Closing Bell: Down on Friday and flat for the week, it’s not called the ALL Ordinaries for nuthin’

Via Getty

- ASX200 closes about 0.2pc lower, and flat for the week

- ASX sectors in full retreat save for Energy/Materials

- Small cap winners led by SHG, BSN, CZR

The ASX benchmark has closed lower in the wake of a hotter-than-expected US consumer inflation read, which reversed the flood of bets on the US Federal Reserve initiating rate cuts as soon as March.

At 4.10pm on Friday, the S&P/ASX200 index (XJO) was down 17 points or about 0.25% to 7,489.

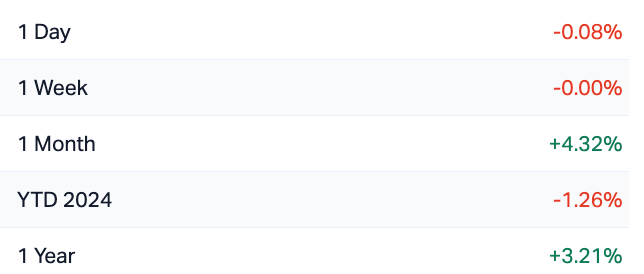

The All Ordinaries (XAO) index could’ve done better as well:

All Ords (XAO) Performance

In New York overnight, Microsoft briefly took the crown from Apple as the world’s most valuable company for the first time since 2021. Love for the iPhone maker dwindled following several early New Year downgrades over China concerns and worries around demand.

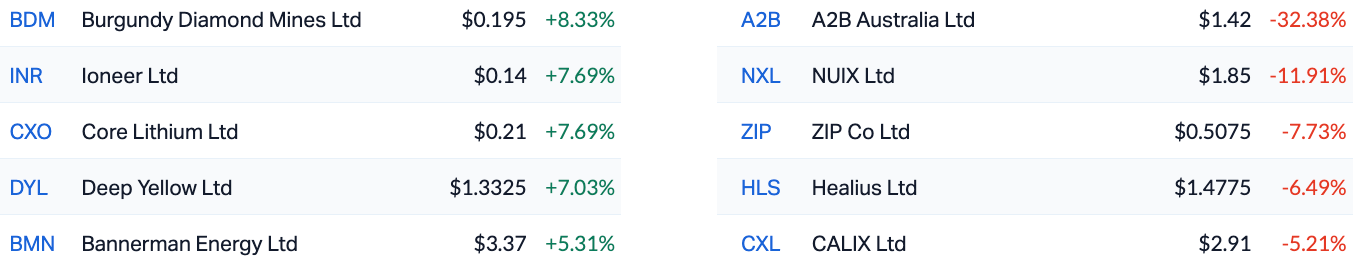

In local corporate news, we’re on Nuix (ASX:NXL) watch again.

The sassy SaaS confidence succubus has given away almost 12% after revealing that its onerous ongoing legal costs – stemming from being dragged by ASIC through the Federal Court – would be leaving an almost 20% 1H hole in its prospective earnings sheet.

Otherwise, as Eddy said this morning, Nuix expects to meet its FY24 strategic target for revenue growth to exceed operating cost growth for the full year.

In an update in the AM, NXL expects to report first half Annualised Contract Value of between $196-$199mn, up 15-17% on the pcp, while H1 Underlying EBITDA is expected to come in between $27-$29mn, up 8-16% on the pcp. Stripping out one offs, like a dirty great Federal Court case, things could even be looking up.

Transport sector small cap A2B, is in a feverish pit of red, no one knows exactly why.

Just before Christmas, the personal transport and payments firm A2B Australia (ASX:A2B) was flying high after selling its property on O’Riordan Street, Sydney for a sweet $78m, and subsequently announced a fully franked dividend of $0.60 per share and entered into a $182mn scheme implementation arrangement with Singapore’s ComfortDelGro Australia subsidiary to acquire 100% of A2B for $1.45 per A2B share in cash.

On Friday, A2B shares crashed by a full third to $1.42 — falling under the scheme’s offer price.

A lot of the day’s early leaders were making headway thanks to market conditions and commodity price movement, leaving Lodestar Minerals (ASX:LSR) out in front on a no-news Friday for the company.

