Closing Bell: ASX tumbles on Fedspeak; gold and oil jump as Middle East tension escalates

ASX tumbles of Fedspeak. Picture Getty

- ASX slipped on Fed’s hawkish comments

- Gold stocks jumped after bullion hit record highs again

- Tension in the Middle East has escalated

The ASX200 slipped on Friday mainly on the back of remarks from US Fed members overnight. The benchmark index closed the day -0.4% lower, and is +0.2% higher for the week.

Big US tech stocks continued their rally overnight despite hawkish comments from Fed Reserve Bank of Boston president Susan Collins and New York Fed president John Williams.

Collins said it it may take more time than previously thought to begin cutting rates, which means fewer rate reductions this year.

“Overall, the recent data have not materially changed my outlook, but they do highlight uncertainties related to timing, and the need for patience …,” she said.

Williams echoed her comments, saying that US inflation still has ‘a ways’ to go to get to 2%. “There’s no clear need to adjust policy in the very near term,” he said.

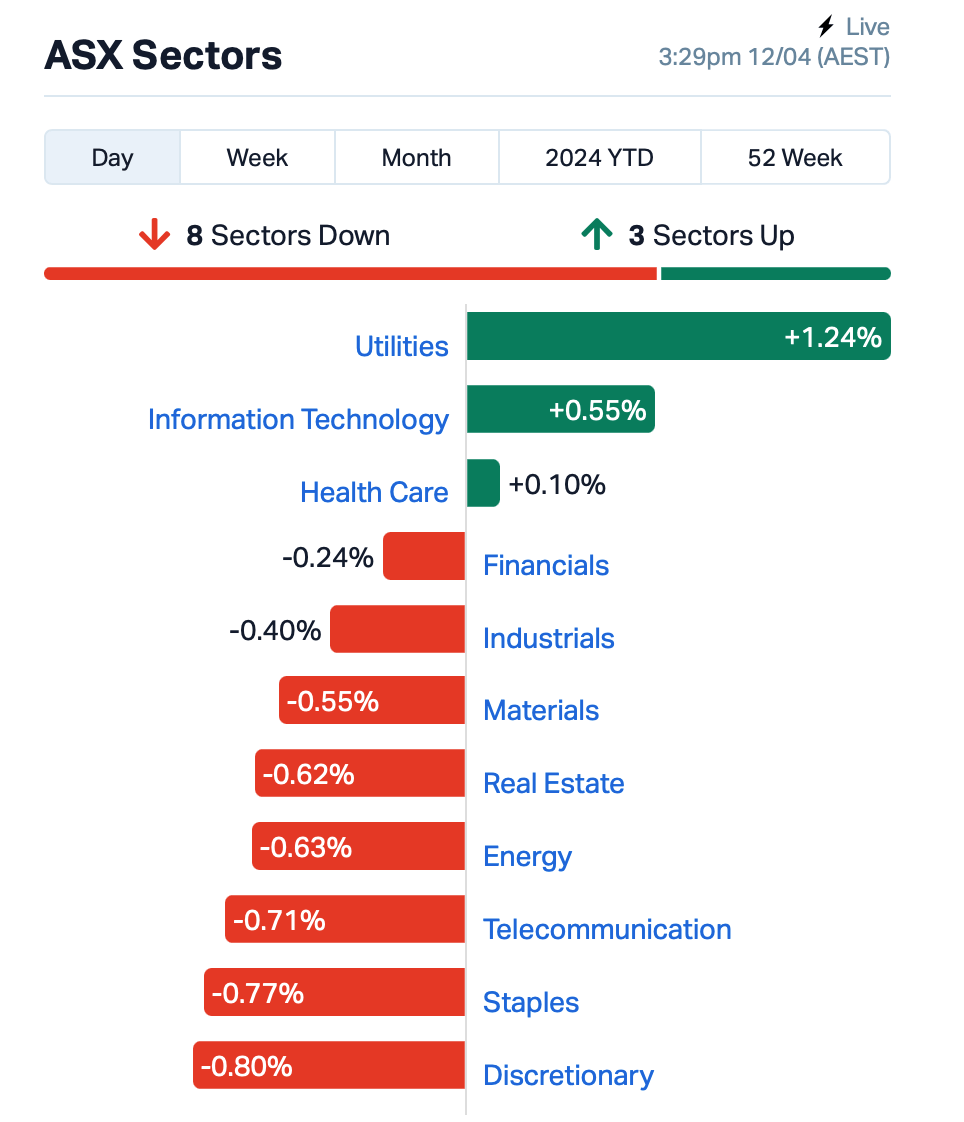

On the ASX, the biggest losers today were the Discretionary and Staples sector, followed by Energy and Telco. Utilities and Tech sectors meanwhile led the winners.

Gold stocks mostly rose after the bullion price surged further in Asian hours today, with spot bullion trading at US$2,385.68 an ounce.

