Closing Bell: ASX traders happy to take the profit after surprise CPI windfall

Via Getty

- The ASX benchmark has ended Wednesday higher after positive inflation data

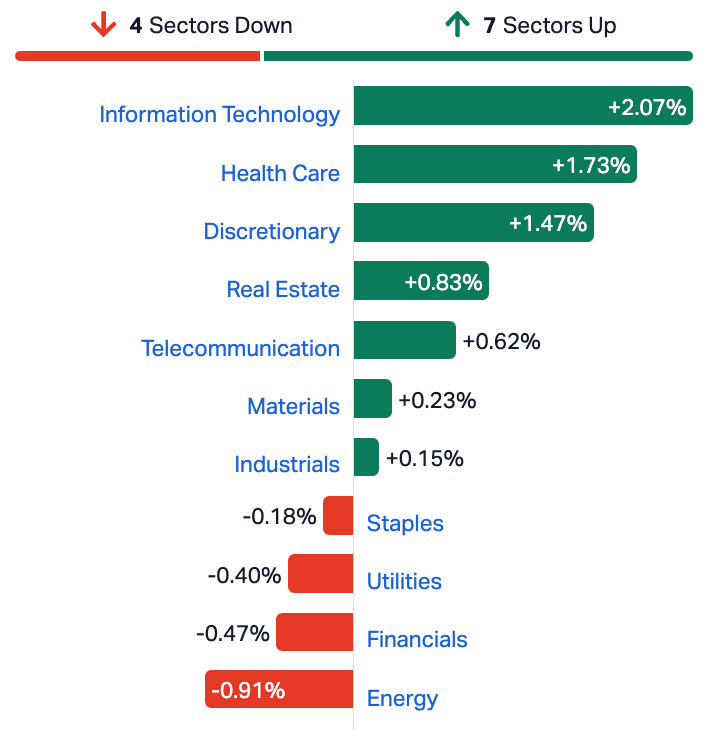

- 7 of 11 sectors in the green, IT ahead by circa +2pc

- Small caps led by Euro Manganese

The local market has trimmed the CPI fat of this morning’s gains, after the Bureau of Stats monthly inflation gauge eased much more than expected in October on the – apparently – softening price of goods.

That chimed well with extra-dovish flavoured Fed chatter, leading US markets to price in a 40% chance the Fed could start easing as early as March 2024.

After the CPI dropped and markets spiked, IG Australia market analyst Tony Sycamore suggested the RBA board led by governor M. Bullock might have been gifted a get-out-of-jail-free card.

“The breath of relief from the RBA’s Martin Place HQ and mortgage holders nationwide was almost audible in the streets of Sydney, as today’s inflation number suggests that under the RBA’s current monetary policy settings, inflation is falling at a pace that should ensure a return to target within a reasonable time frame.”

