Closing Bell: ASX unconvincing ahead of big CPI read and maiden address by new RBA boss

Via Getty

- Benchmark ASX index closes ahead +0.19%

- Materials lead ASX sectors on Tuesday

- Small caps led by ERW, NMR

Local markets have struggled to hang onto early gains after a mixed run on Wall Street overnight.

The benchmark ASX200 (XJO) index has closed about 12 points or 0.19% higher at 4.15pm (AEDT).

We did get a glimpse again of the Aussie battler inside the ASX200 as local markets fired up in the AM, hitting lunchtime almost +0.4% higher.

However, a little worry-selling and a little pre-CPI/RBA-speak anxiety has reminded traders that life is short and scary and profits should be taken.

The benchmark had already fallen some 3.25% in the past three sessions as as US punters watched the 10-year US Treasury yield, which backtracked a little overnight, but remains at near 2007 highs.

And after all, it’s hard for this index to resist the Wall Street pattern. And it’s now down well below 7,000 points from a late July peak of 7472 to a 12-month intraday basis low of 6831. About 8-9%.

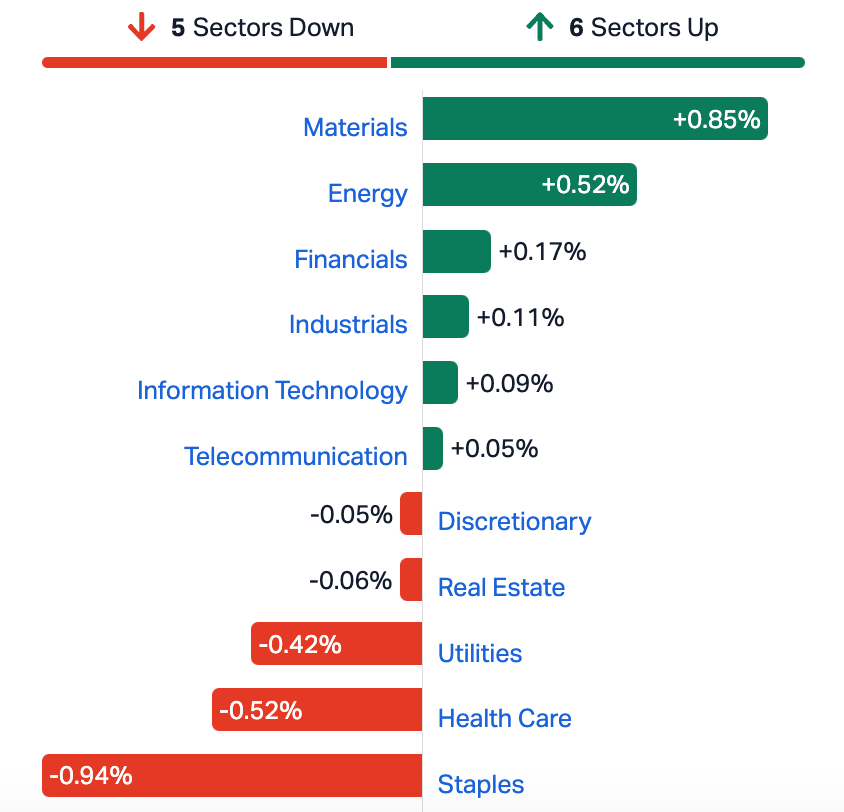

Materials led the gains, Consumer Staples the losses.

ASX SECTORS ON TUESDAY

WORTHY SMALL CAPS

The ASX gaming drama of 2022/2023 continues and it’s heating up.

Mighty Kingdom (ASX:MKL) ) says it’s just terminated its Share Subscription Agreement with Gamestar Studios because Gamestar won’t stump up (allegedly) what it owes.

“Noting Gamestar+’s ongoing failure to meet its obligations in settling payment of circa $2.1m for a shareholder approved placement of ordinary shares at $0.035, the company has reserved its rights against Gamestar+ in relation to the outstanding payment,” MKL told the ASX late on Tuesday.

Mighty Kingdom will continue to work with its legal advisors around assessing recovery options ‘that are aligned to the best interests of all shareholders’.

Flying under the radar, Sheffield Resources (ASX:SFX) says ore production from its 50% owned Thunderbird Mineral Sands Project (Thunderbird) in the Kimberley has kicked off, way, way ahead of the original Final Investment Decision (FID) schedule.

