Closing Bell: ASX surges as missiles fly ahead of Iran-Israel ceasefire

The ASX followed global markets higher as the Iran-Israel ceasefire approaches, adding 1pc. Pic: Getty Images

- ASX surges 1pc as Iran and Israel approach ceasefire

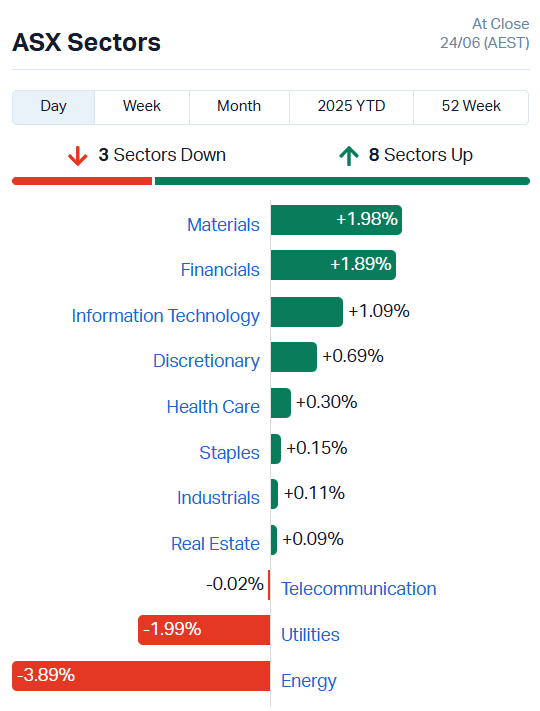

- Materials and financials lead gains, adding more than 1.8pc each

- Energy sector drags, shedding 3.89pc as oil slumps

ASX on the rise as missiles keep firing

The ASX shot up 1% today, with traders springing quickly into action as soon as the dust seemed to settle over the Israel-Iran-US conflict.

US President Trump insists he’s negotiated an official ceasefire between the two nations, to be enacted in 12-hour stages.

The announcement came after a token attack by Iran on a US base in Qatar resulted in zero casualties.

While that seems to have reassured the global audience that the US won’t be escalating its involvement anytime soon, the missiles have certainly not ceased.

Iran has reportedly fired six separate waves of attacks at Israel in the intervening hours, killing at least three people.

Tehran’s state-run TV broadcaster noted the ceasefire had officially begun at about 2:30 pm AEST.

Both sides have acknowledged the ceasefire agreement, but warn the fighting will only end if the other party doesn’t violate it.

If all goes to President Trump’s plan, Israel will also cease its military operations within the next 12 hours, ending the conflict.

Here’s hoping.

In the meantime, the market was roaring, with eight sectors on the up. Materials (+1.98%) and financials (+1.89%) led the way, with info tech (+1.09%) not far behind.

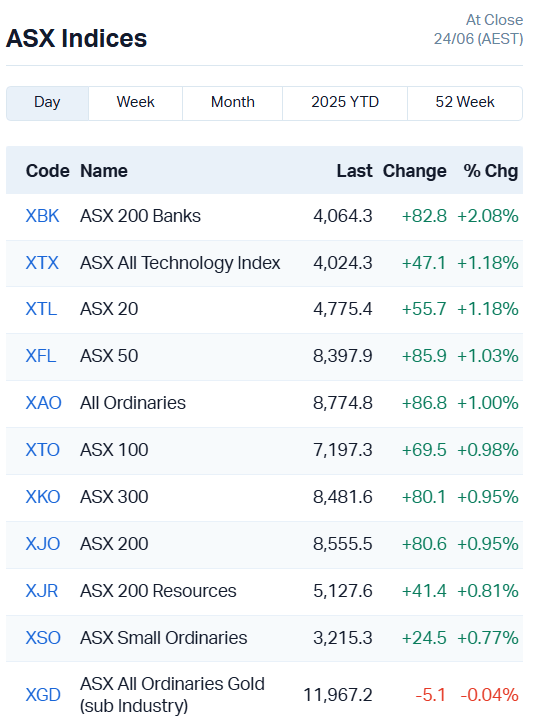

The ASX 200 Banks and All Tech indices are also on a tear, adding more than 2% and 1% respectively.

The ASX 200 Resources index is also having a look in, up 0.8%

Commonwealth Bank nabs new record high

Shares in Commonwealth Bank (ASX:CBA) jumped 2.31% in trade and are now worth $188.60 each, totalling a market capitalisation of $315 billion as the biggest stock on the ASX.

Now worth more than Westpac (ASX:WBC) and National Australia Bank (ASX:NAB) combined, CBA must be doing something special… right?

Maybe.

