Closing Bell: Bank and real estate gains lift ASX despite materials losses

The ASX trundled along in positive territory today, lifted by wins in bank stocks alongside discretionary and real estate sectors. Pic: Getty Images

- ASX shifts gears around 11am to lift 0.25pc by end of trade

- Banks, discretionary and real estate lead gains

- Materials drags as James Hardie dives

ASX settles back into green

Earnings season is making for a bit of a seesaw on the ASX this week, as various heavyweight stocks release their earning reports and come crashing down on one side of the ledger or the other.

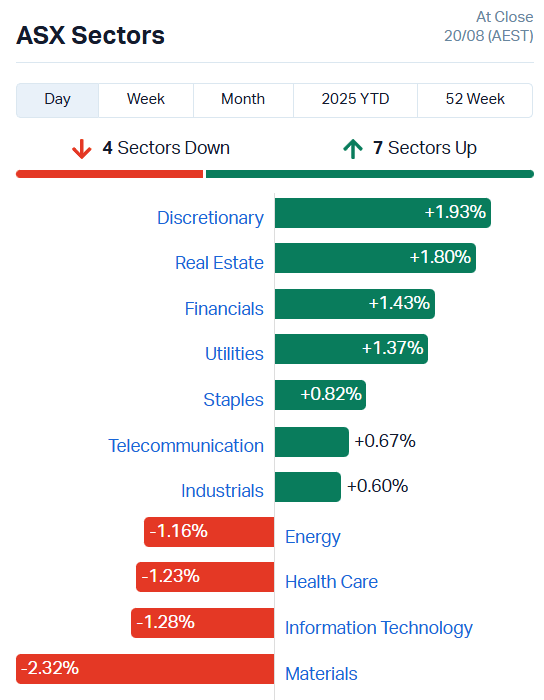

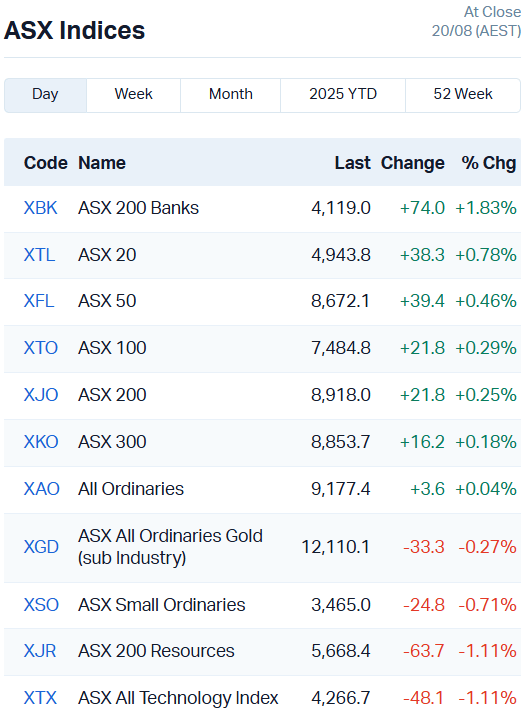

The ASX 200 has climbed 0.25% or 21.8 points today to 8918 with seven of 11 sectors higher.

There were some big losses. CSL (ASX:CSL) continued to slide (-1.79%) after hitting its lowest point in more than five years, now down 18.6% for the week.

James Hardie Industries (ASX:JHX) joined the chorus of groans, losing a whopping $7.7 billion in value this morning after disappointing with its updated guidance for FY26.

The stock is down 28% for the day at $31.92 each, its lowest point since March 2023. The building materials company says housing construction in Australia will be flat until early next year, for all the government’s recent efforts.

Lucky for us, a rate cut in New Zealand and expectations for another in the US are lifting our banks, with strong support from the discretionary and real estate sectors.

All seven stocks on our ASX 200 Banks index were on the up today, with special mentions for Westpac (ASX:WBC), which added 2.47%, and National Australia Bank (ASX:NAB) up 3.68%.

Now, let’s dive in to the afternoon’s reporting wrap.

Earnings Season Wrap

Stockland Corporation (ASX:SGP)

Stockland Corporation gained 7.6% in trade to lift to $6.16 per share, after posting a hefty 171% jump in full-year profit to $826m. Intraday, the stock reached $6.19 each, its highest point since 2008.

The growth was mostly driven by an increase in settlement volumes from master-planned communities, higher development fee income and better results from its logistics portfolio.

SGP will pay a full year dividend of 25.2 cents per share, a 2.4% increase from last year, and offered guidance of the same for next year.

A strong performance from APA’s gas transmission and storage business contributed to a 6.4% lift in EBITDA for the company, coming in at $2.015 billion. Underlying EBITDA margins also increased to 74.2%, a reflection of APA’s cost reduction initiatives.

