Closing Bell: ASX up as Myer-Premier deal excites market; ‘Trump trade’ Bitcoin above US$71k

Retail house Premier Investments surge after potential Myer deal. Picture via Getty Images

- ASX rises following Wall Street’s lead

- Cettire drops 12pc after disappointing earnings update

- Retail house Premier Investments surge after potential Myer deal

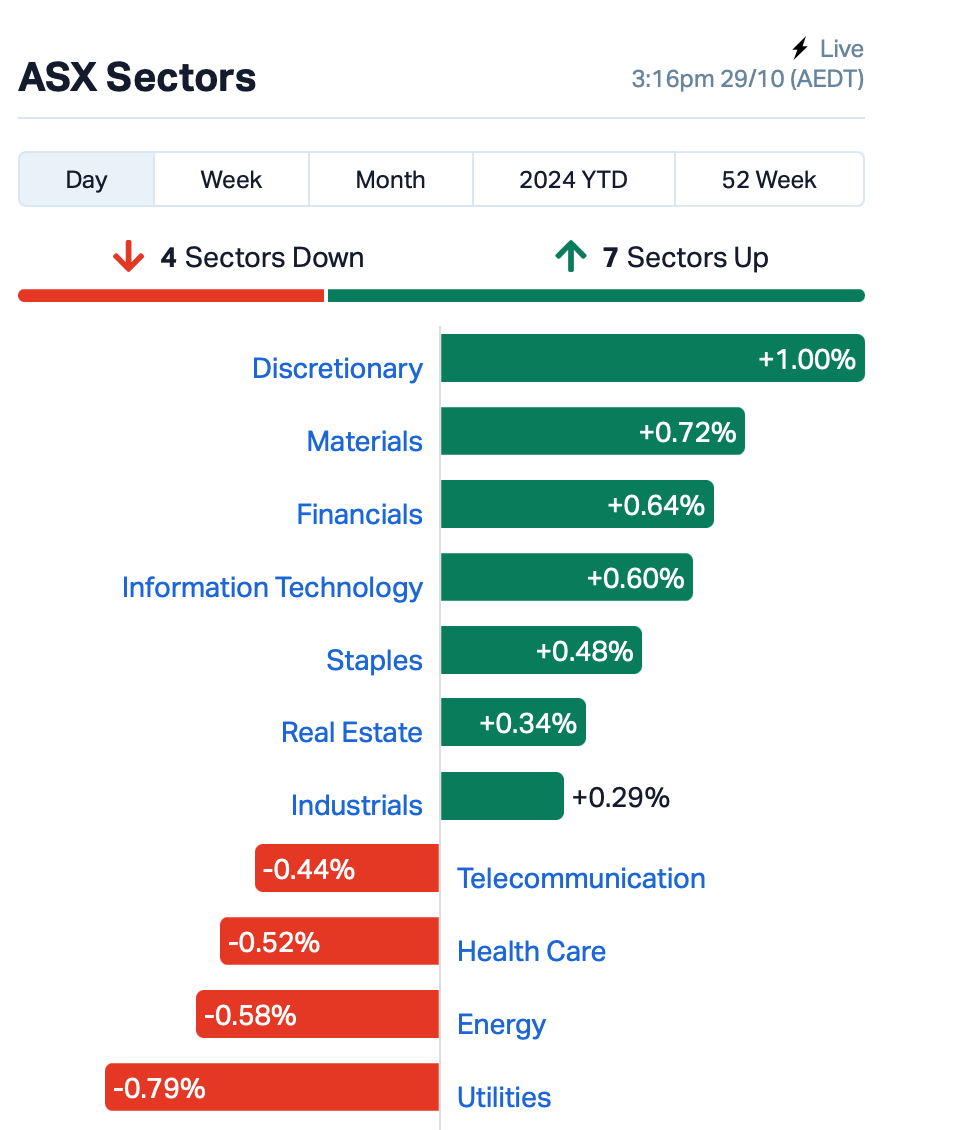

The ASX rose by 0.34% on Tuesday following Wall Street’s lead.

Consumer discretionary stocks led after Myer announced it was snagging Premier Investments’ apparel brands, which include Just Jeans, Jay Jays, Dotti, Portmans and Jacqui E.

