Closing Bell: Benchmark fails to fire on Friday, but ends only a few points lower in a lovely Christmas red

Via Getty

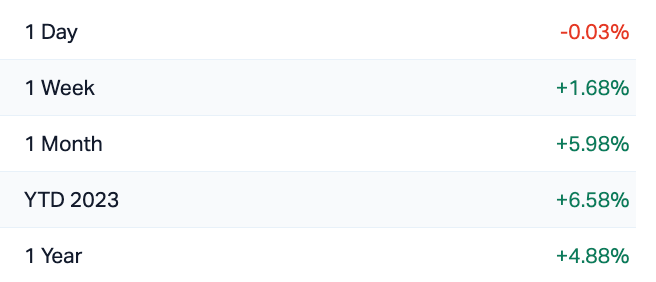

- The benchmark index has ended pretty flat on Friday, but up +1.7% for the week

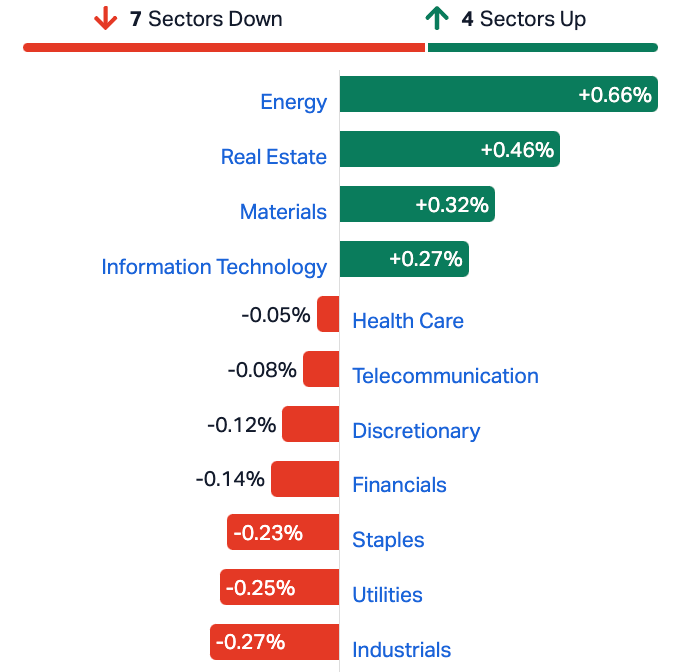

- Energy, Mining sectors offset losses in Utilities, Industrials

- Small caps led by takeover duo AGR, MIL

The Australian sharemarket has not covered itself in glory on the final trading day before Christmas, despite another Wall Street rebound and a generally upbeat outlook heading into the New Year.

The ASX ahead of Xmas

At 4.15m on Friday December 22, the S&P/ASX200 was down two and a half points, or -0.033%, which we’re calling a win anyway – to 7501 points.

The ASX will be closed on Monday and Tuesday for Christmas Day and Boxing Day. I’ll be in bed. Trading will resume on Wednesday. I may still be in bed.

In company news, shipbuilder Austal (ASX:ASB) is up around +4.9% after its US business secured a US$867mn contract with the ever-expanding US Navy, this time for three medical ships.

Closer to home, Lynas (ASX:LYC) and its rare earths have recovered much of this week’s losses – adding some +4.5% even though they’ll possibly get hit by China’s recent refusal to share key rare-earth processing tech.

Pilbara Minerals (ASX:PLS) and Whitehaven Coal (ASX:WHC) have also helped the Materials sector lead the winners out of the gate on Friday.

But, not enjoying the silly season at all is Core Lithium (ASX:CXO) stock which has been shot down by more than fifth.

CXO is reviewing its operations near Darwin as the lithium price continues to age investors prematurely.

Core owns the NT’s only lithium mine, but with the price of spodumene concentrate down some -82% this year, the company is considering its options in the NT, including “possible temporary curtailment of mining operations”.

Meanwhile, it’s three mumbled cheers for Twiggy et al, as Fortescue (ASX:FMG) broke through its all time high as expectations of stronger iron ore demand out of China for the winter restocking lifted prices more than +2.6% overnight.

Demand for next year remained underpinned by bets of ample infrastructure spending by Beijing. That’s yet to be materialised.

Nevertheless officials in Beijing have promised an additional CNY 1 trillion of debt for infrastructure and manufacturing ideas… that’s on top of the other vague but promising signals that infrastructure spend in China could be a short-term cure for the current debt crisis within which the property sector remains fettered to its own hubris.

ASX Sectors on Friday

And speaking of China…

The Hang Seng has made gains into lunchtime in Hong Kong adding almost +0.5% for a decent half day’s work by recent standards.

On the flip side, both China’s mainland indices – the Shanghai Composite and the tech-heavy Shenzhen exchange – are down around -0.35% with Beijing’s mixed signals on economic policy weighing on sentiment.

Hong Kong will end the week lower, however, as will the mainland indexes – marking a fifth straight losing week into Christmas and ensuring both Shanghai and Shenzhen finish 2023 below where they started it.

