Recurring revenue: Why investors love it and which ASX SaaS stocks topped last quarter

Here’s a list of SaaS stocks with strong growth in recurring revenues. Picture Getty Image

- The world is moving toward a subscription economy

- We take a look at the most important metrics for a SaaS company

- Which ASX stocks top the list of recurring revenue earners

The world is moving towards a subscription economy. Think Netflix, Amazon Prime, Zoom, Slack, Adobe or Microsoft.

A subscription is a payment structure where customers pay a weekly, monthly or yearly fee in exchange for products or services.

While subscriptions can be used in practically any industry, it’s the software companies that have been the most successful in leveraging this revenue model.

Just 10 years ago, the software industry looked very different to what it is now. Back then, a user who bought a software program received it at their disposal on an unlimited basis.

But in the last decade, the industry has undergone major changes and began to move towards a subscription format, commonly known as SaaS (Software as a Service). To be clear, SaaS is not a technology per se, but a business model.

From an investor’s perspective, there is a lot to like about a SaaS business model, and Wall Street does find it very appealing.

Let’s take a look at a few reasons why:

Investors love predictability

Let’s start with predictability. If a $100 million revenue company has an 80% annualised recurring revenue (ARR), that’s already $80 million in the bag at the start of every year. That figure is stable and predictable, allowing management to plan and invest for the future accordingly.

Lower costs

Companies can reduce their cost of customer acquisition by leveraging customer relationships. The fact is, it’s easier and cheaper to retain existing customers than to acquire a brand new one. The rule of thumb says it costs 5x more to win a new customer than to retain an old one.

Loyalty

The third reason investors find it appealing is because a subscription model enables more loyalty from customers. A brand that can reliably provide great service month after month is likely to retain customers, providing a stream of recurring revenues for the company far into the future.

The SaaS metrics that matter

As an investor, what metrics should you look out for in a SaaS company?

(Be aware the following may seem a bit of a dull read, but as a tech investor, you need to know this).

It’s also worth noting that the market often rewards (through share price increase) growth in the metric, as opposed to the metric itself.

Annual Recurring Revenue (ARR)

ARR is defined as the value of the contracted term subscriptions normalised to a one-year period.

What does normalised mean?

If you subscribed to software at $100 a month, the company would report that ARR to be $1,200 ($100 x 12).

This is despite the company not having received the full annual amount from you.

If you cancelled your subscription, the ARR figure would have to be adjusted and this is one of the pitfalls you need to be aware of when reading ARR numbers.

The ARR formula is simple:

ARR = (Overall Subscription Cost Per Year + Recurring Revenue From Add-ons or Upgrades) – Revenue Lost from Cancellations.

So what’s the difference between Revenue and ARR?

The main difference is that Revenue is all sales including cash paid to the company, while ARR measures solely your subscription-based revenue which may not include realised cash.

Monthly Recurring Revenue (MRR)

Similar to ARR, MRR is the total subscription revenue generated by your business from all the active subscriptions in a particular month.

Some experts say MRR is the most important measure of a SaaS company’s success as it reflects money already in the bag.

But things could still get complicated when you have customers that are paying on an annual basis.

In this case, the MRR would have to be divided by 12 to reflect the monthly payments.

The MRR formula is as follows:

MRR = Average revenue per subscriber per month x number of subscribers

Note the MRR formula is using the average revenue per subscriber, sometimes known as ARPA (Average Revenue Per Account).

This is because some customers are paying on different basis like an annual, six month, or monthly. The ARPA calculates the average of these customers into one monthly number.

Conversion rate

In basic terms, a SaaS Conversion Rate is the percentage of trial users who become paying customers.

In many cases, SaaS companies allow users to use the software for a given period of time, say a week or a month.

At the end of that trial period, the company would often request you to become a full paying subscriber.

The formula for the Conversion Rate is as follows:

Conversion Rate = The number of people converting to paying subscribers / the number of people using free trial versions of the software

For an SaaS business, experts say that a ballpark figure for a good conversion rate is 7%. A figure lower than that would mean that a company is paying for more sales and marketing to acquire a customer.