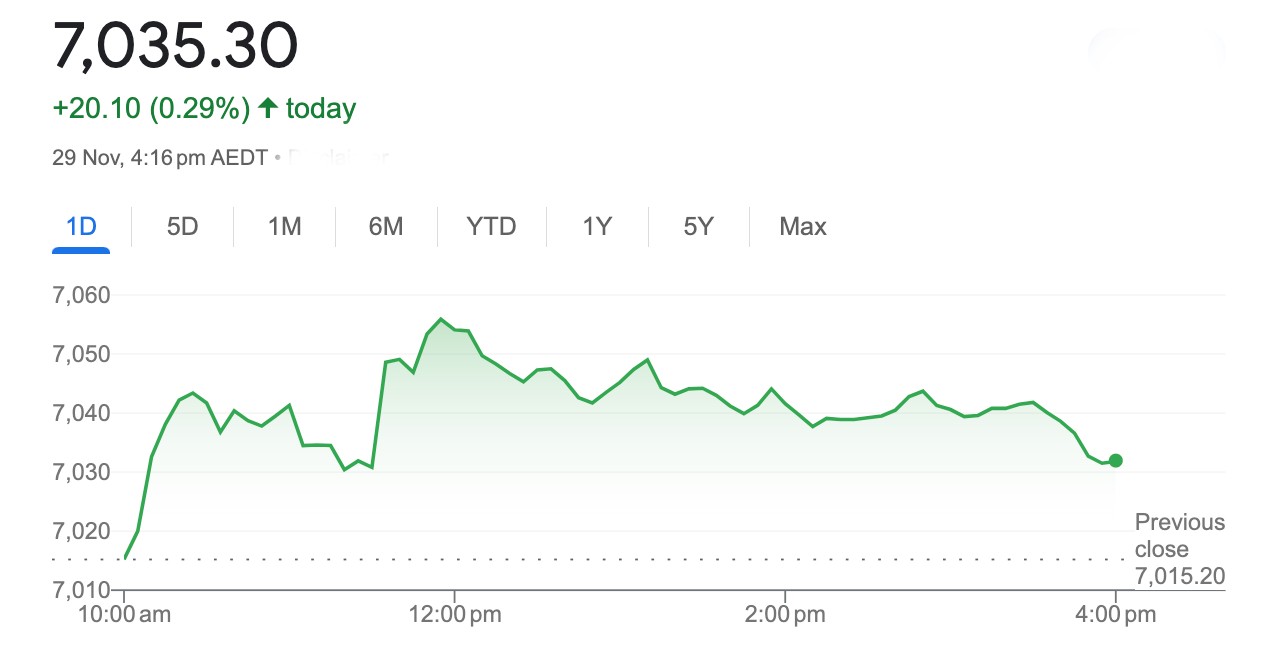

At match-out on Wednesday November 29, the S&P/ASX 200 (XJO) index was up 20 points, or +0.29%…

