Closing Bell: Aussie benchmark fails Tuesday pub test. We should all be there now

'Alone, alone. All, all alone. Alone on a wide, wide sea.' Via Getty

- Local markets end slightly lower

- Telco Sector jumps 1.5pc

- Small Caps led by Way2Vat

The ASX200 has ended a second slumbrous session slightly lower, with a little dribble in the shape of the Star Casino at the corner of its mouth.

US Markets were closed for President’s Day

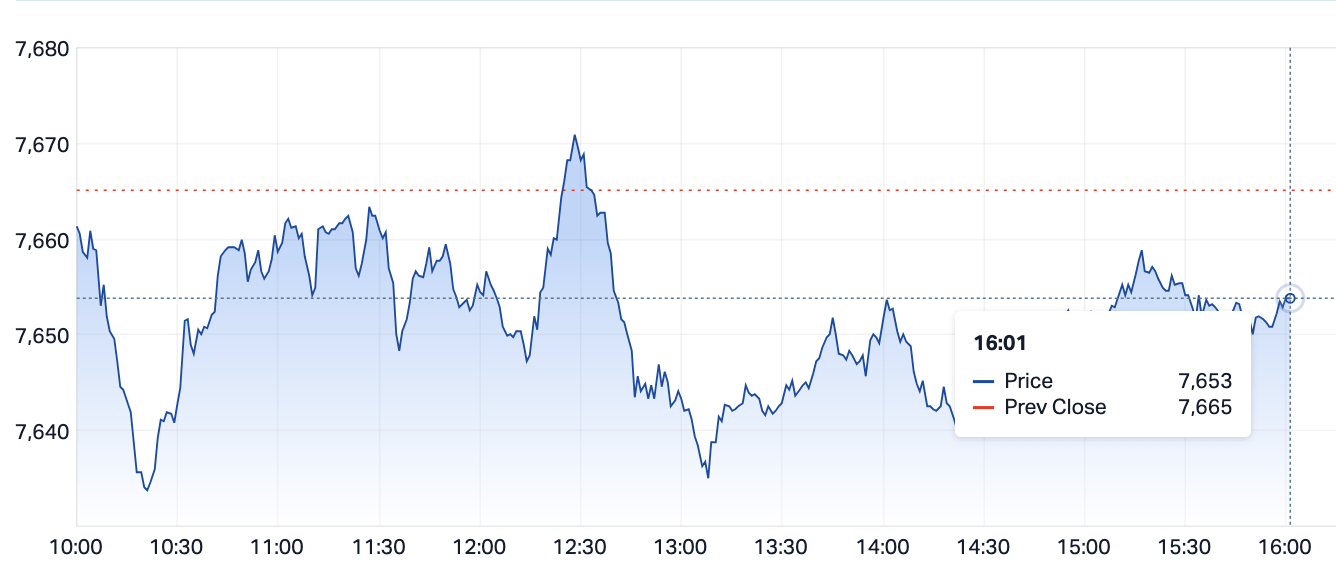

At 4.01pm on February 20, the S&P/ASX200 was down 11 points or 0.15% to 7,654…

ASX200 (XJO)

Local markets have had their fingers bent backwards on Tuesday by non-compliant resources stocks.

Woodside led losses in energy stocks after further falls in the price of oil. Brent crude is struggling at around US$83 a barrel.

Overnight the iron ore price lost more than 3% to $US127.25 a tonne. All the major iron ore diggers were in the red.

Reserve Bank of Australia’s Minutes from February’s board meeting dropped this morning, but didn’t knock anyone out.

The board probably enjoyed discussing a bump to the cash rate by 0.25 points, but didn’t.

Members agreed “that an increase in the cash rate target at this meeting could slow the growth of demand further and reduce the risk of inflation not returning to target in an acceptable timeframe.”