It wasn’t all gravy – APA’s statutory net profit after tax was $129m, lower than the previous period.

The company says that’s because FY24 was a standout year due to a non-cash write-up of an asset. Without that one-off windfall on the books, this year’s result would be 8.4% higher than last year’s.

Shareholders rewarded the natural gas company with a 3.8% uptick to its shares, now $8.8 each.

Real estate portfolio group Vicinity Centres almost doubled its statutory net profit after tax this year, bringing in $1.004b compared to $547.1m last year.

The company offloaded several non-strategic assets and acquired the Lakeside Joondalup premium asset, while maintaining a 99.5% occupancy rate.

VCX will make a final dividend distribution of 6.05c per share, for a total of 12c per share.

Vicinity’s shares lifted 3.2% to $2.62 each by end of trade.

Internet infrastructure company Suplerloop lifted revenue 31% to $546.5m this FY, appreciating on strong consumer growth alongside solid performances in the wholesale segment of its business.

Wholesale revenue lifted 62% to $77.9m and the consumer segment’s revenue 37% to $363.7 million, adding 63,000 net new customers over the year.

Despite a 70% increase in underlying EBITDA to $92.2 million – above guidance! – shareholders weren’t impressed.

SLC’s shares fell 1.69% to $3.2 each.

“EBITDA, EBITDA, EBITDA, that’s all fo…” ah, we made that “joke” yesterday. Moving on, then…

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PPY | Papyrus Australia | 0.032 | 220% | 17,550,348 | $6,028,817 |

| BEL | Bentley Capital Ltd | 0.015 | 50% | 614,545 | $761,279 |

| AYM | Australia United Mining | 0.003 | 50% | 614,432 | $3,685,155 |

| OVT | Ovanti Limited | 0.012 | 50% | 246,497,917 | $34,194,589 |

| PIL | Peppermint Innovation | 0.003 | 20% | 200,000 | $5,828,525 |

| SRN | Surefire Rescs NL | 0.0015 | 0% | 2,267,113 | $5,822,789 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 46,140,260 | $4,154,089 |

| SMS | Star Minerals | 0.051 | 31% | 10,963,129 | $7,297,159 |

| LEG | Legend Mining | 0.009 | 29% | 5,206,307 | $20,401,340 |

| MCM | Mc Mining Ltd | 0.135 | 29% | 977 | $67,587,679 |

| I88 | Infini Resources Ltd | 0.24 | 26% | 501,775 | $9,950,304 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 42,410,366 | $8,000,396 |

| ERA | Energy Resources | 0.0025 | 25% | 38,561,744 | $810,792,482 |

| JAV | Javelin Minerals Ltd | 0.0025 | 0% | 1,119,515 | $15,630,562 |

| RAN | Range International | 0.0025 | 25% | 50,498 | $1,878,581 |

| TMK | TMK Energy Limited | 0.0025 | 0% | 7,200,000 | $25,555,958 |

| WEL | Winchester Energy | 0.0025 | 25% | 3,220 | $2,726,038 |

| ESK | Etherstack PLC | 0.585 | 24% | 537,516 | $62,374,641 |

| LGL | Lynch Group Holdings | 2.165 | 24% | 5,033,512 | $213,615,696 |

| RC1 | Redcastle Resources | 0.011 | 22% | 8,813,791 | $6,692,102 |

| EM2 | Eagle Mountain | 0.006 | 20% | 126,390 | $5,675,186 |

| RDS | Redstone Resources | 0.006 | 20% | 19,260,663 | $5,171,337 |

| SPQ | Superior Resources | 0.006 | 20% | 833,333 | $11,854,914 |

| HMC | HMC Capital Limited | 3.87 | 18% | 8,046,366 | $1,349,253,440 |

| XGL | Xamble Group Limited | 0.021 | 17% | 151,300 | $6,102,256 |

In the news…

Papyrus Australia (ASX:PPY) surged 220% after securing a three-year, $4.2m supply deal with TBS Mining Solutions, a wholly-owned subsidiary of Aquirian (ASX: AQN) for a biodegradable version of its Collar Keeper.

The new products will be manufactured at the Papyrus commercial production facility in Adelaide, currently under development and slated for commissioning in Q4 next year.

Ovanti (ASX:OVT) is up 50% after entering a strategic partnership agreement with Shift 4 Payments, a leading US payment processing and commerce solutions provider listed on the New York Stock Exchange.

Under the three-year deal OVT will launch its USA BNPL business through Shift4’s network of merchants in the US.

Alice Queen (ASX:AQX) is up 33% after completing its maiden drilling at the 100%-owned Viani gold project in Fiji, outlining a potentially large, high-grade epithermal system stretching ~5km.

