Energy | 0.0025 | 25% | 240,824 |

| MI6 | Minerals260Limited | 0.34 | 24% | 974,247 |

| NAE | New Age Exploration | 0.008 | 23% | 23,618,180 |

| ARV | Artemis Resources | 0.043 | 23% | 3,100,132 |

| PH2 | Pure Hydrogen Corp | 0.35 | 23% | 1,869,407 |

| WC8 | Wildcat Resources | 0.027 | 23% | 7,030,796 |

| IVX | Invion Ltd | 0.011 | 22% | 846,783 |

| RDS | Redstone Resources | 0.011 | 22% | 2,660,038 |

| HCH | Hot Chili Ltd | 0.95 | 22% | 1,289,324 |

| IPX | Iperionx Limited | 0.805 | 19% | 311,997 |

| ARN | Aldoro Resources | 0.26 | 18% | 693,331 |

| HPP | Health Plant Protein | 0.098 | 18% | 21,111 |

| NWC | New World Resources | 0.04 | 18% | 7,530,314 |

Outside of a big day for the resources names, the headline making Network-as-a-Service (NaaS) Megaport (ASX:MP1) has reported a more than 40% boom in monthly recurring revenue (MRR) for the year to 30 June.

Eddy Sunarto knows this bunch well, and sector experts see MRR as the most important measure of a company’s success because it reflects money already in the bag.

Annual Recurring Revenue (ARR) is also a vital metric to keep an eye on and Megaport has plenty of that too, with ARR also up 43% at $128.3m as of 30 June 2022.

Tempus Resources (ASX:TMR) has announced a high-grade gold bonanza:

- 523.0g/t gold over 0.42 metres from 96.91 metres

- 32.7g/t gold over 0.45 metres from 124.02 metres, including 133.0g/t gold over 0.11m from 124.02 metres, and

- 7.4g/t gold over 1.73 metres from 164.41 metres, including 17.4g/t gold over 0.73m from 165.41 metres

Big numbers, big gains – as high as 60% – and chewing the quick of its all time high in April this year.

Devex Resources (ASX:DEV), announcing a high-grade uranium bonanza:

Including:

- Nabarlek South: 10.7m @ 1.20% eU3O8 from 123.4m, incl 3.2m @ 3.05% eU3O8

- North Buffalo: 9.1m @ 0.15% eU3O8 from 50.5m, incl 0.4m @ 0.80% eU3O

Big numbers, also a big gain Devex’s shares up circa 30%.

Lithium explorer Enterprise Metals (ASX:ENT) has a well earned rep as a project generator – as enthusiastically favoured by Rick Rule – these co’s tend to partner with other (usually more cashed up) co’s to help fund prospective projects – sharing the risk, the Rick Rule rule and the reward.

Tracking ENT, Jess says they’ve completed checking 54 assays of the Stage 1 -80# orientation soil samples from the Bullfinch North Project in Western Australia where some 23 samples have reported +50ppm lithium.

Around 13 of these samples have recorded even higher results, +60ppm lithium.

“These anomalous lithium samples are predominantly clustered over and around two parallel pegmatite intrusives, which have been identified by mapping of outcrops and interpretation of soil and vegetation trends in detailed imagery,” ENT says.

Shares are up some 30%.

ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks for today [intraday]:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| EVE | EVE Health Group Ltd | 0.001 | -33% | 6,500,000 |