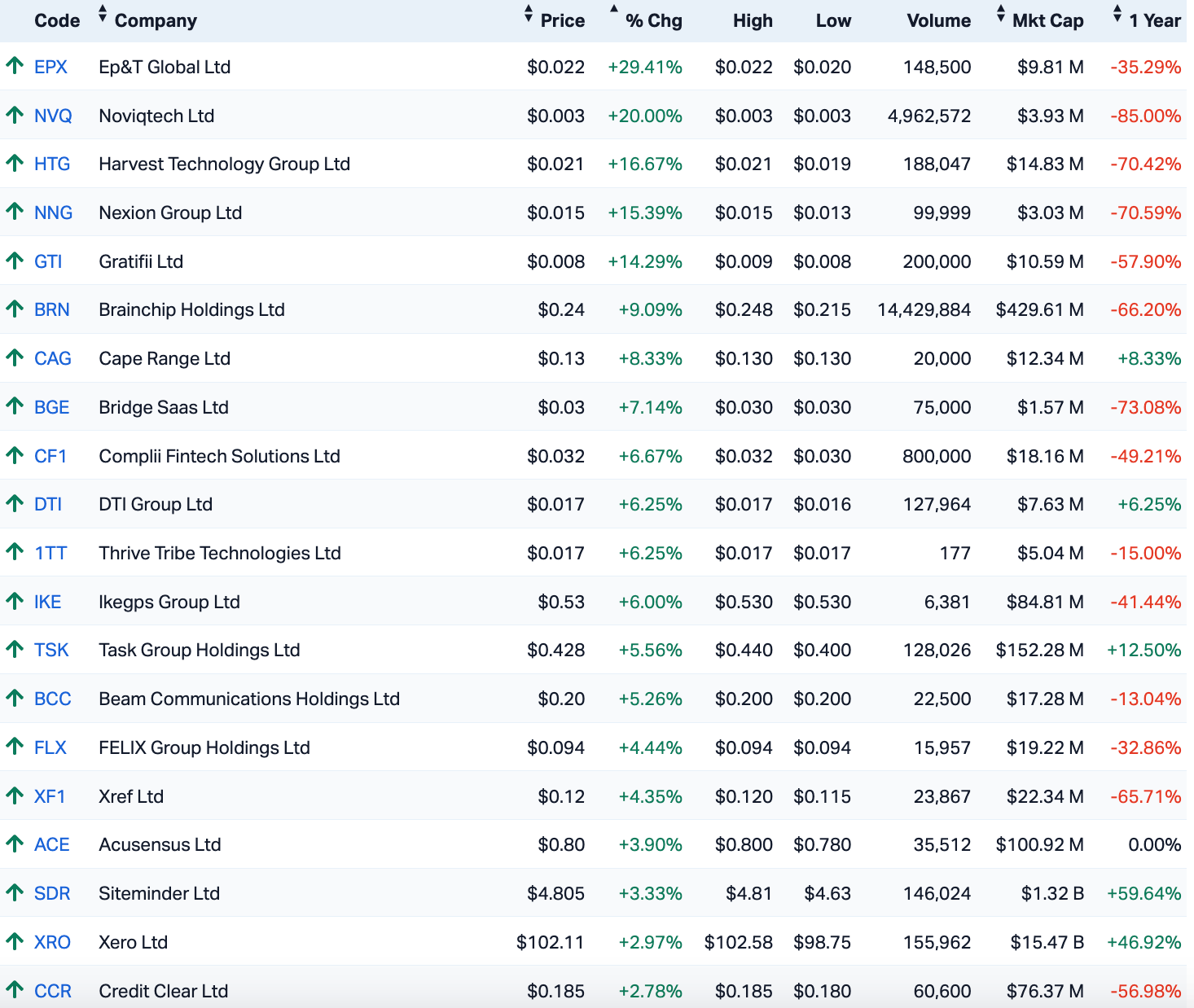

A good day to be in Aussie tech stocks as the IT Sector stormed off in a huff of insolence all its own. This is what the S&P/ASX 200 Information Technology (XIJ) index leader board looked like at circa 3pm in Sydenham:

ASX IT: Tech your pick…

Meanwhile, 7 of the 11 ASX sectors closed higher on Wednesday, volatile oil prices remain a bugbear for the Energy Sector, while Financials walked back some of the easy gains made on Tuesday.

ASX SECTORS ON WEDNESDAY

In company news, and on top of the IT leaderboard is EP&T Global (ASX:EPX) , the company is locked into their AGM on Wednesday arvo, the provider of property ‘energy management solutions to reduce energy and water wastage, and enhance energy efficiency within commercial real estate’ is cooking something. We’ll keep you posted.

Healius is making up some of its recent losses, the healthcare stock climbing from the open. Likewise sector giant CSL is throwing its weight around after winning approval in Japan for what it’s calling the world’s first self-amplifying messenger RNA (sa-mRNA) Covid-19 vaccine.

So they’re Big in Japan now, too.

Kiwi-born Fisher & Paykel Healthcare dropped big revenue and profit numbers for its 1H24 this morning.

Wesfarmers (ASX:WES) says it’s completed the weird-from-the-start acquisition of SILK Laser Australia (ASX:SLA).

SLA shareholders got $3.35 a pop, plus 10 cents on the special dividend, a right kicker on the original $3.15 bid made back in April.

On the nose, but in a good way: it values Silk at circa $180mn. And the stock last traded at $3.34.

We’re watching gold on Wednesday

The spot price for gold looks happy again around $2,050 an ounce – that’ll be the precious metal’s toppest effort since way back in march.

A falling US dollar always helps on that front, while extra dovish remarks from Fed Governor Christopher Waller also laid further foundations.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| LBT | LBT Innovations | 0.016 | 100% | 4,099,787 | $9,247,203 |