Elsewhere today…

Oil prices resumed gains as tensions in the Middle East escalated once again.

There are reports that Iran is planning an “imminent” attack on Israeli targets. Penny Wong has urged Iran to show restraint.

At the time of writing, WTI is trading at US$84.98 a barrel.

ASX LARGE CAP WINNERS TODAY:

Code Name % Change Volume Market Cap DYL Deep Yellow Limited 6% 5,103,840 $1,253,742,701 RRL Regis Resources 6% 5,744,925 $1,563,551,333 RED Red 5 Limited 6% 35,344,174 $1,402,839,222 BOE Boss Energy Ltd 5% 2,788,714 $1,953,358,200 IPH IPH Limited 4% 886,335 $1,461,654,914 SLX Silex Systems 4% 481,857 $1,209,252,281 RSG Resolute Mining 4% 10,304,531 $1,011,298,756 WAF West African Res Ltd 4% 1,598,697 $1,402,010,179 ADT Adriatic Metals 3% 598,414 $1,058,716,091 NWL Netwealth Group 3% 498,683 $4,700,099,424 GMD Genesis Minerals 3% 7,183,781 $2,148,502,338 PRU Perseus Mining Ltd 3% 1,978,429 $3,132,243,970

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NPM | Newpeak Metals | 0.025 | 127% | 21,414,445 | $1,099,469 |

| CNJ | Conico Ltd | 0.002 | 100% | 2,998,365 | $1,805,095 |

| SIX | Sprintex Ltd | 0.025 | 39% | 4,574,761 | $8,578,455 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 840,847 | $3,264,346 |

| LNR | Lanthanein Resources | 0.004 | 33% | 21,671,195 | $5,864,727 |

| E79 | E79Goldmineslimited | 0.040 | 33% | 321,660 | $2,440,022 |

| FHS | Freehill Mining Ltd. | 0.009 | 29% | 5,567,212 | $20,970,911 |

| BVR | Bellavistaresources | 0.140 | 27% | 488,079 | $5,457,207 |

| CMO | Cosmometalslimited | 0.054 | 26% | 817,865 | $5,434,961 |

| AMD | Arrow Minerals | 0.005 | 25% | 4,647,814 | $37,918,825 |

| AVE | Avecho Biotech Ltd | 0.005 | 25% | 340,267 | $12,677,188 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 3,628,851 | $12,000,000 |

| EPM | Eclipse Metals | 0.010 | 25% | 5,665,348 | $17,677,244 |

| RTG | RTG Mining Inc. | 0.032 | 23% | 1,915,939 | $28,213,497 |

| CPO | Culpeominerals | 0.066 | 22% | 12,349,165 | $8,930,100 |

| ORP | Orpheus Uranium Ltd | 0.110 | 21% | 528,848 | $17,275,023 |

| SVG | Savannah Goldfields | 0.030 | 20% | 570,098 | $7,027,123 |

| 88E | 88 Energy Ltd | 0.006 | 20% | 52,384,869 | $125,620,313 |

| BFC | Beston Global Ltd | 0.006 | 20% | 1,995,260 | $9,985,234 |

| ESR | Estrella Res Ltd | 0.006 | 20% | 1,701,500 | $8,796,859 |

| NTM | Nt Minerals Limited | 0.006 | 20% | 100,674 | $4,299,515 |

| TAS | Tasman Resources Ltd | 0.006 | 20% | 244,145 | $3,563,346 |

| ARV | Artemis Resources | 0.019 | 19% | 1,548,207 | $27,059,138 |

| CY5 | Cygnus Metals Ltd | 0.076 | 19% | 3,068,234 | $18,659,785 |

| SRZ | Stellar Resources | 0.019 | 19% | 4,840,056 | $22,980,529 |

Defence manufacturer HighCom (ASX:HCL) receives a new order of ballistic products from a military customer worth $4.7m. Good news for HCL, which suffered a $13.4m loss in the December half “mainly due to the company not securing several large international orders in the Middle East”.

NewPeak Metals (ASX:NPM) finalises the sale of its share in a Finland gold project to a soon-to-be-listed Canadian company. NPM receives CAD$500,000 cash, CAD$1m in shares of the listed company, and a milestone payment of CAD$1.5m in cash or shares on reporting of a 500,000oz gold resource.

Estrella Resources (ASX:ESR) was also on the move, after announcing it had uncovered a manganese host rock over 27km of strike at the Lautém project in Timor-Leste.

The company says that it has managed to secure a site in the city of Dili for its team to work with the samples that are being collected in the field, in a small office that has a sample preparation area established.

Meanwhile, larger gold stocks surged alongside a new record high spot price, led by RED 5 (ASX:RED), Regis (ASX:RRL), Resolute (ASX:RSG), and Bellevue (ASX:BGL).

