Closing Bell: Benchmark can’t get back above water, ASX Emerging Co’s Index down over 5pc this week

Via Getty

- Benchmark index down -0.08% on Thursday, despite near 3% rise for Energy stocks

- All sectors lower bar Materials and Energy

- Small caps led by Pioneer and First Lithiums

Local markets dipped hard again at the open, trading flat in the morning before rising – like a Sphinxian-riddle in the afternoon, bolstered by energy stocks and oil prices – and waning again in later in the day.

A tepid Wall Street’s lead overnight left Asian markets with a mixed message. Free perhaps to write their own fates for a rare occasion.

The benchmark ASX200 was down -0.3% at 2pm, consumer stocks weighing after an unexpected fall in monthly retail sales, before shaking that one off to climb again to end -0.08% short of parity.

The Small Ords (XSO) index lost -0.5% and the Emerging Companies (XEC) index lost yet another -0.3%, to take the XEC’s losses since Monday to circa over -5.0%.

In the US overnight, it was up, down, up.

The S&P 500 rose by +0.02%, the blue chips Dow Jones index was down by -0.2%, and the tech-heavy Nasdaq lifted by +0.2%.

The problem now, as my erstwhile lunchtime legend Gregor Stronach noted, is the likelihood of another US government shutdown is getting very real.

According to the shutdown boffins at Goldman Sachs, chances are at about 90%.

“Not exactly the boldest of predictions, considering the US is about three days away from seizing up like a poorly-serviced chainsaw in dire need of lube,” Mr Stronach observed.

A bipartisan Senate bill which would’ve kept the lights on stateside – allowing for a ‘proper, long-term’ solution to be sorted – is dead in the water according to the Republican House Speaker Kevin McCarthy.

Kev’s stake in all this far outstrips whatever damage a shutdown might do to global markets – his gig is on the line, and if he doesn’t play belly up ball with his own extreme right wingers, it’s goodbye to being House Speaker. Which would be awful.

The Energy Sector’s 2.96% win on Thursday has saved a lot of face.

The big names have done particularly well – aka – your Woodside Energy Group’s (ASX:WDS) and your Santos’ (ASX:STO).