| EMN | Euromanganese | 0.145 | 45% | 22,361,056 | $24,581,548 |

| AUH | Austchina Holdings | 0.004 | 33% | 525,000 | $6,233,651 |

| BP8 | Bph Global Ltd | 0.002 | 100% | 8,829,922 | $2,423,345 |

| MCT | Metalicity Limited | 0.002 | 100% | 26,647,269 | $6,376,629 |

| BMR | Ballymore Resources | 0.145 | 32% | 170,224 | $16,081,699 |

| GML | Gateway Mining | 0.021 | 31% | 449,790 | $5,303,721 |

| EPX | Ept Global Limited | 0.022 | 29% | 148,500 | $7,580,533 |

| ZAG | Zuleika Gold Ltd | 0.022 | 29% | 1,434,338 | $8,891,861 |

| SHN | Sunshine Metals Ltd | 0.036 | 29% | 96,569,273 | $34,272,236 |

| HTG | Harvest Tech Grp Ltd | 0.023 | 28% | 503,911 | $12,707,340 |

| CLA | Celsius Resource Ltd | 0.014 | 27% | 5,206,592 | $24,706,568 |

| FBR | FBR Ltd | 0.024 | 26% | 13,907,440 | $75,523,638 |

| TTT | Titomic Limited | 0.02 | 25% | 7,278,177 | $13,865,838 |

| WEL | Winchester Energy | 0.0025 | 25% | 4,183,000 | $2,040,844 |

| ZNO | Zoono Group Ltd | 0.061 | 22% | 472,928 | $9,496,384 |

| NFL | Norfolkmetalslimited | 0.43 | 21% | 663,906 | $10,765,374 |

| RNO | Rhinomed Ltd | 0.041 | 21% | 134,725 | $9,714,470 |

| EGN | Engenco Limited | 0.3 | 20% | 31,004 | $78,948,353 |

| ADR | Adherium Ltd | 0.003 | 50% | 500,000 | $12,503,985 |

| NVQ | Noviqtech Limited | 0.003 | 20% | 4,962,572 | $3,273,613 |

| SKN | Skin Elements Ltd | 0.006 | 20% | 50,000 | $2,947,430 |

| TMR | Tempus Resources Ltd | 0.006 | 20% | 1,285,567 | $1,714,614 |

| AKM | Aspire Mining Ltd | 0.093 | 19% | 179,414 | $39,595,685 |

| BTR | Brightstar Resources | 0.0155 | 19% | 19,234,193 | $24,905,834 |

It’s Euro Manganese (ASX:EMN) all the way on Wednesday.

Here I turn to my Master of Anything Manganesian, Dr Robert Badman:

This $38m market capped Canadian manganese stock hasn’t had the best time of things since we mentioned it in this column in mid-August … although we’re pretty sure that’s not our fault.

Back then, you see, it was a $52m market capper.

But… its fortunes now look to be making a u-turn in the right direction, with the stock bursting up +45% and making news just about everywhere on the back of a significant project financing deal with $8.2 billion global asset management firm Orion Resource Partners.

It’s a US$100m non-dilutive funding package to advance the development of the Chvaletice manganese project in the Czech Republic – the company’s primary focus.

We are thrilled to share that we've secured US$100 million in non-dilutive financing from Orion Resource Partners to advance the development of our #ChvaleticeProject in the Czech Republic.https://t.co/a56kpAKQeF#HighPurityManganese #EuroManganese #EVs #Orion #investors pic.twitter.com/2ijOxEGxV4

— Euro Manganese (@EuroManganese) November 28, 2023

Rob says EMN is battery materials focused, with manganese a lesser-known (than lithium and nickel anyway) raw material required as ‘a stabilising component in the cathodes of nickel-manganese-cobalt (NMC) lithium-ion batteries used in electric vehicles.’

“The funding is split into two $50 million tranches, including a $50 million loan facility, convertible into a 1.29-1.65% royalty on project revenues, and another $50m in exchange for a 1.93-2.47% royalty on project revenues following a final investment decision by the company’s board,” Rob says.

President & CEO, Dr Matthew James, reckons it’s a ‘transformative transaction’ for Euro Manganese…

“The non-dilutive, tranche structure minimises cost of funds and reduces future project financing requirements.

“This further validates the robust nature of the Chvaletice Project and our team’s ability to deliver this strategic battery raw material project for Europe to the highest of standards.”

Slipping into second place is Ballymore Resources (ASX:BMR) which says it’s raised $1.8m via a placement/ entitlement offer – plus another $1.5m from mining royalty firm Taurus – to advance the Dittmer gold mine to production.

