Closing Bell: Catch up footy leaves benchmark nibbling at parity for second straight session

Via Getty

- Benchmark index recovers early losses, down -0.06% at the bell, up 0.1% at settlement

- Sectors led by Tech and Telcos

- Small caps led by BGE and uranium caps

Local markets struggled out of the blocks again on Monday morning, the taste of stale cigarettes and Wall Street’s weak lead recalling all the unwelcome promises of higher-for-longer US interest rates accompanying last week’s pause on rate hikes from the US Federal Reserve.

At settlement the benchmark had pulled off another comeback, ending 0.1% higher.

Some 15 minutes earlier, at 4pm in Sydney, the ASX200 was -0.06% short of parity, after making up all its morning losses and allowing momentum to guide it home.

The major US indices edged lower Friday to close out a filthy, dirty week of selling, traders not at all coping well despite knowing The Fed totally might not be done hiking rates.

The S&P 500 fell 0.2% Friday and closed down 2.9% for the week, its worst performance since March and third straight weekly loss.

The Nasdaq Composite dropped 0.1% Friday, and logged its third straight week of losses – the big-name tech stocks leading the losses.

So, after falling out of bed again, the ASX200 index was starting its climb out of the pit to be just -0.4% lower at lunchtime and on a trajectory much like Friday’s session, this time the big 4 banks and the major iron ore miners on the retreat, dragging the entire benchmark with them.

Here’s the catch-up footy on the ASX…

Iron ore prices (Futures) traded in Singapore on Monday have dipped well below last week’s six-month-high, dropping 3.5% near 3pm in Sydney.

Prices for the commodity have rallied over the past six weeks despite China’s ongoing property crisis, in a move that’s defied analyst expectations.

Qantas shares were also down over 1.2% after revealing higher oil prices will likely cost the national carrier an additional $200mn.

ASX Sectors on Monday — Intraday — 52 Week Range — Week – Month – Year

US Futures at 1am on Monday in New York

Wall Street’s three stock future measurements clipped into the green late on Sunday night, as traders there brace for one last week of a tough trading month in September.

Stocks stateside have struggled this month as the Federal Reserve signalled higher interest rates for longer, sending bond yields rising.

FROM THE HEADLINES

Shares in Hong Kong are having a maudlin Monday, as more bad real estate business threatens to suck up the Hang Seng’s 2.3% gain on the last Friday session.

The main culprit is easy to locate – shares of China Evergrande have dropped 25% after the distressed and distressing property development giant said it was unable to issue new debt thanks to the ongoing investigation into one of its many shaky subsidiaries, reopening fresh wounds that could accelerate the Group’s surely inevitable liquidation.

A Bloomberg Intelligence gauge of Chinese property developer shares fell by circa 6.4% on Monday, taking its loss in valuation this year to US$55 billion.

Futures of West Texas Intermediate crude maintained their US$90 per barrel level today as investors adopted a wait and watch over ongoing demand and supply juggling. WTI is up 30% since the start of the new fiscal year thanks to Saudi Arabia and Russia extending supply cuts through to at least the end of the year.

Meanwhile Marrickville Prime Minister Anthony Albanese has lobbed a welcome $70mn at the Port Bonython hydrogen export terminal redevelopment in South Australia.

The premier of that state, Peter Malinauskas joined the PM to say both governments would slap a total $100m investment into what’d be the first large-scale export terminal for hydrogen in Whyalla.

