Closing Bell: ASX up on broad rally; but City Chic tumbles heavily after trading update

City Chic tumbles after downbeat update. Picture via Getty Images

- ASX rises on rally across the board

- Israel and Hezbollah agree to 60-day ceasefire

- City Chic tumbles after downbeat update

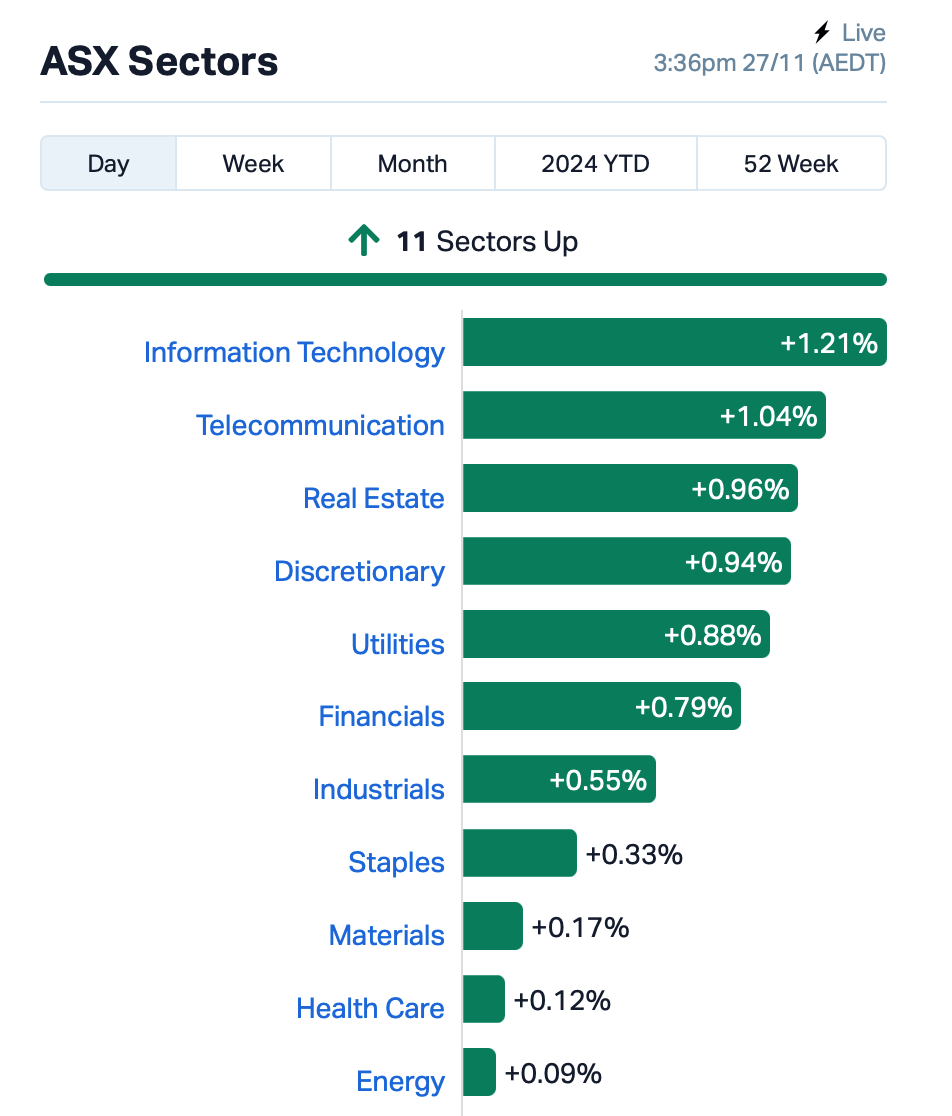

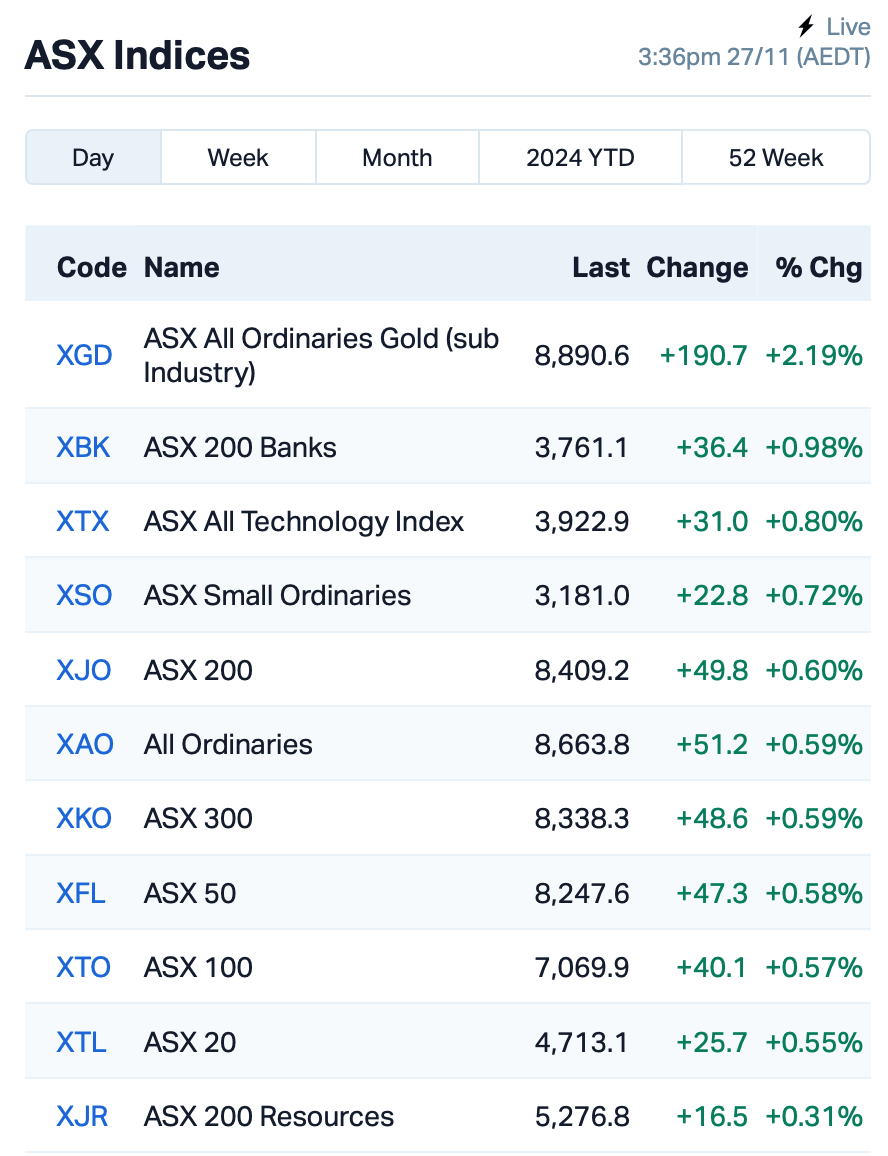

The Aussie share market enjoyed a solid ride on Wednesday, driven by a broad rally as optimism from Wall Street’s record highs filtered through.

At the close of day, the benchmark S&P/ASX 200 Index climbed 0.57%.

Stocks pretty much rose across the globe as Israel and Hezbollah agreed to a 60-day ceasefire after US-mediated talks, marking a first step toward ending their conflict.

But Israel’s PM, Benjamin Netanyahu fired a warning,“The length of the ceasefire will depend on what happens in Lebanon.”

Elsewhere, Bitcoin’s climb towards US$100,000 hit a hurdle as the coin is now hovering around the $92,500 level after traders took profits.

And this is what was happening on the ASX at around 15:30 AEST:

Consumer stocks were led by Webjet (ASX:WEB) after the company posted a half-year profit of $52.5 million,.

However, minnow consumer stock, City Chic Collective (ASX:CCX), fell heavily by 26%.

