Market Highlights: US CPI higher than expected, 11 Bitcoin ETFs start trading, and 5 small caps to watch

ASX to fall on Friday after unexpected US CPI reading. Picture Getty

- ASX to fall on Friday after unexpected US CPI reading

- 11 Bitcoin ETFs have started trading in the US

- Why some experts are not too keen on the Bitcoin ETF

Aussie shares are poised to fall on Friday after an unexpectedly high inflation reading in the US. At 8am AEDT, the ASX 200 index futures contract was pointing down by -0.5%.

In New York overnight, the S&P 500 fell by -0.66%. The blue chips Dow Jones index was up by +0.04%, and the tech-heavy Nasdaq closed flat.

Consumer prices in the US picked up again in December to 3.4% (from 3.1% in November), driven by increase in costs for housing, dining out and car insurance.

The number was more than what analysts had expected and could complicate the Fed’s plans to cut rates this year.

“Not bad numbers, but they do show that disinflation progress is still slow and unlikely to be a straight line down,” said Seema Shah, chief global strategist at Principal Asset Management.

“Certainly, as long as shelter inflation remains stubbornly elevated, the Fed will keep pushing back at the idea of imminent rate cuts.”

Meanwhile, the US weekly jobless claims were also released last night and showed no signs of a weakening in the US job market – coming in at 202,000 which were lower than forecast.

To stocks, car rental company Hertz fell -4% after pulling back from its EV push, selling around 20,000 of its EV fleet to buy more internal combustion engine cars, citing maintenance costs.

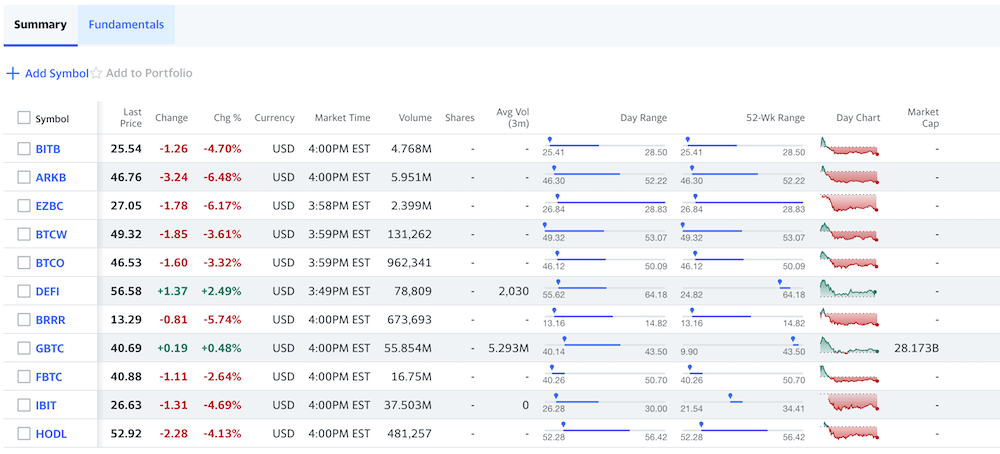

Cryptocurrency related stocks were mainly lower – with Coinbase down -6.7% and Marathon Digital by -12.6%, as the first US spot Bitcoin ETFs began trading.

Here’s the full list of the 11 ETFs that started trading, courtesy of Yahoo Finance:

Why some experts aren’t keen on Bitcoin ETFs

The cryptocurrency market had a very volatile night after the SEC approved 11 spot BTC ETFs on Wednesday.

Ripple Labs CEO Brad Garlinghouse believes the approval by the SEC on Wednesday could open the way for more adoption from institutional investors, as the focus on Bitcoin shifts from a speculative asset to a cryptocurrency with real-world use.

But Bitcoin continued to receive more criticism from its traditional opponents, says Samer Hasn, a market analyst and part of the Research Team at XS.com.

The chairman of the SEC, Gary Gensler, who himself voted to approve the launch of these ETFs, issued a statement warning of the dangers of Bitcoin. He also said that, unlike the metal ETFs that are used in the real world, Bitcoin is a speculative and volatile asset and is used for illicit activities.

Also, a member of the Commission, Caroline Crenshaw, who voted against the approval decision, expressed her concerns about the flood of these products into retirement accounts.

One of the most prominent critics of cryptocurrencies, the CEO of JPMorgan Chase, Jamie Dimon, also continued his criticism after the decision was announced, and reiterated that Bitcoin does not carry any value and that its actual use is in illegal activities.

Famous trader, habitual gold advocate and opponent of cryptocurrencies, Peter Schiff, said that these EFTs are just one of many new ways to gamble on Bitcoin.

On the positive side, the focus in the coming months is shifting to the Bitcoin halving event, which is expected to happen sometime in the second quarter of this year and which is usually a positive sign for the market.

In other markets …

Gold price lifted by +0.25% to US$2,028.34 an ounce.

Oil prices rose by just under +2%, with Brent now trading at US$78.06 a barrel.

Crude jumped after Iran seized a tanker with Iraqi crude destined for Turkey last night, in retaliation for the confiscation last year of the same vessel and its oil by the US.

The benchmark 10-year US Treasury yield fell by 5 basis points (bond prices higher) to 3.97%.

Iron ore futures jumped by +1% to US$134.35 a tonne.

The Aussie dollar fell by -0.15% to US6691c.

5 ASX small caps to watch today

Nuix (ASX:NXL)

Nuix expects to report first half Annualised Contract Value (ACV) of between $196-$199 million, up 15-17% on the pcp. H1 Underlying EBITDA is expected to come in between $27-$29 million, up 8-16% on the pcp. Nuix said it’s on track to meet its FY24 strategic target for revenue growth to exceed operating cost growth for the full year.

Morella Corporation (ASX:1MC)

Morella announced that it has completed a 2D seismic reflection survey in the Southern Project area at the company’s Fish Lake Valley (FLV) Lithium Brine Project in Nevada, US. The seismic reflection survey has, for the first time, defined the deep rift basin geology sitting below the playa. A classical half-graben structure with over 2km of sediment fill has been defined with striking similarities to the structure hosting lithium brines at Albemarle’s Silver Peak Lithium Brine Mine in the Clayton Valley, located 35km to the east.

AIC Mines (ASX:A1M)

AIC reported positive results from exploration drilling completed at the Sandy Creek and Artemis prospects located 20km west of the company’s flagship asset, the Eloise Copper Mine. Both prospects are within trucking distance of the Eloise processing plant, and are part of the company’s strategy to extend the life of the Eloise project through a hub and spoke approach to regional development. Highlights at Sandy Creek include: 7.1m grading 1.10% Cu, 0.2g/t Au and 7.67g/t Ag from 359.5m.

Kelly Partners (ASX:KPG)

The chartered accounting company announced a fully franked dividend of 0.4392 cents per share for the January 2024 month, representing a 10% increase on last financial year’s monthly dividend. Ex-dividend date will be Friday 19 January.

Kingsrose Mining (ASX:KRM)

Kingrose has welcomed two key appointments to the management team. Aina Borch has joined the company as managing director of its wholly owned subsidiary ‘Kingrose Finnmark AS’, based in Norway. Originally a trained teacher, Aina is grounded in the local culture. Claire Saunders has been appointed as communications manager based at the company’s head office in Jersey, Channel Islands. A Fellow of the Chartered Institute of Marketing, Claire has over 30 years’ experience in crafting and delivering marketing communication strategies.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.