Port Bonython is expected to host projects worth up to $13bn and is projected to generate as much as 1.8 million tonnes of hydrogen by 2030.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CLE | Cyclone Metals | 0.0015 | 50% | 116,507,180 | $10,264,505 |

| BGE | Bridgesaaslimited | 0.035 | 40% | 253,911 | $985,900 |

| FRX | Flexiroam Limited | 0.036 | 29% | 240,812 | $18,597,368 |

| 1AI | Algorae Pharma | 0.015 | 25% | 4,982,852 | $19,628,882 |

| DXN | DXN Limited | 0.0025 | 25% | 1,907,923 | $3,446,680 |

| ICN | Icon Energy Limited | 0.011 | 22% | 2,278,783 | $6,912,123 |

| AKN | Auking Mining Ltd | 0.069 | 21% | 564,185 | $11,633,911 |

| AMM | Armada Metals | 0.026 | 21% | 4,717 | $1,474,241 |

| CXU | Cauldron Energy Ltd | 0.012 | 20% | 24,889,727 | $9,515,687 |

| IEC | Intra Energy Corp | 0.006 | 20% | 2,663,428 | $8,103,908 |

| RCW | Rightcrowd | 0.025 | 19% | 267,511 | $5,531,776 |

| AEV | Avenira Limited | 0.0105 | 17% | 1,881,708 | $15,570,065 |

| OKR | Okapi Resources | 0.175 | 17% | 2,305,316 | $31,512,902 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 459,249 | $6,095,248 |

| ECT | Env Clean Tech Ltd. | 0.007 | 17% | 1,775,767 | $17,085,331 |

| ELE | Elmore Ltd | 0.007 | 17% | 30,888 | $8,396,303 |

| OLI | Oliver'S Real Food | 0.022 | 16% | 88,771 | $8,373,906 |

| MXR | Maximus Resources | 0.03 | 15% | 119,820 | $8,326,650 |

| WEC | White Energy Company | 0.071 | 15% | 33,883 | $4,241,183 |

| EL8 | Elevate Uranium Ltd | 0.515 | 14% | 1,413,491 | $125,038,863 |

| TBN | Tamboran | 0.1425 | 14% | 794,702 | $214,584,071 |

| WCG | Webcentral Ltd | 0.125 | 14% | 54,495 | $36,203,885 |

| QXR | Qx Resources Limited | 0.025 | 14% | 5,819,215 | $19,730,971 |

| HFY | Hubify Ltd | 0.017 | 13% | 385,347 | $7,442,044 |

| DYL | Deep Yellow Limited | 1.2025 | 13% | 6,782,817 | $807,683,149 |

Firstly, Cauldron Energy (ASX:CXU) is another of the many smaller stocks which have climbed nicely on Monday despite offering nothing in the way of a market moving update.

However, CXU is part of the upwardly mobile family of ASX uranium players Aurora Energy Metals (ASX:1AE), Elevate Uranium (ASX:EL8), Alligator Energy (ASX:AGE) and Icon Energy (ASX:ICN), as chatter about a nuclear-powered future builds in intensity.

Global investors are all over ASX uranium shares as the spot price clocks more than decade highs, with expectations that the bull run is just starting.

