CLOSING BELL: Benchmark drops 0.12pc, after another eerie day on the ASX

Pic via Getty Images.

- Not much in the way of headline news, but the market plodded along

- ASX 200 closes down -0.12pc, despite a push for Health and the Goldies

- Who won the Small Caps race today? Read on to find out…

It’s not been the busiest of news days, but there are a few items worth mentioning as we wrap up the day’s events.

Chief among them, some new data from the Australian Bureau of Assigning Value to Things (ABS), which released consumer spending figures that prove that rising interest rates have put Australia’s purse strings in a chokehold.

The data shows that consumer spending rose just 0.1% overall over the past year. That is not a lot, by any reasonable measure, especially considering strong population growth over the same period that should have helped that figure climb considerably.

What does it mean? The upshot is that Aussie households are really, really feeling the pinch of rising costs of living, bigger mortgage and rent payments every month, and we’re simply not going shopping.

Well… we are shopping, just not enough to move the needle very far, and – taking into account the aforementioned population growth – it could be argued that we’re too busy stuffing money under the mattress (or what’s left of it, anyway).

Indeed.com Asia-Pacific economist Callam Pickering has some notes, spotting that what little consumer spending there was tended to be “driven by non-discretionary or essential items, up 1.8% over the past year”, while discretionary spending is down 1.9% over the same period.

So it’s a great day to own a supermarket, and a terrible day to be selling jet skis – even though there is a certain subset of the community who would argue that a jet ski is non-discretionary… even mandatory, for those who are true devotees of the stupid bloody things.

For what it’s worth, Pickering is saying that it’s “possible” we’ll see an interest rate hike by the RBA when it meets next month.

He’s not the first to suggest it, but he is part of a growing number of experts who are making similar noise… so, brace yourselves.

Meanwhile, the ACCC today issued a warning that the east coast of Australia is in danger of hitting a gas shortfall as early as 2027, unless more supply than is currently in the pipeline can be rolled out before then.

Late last year, the ACCC released a report that said we’d probably be okay, but supply would be very tight, throughout the transition to renewables through to 2028.

But, it appears that the forecasts have changed for the worse, with the watchdog now sounding the alarm bells about a major shortfall just three years from now, without further supply being brought online.

“This is earlier than our last forecast (in December 2023) of a possible shortfall from 2028, reflecting lower forecast supply due to delays in anticipated regulatory approvals for new projects and problems with legacy gas fields,” the report says.

I’m no expert on the topic of gas – a statement my son just read over my shoulder and told me “don’t tell lies, dad…” – but our resident expert on such matters, the incomparable Bevis Yeo, has assured me that he’s across the story, and will have a deep dive into the Australian gas story “coming soon”.

TO MARKETS

And while we’re on the topic of stuff we drag out of the ground to set on fire, there had been some persistent rumblings about the future of ASX-listed Santos, with overseas heavyweights Saudi Aramco and Abu Dhabi National Oil Company allegedly in the frame with a takeover offer.

However, early this morning, those rumours were scotched by the Middle Eastern companies, which categorically denied any efforts to acquire Santos, sending the local company’s price down this morning. It’s rallied since then, and at the time of writing was just -0.5% off its last closing price of $8.00 a pop.

Meanwhile, there’s really not been a lot of announcement news making waves on the ASX today – in fact, the past couple of days have been pretty quiet, despite rising iron ore prices pushing things higher yesterday, and rising oil prices over the past week or so helping other areas of the market.

Today, though, there’s not all that much to write home about. The ASX 200 benchmark has been fumbling along below zero for the bulk of the session, and is set to close at around -0.1% for the day.

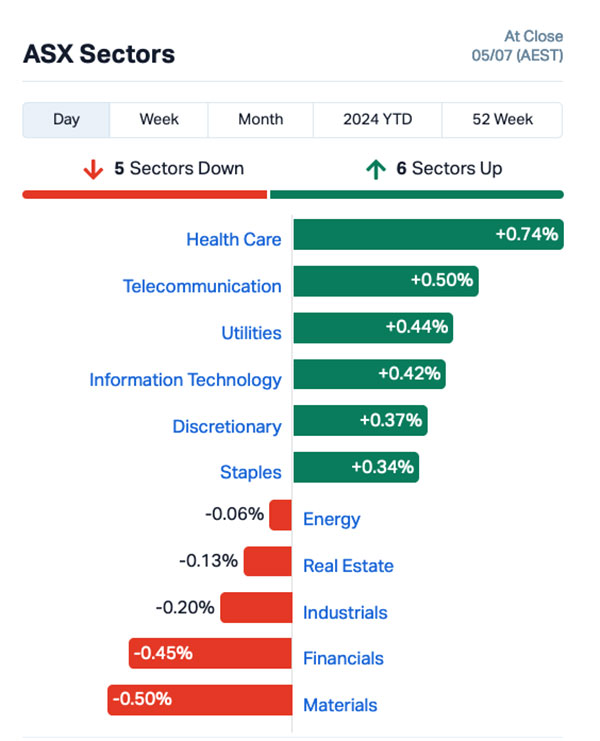

A snapshot of the ASX sectors looks like this:

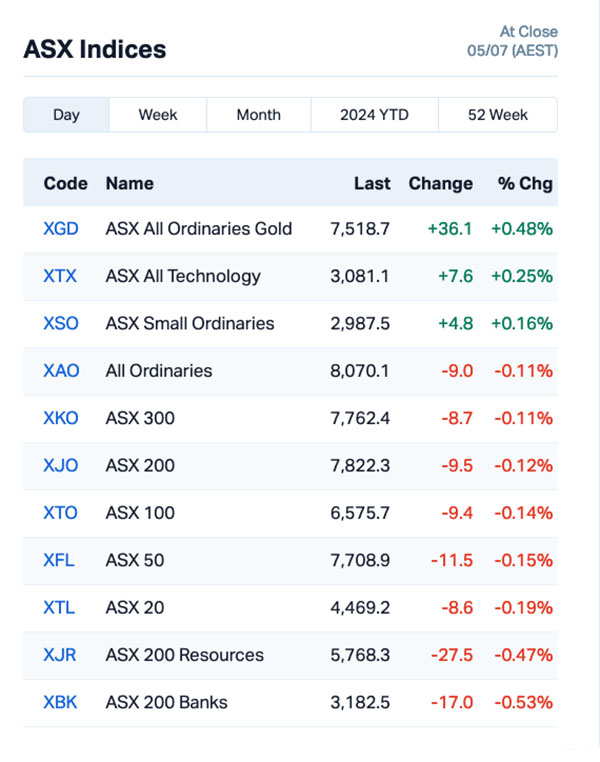

And the ASX indices look like this:

It’s all rather dull, really… and even the Small Caps winners are thin on information… but let’s take a look at them anyway, because that’s what I get paid to do.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PUA | Peak Minerals Ltd | 0.005 | 50.0 | 36,996,203 | $3,124,130 |

| CLZ | Classic Min Ltd | 0.002 | 50.0 | 14,927,273 | $808,365 |

| WML | Woomera Mining Ltd | 0.003 | 50.0 | 2,165,400 | $2,436,278 |

| EQS | Equitystorygroupltd | 0.022 | 46.7 | 376,585 | $1,634,902 |

| TTT | Titomic Limited | 0.135 | 42.1 | 15,538,128 | $96,010,406 |

| AQC | Auspaccoal Ltd | 0.097 | 36.6 | 1,708,921 | $37,899,866 |

| I88 | Infini Resources Ltd | 0.485 | 34.7 | 1,975,757 | $13,673,997 |

| ZLD | Zelira Therapeutics | 0.460 | 27.8 | 13,075 | $4,084,976 |

| CCM | Cadoux Limited | 0.070 | 27.3 | 415,789 | $20,400,467 |

| WIN | WIN Metals | 0.028 | 27.3 | 1,751,534 | $7,021,433 |

| ICL | Iceni Gold | 0.089 | 25.4 | 3,390,507 | $19,366,035 |

| SPD | Southernpalladium | 0.425 | 25.0 | 45,607 | $30,515,000 |

| ASR | Asra Minerals Ltd | 0.005 | 25.0 | 1,004,984 | $8,144,317 |

| LRL | Labyrinth Resources | 0.005 | 25.0 | 4,448,355 | $4,750,175 |

| SIS | Simble Solutions | 0.003 | 25.0 | 35,749 | $1,506,901 |

There was a lot of interest in Titomic (ASX:TTT) on Friday, but the latest news from the company is already four days old – but, for what it’s worth, it was pretty good news. The company sold one of its custom high-pressure cold spray systems to the Oregon Manufacturing Innovation Centre, for a cool $1.2 million.

The system, once installed, will allow the Oregon centre to get into the additive manufacture of multi-metal parts, large-scale titanium parts, and the manufacture of multi-metal coatings, Titomic says.

Classic Minerals (ASX:CLZ) climbed on Friday in the wake of an announcement that LDA Capital had subscribed for 49,850,800 shares of the 51,000,000 on offer, for a total of $47,500.00 at a price per Subscription Share of $0.00095. CLZ submitted the capital Call Notice under the terms of its strategic $15 million Put Option Agreement with the US-based financier announced in December 2022.

Peak Minerals (ASX:PUA) was rising on Friday morning on news that the company has executed binding agreements for the acquisition of 80% of the highly prospective Kitongo and Lolo Uranium Projects and the Minta Rutile Project in Cameroon, West Africa.