Morgan Stanley analyst Richard Wiles says CBA’s price-to-earnings ratio has hit 28, a price point he considers “very difficult to justify” given the bank’s potential forward profit growth.

That said, Nvidia’s price-to-earnings ratio is 46.4, and that Magnificent 7 darling has surged more than 1400% over the past five years, so a lopsided P/E isn’t exactly a death knoll for a stock – not if traders keep buying it, anyway.

CBA isn’t the only stock among its banking brethren making gains. NAB has also added 2.2%, WBC 2.6%, ANZ (ASX:ANZ) 1.3% and Macquarie Group (ASX:MQG) 2.4%.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| GBZ | GBM Rsources Ltd | 0.014 | 133% | 68637883 | $7,026,420 |

| OLY | Olympio Metals Ltd | 0.08 | 86% | 2212203 | $3,786,894 |

| OLH | Oldfields Holdings | 0.025 | 56% | 324319 | $3,408,946 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 5007393 | $6,684,681 |

| JAY | Jayride Group | 0.0015 | 50% | 300001 | $1,427,889 |

| OVT | Ovanti Limited | 0.003 | 50% | 26950886 | $6,011,030 |

| TMK | TMK Energy Limited | 0.003 | 50% | 10552679 | $20,444,766 |

| CDE | Codeifai Limited | 0.048 | 41% | 5524235 | $15,059,907 |

| SRL | Sunrise | 0.91 | 40% | 922202 | $71,647,874 |

| HLX | Helix Resources | 0.002 | 33% | 2500000 | $5,046,291 |

| PGY | Pilot Energy Ltd | 0.008 | 33% | 18033735 | $12,951,960 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 2779483 | $7,254,899 |

| SPQ | Superior Resources | 0.004 | 33% | 1272638 | $7,112,948 |

| AM5 | Antares Metals | 0.009 | 29% | 13633211 | $3,603,970 |

| VAR | Variscan Mines Ltd | 0.009 | 29% | 5510600 | $5,480,004 |

| RML | Resolution Minerals | 0.051 | 28% | 73528751 | $26,325,061 |

| FIN | FIN Resources Ltd | 0.005 | 25% | 205254 | $2,779,554 |

| LMG | Latrobe Magnesium | 0.01 | 25% | 5097110 | $21,012,720 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 5721209 | $3,665,173 |

| SRJ | SRJ Technologies | 0.005 | 25% | 5635496 | $2,422,312 |

| NH3 | Nh3Cleanenergyltd | 0.032 | 23% | 957453 | $14,679,724 |

| LOC | Locatetechnologies | 0.165 | 22% | 3688363 | $30,865,953 |

| IVG | Invert Graphite Ltd | 0.033 | 22% | 1828732 | $9,247,976 |

| PSL | Paterson Resources | 0.018 | 20% | 344830 | $6,840,568 |

| AJL | AJ Lucas Group | 0.006 | 20% | 369982 | $6,878,648 |

Making news…

GBM Resources (ASX:GBZ) will soon be well-funded and debt-free, if the company’s fundraising and reconsolidation plans resolve as expected.

GBZ is looking to raise $13m through a placement that will see incoming chair Ian Middlemas subscribe for $1.2m in shares. The funds will be used to strike out a $6.2m convertible note debt facility with Collins St Asset Management.

The company has also reached an agreement with farm-in partner Wise Walkers to reconsolidate full ownership of the Twin Hills gold asset, converting $2m already spent on the farm-in into equity in GBZ.

If all goes to plan, GBZ will be unencumbered by debt, with full ownership of its 1.84-million-ounce gold inventory across the Twin Hills and Yandan projects.

Olympio Metals (ASX:OLY) has kicked off a maiden drilling program at the Bousquet gold project with a glitter, hitting visible gold in the first drill hole.

The 9m mineralised zone hasn’t been assayed for an official gold grade yet, but Olympio reckons the geology there is already showing a lot of promise, with strong alteration apparent all the way down to 286 metres of depth. OLY expects to have assays in hand by mid-July.

It’s a great start for a project sitting in a particularly fertile fault zone at the Cadillac-Larder Lake Break, which has produced over 100 million ounces of gold over the decades.

Antares Metals (ASX:AM5) is after a different kind of glow at its Mt Isa North project, where a data review has highlighted 49 individual uranium targets.

AM5 has picked out 10 it thinks are particularly promising, demonstrating characteristics similar to the Valhalla uranium deposit 40km to the northwest of Mt Isa.