The company released a downbeat trading update at its AGM, with CEO Phil Ryan admitting that the fashion retailer has been operating at the “lower end” of its earnings and revenue guidance for FY25.

Elsewhere, rare earths miner Lynas (ASX:LYC) rose 1.5% despite giving warning at its AGM that any easing in market volatility for rare earth prices would depend on the health of the Chinese economy.

To economics, ABS data released this morning showed that Aussie inflation remained steady at 2.1% in October, below the forecasted 2.3%, keeping it within the Reserve Bank’s target range.

Across the ditch, the Reserve Bank of New Zealand cut its cash rate by 0.5%, as expected.

And in Asia, stocks fluctuated as markets reacted to President-elect Trump’s new economic team and his tariff plans.

Trump’s cabinet appointments, including Jamieson Greer as US Trade Representative, signalled a tough stance on trade, which is weighing on Asian markets.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WML | Woomera Mining Ltd | 0.002 | 100% | 1,750,579 | $2,166,590 |

| 88E | 88 Energy Ltd | 0.002 | 50% | 1,172,871 | $28,933,812 |

| AVE | Avecho Biotech Ltd | 0.003 | 50% | 16,836,688 | $6,338,594 |

| MTL | Mantle Minerals Ltd | 0.002 | 50% | 1,664,695 | $6,197,446 |

| SOM | SomnoMed Limited | 0.390 | 44% | 101,616 | $58,349,228 |

| NAG | Nagambie Resources | 0.024 | 41% | 11,263,627 | $13,542,807 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 1,100,180 | $9,235,583 |

| GMN | Gold Mountain Ltd | 0.002 | 33% | 2,444,454 | $5,861,210 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 5,267,407 | $3,530,989 |

| ILA | Island Pharma | 0.215 | 30% | 2,817,890 | $25,726,917 |

| HTG | Harvest Tech Grp Ltd | 0.029 | 26% | 1,997,545 | $20,009,162 |

| AKN | Auking Mining Ltd | 0.005 | 25% | 9,444,807 | $1,565,401 |

| BP8 | Bph Global Ltd | 0.005 | 25% | 2,012,500 | $1,586,566 |

| PAB | Patrys Limited | 0.005 | 25% | 251,963 | $8,229,789 |

| TMK | TMK Energy Limited | 0.003 | 25% | 800,000 | $18,651,130 |

| G50 | G50Corp Ltd | 0.180 | 24% | 751,263 | $17,873,327 |

| BIT | Biotron Limited | 0.022 | 22% | 2,978,255 | $16,242,890 |

| BXN | Bioxyne Ltd | 0.017 | 21% | 9,817,115 | $28,689,202 |

| EXT | Excite Technology | 0.012 | 20% | 586,303 | $16,862,792 |

| MEM | Memphasys Ltd | 0.006 | 20% | 1,000,000 | $8,815,407 |

| FSG | Field Solu Hldgs Ltd | 0.025 | 19% | 463,772 | $16,242,336 |

| DOU | Douugh Limited | 0.010 | 19% | 1,675,958 | $8,656,551 |

| WMG | Western Mines | 0.195 | 18% | 77,197 | $14,049,928 |

| TSO | Tesoro Gold Ltd | 0.026 | 18% | 432,307 | $34,175,109 |

Nagambie Resources (ASX:NAG) has entered a two-month trial to store Potential Acid Sulfate Soil (PASS) material from the North East Link Project in the West Pit at its Nagambie Mine. The trial, managed by EPH Environmental and involving the earthmoving contractor VicCivil, will see PASS delivered by EPH trucks and stored under water as part of the mine’s rehabilitation. The arrangement is expected to be cashflow positive for Nagambie, and it hopes this trial could lead to a long-term contract with EPH, generating significant revenue.

Read more on this here > Resources Top 5: Trash is treasure for Nagambie as waste storage trial sets goldie up for cashflow

Somnomed (ASX:SOM) has upgraded its FY25 guidance following a strong start to the year, with Q1 revenue of $25.3 million, up 18.2% year-on-year. The company now expects FY25 revenue of around $105 million and EBITDA of over $7 million. Also, the company has appointed Ye-Fei Guo as its new chief financial officer, effective from November 27. Guo, who joined SomnoMed in August as finance director, brings over 20 years of finance experience.