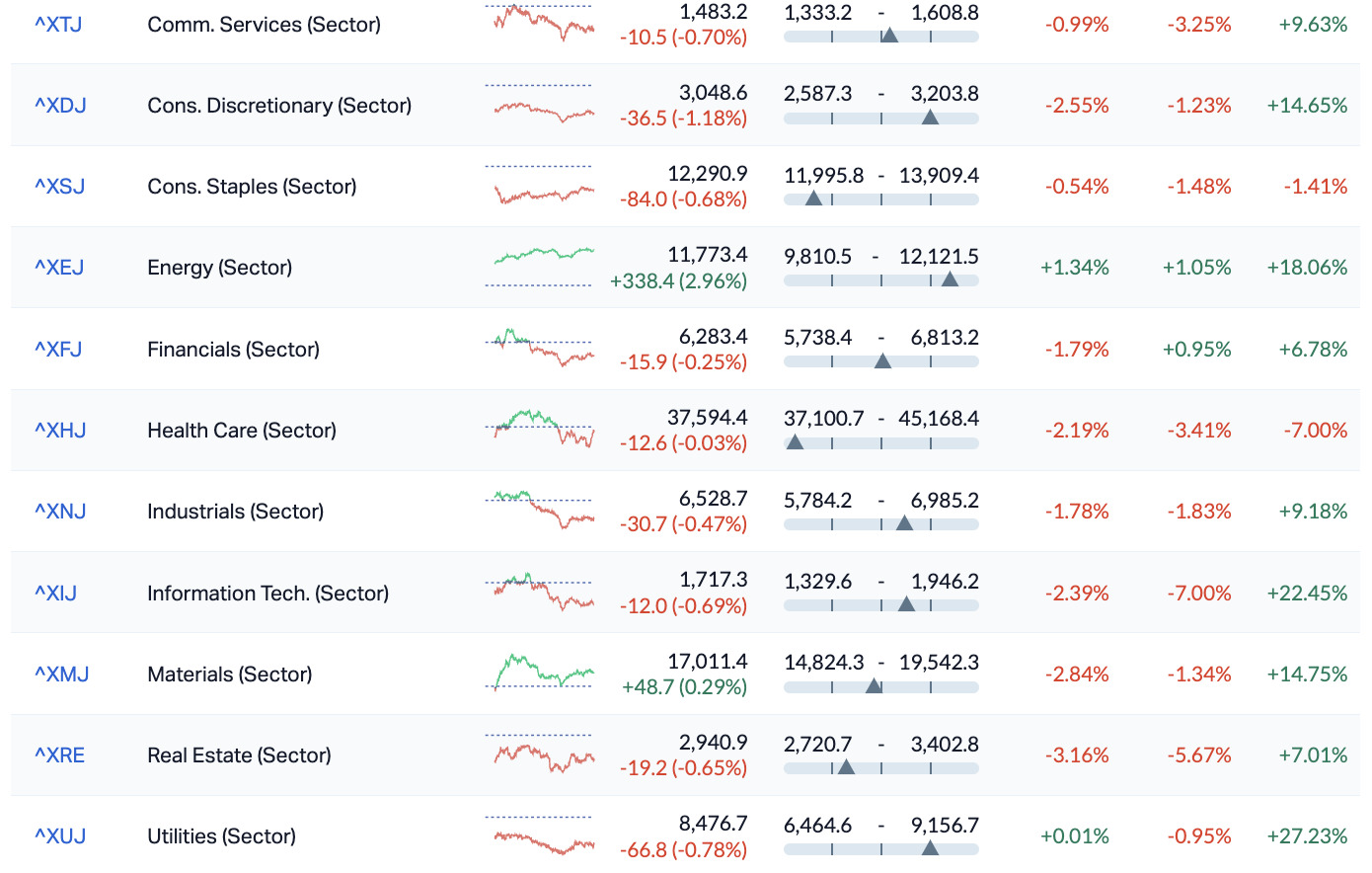

ASX Sectors on Wednesday — Intraday — 52 Week Range — Week – Month – Year

In small caps news

“The world’s largest database of official music credit,” Jaxsta (ASX:JXT) , is set to release its final – audited – results for the FY 2023 on Friday, with the music-minded small cap having previously waved about its preliminary, badly unaudited financial report to the world at the end of August.

In a note this morning, JXT has rewound the tape as best it can in these circumstances, telling shareholders to ignore that last one and brace for an increase in ‘convertible note and derivative financial liabilities… as a result, the fair values of such liabilities increased by $3,530,931 in total from what was disclosed in the unaudited preliminary results.’

As a consequence and in short: expect an increase in the loss for this financial year.

It’s not a bad time to get into the uranium mining services sector and now Clean Teq Water (ASX:CNQ) has a chance to live up to its name, after winning a $5.6mn Heathgate Resources contract for the design and supply of a Clean-IX® U-Column and associated equipment for Heathgate’s Uranium Processing Plant in South Australia.

Clean TeQ says its ‘continuous ion exchange technology can deliver an increased uranium tenor and minimise water use to achieve this outcome, both improving the efficiency of the operation as well as sustainability.’

The preliminary design phase was in the can by August 2023, CNQ says, and the entire project has a 40-week delivery time.

Heathgate Resources (ASX:) will perform the installation which is anticipated to take 6 months. Commissioning of the plant will then take place over 8 weeks following installation handover.

CEO of Clean TeQ Water, Peter Voigt:

“We are delighted to be supporting Heathgate in this important project. The implementation of the Clean-IX® continuous ion exchange technology at an Australian uranium mine is a major achievement for the Company. Clean TeQ Water aims to be the preferred company for clients seeking the best available technology partner for water and metal recovery projects.”

Here’s one for the Li geeks from Dalaroo Metals (ASX:DAL), which has provided a brief and technically impenetrable update on the Lyons River Project in the Gascoyne Province lithium and REE companies and associated prospects, worth sharing, I believe:

- Assessment of Lyons River Project wide lithium in soil geochemical data comprising 3,856 samples highlights north-trending faults in the D5 Edmundian shear zones and the possible flow of Li-rich melts into the fault compartments in the central part of Lyons River Project.

- Geochemical analysis of granitic rocks demonstrates that intrusions of the Thirty Three Supersuite are present, which confirms interpretation of Edmundian deformation, and underlines prospectivity for lithium bearing pegmatites.

I can be quite Edwardian myself as a stubborn fella, and after several pages of Neoproterozoic technical analysis, found something like an outlook:

- Current phase of pegmatite rock-chip sampling and detailed field geological mapping of the 30km strike length of the northern shear zone is well underway to outline Li bearing spodumene pegmatites expected to be completed by end of October 2023.

- We expect first assay results from the rock chip sampling of the highly fertile for LCT-type pegmatites to be received from mid-October 2023 onwards.

- These results from the sampling program will lead to defining drill targets and locations. Drill testing will be undertaken once all approvals are in place.

Ripped from the headlines

WTI crude prices found support overnight to clear a new 12 month high, pushing above $US94 a barrel, as a new read on stockpiles in the largest US storage hub dropped to more than 12 month lows.