And remember, this time last year everyone was loopy about China’s world-changing economic reopening.

On Wednesday, the People’s Bank of China (PBoC) held benchmark lending rates unchanged, a disappointing finale to a disappointing year on the stimulative policy front.

Wall Street, 2023

Overnight in the states, nine out of every 10 companies on the S&P500 gained something – the benchmark itself added another +0.95% to be within reach of its all-time high with a session to spare before Christmas – and this, a day after its biggest intraday losses since late September.

The Dow Jones Industrial Average rose 322 points, or +0.9%, and came close to setting a record for the sixth time in the last seven days.

The tech-driven Nasdaq Composite casually added a further +1.3%.

Over the past 12 months the Americans have made a good fist of a what seemed a bad hand:

But for now, Wall Street is back in inflation-stasis as traders await the next hurdle, with US PCE (personal consumption expenditures) data –the last one of the year – dropping on Saturday morning (Sydenham time).

Traders are salivating for a sudden spate of rate cuts in early in 2024.

According to the CME FedWatch Tool, the Americans are circa 70% odds-on that Chair J. Powell and friends at the Fed will begin cutting the cost of borrowing money as soon as March.

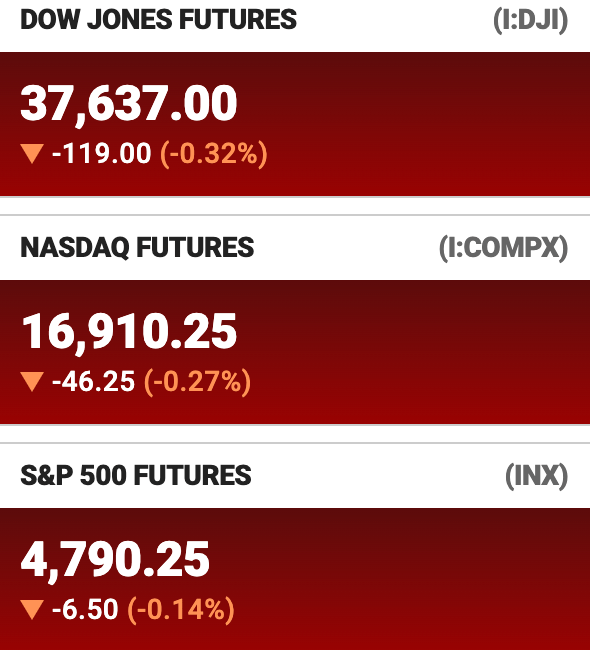

On Friday morning in New York, US Futures are however… anxious:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| AGR | Aguia Res Ltd | 0.018 | 100% | 20,232,343 | $4,549,328 |

| MIL | Millennium Grp Ltd | 1.075 | 73% | 3,540,706 | $29,241,221 |

| AYM | Australia United Min | 0.003 | 50% | 3,741,991 | $3,685,155 |

| NGY | Nuenergy Gas Ltd | 0.03 | 36% | 382,186 | $32,581,021 |

| AHN | Athena Resources | 0.004 | 33% | 952,124 | $3,211,403 |

| AVW | Avira Resources Ltd | 0.002 | 33% | 80,305 | $3,200,685 |

| LSR | Lodestar Minerals | 0.004 | 33% | 1,292,718 | $6,070,192 |

| ENV | Enova Mining Limited | 0.017 | 31% | 31,507,470 | $8,332,081 |

| G6M | Group 6 Metals Ltd | 0.08 | 27% | 2,731,942 | $63,215,757 |

| ICN | Icon Energy Limited | 0.005 | 25% | 2,240,021 | $3,072,055 |

| JAY | Jayride Group | 0.04 | 25% | 3,838 | $7,501,092 |

| AWJ | Auric Mining | 0.099 | 24% | 2,126,388 | $10,468,767 |

| FLX | Felix Group | 0.16 | 23% | 83,240 | $26,584,963 |

| A2B | A2B Australia Ltd | 2.15 | 20% | 1,810,630 | $218,279,209 |

| CUS | Coppersearchlimited | 0.12 | 20% | 108,155 | $9,228,541 |

| CTO | Citigold Corp Ltd | 0.006 | 20% | 3,040,697 | $14,368,295 |

| FHS | Freehill Mining Ltd. | 0.006 | 20% | 14,666,073 | $14,249,172 |

| ADR | Adherium Ltd | 0.067 | 20% | 300,812 | $18,672,639 |

| NYR | Nyrada Inc. | 0.025 | 19% | 329,786 | $3,276,183 |

| HAL | Halo Technologies | 0.19 | 19% | 179,900 | $20,719,234 |

| SLM | Solismineralsltd | 0.16 | 19% | 298,933 | $10,597,055 |

| SER | Strategic Energy | 0.013 | 18% | 648,620 | $5,343,967 |

| GTGDA | Genetic Technologies | 0.175 | 17% | 15,606 | $17,312,487 |

| ADY | Admiralty Resources. | 0.007 | 17% | 19,100 | $7,821,475 |

| CCO | The Calmer Co Int | 0.007 | 17% | 2,857,843 | $5,144,971 |

First up on Friday, is surprise takeover target Millennium Services Group (ASX:MIL).