Island Pharmaceuticals (ASX:ILA) has announced positive results from its phase 2a trial of ISLA-101, an antiviral treatment for dengue. The trial showed that ISLA-101 reduced viral load in treated subjects, demonstrating its anti-dengue activity. The Safety Review Committee (SRC) found no safety concerns and recommended moving forward with the next phase 2b cohort of the trial, which is planned to start in January 2025. The trial was fully funded through a recent $3.5 million placement, and Island is now preparing to submit the SRC’s findings to the US FDA.

Hartshead Resources (ASX:HHR) has provided an update on its Anning and Somerville gas fields development following the UK government’s budget announcement on October 30, which clarified fiscal terms for the project. The company is considering an updated gas export route, and will meet with the UK’s North Sea Transition Authority (NSTA) in December to review the project’s progress. Hartshead is also assessing exploration opportunities within its licence area, which could add significant value to the development.

Auking Mining (ASX:AKN) has secured $1.385 million in funding through a shortfall placement following its recent rights issue. The funding will support ongoing exploration and an earn-in agreement for a 15% interest in a gold project near Cloncurry, Queensland. The company has partnered with Orion Resources to explore and develop this gold project.

TMK Energy (ASX:TMK) has successfully completed three new pilot production wells (LF-04, LF-05, and LF-06) at its Gurvantes XXXV coal seam gas project, on time and within budget. The installation of a distributed temperature sensing system has been completed and is ready for data collection from the new wells.

Orthocell (ASX:OCC) has appointed Device Technologies Asia (DT Asia) as the exclusive distributor of its Remplir nerve repair device in Singapore. This expands the successful partnership, which has seen strong sales of Remplir in Australia and New Zealand. Orthocell believes DT Asia is well-positioned to replicate this success in Singapore, with an experienced sales team and strong relationships with key surgeons. The launch is set for Q1 2025, following recent regulatory approval from Singapore’s Health Sciences Authority.

Jervois Mining (ASX:JRV) has secured an additional US$24.5 million under its working capital loan facility, increasing the total loan limit to US$32 million. So far, US$7.5 million has been drawn. The extra funds will be used for Jervois’ budget needs, including restructuring costs, with US$8 million available to be drawn by mid-December 2024, and another US$16.5 million available later. Jervois’ current cash balance is US$9.8 million and drawn senior debt is US$151.6 million.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.001 | -50% | 105,000 | $1,406,723 |

| CDE | Codeifai Limited | 0.001 | -33% | 76,142,750 | $4,381,942 |

| VML | Vital Metals Limited | 0.002 | -33% | 862,243 | $17,685,201 |

| BDG | Black Dragon Gold | 0.037 | -26% | 2,811,462 | $15,094,136 |

| CCX | City Chic Collective | 0.100 | -26% | 13,670,061 | $51,996,302 |

| AOK | Australian Oil. | 0.003 | -25% | 2,201,400 | $4,007,132 |

| IBG | Ironbark Zinc Ltd | 0.003 | -25% | 1,017,895 | $7,334,591 |

| LNU | Linius Tech Limited | 0.002 | -25% | 240,000 | $12,302,431 |

| LPD | Lepidico Ltd | 0.002 | -25% | 890 | $17,178,371 |

| BEL | Bentley Capital Ltd | 0.010 | -23% | 3,904 | $989,663 |

| NVX | Novonix Limited | 0.770 | -20% | 13,396,772 | $476,482,566 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 834,240 | $15,000,000 |

| TAS | Tasman Resources Ltd | 0.004 | -20% | 500,000 | $4,026,248 |

| BET | Betmakers Tech Group | 0.110 | -19% | 3,194,068 | $130,965,443 |

| G11 | G11 Resources Ltd | 0.015 | -17% | 1,961,520 | $17,399,198 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 943,367 | $9,399,133 |