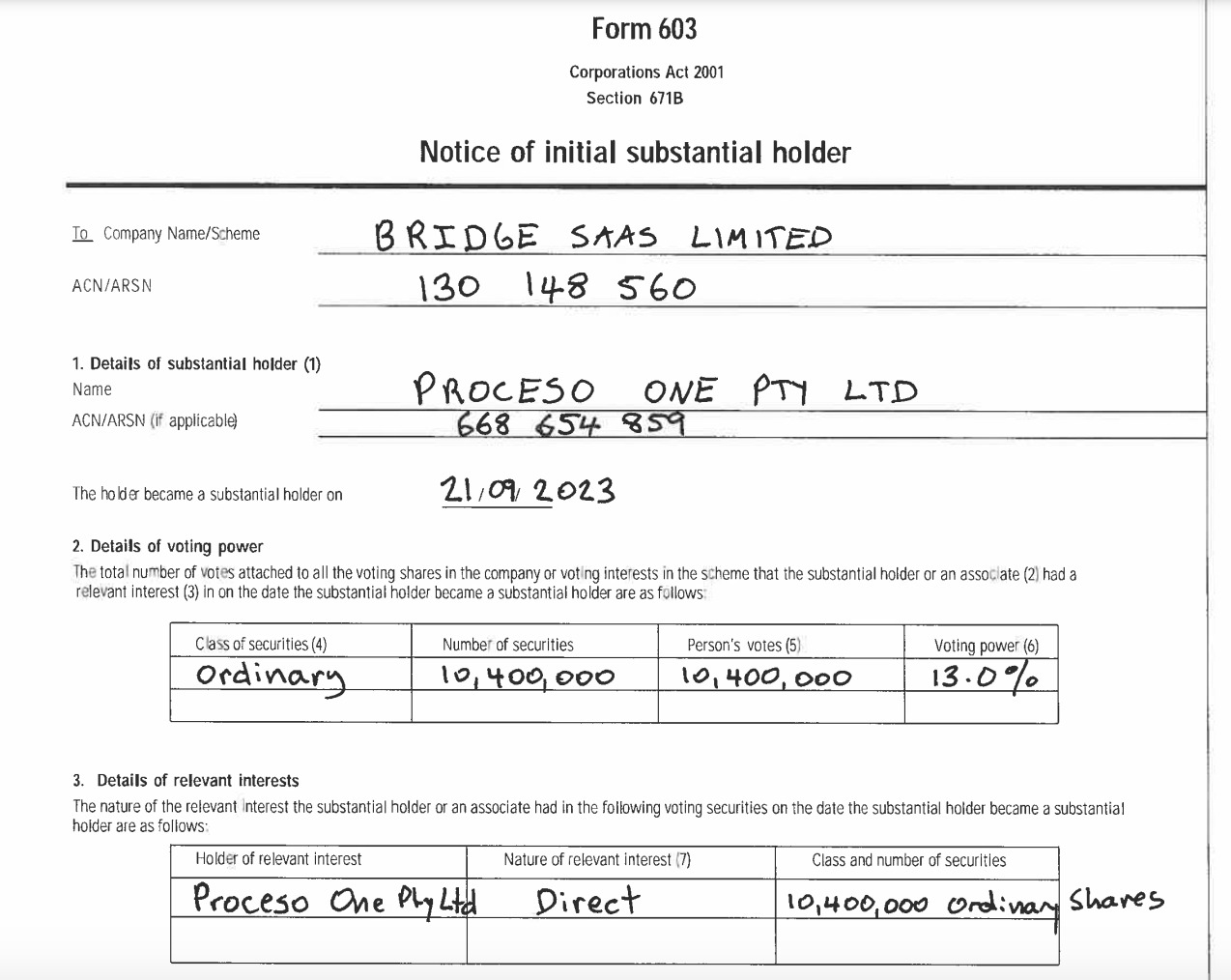

On an entirely different note, last week was a busy one for the Software-as-a-Service (SaaS) Customer Relationship Management (CRM) and workflow solutions to the employment & NDIS industries known as Bridge SaaS (ASX:BGE) .

The SaaS firm said goodbye to Interim CEO Anna-Marie Stella, with the news Non-Executive Director, Leanne Graham, will assume the role of Interim boss.

Leanne is a tech guru, having run Xero’s Kiwi business as General Manager and global head of sales.

That doesn’t explain the super bump in BGE’s share price today, but then again, neither does this entirely… although it does raise eyebrows for all Grade 4 primary teachers:

And Algorae Pharmaceuticals -1AI (ASX:) jumped 25% this morning on no news.

The company (formerly Living Cell Technologies (ASX:LCT)) recently announced that it’s signed an MoU with UNSW to develop an AI platform to assist with:

- deploying advanced machine-learning and other AI methodologies to assess and derive insight from large-scale molecular, clinical, and other relevant datasets, and

- to optimise existing projects and identify new combination drug candidates and repositioning opportunities through AI-enabled predictive modelling.