The acquisition includes six exploration permits under valid application covering an area of ~2,400km2, including the areas previously held by Mega Uranium Ltd (TSX:MGA) and actively explored until 2011.

iTech Minerals (ASX:ITM) was celebrating rock chip sampling results from Reynolds Range, which have come back with samples as high as 182g/t Au, with totals for copper, silver, base metals and lithium still pending, but they are expected to arrive in the coming weeks.

And Zelira Therapeutics (ASX:ZLD) was performing well after recieving a shot in the arm – and a show of confidence – from the company chairman Mr Osagie Imasogie, who has provided the company with a $1.4 million unsecured loan.

The loan was announced several days ago, and Zelira has informed the market that the money has arrived, and will be used to support the advancement of the HOPE SPV clinical trial, as well as general working capital purposes.

ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SHO | Sportshero Ltd | 0.003 | -40.0 | 2,876,995 | $3,089,164 |

| ME1 | Melodiol Glb Health | 0.002 | -33.3 | 11,287,694 | $691,387 |

| MMM | Marley Spoon Se | 0.024 | -27.3 | 257,374 | $3,884,905 |

| AAU | Antilles Gold Ltd | 0.003 | -25.0 | 1,003,376 | $3,986,140 |

| EXL | Elixinol Wellness | 0.003 | -25.0 | 611,859 | $5,284,729 |

| NGS | NGS Ltd | 0.003 | -25.0 | 12,596,378 | $1,004,910 |

| TMG | Trigg Minerals Ltd | 0.009 | -25.0 | 1,196,724 | $5,168,168 |

| CAQ | CAQ Holdings Ltd | 0.016 | -23.8 | 354,565 | $15,073,512 |

| 1MCDA | Morella Corporation | 0.060 | -20.0 | 222,690 | $18,536,398 |

| ALR | Altairminerals | 0.004 | -20.0 | 1,193,839 | $21,482,888 |

| CDT | Castle Minerals | 0.004 | -20.0 | 2,904,813 | $6,639,132 |

| MCL | Mighty Craft Ltd | 0.004 | -20.0 | 453,679 | $1,844,546 |

| MRQ | Mrg Metals Limited | 0.004 | -20.0 | 78,393,793 | $12,625,593 |

| ROG | Red Sky Energy. | 0.004 | -20.0 | 344,749 | $27,111,136 |

| SMM | Somerset Minerals | 0.004 | -20.0 | 3,004,302 | $5,154,994 |

| PWN | Parkway Corp Ltd | 0.008 | -16.7 | 2,337,618 | $24,904,025 |

| UCM | Uscom Limited | 0.015 | -16.7 | 42,622 | $4,488,201 |

| EVR | Ev Resources Ltd | 0.005 | -16.7 | 828,000 | $7,927,629 |

| HT8 | Harris Technology Gl | 1.000 | -16.7 | 66,653 | $3,589,626 |

| FBM | Future Battery | 0.032 | -16.0 | 997,050 | $25,166,485 |

ICYMI – PM EDITION

Aura Energy (ASX:AEE) has taken another five steps towards developing its Tiris uranium project in Mauritania with the first being the appointment of experienced West African project director Jan Booyse and his company, Project EQ, to lead the project development efforts.

The company has also appointed Kenmore Mine Consulting to complete a mine plan optimisation review and Lycopodium to oversee an optimisation and project enhancement study.

Additionally, Knight Piésold Consultingto has been appointed to oversee water resource drilling in the abundant and proximate Taoudeni Basin while Bruce Harvey, who has significant experience developing robust ESG frameworks in Africa and elsewhere, was appointed to review and update the company’s ESG framework.

European Lithium (ASX:EUR) partner Obeikan Investment Group has signed off on a deed of assignment and executed the key shareholders agreement that takes their joint venture closer towards developing a lithium hydroxide processing plant in Saudi Arabia, which offers attractive incentives for developments that could reduce its reliance on oil revenues.

Golden Mile Resources (ASX:G88) has completed field assessments of its projects in WA, part of a strategic review that will let it focus on assets with the highest chance of success.

iTech Minerals (ASX:ITM) rock chip sampling of outcropping low-sulphide gold style vein systems at its Reynolds Range project returned assays of up to 182g/t gold. Results for copper, silver, base metals and lithium are still pending and are expected in coming weeks.

Mt Malcolm Mines (ASX:M2M) recent grade control reverse circulation drilling has confirmed that robust, high-grade mineralisation is present at the Golden Crown prospect within its namesake project in WA after returning multiple high-grade gold intersections topping up at 1m at 111g/t gold.

Pure Hydrogen Corporation (ASX:PH2) could secure a new point of sales for its hydrogen fuel cell and battery electric trucks in California after signing a memorandum of understanding with commercial vehicles supplier Riverview International Trucks.

At Stockhead, we tell it like it is. While Aura Energy, European Lithium, Golden Mile Resources, iTech Metals, Mt Malcolm Mines and Pure Hydrogen are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.