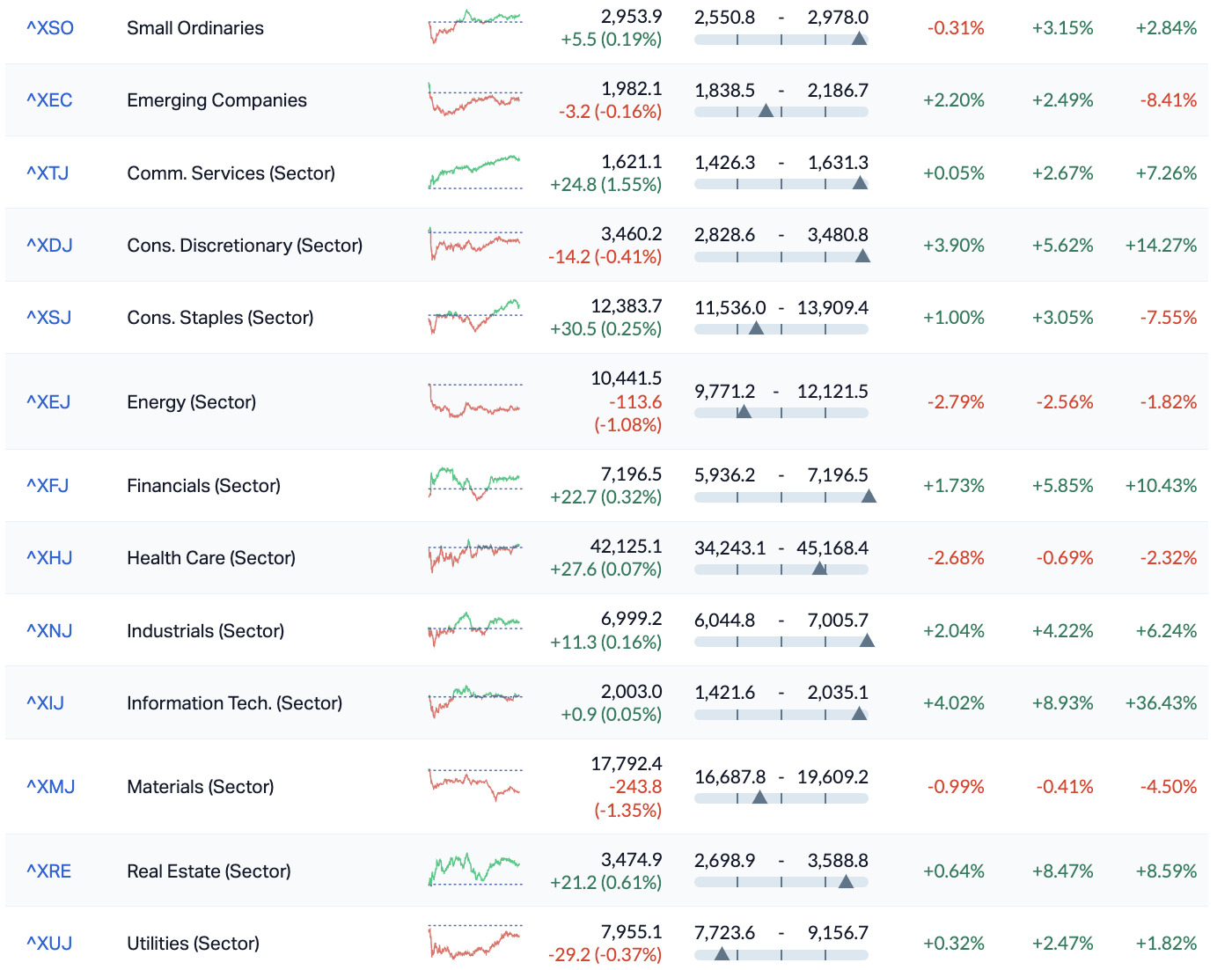

Telecommunication was the only sector really having a crack on Tuesday – up 1.55% at 4pm – while the broader index has trimmed some of this morning’s sharper losses.

The earnings season intensified and there’s more to come, too. This week features nearly 80 of the top 100 major listed companies including heavyweights such as BHP, Rio Tinto, Fortescue Metals, Lendlease, Stockland, Woolworths, and Qantas.

And Virgin Australia Holdings (ASX:VAH) boss Jayne Hrdlicka has announced she’ll be disembarking from Australia’s second-biggest airline after four years at the top.

More shame for Star Entertainment, which delayed the release of its interim results – due on Thursday now that an incredible second Bell inquiry appears imminent for its NSW casino operations.

More questions around the group’s suitability to run a Sydney casino is not a great look.

ASX Sectors on Tuesday

Surprisingly, both local and US earnings seasons have provided pleasant upside surprises here and there. A significant number of beats vs bops have been a boon to markets generally with results largely better than expectations. Most particularly in the US, where 81% of S&P500 companies have exceeded expectations.