QX Resources (ASX:QXR) also rose in morning trade, living on last week’s news that the company’s 39%-owned Bayrock has expanded the mineral lease area by ~33% at the Vuostok Nickel-Copper Project in northern Sweden with the addition of Nr 102 lease covering an additional 34km2 to expand the total lease area to ~130km2.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| MSI | Multistack Internat. | 0.003 | -40% | 11,604 | $681,520 |

| ARE | Argonaut Resources | 0.07 | -30% | 23,174 | $7,316,152 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | 2,248,131 | $11,649,361 |

| KNM | Kneomedia Limited | 0.003 | -25% | 1,009,951 | $6,019,141 |

| MTH | Mithril Resources | 0.0015 | -25% | 558,621 | $6,737,609 |

| TPC | TPC Consolidated Ltd | 5.38 | -25% | 19,951 | $81,101,428 |

| RNX | Renegade Exploration | 0.007 | -22% | 2,956,409 | $8,578,114 |

| OZM | Ozaurum Resources | 0.1 | -20% | 9,929,968 | $15,875,000 |

| AVE | Avecho Biotech Ltd | 0.004 | -20% | 984,090 | $13,491,460 |

| GTG | Genetic Technologies | 0.002 | -20% | 2,179,988 | $28,854,145 |

| IVX | Invion Ltd | 0.004 | -20% | 1,273,810 | $32,108,161 |

| TMX | Terrain Minerals | 0.004 | -20% | 100,750 | $6,288,219 |

| MKG | Mako Gold | 0.014 | -18% | 2,277,036 | $9,792,139 |

| NNG | Nexion Group | 0.014 | -18% | 178,571 | $3,439,234 |

| CDR | Codrus Minerals Ltd | 0.076 | -17% | 1,008,199 | $6,972,680 |

| NYM | Narryermetalslimited | 0.12 | -17% | 180,480 | $6,028,375 |

| HTG | Harvest Tech Grp Ltd | 0.029 | -17% | 1,094,028 | $24,276,538 |

| FGL | Frugl Group Limited | 0.015 | -17% | 2,081,295 | $17,209,116 |

| HAW | Hawthorn Resources | 0.1 | -17% | 17,810 | $40,201,874 |

| EDE | Eden Inv Ltd | 0.0025 | -17% | 13,043,629 | $10,090,911 |

| LML | Lincoln Minerals | 0.005 | -17% | 230,000 | $8,524,271 |

| OAR | OAR Resources Ltd | 0.005 | -17% | 29,908 | $15,678,814 |

| PKO | Peako Limited | 0.005 | -17% | 4,463,468 | $2,824,389 |

| STA | Strandline Res Ltd | 0.105 | -16% | 12,092,406 | $182,820,529 |

| SHN | Sunshine Metals Ltd | 0.0135 | -16% | 4,052,378 | $16,155,564 |

TRADING HALTS

NickelSearch (ASX:NIS) – Pending a material announcement regarding exploration results at its Carlingup project

Amaero International (ASX:3DA) – Pending release of a presentation by the Company in connection with the production of C-103 powder and the impact on the Company’s expected financial performance.

Technology Metals Australia (ASX:TMT) – Pending an announcement to the market in relation to a proposed material transaction regarding a merger

Australian Vanadium (ASX:AVL) – Pending an announcement by the Company in relation to a material acquisition and associated capital raising

Todd River Resources (ASX:TRT) – Pending an announcement to the market regarding a material project acquisition and capital raising

Black Cat Syndicate (ASX:BC8) – Pending the release of an announcement regarding a proposed funding arrangement in relation to the restart of the Paulsens Gold operation

Botanix Pharmaceuticals (ASX:BOT) – Pending release of an announcement regarding US Food and Drug Administration (FDA) communication in respect of the Botanix New Drug Application (NDA) for Sofpironium Bromide gel, for the treatment of primary axillary hyperhidrosis (excessive sweating)

Haranga Resources (ASX:HAR) – Pending an announcement by the company to the market in relation to a proposed capital raising

PolyNovo (ASX:PNV) – Pending release of a trading update and upgrade

Star Entertainment Group (ASX:SGR) – The Star expects to make an announcement to ASX in connection with a refinancing and related capital structure initiatives

Aguia Resources (ASX:AGR) – Pending an anticipated announcement by the company regarding completion of a proposed capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.