Valhalla, owned by Paladin Energy (ASX:PDN), held a JORC resource of 34,550 tonnes of uranium in 2023; a yellowcake bounty AM5 will hope to mirror.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AN1 | Anagenics Limited | 0.004 | -33% | 9020000 | $2,977,922 |

| ERA | Energy Resources | 0.002 | -33% | 7871287 | $1,216,188,722 |

| GMN | Gold Mountain Ltd | 0.001 | -33% | 1.39E+08 | $8,429,639 |

| TEG | Triangle Energy Ltd | 0.002 | -33% | 6698891 | $6,267,702 |

| ANX | Anax Metals Ltd | 0.005 | -29% | 21916830 | $6,179,653 |

| AMS | Atomos | 0.003 | -25% | 8503915 | $4,860,074 |

| ASR | Asra Minerals Ltd | 0.0015 | -25% | 34498500 | $7,983,396 |

| HCD | Hydrocarbon Dynamics | 0.0015 | -25% | 2185 | $2,156,219 |

| WBE | Whitebark Energy | 0.003 | -25% | 1773408 | $2,749,334 |

| COY | Coppermoly Limited | 0.011 | -21% | 688940 | $12,357,204 |

| BRU | Buru Energy | 0.024 | -20% | 12012602 | $23,382,288 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 1652605 | $10,343,383 |

| CUL | Cullen Resources | 0.004 | -20% | 1643867 | $3,467,009 |

| EE1 | Earths Energy Ltd | 0.004 | -20% | 808300 | $2,649,821 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 60000 | $7,963,906 |

| SKK | Stakk Limited | 0.004 | -20% | 23035 | $10,375,398 |

| AQC | Auspaccoal Ltd | 0.044 | -20% | 3308771 | $38,525,718 |

| TGH | Terragen | 0.017 | -19% | 11756 | $10,605,361 |

| BEZ | Besragoldinc | 0.047 | -19% | 3795570 | $24,098,824 |

| CML | Connected Minerals | 0.11 | -19% | 25245 | $5,583,359 |

| BEL | Bentley Capital Ltd | 0.009 | -18% | 31765 | $837,407 |

| HCL | Highcom Ltd | 0.27 | -17% | 981821 | $33,371,868 |

| AZL | Arizona Lithium Ltd | 0.005 | -17% | 6033122 | $31,621,887 |

| CTQ | Careteq Limited | 0.01 | -17% | 500162 | $2,845,425 |

| CYQ | Cycliq Group Ltd | 0.0025 | -17% | 233333 | $1,381,550 |

IN CASE YOU MISSED IT

Brightstar Resources’ (ASX:BTR) ongoing infill and extensional drill campaign at the 1.5Moz Sandstone hub in WA’s East Murchison region has highlighted significant potential for bulk-tonnage gold.

White Cliff Minerals (ASX:WCN) has bolstered its board with John Hancock as it looks to capitalise on a large-scale Canadian copper opportunity.

Many Peaks Minerals’ (ASX:MPK) diamond drilling has further enhanced the scale potential of its Ferké gold project in Côte d’Ivoire after all holes drilled to date returned significant gold intersections.

DigitalX (ASX:DCC) backs US stablecoin breakthrough as turning point for global crypto adoption.

Brookside Energy (ASX:BRK) is on a roll in its SWISH Play acreage within the world-class Anadarko Basin with addition of a fifth drilling spacing unit (DSU).

Victory Metals (ASX:VTM) has received US$10 million from Saudi Arabia to advance its North Stanmore rare earths project.

European Lithium (ASX:EUR) subsidiary Critical Metals Corp will start diamond drilling shortly at the Tanbreez rare earths project in Greenland.

Antares Metals (ASX:AM5) has defined priority uranium targets for follow-up exploration at its Mt Isa North project in Queensland.

RareX (ASX:REE) has struck high-grade gallium mineralisation at its Cummins Range project, placing it as one of Australia’s most “geopolitically relevant” mineral deposits.

Surface geochemical sampling at Koonenberry Gold’s (ASX:KNB) Enmore gold project has grown the Sunnyside gold system to a potential strike length of ~2km.

St George Mining (ASX:SGQ) is deepening ties with local government and the community in Minas Gerais, Brazil, as it moves to develop the Araxá niobium-REE project.

Rhythm Biosciences (ASX:RHY) has secured full reinstatement of NATA accreditation for the Genetype cancer risk assessment portfolio, acquired from Genetic Technologies’ administrators.

TRADING HALTS

Adherium Limited (ASX:ADR) – cap raise

Bannerman Energy Ltd (ASX:BMN) – cap raise

Bowen Coking Coal Ltd (ASX:BCB) – funding operations update

Develop Global Ltd (ASX:DVP) – cap raise

Firebrick Pharma Ltd (ASX:FRE) – cap raise

MTM Critical Metals Ltd (ASX:MTM) – cap raise

Rapid Critical Metals Ltd (ASX:RCM) – cap raise

At Stockhead, we tell it like it is. While Antares Metals is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.