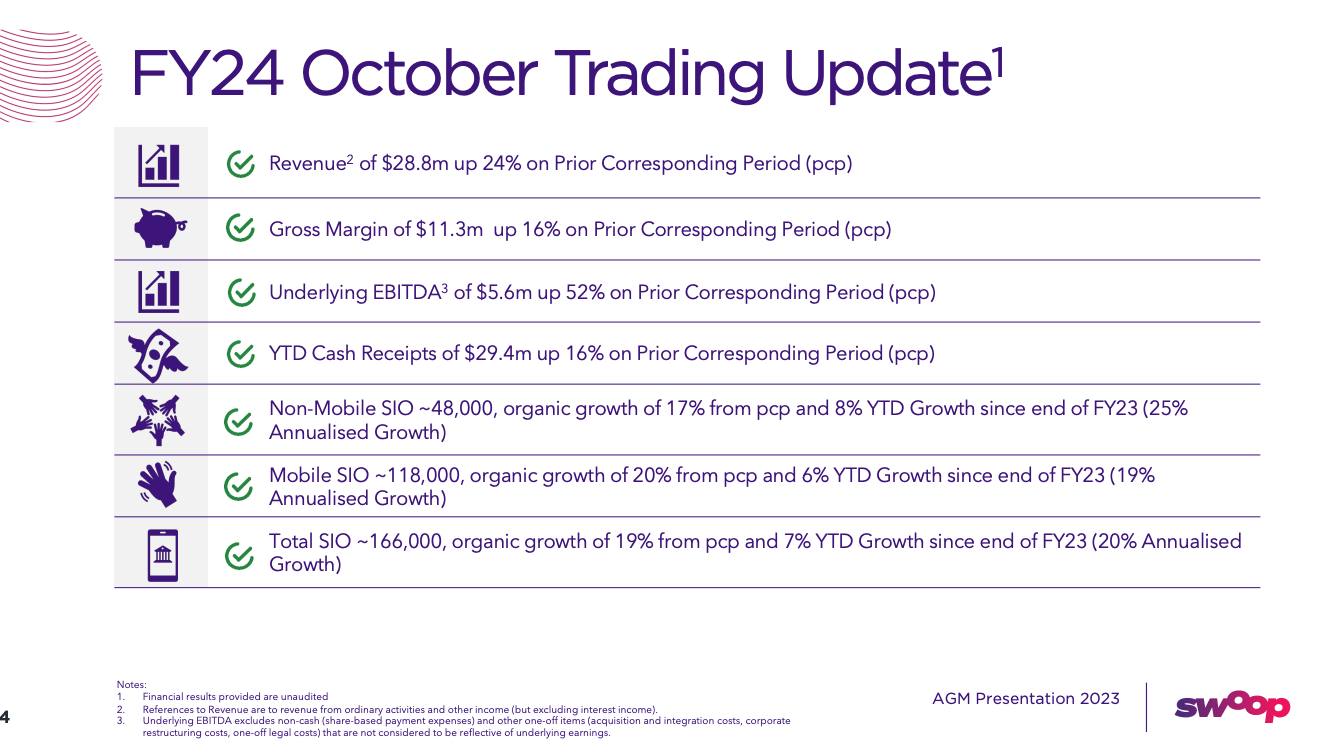

And look out above, I don’t know why but Swoop Telecommunications (ASX:SWP) is going gangbusters.

I sense M&A, but I see daylight.

This is all I got (from the AGM last week…)

I’m not at heart a suspicious man, but I am a highly paid journalist with a heightened fear of patterns:

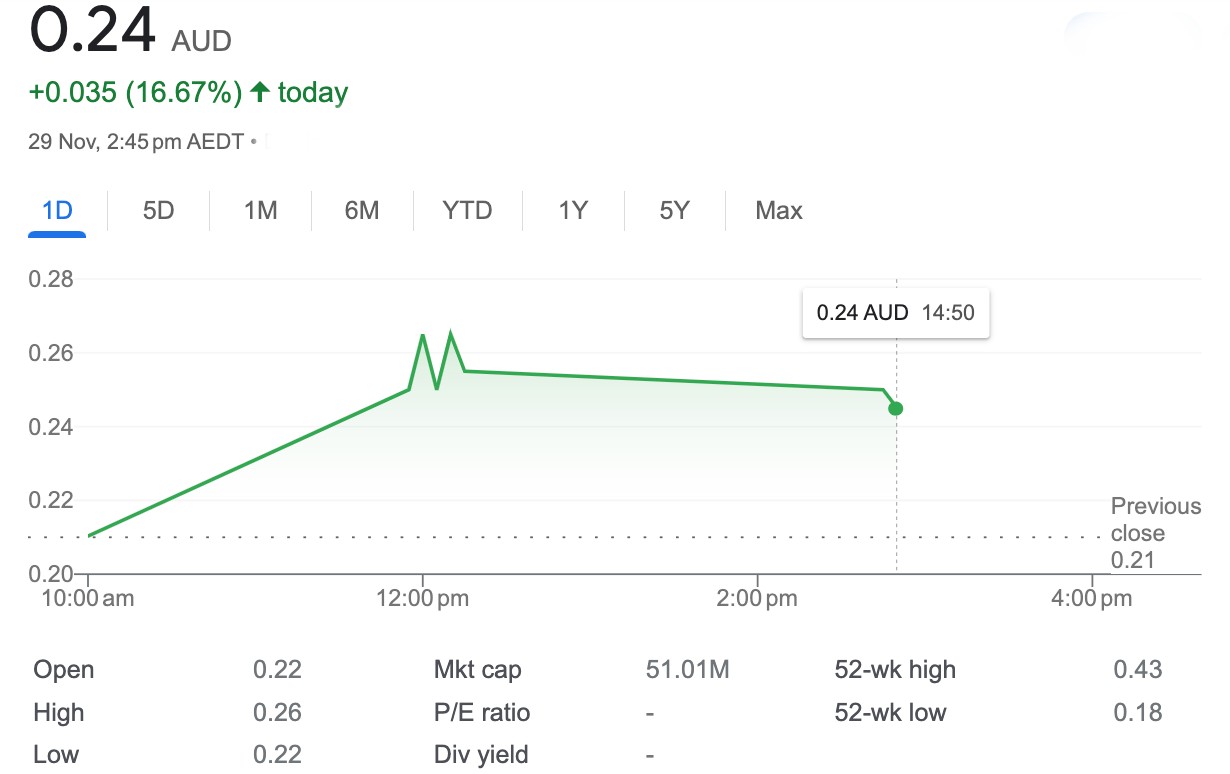

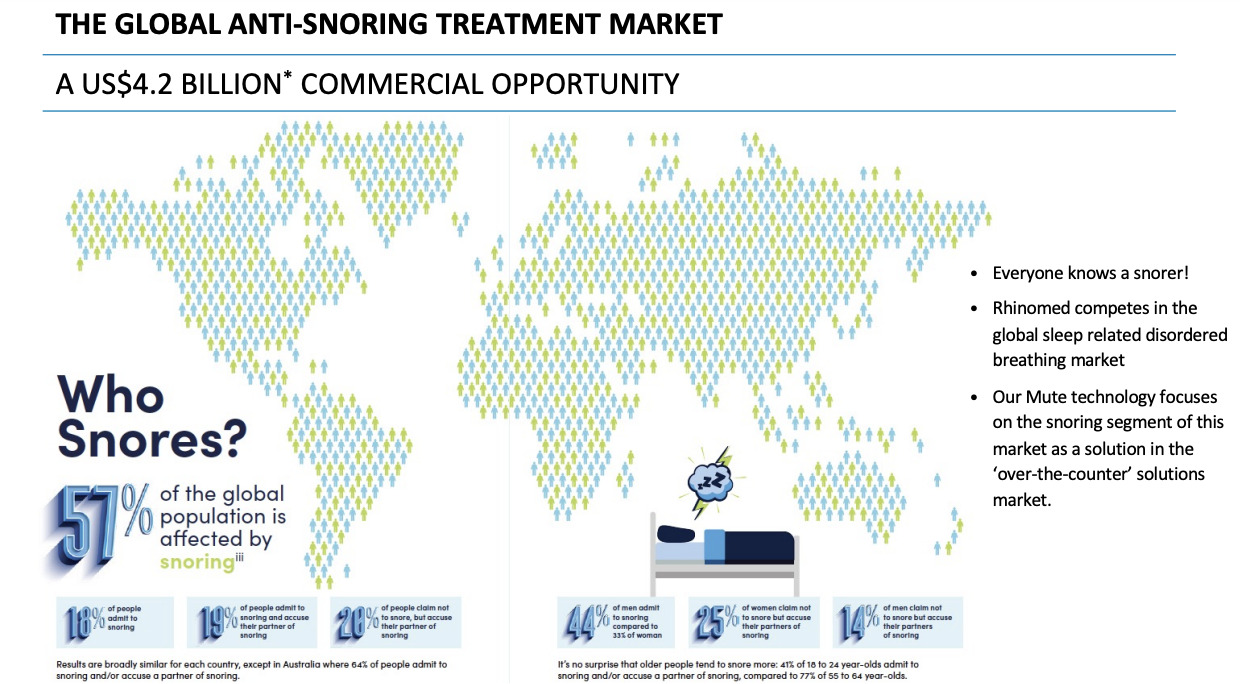

Rhinomed (ASX:RNO) is another wee mystery to me on Wednesday.