MIL says it has entered into a scheme implementation agreement with an entity run by SoftBank Robotics Singapore for the acquisition of 100% of the shares in Millennium by way of scheme of arrangement.

In brief:

Millennium shareholders have been giventhe option to receive $1.15 cash per Millennium share, unlisted scrip consideration or a combination of cash and unlisted scrip consideration.

The $1.15 cash per Millennium share consideration represents an 85% premium to Millennium’s closing share price of $0.62 per share on 21 December 20231 and a 105% premium to the 3-month volume weighted average price up to and including 21 December 2023.

And an enthused Millennium board ‘unanimously recommends that shareholders vote in favour of the scheme, in the absence of a Superior Proposal’

… and OFC, subject to the Independent Expert concluding (and continuing to conclude) that the Scheme is in the best interests of Millennium shareholders.

Nice Xmas pressie there – up +70%.

Still on the takeover theme, Aguia Resources (ASX:AGR) is hoping to be bed down the South American gold hunter Andean Mining.

AGR wants to acquire Andean and its pre-Xmas sexy Santa Barbara gold mine as well as the Atocha silver-gold exploration project in an all-share, everyone in the same bed offer.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| KNM | Kneomedia Limited | 0.002 | -33% | 1,200,013 | $4,599,814 |

| GES | Genesis Resources | 0.005 | -29% | 36,293 | $5,479,889 |

| FAU | First Au Ltd | 0.003 | -25% | 668,875 | $6,647,973 |

| ME1 | Melodiol Glb Health | 0.0015 | -25% | 2,813,889 | $9,457,648 |

| NVQ | Noviqtech Limited | 0.003 | -25% | 32,969 | $5,237,781 |

| PXX | Polarx Limited | 0.006 | -25% | 2,241,789 | $13,116,934 |

| CXO | Core Lithium | 0.2625 | -20% | 72,760,528 | $705,188,730 |

| RC1 | Redcastle Resources | 0.012 | -20% | 936,154 | $4,924,262 |

| CGO | CPT Global Limited | 0.16 | -20% | 60,896 | $8,379,473 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 12,541 | $17,185,862 |

| RIL | Redivium Limited | 0.005 | -17% | 127,107 | $16,385,129 |

| SFG | Seafarms Group Ltd | 0.005 | -17% | 1,035,515 | $29,019,595 |

| PLG | Pearlgullironlimited | 0.031 | -16% | 338,854 | $7,568,046 |

| POD | Podium Minerals | 0.028 | -15% | 3,927,774 | $12,023,108 |

| BFC | Beston Global Ltd | 0.0085 | -15% | 4,317,428 | $19,970,469 |

| AML | Aeon Metals Ltd. | 0.009 | -14% | 7,000 | $11,512,207 |

| COD | Coda Minerals Ltd | 0.15 | -14% | 34,649 | $24,914,990 |

| ATH | Alterity Therap Ltd | 0.006 | -14% | 1,628,571 | $19,616,523 |

| CCZ | Castillo Copper Ltd | 0.006 | -14% | 61,000 | $9,096,537 |

| ION | Iondrive Limited | 0.012 | -14% | 43,500 | $6,807,994 |

| PRX | Prodigy Gold NL | 0.006 | -14% | 2,000 | $12,257,755 |

| PUA | Peak Minerals Ltd | 0.003 | -14% | 200,000 | $3,644,818 |

| VMS | Venture Minerals | 0.006 | -14% | 5,106,909 | $13,650,091 |

| VKA | Viking Mines Ltd | 0.013 | -13% | 500,000 | $15,378,876 |

| 5EA | 5Eadvanced | 0.2 | -13% | 292,005 | $70,761,839 |

TRADING HALTS

Orion Equities (ASX:OEQ) – In relation to the company’s listed shares pending the release of a market announcement in respect of the company’s entitlement to a royalty on production from the Paulsens East Iron Ore Project owned by Strike Resources (ASX:SRK)

Strike Resources (ASX:SRK) – Also in relation to the company’s Paulsens East Iron Ore Project and Apurimac Iron Ore Project

European Lithium (ASX:EUR) – Pending an announcement in connection with the effectiveness of the NASDAQ merger transaction

Novatti (ASX:NOV) – Pending an announcement by the company regarding a capital raising

Aurumin (ASX:AUN) – Pending the release of an announcement (“Announcement”) in relation to the transaction with Beacon Minerals involving the sale Mt Dimer mining tenements, and transactions associated with the Convertible Note

Black Mountain Energy (ASX:BME) – In relation to an announcement concerning an application to be removed from the official list of the ASX

A2B Australia (ASX:A2B) – With respect to its ordinary shares, pending the release of an announcement in relation to the status of the settlement of the O’Riordan Street property

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.