Thunderbird is expected to generate significant value out of what’s one of the world’s largest zircon reserves.

With a total after-tax NPV of $1.39 billion and an IRR of 27% for Stage 1 & 2 of Thunderbird, the project was fully funded during the last financial year and is set to deliver $695m in NPV to Sheffield’s shareholders over a 36-year life.

The initial stages of ore processing will see a gradual ramp up through to steady state processing, production of concentrates, and building of concentrate product stockpiles on site and at the port of Broome in preparation for the first delivery of product to customers.

Sheffield expects first shipment of concentrate product to be moved via Kimberley Mineral Sands in early in Q1 2024.

This week the Exec Chair Bruce Griffin congratulated his lads, contractors and partners (like Yansteel) for contributing to the “tremendous achievement”.

“Delivery of a greenfield mining project in Australia can be a challenging experience, particularly for a junior miner. Overcoming these hurdles, especially in the current inflationary environment to deliver first ore production ahead of schedule and under budget and without a lost time injury is an outstanding achievement that each and every one associated with Thunderbird should be incredibly proud of.

“With production activities now underway at Thunderbird, KMS are focused on accumulating concentrate stockpiles and to enable delivery of the forecast first shipment of product early in the new year.”

Australian B2B lender Butn (ASX:BTN) has jumped after dropping record quarterly revenue and originations.

BTN backs SMEs with cash through leveraging the end debtor’s credit. The blurb is:

“With a vision of ‘Your money, today’ Butn delivers cashflow funding solutions at the click of a Butn, having funded over $1.5 billion to Australian businesses.”

Q1 FY24 bullies:

– Quarter originations of $124.1 million, up 21% on the pcp, the 2nd successive record for quarterly originations

– Record quarterly revenue of $3.4 million, up 31% on pcp at a 2.7% revenue margin (2.5% in the pcp)

– Quarterly platform originations exceeded $30 million for the second successive quarter, up 53% on pcp

Last week, Superior Resources (ASX:SPQ) jumped after starting its Phase 2 drilling program at the SPQ flagship Greenvale Project.

The stock climbed again, Tuesday.

Superior’s MD Peter Hwang:

“We are naturally, very excited to see the rig turning again at Bottletree and we have a program that takes us to the south of last year’s line of holes to target a high priority interpreted central porphyry core.

“In addition, we will also be defining the strike-extent of the significant wall rock mineralisation zone that extends from surface at the Discovery Outcrop to at least 850 metres down-dip depth with a thickness of at least 250 metres. With the zone open at depth and along strike, this represents a potentially sizeable wall rock copper deposit in its own right.”

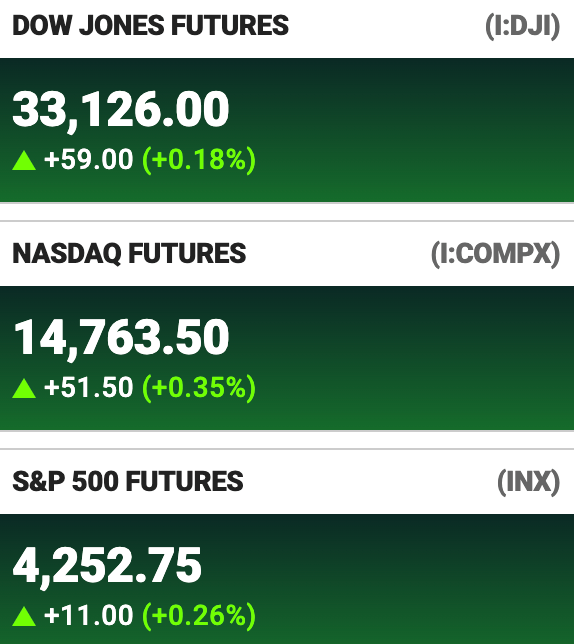

US FUTURES AT 1300 IN NEW YORK

RIPPED FROM THE HEADLINES

The Hang Seng has fallen again on Tuesday, that’s a hat-trick of straight losses, hitting a near 12-month low as tech, banks, and telcos lead a market beset by more worries regarding China’s indebted housing sector. Not even a big effort by the PBOC Governor – promising a helping policy setting while helping banks to cut real lending rates has turned sentiment.