We’re watching oil…

US crude oil prices reached their highest settlement since November, driven by escalating tensions in the Middle East, which overshadowed concerns about US inflation and demand uncertainties for the year.

Simmering conflicts between Israel and Lebanon, with Israel bombing southern Lebanon in retaliation for rocket attacks and Hezbollah threatening retaliation, added to the regional instability.

US Markets…

US equity futures were steady in muted trading as investors awaited fresh catalysts after a week that saw the S&P 500 breach new records and European indices not making the cut.

All three major indexes broke their five-week winning streaks to end the week in the negative. The S&P 500 ended the week lower by 0.42%, while the Dow slipped 0.11%. The Nasdaq tumbled 1.34%.

Applied Materials popped 6% Friday on stronger-than-expected earnings.

Shares of food delivery service DoorDash dropped 8% on a wider-than-expected loss.

US sectors, all closed lower overnight except for Materials, Healthcare and Consumer Staples.

Unlike in Sydney, Communication Services was the worst performer.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| W2V | Way2Vatltd | 0.032 | 60% | 132,081,482 | $13,032,169 |

| EXL | Elixinol Wellness | 0.009 | 50% | 2,377,022 | $3,797,230 |

| AVW | Avira Resources Ltd | 0.0015 | 50% | 150,285 | $2,133,790 |

| RKT | Rocketdna Ltd | 0.01 | 43% | 47,769,028 | $4,592,804 |

| BP8 | BPH Global Ltd | 0.002 | 33% | 167,999 | $2,931,174 |

| AHK | Ark Mines Limited | 0.2 | 33% | 105,902 | $8,316,962 |

| PL3 | Patagonia Lithium | 0.17 | 31% | 235,497 | $6,386,705 |

| LSA | Lachlan Star Ltd | 0.052 | 30% | 981,979 | $8,302,928 |

| BVS | Bravura Solution Ltd | 1.245 | 30% | 7,928,441 | $430,419,842 |

| OSL | Oncosil Medical | 0.009 | 29% | 1,212,315 | $13,821,788 |

| SKN | Skin Elements Ltd | 0.005 | 25% | 311,471 | $2,357,944 |

| ZEO | Zeotech Limited | 0.031 | 24% | 824,895 | $43,335,577 |

| INV | Investsmart Group | 0.155 | 24% | 5,000 | $17,835,061 |

| COY | Coppermoly Limited | 0.011 | 22% | 90,394 | $6,265,219 |

| WCN | White Cliff Min Ltd | 0.017 | 21% | 8,775,065 | $18,702,031 |

| TTM | Titan Minerals | 0.023 | 21% | 3,390,284 | $32,221,079 |

| MOZ | Mosaic Brands Ltd | 0.205 | 21% | 194,260 | $30,346,095 |

| AYT | Austin Metals Ltd | 0.006 | 20% | 655 | $6,425,957 |

| CHK | Cohiba Min Ltd | 0.003 | 20% | 11,322,357 | $6,325,575 |

| HIQ | Hitiq Limited | 0.025 | 19% | 27,743 | $7,388,744 |

| PKD | Parkd Ltd | 0.025 | 19% | 507,094 | $2,184,292 |

| STP | Step One Limited | 1.45 | 19% | 1,388,326 | $226,115,155 |

| XF1 | Xref Limited | 0.13 | 18% | 106,430 | $20,479,392 |

| PXX | Polarx Limited | 0.013 | 18% | 6,947,947 | $18,035,785 |

| MTM | MTM Critical Metals | 0.092 | 18% | 7,011,913 | $9,695,116 |

Out in front on Tuesday was Way2VAT (ASX:W2V), stretching its two-day run into a third consecutive winner, up 55% before lunch on Friday’s news that it has launched a new AI-driven automatic auditing system.

Parkd (ASX:PKD) has been given the go-ahead to proceed with Stage 2 of the design and construction contract with John Hughes Automotive Group, for construction of a multi-level car storage facility to support its VW service centre in Victoria Park, Perth.

The project value of Stage 2 works is $4.3 million “under terms and conditions that are industry standard for a contract of this nature”, with contract claims due to kick off in March of this year.

Elixinol Wellness (ASX:EXL) was rising on news that it’s set to sell its non-core investment – a minority stake in Altmed Pets – to Altmed Pets, for US$1.5 million in cash… $100,000 up front, the rest later.

Bravura Solutions (ASX:BVS) was trading higher on happy 1HFY24 results including a gross revenue bump of 7.4% to $124 million, putting the company on an EBITDA of $7.9 million, which is $11.5 million better than the previous year.