Churn Rate and Retention Rate

Churn rate is an essential metric that can make or break the success of a SaaS company

Also called Attrition Rate, it’s defined as the percentage of customers that cancel their subscriptions in any given time period.

Churn Rate = Total number of customers that cancel divided by the total number of all subscribers

Experts believe that a “good” churn rate for SaaS companies that target small businesses is 3-5% monthly.

The larger the target clients, the lower the churn rate should be. For example for an SaaS company that targets enterprise clients, a good churn rate should be less than 1% per month.

On the flip side of the Churn Rate is the Retention Rate.

Retention Rate = 100% – Churn Rate

Retention rate is the number of subscribers that keep their subscriptions during a given month.

Customer Lifetime Value (CLV) and Total Contract Value (TCV)

CLV is a key SaaS metric that adds up all the sales expected from a customer over the lifespan of their relationship with the company.

So why is this an important metric?

Because CLV tells the company their return on investment (ROI) of their marketing efforts. Knowing CLV helps a company determine how much it should be spending to acquire a new customer.

For example, let’s say it costs $500 for a SaaS company to acquire a new customer through its marketing and sales efforts.

If the CLV is more than $500, the company expects that an average subscriber would spend more than $500 before they cancel the subscription – making its ROI on marketing positive.

CLV can be calculated as:

CLV = Monthly Recurring Revenue per customer x the number months an average customer subscribes

The concept of CLV is similar to Total Contract Value (TCV), which is more often used by ASX companies.

TCV is defined as the expected sum total of revenue accrued to the SaaS company from a client over the entire contract term.

The term TCV is more used when the clients are businesses instead of individuals.

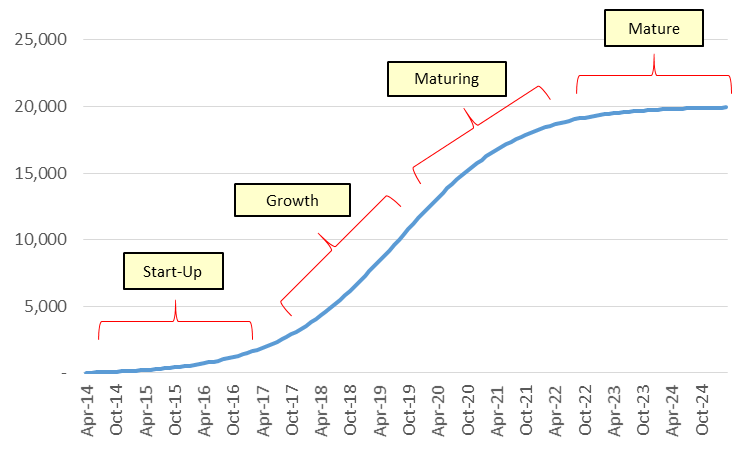

Source: Clare Capital

Top recurring revenue earners on the ASX last quarter

K2Fly (ASX:K2F)

K2Fly is a consulting systems integrator which targets major WA-based miners.

It develops and implements its own software including an enterprise land management solution called Infoscope.

It also resells other companies’ software and delivers consultancy and advisory services.

K2Fly has signed up major clients and now counts BHP as another one of the global Tier 1 customers on its list after signing up the company in the first quarter.

K2Fly’s Q1 FY23 highlights:

- ARR grew 15% to $6.0m compared to the prior quarter, and was up 76% compared to Q4 FY21

- TCV grew 80% to $17.8m compared to Q4FY21, and was up 7% compared to Q3FY22

- A major contract was signed with BHP Iron Ore during the quarter

- Cash Receipts from customers during the quarter were up 170% over Q4 FY21 at $5.4m.

Delta Drone (ASX:DLT)

Delta Drone builds drones for the security and logistics sectors, designed for those who work in complex or high-stakes situations.

The company’s ISS SPOTTER is a range of three surveillance solutions dedicated to the security sector.