That’s not worked yet. Traders continued to track US Treasury yields. Traders await the release of China’s industrial profits later this week. Among the early losers were Meituan (-2.7%), HCBC (-2.4%) and Tencent (-2.0%).

Bloomers reports that the BoJ (Bank of Japan) wants to go for yet another unscheduled bond-purchase operation as it tries to curb rising sovereign yields, ahead of next week’s big BoJ policy meet.

Tuesday marks the fifth time the central bank’s stepped in with more buying since it adjusted its yield-curve control program in July. It’s also resorted to bigger buyouts in regular operations and loans to commercial banks that help them buy debt on the cheap.

Despite all this, Japan’s benchmark 10-year yield has repeatedly set fresh decade highs this month.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| ERW | Errawarra Resources | 0.145 | 46% | 1,313,884 | $6,880,896 |

| SDG | Sunland Group Ltd | 0.078 | 42% | 6,745,834 | $7,531,119 |

| WOA | Wide Open Agricultur | 0.19 | 31% | 839,786 | $20,775,857 |

| NSM | Northstaw | 0.039 | 30% | 24,221 | $3,603,810 |

| GRE | Greentechmetals | 0.355 | 29% | 800,397 | $15,627,944 |

| HOR | Horseshoe Metals Ltd | 0.009 | 29% | 305,840 | $4,504,351 |

| ARV | Artemis Resources | 0.023 | 28% | 5,881,735 | $28,348,531 |

| ADS | Adslot Ltd. | 0.005 | 25% | 16,166 | $12,897,982 |

| LNU | Linius Tech Limited | 0.0025 | 25% | 66,143 | $8,459,581 |

| RDN | Raiden Resources Ltd | 0.0325 | 25% | 89,928,142 | $60,732,494 |

| CVV | Caravel Minerals Ltd | 0.16 | 23% | 852,642 | $68,156,374 |

| NMR | Native Mineral Res | 0.038 | 23% | 986,611 | $6,247,604 |

| ID8 | Identitii Limited | 0.017 | 21% | 1,680,787 | $5,981,332 |

| ZAG | Zuleika Gold Ltd | 0.017 | 21% | 366,471 | $7,322,709 |

| GRV | Greenvale Energy Ltd | 0.115 | 21% | 308,857 | $41,111,938 |

| BOD | BOD Science Ltd | 0.06 | 20% | 200,050 | $8,866,925 |

| KPO | Kalina Power Limited | 0.006 | 20% | 133,678 | $7,575,979 |

| LVT | Livetiles Limited | 0.006 | 20% | 766,770 | $5,885,553 |

| UCM | Uscom Limited | 0.048 | 20% | 50,000 | $7,621,342 |

| CRS | Caprice Resources | 0.037 | 19% | 200,000 | $3,619,465 |

| DCC | Digitalx Limited | 0.037 | 19% | 5,139,649 | $23,111,090 |

| WC8 | Wildcat Resources | 0.69 | 19% | 19,285,399 | $603,692,713 |

| AML | Aeon Metals Ltd. | 0.013 | 18% | 142,757 | $12,060,407 |

| TNY | Tinybeans Group Ltd | 0.175 | 17% | 144,738 | $12,575,789 |

| BFC | Beston Global Ltd | 0.007 | 17% | 166,666 | $11,982,281 |

Errawarra Resources (ASX:ERW), if you’ve still not met somehow, is a WA explorer (mainly into nickel and lithium at present, but also gold and graphite and generally substance agnostic), is up again – this time after a board change – but it hasn’t taken much of late to get the ERW squad cheering.

ASX Release: #ERW advises that Mr Jonathan Battershill resigned today as a non-executive Director, and would like to thank Mr Battershill for his contributions. #ERW welcomes Mr Bruce Garlick, appointed non-independent non-executive Director to the Board. https://t.co/pudmaymyYv pic.twitter.com/HoGpVGXxEJ

— Errawarra Resources Ltd (@errawarra) October 23, 2023

Garlick is a finance executive with more than 30 years’ experience under his belt in the fields of mining, exploration and engineering. Handy.

An ERW recap:

Last week Errawarra provided this update on its lithium run at the highly prospective Andover West project, which adjoins big gun projects belonging to Azure Minerals (ASX:AZS) and Raiden Resources (ASX:RDN).

Essentially:

• Multiple pegmatites identified from ongoing reconnaissance rock chip sampling at Andover West.

