Closing Bell: ASX upbeat as China considers going back on the stronger meds

Happy now. Via Getty

- ASX200 rises about 0.5pc, not bad for a Wednesday

- Gains broad based, with Materials and Healthcare top performers

- Small cap winners led by Sunshine Metals and Yowie Group

The Australian sharemarket lifted at the open tracking the gains of Wall Street, which drifted higher through a quiet session as the bond market calmed down following some sharp swings.

Local equity markets lifted from the get go this morning following a quiet but positive session in New York, however attention has quickly turned closer to home as reports out of China have turned the spotlight back on the rollout of emergency economic stimulus measures.

At 4pm on February 7, the S&P/ASX200 was up 35 points or 0.47% to 7,618.1

Yes. You’d have to say it’s getting hot in here… not quite enough to take off all your clothes yet, but anticipation is definitely mounting that Beijing is ready to roll out some blunter measures to get the China show back on the road.

Chinese stocks have had a few straight sessions of gains – it’s not a rebound by any stretch – but the stimmy rumour mill is turning at velocity.

Bloomberg reports suggest that there could be movement at the station from regulators, with Chinese President Xi Jinping inviting them for a chat and hopefully a fix. They certainly can’t let the colt from Old Regret do a runner now. Now when the CSI 300 benchmark closed 3.5% higher – its best day since 2022.

The CSI 1000 small cap index jumped 7%, that’s the most since 2008.

Bloomberg reports that Chinese President Xi Jinping will be chatting with market regulators, and once Xi gets involved things usually comes to a sudden conclusion.

Citi analysts are certainly buying the prospect of stronger Chinese infrastructure stimulus. This morning they forecast iron ore prices could clock US$150 a tonne over the next 3 months, although the market is likely to move into a surplus later in the year.

Utilities stocks are moving higher in afternoon trade after the Mining (materials) sector surged over 1.5% before lunchtime

The iron ore big boppers, Messrs BHP (ASX:BHP), Fortescue (ASX:FMG) (up 1.7%) and Rio Tinto (ASX:RIO) kicked higher in the morning, while the goldies followed the overnight gold spot price, which lifted about 0.6%.

Among the Healthcare names, Neurotech (ASX:NTI) surged after reporting positive progress for the company’s world-first Phase 1/2 clinical trial for its proprietary broad spectrum cannabinoid drug therapy.

Consumer Discretionary stocks have copped it. While energy stocks join them among the laggards, although the oil and gas heavyweights Woodside and Santos are both more than 1% higher after shelving a mega LNG merger.

Elsewhere, Financials are higher, but National Australia Bank (ASX:NAB) shares are lower and lots of people are down generally after revealing MD and CEO Ross McEwan plans to call it a day in April. He’ll be replaced by Andrew Irvine, NAB’s top private banker.

And it’s been a happy session for Cettire (ASX:CTT) which has reported a 60% jump in HY profit, driven by a 90% surge in sales revenue to over $354mn. The stock was up about 24% last I looked.