The COUNTBOT is an exclusive automated warehouse inventory solution for logistics activities.

Delta also provides services for the mining industry.

Last week it announced a deal with Assmang’s Khumani Iron Ore Project in South Africa for drone surveying services. The ARR related to that contract is worth $880k over three years.

Delta’s Q2 FY22 highlights:

- Revenue from continuing operations $1.442m in Q2 FY22, up 7%, on Q1 FY22, of which ARR accounted for 29% of total revenue

- ARR was $1.710m at the end of the June quarter, up 30% on Q1 FY22

- Total contract value (TCV) was $3.822m at the end of the June quarter, up 27% on Q1 FY22

Volpara Health (ASX:VHT)

Volpara Health is a global leader in the early detection of breast cancer.

Volpara’s software provides clinicians feedback on breast density, compression, dose, and quality – enabling them to offer their patients personalised breast care and enhanced risk assessment.

The US and Australia remain Volpara’s key regions for driving strategic growth, representing 98.4% of the company’s revenue.

The company has just announced a new strategy focused on delivering operating cashflow break-even in Q4 FY24, and net operating cashflow profitability in FY25, using current cash on hand.

Volpara’s Q1 FY23 highlights:

- Record quarterly cash receipts from customers of NZ$8.7m, up 35% compared to Q1FY22

- Subscription-based receipts in Q1FY23 of over NZ$8.3m, up 36% compared to Q1FY22

- Contracted ARR was ~US$23.7m, up almost US$1.5M on the prior quarter

- ARR was ~US$18.5m, up from US$17.3n in the prior quarter

- Average Revenue Per Account (ARPA) is now ~US$31.4K at end Q1FY23, up from ~US$28.9K at end Q4FY22

- SaaS churn remains low

Envirosuite (ASX:EVS)

Envirosuite has one of the most advanced environmental intelligence platforms for aviation, waste, wastewater, water treatment, mining and industrials.

The EVS software harnesses the power of real-time monitoring data, weather forecasting and emissions modelling.

It measures environmental factors such as air quality, water quality, noise, odour, dust, and vibration.

The company recently made headlines, achieving a record Q4 2022 of growth.

Envirosuite’s Q4 FY22 highlights:

- Total ARR of $53.0m, up 14.0% pcp, and new ARR for FY22 to $8.6m, up 30.3% on pcp

- Record new sales in Q4 of $6.0m, up 27.7% on pcp with strategic customer wins and expansion from existing customers across all three product suites

- Q4 sales comprised of $3.1m in new ARR, up 34.8% on pcp, and $2.9m in Project Sales up 20.8% on pcp

Spacetalk (ASX:SPA)

Spacetalk is a mobile phone, GPS tracker and watch all-in-one wearable device.

The device is made for children, and can make and receive calls from a set of contacts you choose in the AllMyTribe smartphone app.

If the child needs help, a special SOS alert function can be customised to call you and other guardians.

Spacetalk’s Q4 FY22 highlights :

- Total Revenue of $4.1 million. 41% growth on pcp2

- Wearables Revenue of $3.5 million. 52% growth on pcp

- App ARR of $3.8 million. 41% growth on pcp

- Wearables sales for the quarter were achieved with marketing expenses of $0.5 million compared to $0.3 million in the pcp

icetana (ASX:ICE)

icetana is an experts in artificial intelligence (AI) security detection software.

The software is designed to identify abnormal events and unexpected behaviour in real time for large-scale surveillance networks.

Using AI and Machine Learning techniques, icetana software learns and filters out routine motion, showing only unusual behaviour.

icetana’s Q4 FY23 highlights:

- ARR of $1.5m as at June 2022, up 11% year on year from June 2021.

- Net customer retention of 103% over the quarter

- Total cash receipts of $915k during the quarter, up 12% year on year and up 208% on previous quarter.

- Net cash outflow of $347k for the quarter and well capitalised with $2.0m cash at bank

Share prices today:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.