• Follow-up sampling to be focused on 4 pegmatite zones where anomalous lithium results were previously returned.

• Project “continues to display potential for lithium bearing pegmatites.”

Boots are on the ground at Andover West. The technical team are continuing to sample the highly prospective ground which adjoins Azure Minerals and Raiden Resources. #lithium #pilbara #exploration $ERW pic.twitter.com/SHDbOzUoCo

— Errawarra Resources Ltd (@errawarra) October 19, 2023

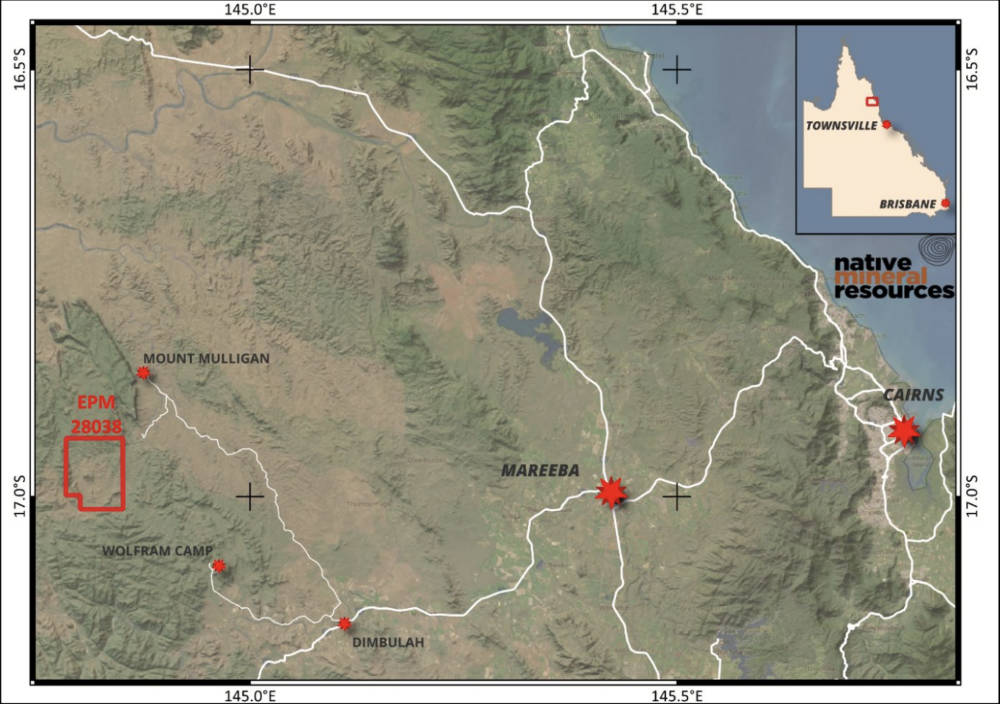

The stock of Native Mineral Resources (ASX:NMR) jumped this arvo after reporting intersected porphyry, (which indicates that zinc mineralisation increases with depth), at its Maneater Hill project in Far North Queensland.

The company was granted the tenement over Maneater Hill in July last year and subsequent drilling recorded massive, semi-massive, and disseminated sulphides for over 370m from a down-hole depth of 107m in hole MPD002.

This returned multiple 1m intervals recording grades of up to 2.14g/t gold, 1.7% zinc, 0.5% antimony, 57.1g/t silver, 0.75% lead and 0.35% copper.

The next hole pulled 446m of polymetallic mineralisation that included high-grade gold assays of 1m at 17.9g/t and 1m at 6.32g/t, adding depth to the target.

Here’s a drawing:

First assays from the company’s six-hole diamond drilling program to test priority anomalies highlighted by an IP survey has demonstrated that zinc mineralisation increases with depth in drill hole MPD005, which returned a top intercept of 5m at 0.48% zinc within a broader 22m at 0.23% zinc.

Adding interest, the hole intersected six separate sections of quartz feldspar porphyry totalling 23m from a depth of 286.5m. This porphyry also shows multiple phases of mineralisation and is interpreted to be similar to the Red Dome and Mungana deposits near Chillagoe.

“The increase in zinc values with depth in hole MDP005 indicates that there is a potentially large mineralised system located at Maneater and NMR is continuing its exploration to pinpoint the system with the next diamond hole MPD006.”

