Closing Bell: Emerging Co’s Index bullies Russian aggression, rises 2.75%

Pic: Getty

The ASX Emerging Companies Index (XEC) has recovered strongly on Wednesday, gaining 2.75%.

The ASX200 also closed higher, gaining around 45 points or 0.6%. The market found its feet in afternoon trade, tech stocks leading the way.

Look. Rather than re-rattle your war cage – instead take a quick read of Jimmy Whelan’s sensitive piece on how to make money out of World War 3. You’ll laugh, you’ll cry. You’ll probably profit.

Later, you’ll also probably have trouble sleeping and what sleep you get will be plagued by visceral dreams and moral turpitude.

Also, in the coming years, despite the passage of time and the comforts they’ve come to expect – your children may look at you there: a hollow person, staring blank-faced and distant at the breakfast table – and you’ll ask yourself, ‘do they know what I did last summer?’

That’s why I’m going straight to…

Consensus expectations of a rate hike seemed to be numb to stateside economic data released overnight.

IG Markets’ Man-in-Singapore, Jun Rong Yeap, is of the opinion most of the interest rate dot-plotting is already priced in for now and the bulk of the market’s fear and focus is fixated on the alliterative potential of geopolitical risk.

Both the US manufacturing and services flash PMI hit two-month highs – suggesting a growing confidence in a robust recovery from pandemic-related pickles and a broad, if nascent, improvement in some of those supply bottlenecks.

There’s always a however…

“However,” Jun said on cue, “inflationary pressures are also showing no signs of backing down, with the prices charged for goods and services in the US rising at a record pace in February.”

“The US CB consumer confidence index also trended lower in January, reflecting a dampened consumer spending outlook.”

Your Friday inflationary indicator

So for fans of The Fed, Friday’s US core PCE index will be the key driver to shift rate hike expectations.

It’s expected to stay elevated at 5.1% year-on-year increase versus the 4.9% in January.

Bringing it home

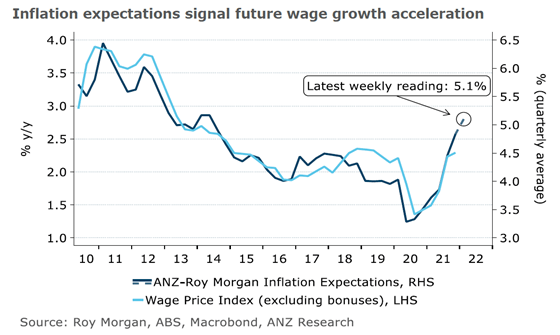

The ABS reports the Wage Price Index (WPI) rose 0.7% q/q which is the measurement’s fastest pace of growth since Q1 2014.

More wage freezes ended over Q4 and tight labour-market conditions finally started to impact pay packets… it’s probably fair to also say that public sector wage agreements resuming down in Canberra helped.

But the graph-makers at ANZ reckon we’ve got a pay rise in then post. Best check with your boss.

And this, in a note from analysts at Barclays this arvo: overall labour costs will continue to rise in line with strength in the jobs market, though WPI may remain softer.

“We continue to see inflation rising faster than wages and think higher inflation will lead the RBA to hike in August.” That’s largely what everyone’s saying at the moment.

Escalating tensions between Russia and the West is boosting oil prices to almost $US100 a barrel. Brent crude is up 1.9 per cent to $US97.17 per barrel while US WTI is up 2.1 per cent to $US93 per barrel.

TODAY’S BIGGEST SMALL CAP WINNERS

(Stocks highlighted in yellow rose after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| AGS | Alliance Resources | 0.185 | 37.0% | 301,539 |

| CDT | Castle Minerals | 0.057 | 35.7% | 65,965,445 |

| BAS | Bass Oil Ltd | 0.002 | 33.3% | 3,607,862 |

| MRI | Myrewardsinternation | 0.076 | 24.6% | 881,770 |

| CLB | Candy Club | 0.12 | 22.4% | 771,047 |

| ARR | American Rare Earths | 0.395 | 21.5% | 5,715,990 |

| CNB | Carnaby Resource Ltd | 1.555 | 20.5% | 1,377,521 |

| AUH | Austchina Holdings | 0.018 | 20.0% | 26,706,195 |

| TAR | Taruga Minerals | 0.036 | 20.0% | 963,404 |

| MBK | Metal Bank Ltd | 0.006 | 20.0% | 4,780,274 |

| BLZ | Blaze Minerals Ltd | 0.037 | 19.4% | 1,366,719 |

| SPN | Sparc Tech Ltd | 0.83 | 17.7% | 1,002,928 |

| NET | Netlinkz Limited | 0.02 | 17.6% | 856,714 |

| PEX | Peel Mining Limited | 0.235 | 17.5% | 4,816,325 |

| CLH | Collection House | 0.14 | 16.7% | 719,189 |

| ALY | Alchemy Resource Ltd | 0.014 | 16.7% | 2,641,052 |

| AQX | Alice Queen Ltd | 0.007 | 16.7% | 1,829,999 |

| OAR | OAR Resources Ltd | 0.007 | 16.7% | 2,301,104 |

| SRN | Surefire Rescs NL | 0.014 | 16.7% | 2,984,772 |

| THR | Thor Mining PLC | 0.014 | 16.7% | 7,364,117 |

| TMK | Tamaska Oil Gas Ltd | 0.014 | 16.7% | 9,659,620 |

| NZM | Nzme Limited | 1.23 | 16.6% | 1,072,294 |

| EP1 | E&P Financial Group | 0.5 | 16.3% | 26,852 |

| NC1 | Nicoresourceslimited | 0.645 | 16.2% | 1,439,576 |

| VMY | Vimy Resources Ltd | 0.18 | 16.1% | 3,993,507 |

First up — the Charlie Sheen stocks — winning on no discernible news:

Bass Oil (ASX:BAS) and Rewardle Holdings (ASX:RXH).

Actually, it’s Tyro Payments (ASX:TYR) dancing on the ceiling of Wednesday arvo after reports of it’s demise earlier this week appear to have been pre-emptive.

Tyro shed a third of its value on Monday following a weak first-half result.

Around 3pm Tyro is up circa 10% a decent comeback considering the half year report which revealed profits crashed some 425% to a loss of well over $18m.

Alliance Resources (ASX:AGS) last night AGS reported its major shareholder Ian Gandel tabled an off-market takeover bid at 18c per share – a ~35% premium on the last closing price.

In this carefully wrought, incisive analysis, Reuben says, “Gandel is a rich guy who built and leased shopping centres and was previously involved in the Priceline retail chain. He’s also big into mining…”

Castle Minerals (ASX:CDT) is killing it on Wednesday, after taking a new look at old gold samples. A good idea cos CDT uncovered several lithium anomalies at its ‘Woodcutters’ project in the Norseman region of WA.

Woodcutters encompasses some 10km of the “Western Australia Lithium Corridor” which hosts the nearby Bald Hill, Buldania, and Mt Marion deposits.

And the Collection House (ASX:CLH) share price is circa 20% the better after Credit Corp (ASX:CCP) announced it had entered into a binding agreement to acquire CLH’s New Zealand purchased debt ledger (PDL) for $12m

As part of the deal, Credit Corp says it’s acquired the senior secured debt of Collection House, and then advanced a working capital loan facility to Collection House, worth some $7.5 million.

TODAY’S BIGGEST SMALL CAP LOSERS

(Stocks highlighted in yellow fell after making announcements during the trading day).

Scroll or swipe to reveal table. Click headings to sort.

| Code | Company | Price | % | Volume |

|---|---|---|---|---|

| XST | Xstate Resources | 0.003 | -25.0% | 18,202,280 |

| CGO | CPT Global Limited | 0.56 | -20.0% | 301,118 |

| CT1 | Constellation Tech | 0.005 | -16.7% | 807,903 |

| GTG | Genetic Technologies | 0.005 | -16.7% | 21,802,788 |

| T3D | 333D Limited | 0.0025 | -16.7% | 501,493 |

| CHM | Chimeric Therapeutic | 0.1625 | -15.7% | 3,390,554 |

| BRV | Big River Gold Ltd | 0.27 | -15.6% | 123,266 |

| NTD | National Tyre&Wheel | 1.35 | -15.6% | 1,218,838 |

| TSL | Titanium Sands Ltd | 0.022 | -15.4% | 494,000 |

| SPX | Spenda Limited | 0.0205 | -14.6% | 51,478,809 |

| DM1 | Desert Metals | 0.45 | -14.3% | 544,781 |

| EPM | Eclipse Metals | 0.03 | -14.3% | 7,972,552 |

| RIM | Rimfire Pacific | 0.006 | -14.3% | 375,000 |

| T3K | Tek Ocean Group | 0.275 | -14.1% | 350,057 |

| DMP | Domino Pizza | 86.26 | -13.9% | 1,107,276 |

| FFI | F.F.I. Holdings | 6.2 | -13.0% | 17,766 |

| HIQ | Hitiq Limited | 0.1 | -13.0% | 1,261,799 |

| CZR | CZR Resources Ltd | 0.007 | -12.5% | 1,774,188 |

| NZS | New Zealand Coastal | 0.007 | -12.5% | 2,133,527 |

| SIH | Sihayo Gold Limited | 0.007 | -12.5% | 195,929 |

| ALM | Alma Metals Ltd | 0.029 | -12.1% | 39,027 |

| RGL | Riversgold | 0.022 | -12.0% | 877,600 |

| CBY | Canterbury Resources | 0.075 | -11.8% | 209,999 |

| GNX | Genex Power Ltd | 0.15 | -11.8% | 6,415,184 |

| VBC | Verbrec Limited | 0.115 | -11.5% | 85,298 |

LAST ORDERS: ANNOUNCEMENTS YOU MAY’VE MISSED

Duke Exploration (ASX:DEX) has announced a major reverse circulation (RC) drilling program at its flagship Bundarra project in Central Queensland to identify copper mineralised targets that increase the current resource base. Up to 11,600m in 46 RC drill holes is planned to be drilled over about four months.

TRADING HALTS

Galilee Energy Limited (ASX:GLL)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.