However, in amongst the winners list there are a handful of noteworthy mentions, including Duketon Mining (ASX:DKM) with an early 16% lift off the back of an upbeat quarterly delivered this morning, showing that the company is still beavering away at its Tate Prospect, located north of the Duketon Greenstone Belt – and that there’s still money in the bank to keep the hunt going for a while yet.

And 88 Energy (ASX:88E) dropped a flow-test update on the market news list this morning, letting everyone know that things are full steam ahead for the Hickory-1 discovery well next month.

All Ords (XAO)

Best and Fairest — Worst and Unsportsmanlike

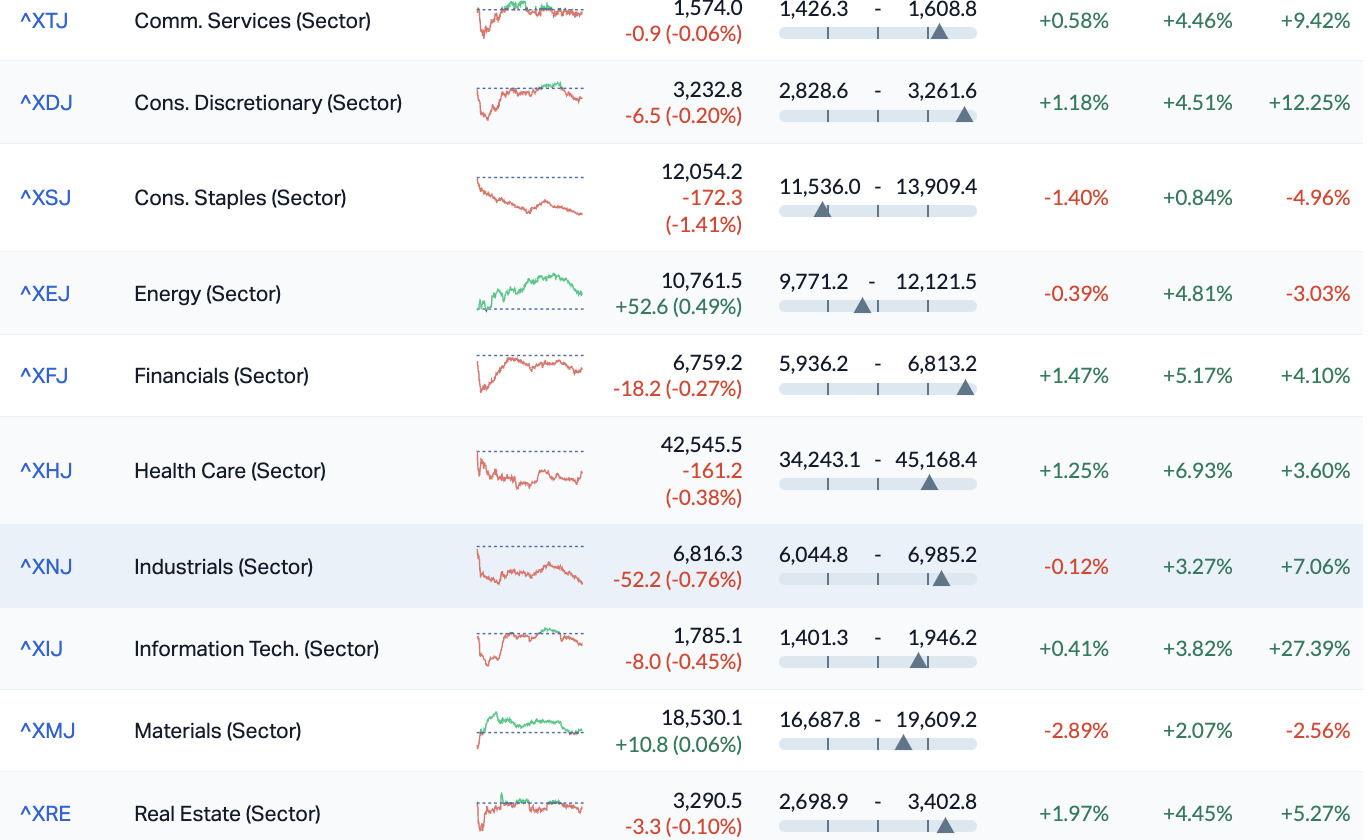

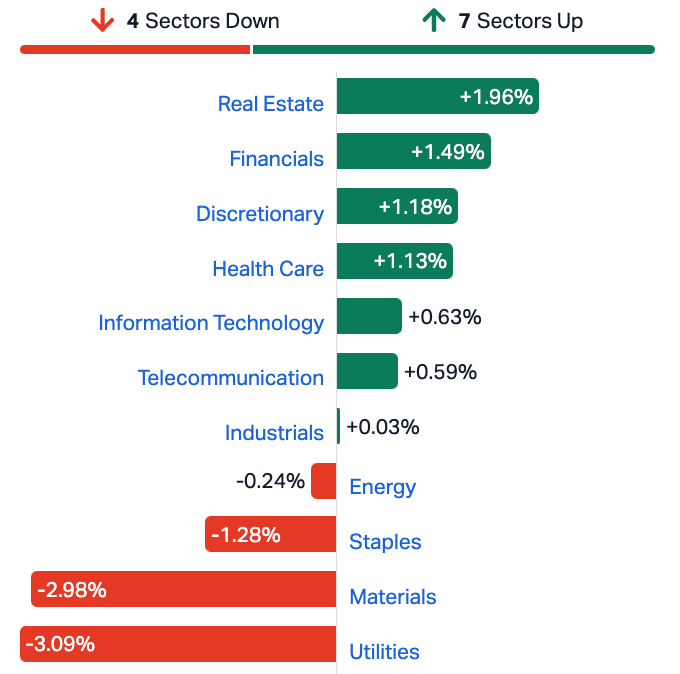

The Energy and Materials Sector were doing best they could on Friday, but to no avail. Rising commodity prices were smothered by the avalanche of bets in need of unwinding.

The iron ore heavyweights were in the money after iron ore prices lifted. Likewise for the energy names like Santos which followed oil prices higher after we helped the US and Friends bomb bits of Yemen.