Toys R Us (ASX:TOY) was up on news that the company has completed a private placement of 84,615,385 new fully paid ordinary shares in the company at an offer price of $0.0065 raising $550,000 (roughly three Lego sets and a Summer Sun House Barbie doll) before costs.

And Cohiba Minerals (ASX:CHK) was also up on news of a placement, announcing that the company has raised $850,000 from professional and sophisticated investors, which will see the company issue 708,333,333 fully paid ordinary shares at $0.0012 a pop.

Belararox (ASX:BRX) made headway throughout the afternoon, after nanaging director Arvind Misr delivered a presentation to the Copper in the Americas investor call shortly before lunchtime.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| RBR | RBR Group Ltd | 0.002 | -33% | 110 | $4,855,214 |

| STX | Strike Energy Ltd | 0.215 | -26% | 69,221,034 | $830,045,499 |

| TKL | Traka Resources | 0.0015 | -25% | 250,000 | $3,501,317 |

| ADR | Adherium Ltd | 0.043 | -22% | 85,887 | $18,339,199 |

| AXN | Alliance Nickel Ltd | 0.036 | -20% | 587,539 | $32,662,783 |

| ATH | Alterity Therapeutics | 0.004 | -20% | 400,196 | $21,913,774 |

| CAV | Carnavale Resources | 0.004 | -20% | 12,537,500 | $17,117,759 |

| CNJ | Conico Ltd | 0.002 | -20% | 400,000 | $3,925,237 |

| IEC | Intra Energy Corp | 0.002 | -20% | 100,000 | $4,226,954 |

| PRX | Prodigy Gold NL | 0.004 | -20% | 3,326,102 | $8,755,539 |

| PUR | Pursuit Minerals | 0.004 | -20% | 150,323 | $14,719,857 |

| RDS | Redstone Resources | 0.004 | -20% | 200,000 | $4,626,892 |

| RMX | Red Mount Min Ltd | 0.002 | -20% | 2,611,228 | $6,683,940 |

| VML | Vital Metals Limited | 0.004 | -20% | 6,660 | $29,475,335 |

| SGR | The Star Entertainment Group | 0.45 | -20% | 133,580,546 | $1,606,461,291 |

| HUM | Humm Group Limited | 0.56 | -19% | 5,008,926 | $353,184,666 |

| HAL | Halo Technologies | 0.11 | -19% | 61,536 | $17,481,854 |

| ASV | Asset Vision Company | 0.015 | -17% | 1,937,297 | $13,065,058 |

| FTC | Fintech Chain Ltd | 0.015 | -17% | 48,964 | $11,713,853 |

| BMO | Bastion Minerals | 0.01 | -17% | 6,397,167 | $3,737,329 |

| ECT | Env Clean Tech Ltd. | 0.005 | -17% | 253,915 | $17,185,862 |

| LRL | Labyrinth Resources | 0.005 | -17% | 238,200 | $7,125,262 |

| MSI | Multistack International | 0.005 | -17% | 2,929 | $817,824 |

| NSM | Northstaw | 0.04 | -17% | 4,000 | $6,714,038 |

ICYMI – PM Edition

First Lithium (ASX:FL1) has intersected more high-grade lithium at the Eastern Pegmatite at its Blakala prospect in Mali, with intercepts such as 19m @ 1.85% Li2O from 41m (hole BDFS22) and 17.8m @ 1.39% Li2O from 20m (hole BDFS20).

Wisr (ASX:WZR) intends to recommence loan volume growth in H2FY2, after announcing an 11% on pcp revenue increase to $48.1 million, and an EBITDA of of $0.2 million, a vast improvement on pcp F1HY23 when it banked a $0.9 million drop.

TRADING HALTS

NickelX (ASX:NKL) – pending an update to the market in respect of the option agreement the Company previously announced regarding an update and supplementary announcement to NKL’s announcement lodged earlier today.

Enova Mining (ASX:ENV) – pending an announcement by Enova Mining in relation to the potential acquisition of a mineral project.

ECS Botanics (ASX:ECS) ) – halt called to allow for considering, planning and executing a capital raising.

Stellar Resources (ASX:SRZ) – pending an announcement regarding a capital raise.

Orthocell (ASX:OCC) – pending an announcement by the Company in relation to a proposed strategic placement.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.