PMV’s shares rose over 10%, while Myer was down 1%.

Energy stocks lagged after oil prices took a 5% hit overnight.

Oil prices tumbled as Wall Street traders returned from the weekend feeling relieved that Israel’s retaliatory strikes on Iran were confined to military and not oil targets.

Online fashion retailer, Cettire (ASX:CTT), had a rough day, dropping 12% after a disappointing first-quarter update. While sales revenue rose 22% to $155 million, earnings took a hit, with adjusted EBITDA plummeting 77% to $2 million due to ongoing promotional activities.

Steelmaker Bluescope Steel (ASX:BSL) also dropped 0.5% after the company said it was going to miss its first-half FY25 earnings guidance. The new EBIT forecast is $270 million to $310 million, down from the previous range of $350 million to $420 million, citing tough operating conditions.

Still in the large caps space, Coronado Global Resources’ (ASX:CRN) shares dropped 5% after the company reported a 15% decline in ROM (run of mine) production and a 3% drop in sales volumes for Q3. Following this, the company downgraded its full-year production outlook and raised its cost guidance.

And, blood products and vaccines giant CSL (ASX:CSL) has reaffirmed current-year earnings expectations as it enters a period of reduced capital expenditure.

CSL’s CEO Paul McKenzie told the gathered throng at CSL’s AGM this morning that management was still good for current year net profit of $3.2 billion to $3.3 billion, 10-13% better than last year. Revenue is expected to grow 5-7% on last year’s $14.8 billion. CSL’s shares traded flat today.

Meanwhile, Bitcoin has made a splash, breaking past $US71,000 a little earlier. This is the first time Bitcoin has traded above US$70k since June, on the back of excitement around the upcoming US election. Other top coins, including Ethereum, also saw a a lift.

With Trump’s campaigning embracing digital assets, Bitcoin is becoming known as a “Trump trade,” especially with him leading in the polls against Kamala Harris.

Across the region today, Asian stocks mostly rose as traders get ready for some key economic updates in the US tonight that could influence the Fed Reserve’s decisions.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTL | Mantle Minerals Ltd | 0.002 | 100% | 2,882,434 | $6,197,446 |