The first two holes hit pay dirt with results of 17.6 g/t gold and 26.4 g/t gold, confirming high-grade gold to some 175m of depth. Subsequent holes returned more modest grades but validated the structure, supporting ongoing exploration.

Infini Resources (ASX:188) rose 26% today after releasing the results of a comprehensive desktop study at the Reynolds Lake Uranium Project in Canada.

Geophysical interpretation outlined major shear zones and a network of cross-cutting N-S faults, considered key structural controls for uranium mineralisation.

To follow up, Infini will put boots on the ground for a program of soil and rock sampling in September.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.001 | -50% | 2,250,000 | $12,894,892 |

| AOA | Ausmon Resources | 0.0035 | -30% | 13,056,755 | $6,556,067 |

| TON | Triton Minerals | 0.005 | -29% | 648,261 | $10,978,721 |

| JHX | James Hardie Indust | 31.835 | -28% | 10,841,638 | $19,061,852,064 |

| BCC | Beam Communications | 0.13 | -28% | 598,247 | $15,555,946 |

| HLX | Helix Resources | 0.0015 | -25% | 2,144,942 | $6,728,387 |

| STP | Step One Limited | 0.52 | -24% | 4,011,131 | $126,958,099 |

| SRJ | SRJ Technologies | 0.007 | -22% | 1,831,141 | $9,368,123 |

| FNX | Finexia Financialgrp | 0.11 | -21% | 568,556 | $8,722,555 |

| IVX | Invion Ltd | 0.115 | -21% | 2,127,079 | $12,418,822 |

| MGT | Magnetite Mines | 0.096 | -20% | 1,676,488 | $14,706,928 |

| RGT | Argent Biopharma Ltd | 0.12 | -20% | 253,821 | $10,827,473 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 927,001 | $11,584,182 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 670,000 | $23,424,247 |

| FUN | Fortuna Metals Ltd | 0.054 | -19% | 220,925 | $12,552,054 |

| RFG | Retail Food Group | 1.725 | -17% | 464,682 | $130,266,733 |

| TAS | Tasman Resources Ltd | 0.015 | -17% | 36,007 | $5,028,349 |

| AKN | Auking Mining Ltd | 0.005 | -17% | 5,030,510 | $4,128,698 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 336,860 | $2,763,100 |

| DTM | Dart Mining NL | 0.0025 | -17% | 3,571,166 | $3,594,167 |

| VEN | Vintage Energy | 0.005 | -17% | 228,000 | $12,521,482 |

| BOC | Bougainville Copper | 0.505 | -17% | 170,029 | $242,642,813 |

| ARU | Arafura Rare Earths | 0.185 | -16% | 38,628,219 | $542,152,312 |

| MQR | Marquee Resource Ltd | 0.011 | -15% | 5,662,997 | $7,627,350 |

| CRI | Critica Ltd | 0.017 | -15% | 7,453,409 | $53,963,643 |

In Case You Missed It

Neurizon Therapeutics (ASX:NUZ) has reported positive topline results from an open-label extension study of its lead candidate NUZ-001 for amyotrophic lateral sclerosis.

ClearVue Technologies (ASX:CPV) has strengthened its foothold in the Middle East with a five-year manufacturing and distribution agreement with Emirates Glass.

Taruga Minerals’ (ASX:TAR) three new licences in the northern Gascoyne contain numerous high-grade historical precious and base metal workings.

Mammoth Minerals (ASX:M79) is working toward resurrecting the historical Standby Mine with systemic exploration at the Bella gold project.

Zenith Minerals (ASX:ZNC) has kicked off a 3,000m drilling program at its Red Mountain project in Queensland in search of gold and copper.

TG Metals’ (ASX:TG6) drilling of historical stockpiles and surface mineralisation at the Van Uden gold project in WA has progressed the definition of near-term cash flow opportunities.

Sovereign Metals (ASX:SVM) has de-risked the land rehabilitation plans for its Kasiya rutile-graphite project in Malawi.

Pursuit Minerals’ (ASX:PUR) PFS for a 5,000tpa lithium carbonate operation at Rio Grande Sur in Argentina is on track, with the final pond design for stage 1 complete.

Trading halts

- Papyrus Australia (ASX:PPY) – offtake agreement

- Universal Biosensors (ASX:UBI) – entering voluntary administration

- Axel Ree (ASX:AXL) – maiden gallium mineral resource estimate at the Caladão Project

- RLF Agtech (ASX:RLF) – national trading agreement and cap raise

- Great Northern Minerals (ASX:GNM) – acquisition and cap raise

- Golden Mile Resources (ASX:G88) – cap raise

- Elanor Commercial Property Fund (ASX:ECF) – off-market takeover offer

At Stockhead, we tell it like it is. While Alice Queen is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.