NMR also has a pipeline of activity planned at its McLaughlin Lake lithium project in Canada with initial planning for a maiden drilling in 1Q 2024 now well advanced.

Sampling at McLaughlin Lake has already returned up to 2.77% Li2O along with elevated levels of lithium indicator minerals rubidium and caesium.

The long-listed developer Sunland Group (ASX:SDG) has formally applied for delisting from the ASX after near 28 years, during which it adorned the Golden Corner of southern Queensland with landmarks like ‘Q1’ and ‘Palazzo Versace.’

The timing is getting close, and the stock price is up about 35% today. Sunland’s founders, the Abedian family, have been buying back shares with a plan to getting off the ASX since the pandemic.

The group has been busy indeed – flogging assets and returning the cash to shareholders via some meaty divs – some $200mn paid last financial year.

And also climbing aggressively late on Tuesday is Wide Open Agriculture (ASX:WOA), which last week secured final consent and approval for its 100% acquisition of Prolupin and its assets for $4.2m.

That was Thursday and here we are on Tuesday and WOA is ‘transitioning’ into the ‘world’s largest lupin protein producer’.

The move gives WOA immediate commercial scale manufacturing, as well as ‘unlocks the ability to produce different types of lupin concentrates, and open up commercial opportunities in Europe’.

The CEO of Wide Open Agriculture, Jay Albany said; “With this move, we’re not just expanding our manufacturing capacity but also unlocking the potential to diversify our lupin product offerings. Most importantly, we’re forging stronger connections in the European market, opening doors to a myriad of potential commercial opportunities.”

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| FHS | Freehill Mining Ltd. | 0.002 | -33% | 6,873,418 | $8,534,403 |

| GSM | Golden State Mining | 0.023 | -32% | 11,917,868 | $6,497,001 |

| MKL | Mighty Kingdom Ltd | 0.011 | -27% | 1,412,480 | $4,893,294 |

| DXN | DXN Limited | 0.0015 | -25% | 800,000 | $3,446,680 |

| MXC | Mgc Pharmaceuticals | 0.0015 | -25% | 7,143,154 | $8,855,936 |

| NVQ | Noviqtech Limited | 0.003 | -25% | 463,561 | $4,952,781 |

| KP2 | Kore Potash PLC | 0.01 | -23% | 445,092 | $8,681,443 |

| NXS | Next Science Limited | 0.23 | -21% | 4,208,032 | $77,094,783 |

| CYQ | Cycliq Group Ltd | 0.004 | -20% | 4,000,000 | $1,787,583 |

| MCT | Metalicity Limited | 0.002 | -20% | 40,000 | $9,340,215 |

| JAL | Jameson Resources | 0.041 | -20% | 90,000 | $19,967,066 |

| TAL | Talius Group Limited | 0.009 | -18% | 550,000 | $25,147,533 |

| DAL | Dalaroometalsltd | 0.033 | -18% | 477,878 | $3,264,000 |

| S3N | Sensore Ltd | 0.12 | -17% | 18,486 | $5,277,020 |

| DRE | Dreadnought Resources Ltd | 0.035 | -17% | 33,231,392 | $144,630,509 |

| MHC | Manhattan Corp Ltd | 0.005 | -17% | 9,858,391 | $17,621,879 |

| YPB | YPB Group Ltd | 0.0025 | -17% | 52,409 | $2,230,384 |

| HPC | Thehydration | 0.031 | -16% | 20,000 | $8,886,262 |

| PRS | Prospech Limited | 0.021 | -16% | 1,461,871 | $5,493,999 |

| TOY | Toys R Us | 0.011 | -15% | 10,691,027 | $11,997,935 |

| AJX | Alexium Int Group | 0.017 | -15% | 318 | $13,165,143 |

| MKG | Mako Gold | 0.017 | -15% | 71,002 | $11,520,164 |

| NAG | Nagambie Resources | 0.017 | -15% | 360,660 | $11,634,526 |

| NC6 | Nanollose Limited | 0.04 | -15% | 169,439 | $6,997,659 |

| 88E | 88 Energy Ltd | 0.006 | -14% | 8,627,957 | $154,830,585 |

TRADING HALTS

Melodiol Global Health (ASX:ME1) – Capital raising

Viridis Mining and Minerals (ASX:VMM) – Capital raising

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.