The ‘nasal spray and and airway technology’ company’s stock is up over +20%.

Trawling through any recent news, and I do have these terrific moments from the AGM materials:

And I also have this:

Probably not worth a random 20% bump, but totally newsworthy all the same.

At the AGM on the Nov. 17th, CEO Michael Johnson emphasized a cost reduction and right sizing program of this shape:

• Reduced headcount

• Reduction in marketing expenditure

• Implement new NetSuite ERP system

• Successfully achieve ISO 134386 certification

• Delivering $4.8m in savings and a reduction in expenditure of 30% when compared to FY22 operational expenditure

• Drive to breakeven in 2H FY24

If it worked for META then it could be working for RNO.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the day’s worst performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| REM | Remsensetechnologies | 0.018 | -35% | 5,000 | $2,906,239 |

| CHK | Cohiba Min Ltd | 0.002 | -33% | 2,150,000 | $6,639,733 |

| VPR | Volt Power Group | 0.001 | 0% | 244,234 | $16,074,312 |

| EML | EML Payments Ltd | 0.77 | -30% | 25,534,375 | $410,189,482 |

| SIS | Simble Solutions | 0.003 | -25% | 200,383 | $2,411,803 |

| FFG | Fatfish Group | 0.011 | -21% | 39,647,587 | $16,663,356 |

| CRB | Carbine Resources | 0.004 | -20% | 950,000 | $2,758,689 |

| SRJ | SRJ Technologies | 0.075 | -19% | 75,000 | $14,059,899 |

| 8CO | 8Common Limited | 0.058 | -18% | 440,504 | $15,910,738 |

| PSL | Paterson Resources | 0.029 | -17% | 317,631 | $13,905,301 |

| G50 | Gold50Limited | 0.125 | -17% | 21,756 | $16,393,500 |

| FGL | Frugl Group Limited | 0.01 | -17% | 4,173,110 | $11,532,744 |

| IXU | Ixup Limited | 0.046 | -16% | 279,166 | $59,488,476 |

| DTC | Damstra Holdings | 0.16 | -16% | 1,952,126 | $48,997,598 |

| SCT | Scout Security Ltd | 0.016 | -16% | 33,948 | $4,416,120 |

| CRS | Caprice Resources | 0.027 | -16% | 80,000 | $4,296,602 |

| MCP | McPherson's Ltd | 0.425 | -15% | 125,746 | $71,974,571 |

| ADVDB | Ardiden Ltd | 0.18 | -14% | 187,547 | $13,128,676 |

| ADG | Adelong Gold Limited | 0.006 | -14% | 6,645,678 | $4,174,256 |

| AL8 | Alderan Resource Ltd | 0.006 | -14% | 797,725 | $7,748,029 |

| AR9 | Archtis Limited | 0.12 | -14% | 294,802 | $39,996,169 |

| BFC | Beston Global Ltd | 0.006 | -14% | 777,422 | $13,979,328 |

| IBG | Ironbark Zinc Ltd | 0.006 | -14% | 1,370,386 | $10,317,108 |

| IVX | Invion Ltd | 0.006 | -14% | 2,219,075 | $44,951,425 |

| LRL | Labyrinth Resources | 0.006 | -14% | 1,025,488 | $8,312,806 |

TRADING HALTS

Metrics Master Income Trust (ASX: MXT) – Pending an announcement in relation to a capital raising

Rectifier Technologies (ASX:RFT) – Pending an announcement regard to the appointment of an additional Australian resident Director

Respiri (ASX:RSH) – Pending an announcement regarding a capital raising and placement of shares

Great Western Exploration (ASX:GTE) – Pending an announcement in relation to a fund raising

Mitre Mining (ASX:MMC) – Pending an announcement in relation to a material acquisition and capital raising

Dreadnought Resources (ASX:DRE) – Pending a material release regarding a Resource upgrade at the Company’s Mangaroon Rare Earths Project

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.