| LIS | Lisenergylimited | 0.285 | 54% | 9,212,453 | $118,437,043 |

| BP8 | Bph Global Ltd | 0.003 | 50% | 347,666 | $793,283 |

| CLE | Cyclone Metals | 0.002 | 50% | 2,125,000 | $12,738,964 |

| ERA | Energy Resources | 0.003 | 50% | 8,892,237 | $44,296,598 |

| PPK | PPK Group Limited | 0.645 | 37% | 850,988 | $42,681,874 |

| MHC | Manhattan Corp Ltd | 0.002 | 33% | 1,888,785 | $6,746,955 |

| PAB | Patrys Limited | 0.004 | 33% | 1,000,000 | $6,172,342 |

| SKN | Skin Elements Ltd | 0.004 | 33% | 359,748 | $1,768,458 |

| DOU | Douugh Limited | 0.009 | 29% | 299,429 | $7,574,482 |

| SCN | Scorpion Minerals | 0.015 | 25% | 10,002 | $4,913,474 |

| EWC | Energy World Corpor. | 0.025 | 25% | 1,474,598 | $61,578,425 |

| OLL | Openlearning | 0.016 | 23% | 1,050,835 | $5,499,894 |

| SKO | Serko | 3.000 | 22% | 15,113 | $301,405,178 |

| PCK | Painchek Ltd | 0.034 | 21% | 3,425,776 | $45,843,312 |

| PUA | Peak Minerals Ltd | 0.006 | 20% | 1,996,674 | $12,485,551 |

| EEL | Enrg Elements Ltd | 0.002 | 20% | 2,052,977 | $1,741,833 |

| MPR | Mpower Group Limited | 0.013 | 18% | 60,848 | $3,780,736 |

| ARD | Argent Minerals | 0.035 | 17% | 13,165,400 | $43,317,770 |

| ALR | Altairminerals | 0.004 | 17% | 200,197 | $12,889,733 |

| JAV | Javelin Minerals Ltd | 0.004 | 17% | 3,383,333 | $12,830,539 |

| MRQ | Mrg Metals Limited | 0.004 | 17% | 4,500,000 | $8,179,556 |

| ODE | Odessa Minerals Ltd | 0.007 | 17% | 20,643,942 | $7,609,695 |

Mantle Minerals (ASX:MTL) doubled after saying that RC drilling has been completed at Mount Berghaus and Roberts Hill, located near the 10.5 million-ounce HEMI deposit. The programme aimed to explore for ‘Hemi-Style’ intrusive systems beneath previous aircore gold findings. Eleven holes were drilled, totalling 1,854 metres, and results are expected in November. The drilling targeted areas where earlier aircore results showed over 0.5 grams per tonne of gold, suggesting potential for more gold in the underlying fresh basement rocks.

Energy World Corporation (ASX:EWC) is showing on the winner’s list today, but there’s no clear reason why. The company did respond to an ASX speeding ticket yesterday with a pro forma “we don’t know, either” – and it has announced that there’s an AGM coming up on November 28.

Tech company Serko (ASX:SKO) was up on news that it is set to acquire Sabre’s business travel management solution GetThere for $US12 million, a move that increases Serko’s North American presence to become the #2 online booking tool provider. The two companies will now work together to co-develop and co-invest to bring new capabilities to the industry, while the deal “incentivises Sabre co-selling Serko solutions with revenue share”, with up to US$12.75 million.

PainChek (ASX:PCK) has announced preliminary results from a recent US clinical validation study and statistical analysis – including positive performance results in a paired study with the Abbey Pain Scale, which the company says will help pave the way forward for FDA approval for its product.

Argosy Minerals (ASX:AGY) has defined a scheduled pathway to deliver the 12,000tpa Rincon project in Argentina, targeting a final investment decision (FID) during H2-2025. Feasibility and engineering works are currently progressing in conjunction with international engineering consulting services firms Lycopodium and Saxum to support an expedited development schedule towards completing the DFS and achieving an FID. This is scheduled to support commencing early site works, procuring long-lead items, completing front-end engineering design (FEED), and commencing construction works by the end of 2025.

Lanthanein Resources (ASX:LNR) was up today on the release of its September quarterly update, outlining stand-out bits and pieces of activities undertaken across the Lady Grey project, adjacent to the historical Bounty gold mine (now Mt Holland), which pumped out 1.3Moz.

The company received the all-clear to drill an exciting target at Lady Grey – a modelled conductor plate under MLEM Line #6, 200m below surface – which coincides with a 75ppb UFF soil gold anomaly plus high-order nickel and copper anomalies.

LNR has also recently completed a close spaced aeromagnetic survey on 25-metre line spacings using an Unmanned Airborne Vehicle (UAV). The area covered by the survey provides coverage of a gap between two open file aeromagnetic surveys and provides closer spaced coverage over the MLEM Line #1 modelled conductor plate.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RNE | Renu Energy Ltd | 0.001 | -50% | 1,336,010 | $1,777,157 |

| SER | Strategic Energy | 0.011 | -38% | 22,601,941 | $11,407,567 |

| BEL | Bentley Capital Ltd | 0.010 | -33% | 25,000 | $1,141,919 |

| GDA | Good Drinks Aus Ltd | 0.235 | -28% | 1,202,602 | $42,942,796 |

| SNG | Siren Gold | 0.085 | -26% | 5,823,310 | $23,824,998 |

| IEC | Intra Energy Corp | 0.002 | -25% | 1,000,000 | $3,381,563 |

| RBR | RBR Group Ltd | 0.002 | -25% | 25,000 | $3,268,809 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 1,720,026 | $13,151,701 |