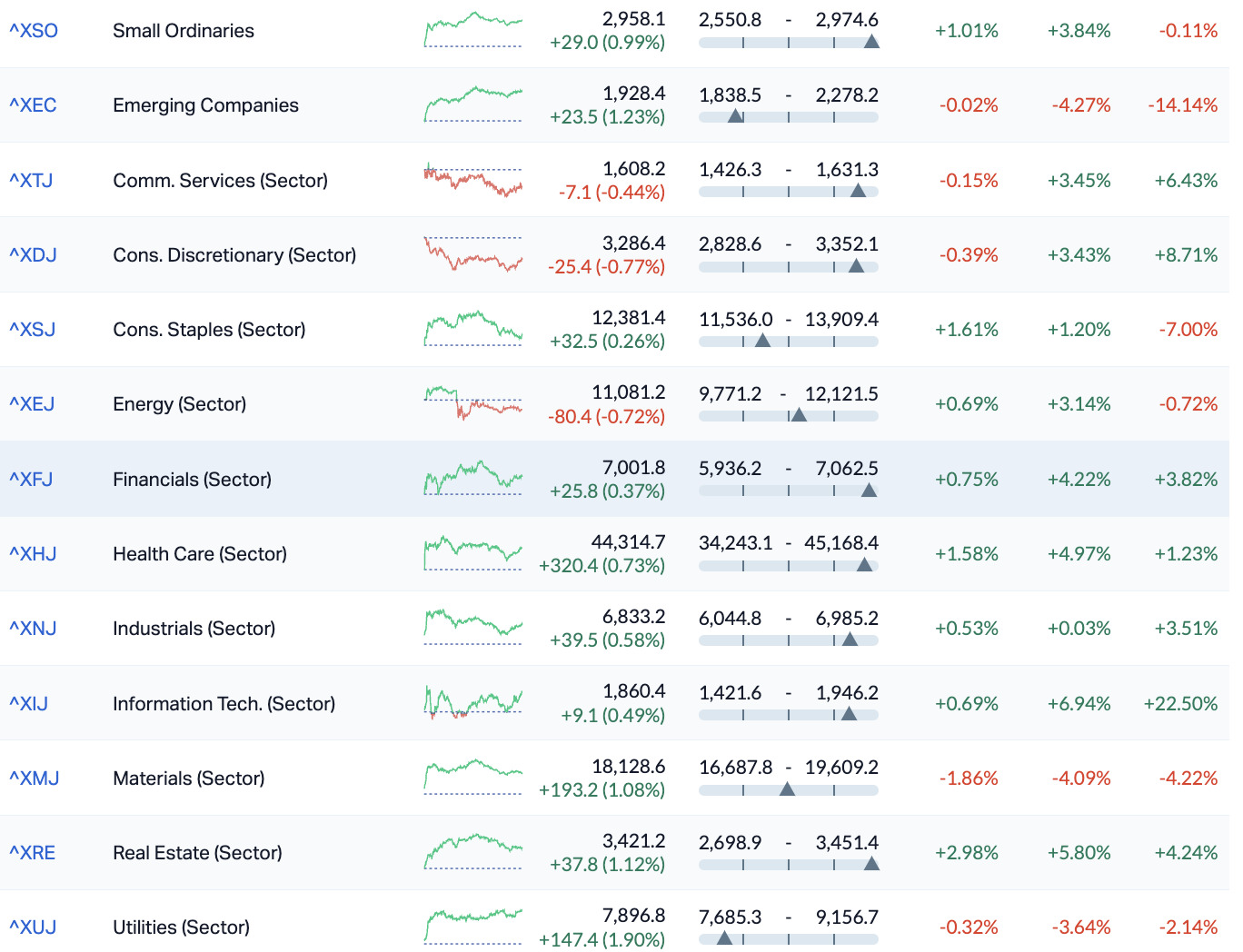

ASX Sectors on Wednesday

![]()

We’re watching professor Alan Fels…

Former Australian Competition and Consumer Commission (ACCC) dynamo, Professor Allan Fels has whipped up a quick fix for Aussie price gouging after dropping a report which says poor competition invites exploitation and fuels inflation.

Fels wants to create a national competition and prices commission, able to review the market and examine reasons for high prices independently of the competition watchdog, the Australian Competition and Consumer Commission

His suggestions published in the Inquiry into price gouging and unfair pricing practices final report, ACTU are both regulatory…

- Strengthen our competition law and policy to stop more potentially anti-competitive mergers

- Reverse the onus of proof in merger cases

- Allow for big businesses in breach of competition laws to be broken up

…As well as by sector, with the decisions likely to impact ASX companies.

Supermarkets

- Conduct an in-depth review of supermarkets

- Make the grocery code of conduct ‘mandatory and legally enforceable’ by the competition regulator

Education, childhood care and aged care

- Allow the regulator to investigate pricing decisions made by for-profit providers to ensure they are not involved in gaming

- Continuous prices reviews in disability care, disability support and aged care

Airlines

- Regulate airport prices in the same way other utility prices are regulated

- Removing international and domestic restrictions on competition

- Review any remaining restrictions

Meanwhile, in the States…

Overnight in New York, Wall Street’s major indices inched higher, as traders sifted the ashes of several critical blue chip quarterlies. Basically, the street tried to stay busy ahead of further Fedspeak clue-dropping on the timing of US interest rate cuts.

The S&P500 added 0.2%, the Nasdaq ended slightly higher, while the Dow Jones gained 140 points.

The The S&P500 healthcare sector was up 0.6% scaling a new record high, while the Technology sector took on the most water.

Leading the healthcare charge early was Eli Lilly which initially jumped almost 4% after lifting 2024 profit estimates, driven by demand for its blockbuster weight-loss drug (Zepbound) and diabetes treatment Mounjaro.

While Eli ended slightly lower, GE HealthCare Tech surged 8% after the medtech posted better than expected Q4 revenue. Outperforming was Palantir Technologies up more than 30% after floating stronger-than-expected FY profit guidance

At the midpoint of US reports, LSEG data reckons some 80.5% have beaten expectations.

US Futures are pretty damn flat right now in Sydney (at 3.30pm on Wednesday).