The greenback likewise pushed into new 10-month high territory as market momentum that interest rates will remain higher for longer, continues to find carriage. The benchmark 10-year US yield levatated itself to around 4.6% – clocking a new of its own – going back to 2007.

Things can’t get worse for the shares of China Evergrande Group which got themselves suspended on Thursday in Honkers.

Well, that’s not entirely true – things can get much, much worse when it comes to Chinese property.

Anyway, the Hong Kong’s exchange pulled Evergrande shares at 32 Hong Kong cents after the chairman of the disintegrating Chinese real estate developer got himself put under surveillance, as per Bloomberg News.

That’s silly, because all those guys would be under surveillance as a rule.

Evergrande only resumed trading exactly one month ago after previously being sidelined for 17 months, so they’ll know how to stay busy.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.002 | 100.00 | 159,438 | $15,642,574 |

| MXC | Mgc Pharmaceuticals | 0.002 | 100.00 | 3,067,946 | $4,427,968 |

| PLN | Pioneer Lithium | 0.348 | 73.75 | 1,199,901 | $5,685,000 |

| FL1 | First Lithium Ltd | 0.285 | 58.33 | 7,721,326 | $12,609,300 |

| MEB | Medibio Limited | 0.002 | 50.00 | 3,000,000 | $6,100,744 |

| LPI | Lithium Pwr Int Ltd | 0.335 | 28.85 | 6,515,711 | $163,601,766 |

| VAR | Variscan Mines Ltd | 0.014 | 27.27 | 848,695 | $3,922,762 |

| IVX | Invion Ltd | 0.005 | 25.00 | 13,408,579 | $25,686,529 |

| AJL | AJ Lucas Group | 0.015 | 25.00 | 57,785 | $16,508,756 |

| JTL | Jayex Technology Ltd | 0.010 | 25.00 | 246,314 | $2,250,228 |

| CYQ | Cycliq Group Ltd | 0.005 | 25.00 | 6,720,902 | $1,430,067 |

| ROO | Roots Sustainable | 0.005 | 25.00 | 236,477 | $554,889 |

| MTC | Metalstech Ltd | 0.210 | 23.53 | 797,909 | $32,062,780 |

| BIT | Biotron Limited | 0.046 | 21.05 | 7,679,414 | $34,273,906 |

| AEV | Avenira Limited | 0.012 | 20.00 | 4,395,669 | $17,300,072 |

| CXU | Cauldron Energy Ltd | 0.012 | 20.00 | 25,191,295 | $9,515,687 |

| TMG | Trigg Minerals Ltd | 0.012 | 20.00 | 1,084,994 | $2,013,846 |

| GMR | Golden Rim Resources | 0.026 | 18.18 | 417,520 | $13,014,944 |

| ODE | Odessa Minerals Ltd | 0.013 | 18.18 | 12,687,787 | $10,418,230 |

| DMM | Dmcmininglimited | 0.068 | 17.24 | 567,071 | $1,737,100 |

| BOD | BOD Science Ltd | 0.075 | 17.19 | 204,551 | $11,229,664 |

| BFC | Beston Global Ltd | 0.007 | 16.67 | 2,041,306 | $11,982,281 |

| GCR | Golden Cross | 0.004 | 16.67 | 129,513 | $3,291,768 |

| KCC | Kincora Copper | 0.036 | 16.13 | 52,777 | $4,971,751 |

| RAS | Ragusa Minerals Ltd | 0.037 | 15.63 | 392,935 | $4,563,161 |

Pioneer Lithium (ASX:PLN) has topped the charts this morning with a belter of a debut, going live on the market after a heavily oversubscribed $5 million IPO, thanks to the company’s “multi-asset portfolio of strategically located lithium projects in Ontario and Quebec, Canada”.

That includes the Root Lake (90% owned) and Lauri Lake (100% owned) Projects in Ontario and the LaGrande (100% owned) Lithium Project in Quebec’s world-class James Bay region.

It’s the Root Lake project that will be the immediate focus for PLN, positioned directly between Green Technology Metals (ASX:GT1) Root Bay and Morrison/McCombe lithium deposits, and its James Bay Quebec LaGrande Project.

PLN’s trading price is showing a bump of 67.5% at lunchtime.

Over in northern Spain, Variscan Mines ASX:VAR) offered a stellar update on its progress and exploration work at the Novales-Udias project, located in Cantabria, where VAR says underground drilling at the San Jose Mine is now well advanced and new assay results are imminent.