| REC | Rechargemetals | 0.033 | -23% | 1,963,922 | $6,006,669 |

| WNX | Wellnex Life Ltd | 0.770 | -21% | 91,076 | $27,337,781 |

| AAU | Antilles Gold Ltd | 0.004 | -20% | 224,001 | $9,278,714 |

| AVE | Avecho Biotech Ltd | 0.002 | -20% | 737,342 | $7,923,243 |

| H2G | Greenhy2 Limited | 0.004 | -20% | 1,739,699 | $2,990,921 |

| PUR | Pursuit Minerals | 0.002 | -20% | 3,154,951 | $9,088,500 |

| TOU | Tlou Energy Ltd | 0.017 | -19% | 1,652,900 | $27,270,271 |

| WCN | White Cliff Min Ltd | 0.018 | -18% | 20,907,393 | $41,590,356 |

| NVA | Nova Minerals Ltd | 0.250 | -17% | 1,153,920 | $81,581,064 |

| PPY | Papyrus Australia | 0.015 | -17% | 195,000 | $8,868,467 |

| EPM | Eclipse Metals | 0.005 | -17% | 300,000 | $13,505,133 |

| MEL | Metgasco Ltd | 0.005 | -17% | 44,374 | $8,745,520 |

| RC1 | Redcastle Resources | 0.011 | -15% | 9,181,113 | $6,390,125 |

Black Cat Syndicate’s (ASX:BC8) shares fell 10% after completing an $80 million institutional placement at a discounted price of 52 cents per share. The placement, backed by existing and new investors, aims to boost its gold production.

IN CASE YOU MISSED IT

Brightstar Resources’ (ASX:BTR) infill drilling has returned high-grade hits including 1m at 80.4g/t gold that show consistent mineralisation within and below the planned pit shell at the Pericles deposit. This will underpin a resource update that will increase confidence in the coming definitive feasibility study mine plan.

Recharge Metals (ASX:REC) is acquiring the Carter project that covers most of the existing 3.7Mlbs Acadia and 1.4Mlbs Mindy deposits within a proven ISR uranium producing region in Montana. There is also considerable potential to grow resources as multiple additional roll fronts have been mapped within the project.

Strate Minerals (ASX:SMX) has identified four high priority drill targets at its recently acquired Penny South gold project in WA – one of which includes following up an intercept of 2m at 34g/t. Drilling is expected to start later this year or early next.

An airborne geophysical survey at White Cliff Minerals’ (ASX:WCN) Rae copper project in Canada has flagged three targets and boosted confidence in its potential to host district scale sediment-hosted copper.

EZZ Life Science Holdings (ASX:EZZ) has announced a $0.02 per share fully franked dividend to shareholders for the 12- month period ended 30 June 2024, with a payment date of 9 December 2024. The company is focused on R&D in gene technology to address four key human health challenges: genetic longevity, human papillomavirus (HPV), children’s health, and weight management. They also develop and distribute a range of health and wellness products worldwide, with a focus on Australia, New Zealand and China.

And Indiana Resources (ASX:IDA) has received the second instalment of US$25m of its US$90m settlement agreement with Tanzania for its unlawful expropriation of the Ntaka Hill nickel sulphide project. The final instalment of US$30 million is due to be paid on or before 30 March 2025. The board is currently planning for a dividend payment to shareholders in December 2024 with further details will be provided in due course.

Peregrine Gold (ASX:PGD) has announced a 1 for 4 non-renounceable entitlement issue to raise $2.5m at $0.15 per new share to fund exploration activities at its portfolio of Pilbara projects – including the Newman and Mallina gold projects – as well as for working capital. The share price represents a 15.25% discount to the 10-day VWAP on 28th October The 1 free attaching new option for every 1 new share applied for and issued, is exercisable at $0.25 on or before 16 December 2027.

TRADING HALTS

Basin Energy (ASX: BSN) – pending an announcement regarding a material project acquisition

Moab Minerals (ASX: MOM) – cap raise

Midas Minerals (ASX: MM1) – cap raise

Great Boulder Resources (ASX: GBR) – cap raise

Yandal Resources (ASX: YRL) – cap raise

Caprice Resources (ASX: CRS) – cap raise

Linius Technologies (ASX: LNU) – a partnership agreement

Shriro Holdings (ASX: SHM) – proposed buy-back

Matsa Resources (ASX: MAT) – update on the permitting of the Devon Pit Gold Mine

At Stockhead, we tell it like it is. While Brightstar Resources, EZZ Life Science Holdings, Indiana Resources, Peregrine Gold, Recharge Metals, Strate Minerals and White Cliff Minerals are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.