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| GTI | Gratifii | 0.009 | 50% | 1,303,658 | $8,215,336 |

| PUA | Peak Minerals Ltd | 0.003 | 50% | 90,085 | $2,082,753 |

| CC9 | Chariot Corporation | 0.355 | 39% | 566,915 | $20,855,521 |

| HT8 | Harris Technology Gl | 0.018 | 38% | 1,011,479 | $3,888,761 |

| PVL | Powerhouse Ven Ltd | 0.044 | 38% | 3,836 | $3,863,782 |

| DCX | Discovex Res Ltd | 0.002 | 33% | 447,530 | $4,953,852 |

| MRD | Mount Ridley Mines | 0.002 | 33% | 158,227 | $11,677,324 |

| TD1 | Tali Digital Limited | 0.002 | 33% | 2,638,000 | $4,942,733 |

| YPB | YPB Group Ltd | 0.002 | 33% | 6,907,313 | $1,185,692 |

| ADY | Admiralty Resources | 0.009 | 29% | 75,360 | $9,125,054 |

| CL8 | Carly Holdings Ltd | 0.018 | 29% | 50,000 | $3,757,185 |

| NKL | Nickelxltd | 0.05 | 28% | 246,072 | $3,424,792 |

| HTG | Harvest Tech Group | 0.029 | 26% | 724,137 | $16,237,157 |

| CTT | Cettire | 3.99 | 26% | 12,257,129 | $1,208,525,157 |

| ASV | Assetvisonco | 0.01 | 25% | 1,923,580 | $5,806,693 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,339,119 | $12,000,000 |

| DOU | Douugh Limited | 0.005 | 25% | 100,000 | $4,328,276 |

| TMX | Terrain Minerals | 0.005 | 25% | 200,000 | $5,726,683 |

| KGD | Kula Gold Limited | 0.008 | 23% | 10,839,776 | $2,750,877 |

| ROC | Rocketboots | 0.11 | 22% | 147,031 | $2,928,465 |

| HMY | Harmoney Corp Ltd | 0.64 | 22% | 175,307 | $53,531,177 |

| FAU | First Au Ltd | 0.003 | 20% | 330,016 | $4,154,983 |

| LML | Lincoln Minerals | 0.006 | 20% | 2,377,335 | $8,520,226 |

| SHN | Sunshine Metals Ltd | 0.012 | 20% | 19,340,244 | $12,240,084 |

| SIT | Site Group Int Ltd | 0.003 | 20% | 750,000 | $6,506,226 |

Sunshine Metals (ASX:SHN) surged a lazy 40% this morning and has enjoyed the arvo too after rpeorting a significant upgrade to the company’s Liontown resource (not to be confused with Liontown Resources (ASX:LTR), which is a whole different company).

Sunshine’s Liontown resource (again, not the company) has increased 21% to 2.94mt @ 10.6% ZnEq, which includes a 116% increase in Indicated Resources to 1.85mt @ 10.9% ZnEq, now 63% of the total resource.

For what it’s worth, Liontown Resources (the company, not the resource) is also moving sharply today – up nearly 10% last time I checked, without any announcement… so I am growing concerned that there might be investors throwing money at the wrong thing in their rush to get behind Sunshine’s fabulous news.

Direct-to-consumer unsecured personal loan specialists Harmoney Corp (ASX:HMY) posted a solid gain for the morning as well, up 28.6% despite not having much to say to the market for about a week.

Yowie Group (ASX:YOW) is up again as well, after the apparently-stalled takeover bid by Keybridge Capital (ASX:KBC) was thrown a lifeline by regulators late on Tuesday.

“Keybridge has sought, and received, consent from the Australian Securities and Investments Commission (ASIC) … to enable unaccepted offers under its takeover bid for Yowie,” according to an announcement that arrived after hours on Tuesday.

There was, apparently, a SNAFU at Keybridge during the Christmas break, and I suspect someone forgot to put something in the mail – meaning Keybridge “did not dispatch the Bidder’s Statement within the 28-day time period prescribed by item 6 of subsection 633(1)”.

But, ASIC has seen fit to allow things to continue like nothing happened, and Keybridge is set to deliver a new bidder’s statement shortly as the takeover bidding continues.

Harris Technology (ASX:HT8) moved quickly in the afternoon, rising 38.5% to take the company’s gains to 50% for the week, and more than 68% for the month, after the company announced Q2 FY24 Sales of $4.9 million that led to positive operating cash flow of $235,000 for the quarter, which was reported to the market in late January.