None of this could offset the various growth and interest rate sensitive sectors which were all lower led by Consumer Staples, down 1.6%.

ASX SECTORS at 3.45pm on FRIDAY

![]()

ASX SECTORS THIS WEEK

Meanwhile, around the ‘hood, Asian-Pacific markets were mixed at lunchtime in Beijing and Tokyo.

Once again the trading was at its most furious on the Nikkei 225 and the Topix, as a weak yen, a dovish tilt from the Bank of Japan (BoJ) and bullish corporate results continued to boost the optimism.

Hong Kong and mainland China stocks also advanced as investors digested robust trade figures in China, while consumer and producer prices in the country remained.

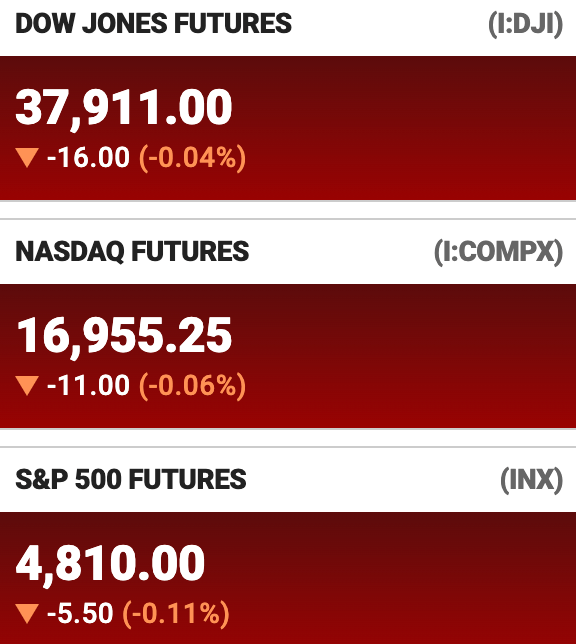

US stockmarket futures at 3pm on Friday in Sydney:

Next week on the ASX

Looking ahead to next week, Westpac’s Consumer Confidence drops on Tuesday, along with Melbourne Institute’s inflation expectations, both of which hinge on a consumer outlook rather than pure economic indicators, according to eToro analyst Josh Gilbert.