Lunnon Metals (ASX:LM8) reported the results of a recent reverse circulation (RC) drilling program at the Baker nickel deposit, the company’s cornerstone asset at its Kambalda nickel project. Extensional drilling program has delivered growth potential up-dip. Results include 9.0m @ 5.29% Ni, 6.0m @ 4.99% Ni, 7.0m @ 3.99% Ni and 3.0m @ 8.14% Ni. Mineral Resource Estimate will be updated in due course.

FBR (ASX:FBR) says its ordinary shares have commenced trading on the OTCQB Venture Market under the ticker “FBRKF”. The OTCQB Venture Market is a US trading platform operated by OTC Markets Group in New York. FBR says the listing will increase exposure to, and generate increased interest from, US domiciled retail and institutional investors in its shares.

Oncosil Medical (ASX:OSL)’s clinical strategy continues to progress, with the first patient treatment using the OncoSil device occurring in the UK for the TRIPP-FXX clinical study. The TRIPP-FXX study will assess the safety and efficacy of the OncoSil device when given with standard FOLFIRINOX chemotherapy for treatment of locally advanced pancreatic cancer.

Sierra Rutile (ASX:SRX) announced the results of the Definitive Feasibility Study (DFS) for the Sembehun Project in Sierra Leone. Highlights include: Expected mine life of 14 years, no change to previous Sembehun Ore Reserve of 173.7 Mt @ 1.46% rutile, and an average of 175ktpa of rutile production projected from 2028 to 2038. Capex estimate is reduced by 11% to $301 million, or a $36 million reduction on the 2022 Preliminary Feasibility Study (PFS). Expected payback is within 55 months from project commencement.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MRD | Mount Ridley Mines | 0.001 | -50% | 653,013 | $15,569,766 |

| MHC | Manhattan Corp Ltd | 0.002 | -33% | 2,310,000 | $8,810,939 |

| SIT | Site Group Int Ltd | 0.002 | -33% | 4,413,500 | $7,807,471 |

| AHN | Athena Resources | 0.003 | -25% | 411,005 | $4,281,870 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 146,926 | $11,649,361 |

| MRQ | Mrg Metals Limited | 0.002 | -25% | 3,357,637 | $5,050,237 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 360,000 | $12,394,892 |

| CMB | Cambium Bio Limited | 0.010 | -23% | 654,039 | $9,959,200 |

| EMP | Emperor Energy Ltd | 0.012 | -20% | 1,348,000 | $5,111,062 |

| 3PL | 3P Learning Ltd | 1.005 | -20% | 7,142 | $343,217,168 |

| HTA | Hutchison | 0.030 | -19% | 40,000 | $502,182,817 |

| DGR | DGR Global Ltd | 0.014 | -18% | 556,456 | $17,742,789 |

| FNR | Far Northern Res | 0.165 | -18% | 116,234 | $7,149,165 |

| CVR | Cavalierresources | 0.175 | -17% | 17,421 | $6,684,072 |

| KTA | Krakatoa Resources | 0.015 | -17% | 5,866,506 | $8,497,930 |

| OAU | Ora Gold Limited | 0.005 | -17% | 557,450 | $34,836,005 |

| FEG | Far East Gold | 0.135 | -16% | 378,614 | $41,213,894 |

| AVH | Avita Medical | 3.360 | -16% | 1,537,056 | $239,574,986 |

| TTI | Traffic Technologies | 0.006 | -14% | 1,000,000 | $6,099,245 |

| G11 | G11 Resources Ltd | 0.026 | -13% | 164,680 | $22,473,663 |

| MRZ | Mont Royal Resources | 0.067 | -13% | 50,000 | $6,547,294 |

| GGE | Grand Gulf Energy | 0.007 | -13% | 585,500 | $16,761,976 |

| VN8 | Vonex Limited. | 0.014 | -13% | 724 | $5,789,258 |

| NWF | Newfield Resources | 0.110 | -12% | 94,652 | $113,837,865 |

IN CASE YOU MISSED IT

You haven’t missed a thing, apparently.

TRADING HALTS

Alvo Minerals (ASX:ALV) – pending an announcement regarding a capital raising.

New World Resources (ASX:NWC) – pending the release of an announcement in relation to a capital raising.

Amplia (ASX:ATX) – halt requested to allow Amplia to undertake an entitlement offer process.

Titanium Sands (ASX:TSL) – pending an announcement regarding a material capital raising.

Kin Mining (ASX:KIN) – pending the release of an update regarding a potential transaction between Kin Mining and PNX Metals.

PNX Metals (ASX:PNX) – pending the release of an update regarding a potential transaction between PNX Metals and Kin Mining.

Genex Power (ASX:GNX) – pending a material announcement regarding a non-binding, indicative and conditional proposal that Genex received from Electric Power Development Co.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.