NickelX (ASX:NKL) was likewise moving apparently on old news, up 28% after the company kicked off an RC program over at its Dalwallinu project in WA’s West Yilgarn a few days ago, testing for nickel, copper and PGE some 208km northeast of Perth.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | MARKET CAP |

|---|---|---|---|---|---|

| TTA | TTA Holdings Ltd | 0.003 | -73% | 1,642 | $1,511,658 |

| EE1 | Earths Energy Ltd | 0.015 | -63% | 31,756,157 | $21,728,533 |

| JAV | Javelin Minerals Ltd | 0.001 | -50% | 101,087 | $3,267,458 |

| SLB | Stelar Metals | 0.082 | -43% | 7,231,277 | $7,599,149 |

| T3D | 333D Limited | 0.011 | -35% | 4,325 | $2,030,564 |

| BOC | Bougainville Copper | 0.44 | -26% | 286,259 | $238,632,188 |

| BP8 | BPH Global Ltd | 0.0015 | -25% | 947,368 | $3,671,126 |

| MOH | Moho Resources | 0.006 | -25% | 2,615,400 | $4,287,529 |

| NRZ | Neurizer Ltd | 0.006 | -25% | 13,522,087 | $11,273,566 |

| CHK | Cohiba Min Ltd | 0.002 | -20% | 995,000 | $6,325,575 |

| CTN | Catalina Resources | 0.004 | -20% | 202,477 | $6,192,434 |

| RDS | Redstone Resources | 0.004 | -20% | 2,105,000 | $4,626,892 |

| MKG | Mako Gold | 0.025 | -19% | 20,696,864 | $20,534,692 |

| NFL | Norfolk Metals | 0.15 | -19% | 1,497,260 | $6,535,124 |

| MRZ | Mont Royal Resources | 0.09 | -18% | 75,101 | $9,353,277 |

| ART | Airtasker Limited | 0.22 | -17% | 1,036,949 | $119,819,626 |

| AHN | Athena Resources | 0.0025 | -17% | 19,000 | $3,211,403 |

| CCO | The Calmer Co Int | 0.005 | -17% | 8,215,234 | $5,144,971 |

| CCZ | Castillo Copper Ltd | 0.005 | -17% | 1,131,607 | $7,797,032 |

| NVQ | Noviqtech Limited | 0.0025 | -17% | 25,000 | $3,928,336 |

| OAR | OAR Resources Ltd | 0.0025 | -17% | 1,291,888 | $7,931,183 |

| RR1 | Reach Resources Ltd | 0.0025 | -17% | 4,747,675 | $9,630,891 |

| TMK | TMK Energy Limited | 0.005 | -17% | 784,112 | $36,735,476 |

| EEL | Enrg Elements Ltd | 0.011 | -15% | 2,150,000 | $13,129,545 |

| RRR | Revolver Resources | 0.073 | -15% | 379,858 | $22,327,687 |

In Case You Missed It – PM Edition

Assays from the first phase of drilling have produced consistent rare earth element (REE) and heavy mineral intersections from Ark Mines’ (ASX:AHK) Sandy Mitchell project, about 300km west of Cairns in Northern Queensland, building further confidence around its commercial development potential.

Melodiol Global Health Limited (ASX:ME1) says its operating division Health House International (HHI) posted $1 million in unaudited revenue during January 2024, while its Canadian subsidiary Mernova Medicinal delivered $1,003,405 in revenue to date during Q1 FY24, laying the foundation for stronger growth among the group.

Strategic Energy Resources’ (ASX:SER) joint exploration efforts with Fortescue subsidiary FMG Resources has delivered early success, with intense IOCG-type alteration intersected at the Canobie project in northern Queensland.

Indiana Resources (ASX:IDA) says that it’s closer to being compensated for the unlawful expropriation of its Ntaka Hill nickel sulphide project more than five years ago after the International Centre for Settlement of Investment Disputes struck out most of Tanzania’s grounds for annulling the award.

Battery metals explorer Summit Minerals (ASX:SUM) has a new managing director, with CEO Gower He – a highly experienced corporate leader and energy-transition specialist – elevated to the role just months after joining the company in October 2023

Adavale Resources (ASX:ADD) is pressing ahead with uranium exploration, submitting a Notice of Entry to both native title holders and pastoral station owners of its intention to carry out ground surveys at the Mundowdna (EL6821) and Mundowdna South (EL6957) tenements in South Australia.

Sunshine Metals (ASX:SHN) has announced that its Liontown has increased 21% to 2.94mt @ 10.6% ZnEq, which includes a 116% increase in Indicated Resources to 1.85mt @ 10.9% ZnEq, now 63% of the total resource.

Burley Minerals (ASX:BUR) has uncovered additional spodumene-bearing pegmatite dykes at its Chubb lithium project, 25km north of the mining community of Val d’Or in the heart of the world-class lithium province of Québec.

TRADING HALTS

Rhythm Biosciences (ASX:RHY) – pending an announcement to the market regarding a proposed capital raising.

BMG Resources (ASX:BMG) – pending an announcement of a material agreement regarding a potential project acquisition.

BPH Energy (ASX:BPH) – pending a material announcement to be made for the purpose of considering, planning and executing a capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.