“Markets are now fully pricing in a rate cut from the RBA by August this year, but that may come sooner if economic data continues to move in the right direction.”

This week delivered a promising outlook for the year in the form of the Monthly CPI read, Josh told Stockhead on Friday, Year on Year consumer price growth has slowed faster than expected, hitting 4.3% compared to a forecast of 4.4%.

“With Aussies still concerned that additional rate hikes are still within the RBA’s scope, the arrival of the most significant decrease since January 2022 is welcome news.

“The first RBA monetary policy meeting of the year commences at the start of February, where the board is largely expected to keep rates on hold and that would more than likely mean the peak in interest rates,” Josh says.

The other vital number in the battle against inflation is unemployment and on that front, next week marks the year’s first insights into the health of the job market.

“It’s likely we’ll see a small rise in unemployment, with December unlikely to have been a key month for new hires. If the figure slips above 3.9% to 4% or higher, we will be well and truly on track to reach the Treasurer’s ‘sustainable unemployment’ target of 4.5%.

“While some economists believe it’s unnecessary for the rate to climb that high for the economy to recover, anything above 4.25% will give the RBA the confidence it needs to consider cutting rates sooner.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| SHG | Singular Health | 0.085 | 77% | 3,140,983 | $6,782,893 |

| LSR | Lodestar Minerals | 0.004 | 33% | 112,609 | $6,070,192 |

| SIH | Sihayo Gold Limited | 0.002 | 33% | 332,380 | $18,306,384 |

| EEL | Enrg Elements Ltd | 0.009 | 29% | 37,089,982 | $7,069,755 |

| BCT | Bluechiip Limited | 0.015 | 25% | 66,666 | $9,544,486 |

| CHK | Cohiba Min Ltd | 0.0025 | 25% | 103,212 | $5,060,460 |

| CNJ | Conico Ltd | 0.005 | 25% | 1,645,000 | $6,280,380 |

| EPM | Eclipse Metals | 0.01 | 25% | 2,842,924 | $16,500,434 |

| HCD | Hydrocarbon Dynamic | 0.005 | 25% | 200,000 | $3,078,664 |

| BSN | Basinenergylimited | 0.155 | 24% | 1,051,564 | $7,785,001 |

| HXG | Hexagon Energy | 0.012 | 20% | 451,497 | $5,129,159 |

| IS3 | I Synergy Group Ltd | 0.006 | 20% | 734,094 | $1,520,402 |

| WWG | Wisewaygroupltd | 0.05 | 19% | 12,000 | $7,026,343 |

| MMA | Maronanmetalslimited | 0.255 | 19% | 61,945 | $16,126,497 |

| BMG | BMG Resources Ltd | 0.013 | 18% | 1,807,505 | $6,971,769 |

| GML | Gateway Mining | 0.021 | 17% | 309,091 | $6,127,486 |

| GTR | Gti Energy Ltd | 0.0105 | 17% | 18,461,424 | $18,449,524 |

| UVA | Uvrelimited | 0.14 | 17% | 280,644 | $3,971,787 |

| AMD | Arrow Minerals | 0.007 | 17% | 3,934,371 | $20,842,591 |

| CRB | Carbine Resources | 0.007 | 17% | 519,508 | $3,310,427 |

| EVR | Ev Resources Ltd | 0.014 | 17% | 1,002,753 | $13,195,060 |

| CMP | Compumedics Limited | 0.435 | 16% | 247,250 | $66,436,106 |

| DKM | Duketon Mining | 0.185 | 16% | 29,368 | $19,556,762 |

| EME | Energy Metals Ltd | 0.15 | 15% | 114,495 | $27,258,831 |

| CZR | CZR Resources Ltd | 0.345 | 15% | 5,599,326 | $70,720,394 |

Singular Health (ASX:SHG) has risen to the top of the ladder late in the day, on yesterday’s news that it has received its first binding enterprise licence order for 5,000 annual licences of the 3Dicom Patient software in the US.