Here’s some handy bullies:

• Drilling ongoing and fully funded to 2023 calendar year end

• ERM (formerly CSA Global) commissioned to produce maiden JORC compliant Mineral

Resource Estimate for the San Jose Mine; expected in October 2023

• Piran Mining contracted to produce a Mine Re-start Study for the San Jose Mine; due in Q1

2024

• As part of the Mine Re-start Study, metallurgical test-work is now underway

• Structural geological assessment and targeting study by world-renowned expert Dr. Brett

Davis scheduled for Q4 2023

• Applications for surface drilling permits over the Novales – Udias project and the San Jose

Mine are well advanced in anticipation for a program scheduled for Q1 2024

The share price is up more than 27%.

First Lithium (ASX:FL1) – formerly known as (Ookami) jumped back to work on the ASX this AM after a long sand lonely suspension.

FL1 stock clocked in at over +41% by lunch in a warm welcome back..

FL1 is hunting spodumene in Mali, just down the road from Goulamina where China’s Ganfeng and $700 million capped ASX developer Leo Lithium (ASX:LLL) plan to open Africa’s first major spod mine next year at a world class 500,000tpa.

You should read Reub’s and Josh’s work on this one – it’s complicated, and they’re far better at explaining it than I am.

Meanwhile, in third place, it’s MetalsTech (ASX:MTC), up 35.2% because “lithium”, which seems to be the hard driver for Small Caps today.

MTC recently announced that it bought a hard rock lithium project in… you guessed it… James Bay, and this morning announced that “highly respected lithium industry executive” Robert Sills has been added to the board as a non-executive technical director.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| XTC | Xantippe Res Ltd | 0.001 | -33.33 | 107,100 | $26,292,008 |

| BEX | Bikeexchange Ltd | 0.006 | -25.00 | 80,000 | $11,461,038 |

| MRD | Mount Ridley Mines | 0.002 | -25.00 | 897,505 | $15,569,766 |

| CVR | Cavalierresources | 0.125 | -21.88 | 48,186 | $5,092,627 |

| MRI | Myrewardsinternation | 0.008 | -20.00 | 1,188,444 | $4,266,338 |

| CDR | Codrus Minerals Ltd | 0.065 | -19.75 | 1,782,777 | $6,138,990 |

| RMY | RMA Global | 0.081 | -19.00 | 9,555 | $55,794,263 |

| ELE | Elmore Ltd | 0.005 | -18.18 | 5,231,222 | $7,696,611 |

| NTM | Nt Minerals Limited | 0.009 | -18.18 | 320,943 | $8,807,688 |

| AGR | Aguia Res Ltd | 0.014 | -17.65 | 250,300 | $7,375,522 |

| DTM | Dart Mining NL | 0.020 | -16.67 | 942,135 | $4,152,293 |

| DOU | Douugh Limited | 0.005 | -16.67 | 144,427 | $6,341,852 |

| CNJ | Conico Ltd | 0.005 | -16.67 | 889,535 | $9,420,570 |

| IEC | Intra Energy Corp | 0.005 | -16.67 | 18,234,912 | $9,724,690 |

| STM | Sunstone Metals Ltd | 0.015 | -16.67 | 3,305,273 | $55,475,728 |

| TIG | Tigers Realm Coal | 0.005 | -16.67 | 745,000 | $78,400,214 |

| BCB | Bowen Coal Limited | 0.130 | -16.13 | 5,250,106 | $331,077,811 |

| PCL | Pancontinental Energ | 0.016 | -15.79 | 48,663,575 | $153,144,233 |

| RVS | Revasum | 0.115 | -14.81 | 3,781 | $14,298,748 |

| LRL | Labyrinth Resources | 0.006 | -14.29 | 425,714 | $8,312,806 |

| MOB | Mobilicom Ltd | 0.006 | -14.29 | 81,683 | $9,286,737 |

| BKY | Berkeley Energia Ltd | 0.370 | -13.95 | 495,778 | $191,692,587 |

| SAU | Southern Gold | 0.013 | -13.33 | 2,194,086 | $7,294,279 |

| FFF | Forbidden Foods | 0.014 | -12.50 | 225,040 | $2,989,769 |

| BXN | Bioxyne Ltd | 0.014 | -12.50 | 349,146 | $30,426,326 |

TRADING HALTS

Australian Potash (ASX:APC) – Pending the release of an announcement in relation to a capital raising

Meeka Gold (ASX:MEK) – Pending the release of an announcement in relation to a capital raising

Moho Resources (ASX:MOH) – Pending the release of an announcement in relation to a capital raising

Tempus Resources (ASX:TMR) – Pending the release of an announcement in relation to a capital raising

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.