| ERA | Energy Resources | 0.003 | -17% | 31,736,524 | $1,216,188,722 |

| ERW | Errawarra Resources | 0.066 | -15% | 98,504 | $7,481,812 |

| NOR | Norwood Systems Ltd. | 0.028 | -15% | 215,795 | $15,724,066 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 194 | $7,882,396 |

| CR9 | Corellares | 0.006 | -14% | 45,646 | $3,255,647 |

| GTR | Gti Energy Ltd | 0.003 | -14% | 45,285 | $10,370,324 |

| ICG | Inca Minerals Ltd | 0.006 | -14% | 1,013,766 | $7,187,058 |

| JAV | Javelin Minerals Ltd | 0.003 | -14% | 333,334 | $18,162,887 |

IN CASE YOU MISSED IT

Sunshine Metals (ASX:SHN) is moving towards a resource update before Christmas at its Ravenswood Consolidated project in Queensland, following the receipt of further positive assays at the Gap Zone prospect.

A diamond drill rig has arrived on site at Cannindah Resources’ (ASX:CAE) namesake project in Queensland, with drilling to commence imminently, aiming to grow the known resource area and look into an undrilled IP anomaly some 800m away.

Javelin Minerals (ASX:JAV) has launched into a maiden drilling program at its brownfields Coogee gold-copper project in Kalgoorlie, aiming to extend mineralisation at depth and along strike. A Phase 2 program is expected to follow in late January.

Argent Minerals’ (ASX:ARD) latest drilling has uncovered new volcanogenic massive sulphide mineralisation at Sugarloaf Hill, including 44m grading 0.31% copper+lead+zinc from just 1m and 56m at 0.22% copper+lead+zinc from 24m, instilling confidence in the upside potential of its Kempfield project in NSW.

High-grade lithium has been discovered and confirmed at three locations along a 3km pegmatite corridor within Perpetual Resources’ (ASX:PEC) Isabella project in Brazil’s Lithium Valley.

Final assays from maiden exploration returned up to 5.4% Li20, with 28 samples pending and further reconnaissance activities being planned in preparation for maiden drilling.

Vertex Minerals (ASX:VTX) is ahead of schedule in installing the gravity gold processing plant at its mine-ready project in New South Wales. It’s time made up from the weather restricting prior civil construction, with the company now hopeful it’ll be able to power the plant up for testing in just a few weeks’ time. And after that – Vertex will move on to commissioning the plant with the gold ore stockpiles it has sitting at the plant.

Chariot Corporation (ASX:CC9) has kicked off Phase 2 drilling at its Black Mountain lithium project in Wyoming, USA. The drilling effort is targeting high-grade lithium zones, with 18 RC holes planned for ~1,000m. Drilling will aim to define a resource that could underpin a pilot mine to supply lithium to the rapidly-growing US market.

Prodigy Gold (ASX:PRX) has reported high-grade gold results exceeding 8.5g/t from its Tanami North project in the Northern Territory. The results came from Photon Assay analysis of 30 RC samples, a method known for its speed, accuracy, and environmental benefits, though subject to sampling bias. The company cross-checked these with fire assays results, bolstering confidence in the project’s future development potential.

Killi Resources’ (ASX:KLI) JV partner Gold Fields has commenced a 1600km2 airborne gravity survey at the West Tanami project in WA’s Kimberley. It marks the first step in Gold Fields’ agreement to earn up to an 85% interest by investing $13 million in exploration over two stages.

Anson Resources (ASX:ASN) has enjoyed success in testing its chemical-free pretreatment process to reduce iron content in brine ahead of being fed into the Koch DLE process.So far, the testwork has yielded 122,000 litres of lithium eluate after pretreatment. The approach looks to lower production costs and improve environmental outcomes, with testing continuing until February 2025.

At Stockhead, we tell it like it is. While Sunshine Metals, Cannindah Resources, Javelin Minerals, Argent Minerals, Perpetual Resources, Vertex Minerals, Chariot Corporation, Prodigy Gold, Killi Resources and Anson Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.