What it means in essence, is that a small number of US military veterans are now able to access their medical records digitally, rather than having to order (and wait for) a hard copy – which is a massive step forward for them.

Details of the enterprise sale are “commercial-in-confidence”, but SHG says revenue generated from this order “exceeds the total direct-to-consumer sales of the 3Dicom software in 2023 of ~A$50,000 by more than 40%”.

Which means, if I’m reading this correctly, this is an enormous jump for Singular – it’s up 110% for the week, adding close to $7 million in market cap off the back of a $70k contract.

Uranium player Basin Energy (ASX:BSN) has seen a rise this afternoon as well, up a tidy 24% and climbing along with the rest of the uranium market as interest in yellowcake booms this week.

That’s off the back of a recent decision by the US Department of Energy (DOE) that it was exploring domestic supply of an enriched uranium fuel to reduce its reliance on Russian supplies, which has re-lit the fuse under local uranium players as well.

And CZR Resources (ASX:CZR) is sailing again on the back of news yesterday of the $102m sale of its Robe Mesa iron ore project in the Pilbara to a Chinese buyer, which will see CZR bank double its pre-bid market cap in cash.

The buyer, as Reubs reported earlier, is Miracle Iron, which will pay a combined $122m to secure Strike Resources’ (ASX:SRK) Paulsens East project, which was briefly mined and shipped through the junior Utah Point Facility in Port Hedland a couple years ago, and CZR’s larger 33Mt Robe Mesa, an extension of Rio Tinto’s (ASX:RIO) Mesa F deposit at its Robe River JV.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ME1 | Melodiol Glb Health | 0.001 | -50% | 130,000 | $9,457,648 |

| AUH | Austchina Holdings | 0.003 | -25% | 320,000 | $8,311,535 |

| ERG | Eneco Refresh Ltd | 0.013 | -24% | 336,397 | $4,630,092 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 25,158 | $9,167,534 |

| MCT | Metalicity Limited | 0.002 | -20% | 34,000 | $11,212,634 |

| AIV | Activex Limited | 0.014 | -18% | 66,667 | $3,663,544 |

| FOS | FOS Capital Ltd | 0.2 | -17% | 64,606 | $12,913,473 |

| TMR | Tempus Resources Ltd | 0.005 | -17% | 90,329 | $2,399,861 |

| YRL | Yandal Resources | 0.13 | -16% | 548,977 | $36,382,554 |

| PNM | Pacific Nickel Mines | 0.067 | -15% | 1,029,951 | $33,041,995 |

| IND | Industrialminerals | 0.56 | -15% | 875,531 | $45,381,600 |

| LDX | Lumos Diagnostics | 0.09 | -14% | 23,639,634 | $50,536,505 |

| HLX | Helix Resources | 0.003 | -14% | 15,029,519 | $8,131,010 |

| MTM | MTM Critical Metals | 0.099 | -14% | 6,725,907 | $11,435,265 |

| FZR | Fitzroy River Corp | 0.125 | -14% | 472 | $15,653,366 |

| KAL | Kalgoorliegoldmining | 0.025 | -14% | 16,232 | $4,596,521 |

| RC1 | Redcastle Resources | 0.013 | -13% | 273,300 | $4,924,262 |

| HAW | Hawthorn Resources | 0.087 | -13% | 15,750 | $33,501,561 |

| AHN | Athena Resources | 0.0035 | -13% | 400,000 | $4,281,870 |

| GCM | Green Critical Min | 0.007 | -13% | 2,172,720 | $9,092,680 |

| RIE | Riedel Resources Ltd | 0.0035 | -13% | 4,000 | $8,895,343 |

| SRZ | Stellar Resources | 0.007 | -13% | 675,000 | $9,192,212 |

| FLC | Fluence Corporation | 0.105 | -13% | 166,047 | $129,142,166 |

| GLH | Global Health Ltd | 0.105 | -13% | 544 | $6,965,944 |

| SLM | Solismineralsltd | 0.14 | -13% | 485,006 | $12,544,113 |

TRADING HALTS

Nada today.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.