| ANL | Amani Gold Ltd | 0.0015 | -25% | 16,787,747 |

| TSL | Titanium Sands Ltd | 0.015 | -25% | 61,000 |

| BUR | Burleyminerals | 0.095 | -21% | 10,000 |

| WBE | Whitebark Energy | 0.002 | -20% | 554,741 |

| XST | Xstate Resources | 0.002 | -20% | 250,000 |

| FIN | FIN Resources Ltd | 0.013 | -19% | 339,803 |

| EQN | Equinoxresources | 0.125 | -17% | 16,088 |

| ARE | Argonaut Resources | 0.0025 | -17% | 379,309 |

| CPT | Cipherpoint Limited | 0.005 | -17% | 319,493 |

| GLV | Global Oil & Gas | 0.0025 | -17% | 91,667 |

| DC2 | Dctwo | 0.058 | -16% | 125,670 |

| ISU | Iselect Ltd | 0.16 | -16% | 205,018 |

| SMX | Security Matters | 0.215 | -16% | 261,136 |

| DM1 | Desert Metals | 0.2 | -15% | 190,287 |

| ROC | Rocketboots | 0.115 | -15% | 43,341 |

| DKM | Duketon Mining | 0.285 | -14% | 35,556 |

| AHN | Athena Resources | 0.013 | -13% | 4,482,782 |

| DLM | Dominion Minerals | 0.06 | -13% | 380,279 |

| CDD | Cardno Limited | 0.6 | -13% | 645,203 |

| OSX | Osteopore Limited | 0.2 | -13% | 149,712 |

| MOZ | Mosaic Brands Ltd | 0.305 | -13% | 260,727 |

| SYN | Synergia Energy Ltd | 0.0035 | -13% | 6,036,060 |

| BYI | Beyond International | 0.35 | -13% | 3,511 |

| NMR | Native Mineral Res | 0.105 | -13% | 355,335 |

WHAT YOU MAY’VE MISSED

Aussie digger Hot Chili (ASX:HCH) is reporting its highest-grade results at Velentina, ever – namely an 8m grading 5.7% Copper & 24g/t Silver.

First assays returned from drilling across the historical Valentina high grade copper mine confirm a significant 120m strike extension to the deposit, recording this splendid hit:

8m grading 5.9% CuEq (5.7% copper (Cu), 24.1g/t silver (Ag)) from 27m downhole in reverse circulation (RC) drill hole VAP0009.

Valentina and its neighbouring San Antonio satellite copper deposit (Inferred resource of 4.2Mt grading 1.2% CuEq (1.1% Cu, 2.1g/t Ag) for 48kt Cu and 287koz Ag, reported March 2022) are the centre-piece of the Company’s Costa Fuego, coastal range, copper-gold hub in Chile.

HCH says both deposits represent shallow, high-grade open pit opportunities, with the potential to provide front-end ore sources and make a positive material impact on the payback period and overall project economics of the Costa Fuego copper-gold development.

Thirteen RC and three DD drill holes have been completed at the San Antonio high-grade copper resource will likely aid HCH to upgrade its categorisation from Inferred to Indicated, ahead of a planned resource upgrade for Costa Fuego in late 2022.

Bryah Resources (ASX:BYH) has won investor backing following a successful $1.43m placement to advance exploration at its Windalah copper-gold project. BYH says sophisticated and professional investors have made firm commitments to subscribe for shares priced at 2.7c each with Australian Vanadium participating in the placement to maintain its 4.97% shareholding.

BYH will use proceeds from the placement to drill diamond tails at Windalah, which includes $140,000 of additional funding through WA’s Exploration Incentive Scheme, complete the Olympus EIS program, and fund its share of its manganese joint venture with OMH.

Godolphin Resources (ASX: GRL) has received the final assay results from the two-hole drill hole program and a soil sampling program at the Cyclops Prospect on its 100%-owned Yeoval Tenement in central west NSW – and they’re not too shabby at all:

Drill results from GYDD001 include:

- 18m @ 0.52% Cu from 118m, including:

- 8m @ 1.01% Cu from 118m and

- 4m @ 1.75% Cu from 122m;

- 14m @ 0.42% Cu from 88m, including:

- 2m @ 1.51% Cu from 94m;

- 4m @ 0.47% Cu from 214m;

- 4m @ 0.14g/t Au from 92m;

- 28m @ 338ppm Mo adjacent to the copper zon

It’s an encouraging boost for Godolphin, especially considering the number of high-grade zones close to surface its found with the first diamond drill hole at the prospect.

Meanwhile, MetalsGrove Mining (ASX:MGA) says it’s off to the races at its pper Coondina Lithium Project in Western Australia.

MetalsGrove says the extensive surface soil programme will comprise approximately 2,500 samples on a grid spaced 50m x 200m covering ~50% of the Upper Coondina Project area, as the company goes in search of lithium-tin-tantalum.

The company is also set to take to the skies next month, using a chopper to survey a 590-line kilometre zone with magnetic and radiometric gadgets, to provide detailed lithological and structural mapping.

TRADING HALTS

West Wits Mining (ASX:WWI) – Capital raising.

Strickland Metals (ASX:STK) – More Capital raising.

Singular Health Group (ASX:SHG) – Even more capital raising.

Kalium Lakes (ASX:KLL) – Even even more more capital raising, plus a debt restructure, just to spice things up a little.

Auroch Minerals (ASX:AOU) – Auroch’s got an announcement about its Saints Nickel Project. Sweeeet.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.