Closing Bell: ASX steady as coal play Coronado sinks 16pc; NextDC rides on data centre boom

NextDC rides data centre boom. Picture Getty

- ASX up on Thursday, tech stocks rise boosted by NextDC

- Wodside Energy drops due to downgrade and oil price fall

- Iron Ore and coal slide, and Coronado sinks on production and cost issues

After a rough session on Wednesday, the ASX saw a bit of a lift today, up 0.29%.

Overnight in New York, shares eased as investors held back waiting for Friday’s August payrolls report, which could sway the US Fed’s decision on whether to cut rates by 25 or 50 basis points.

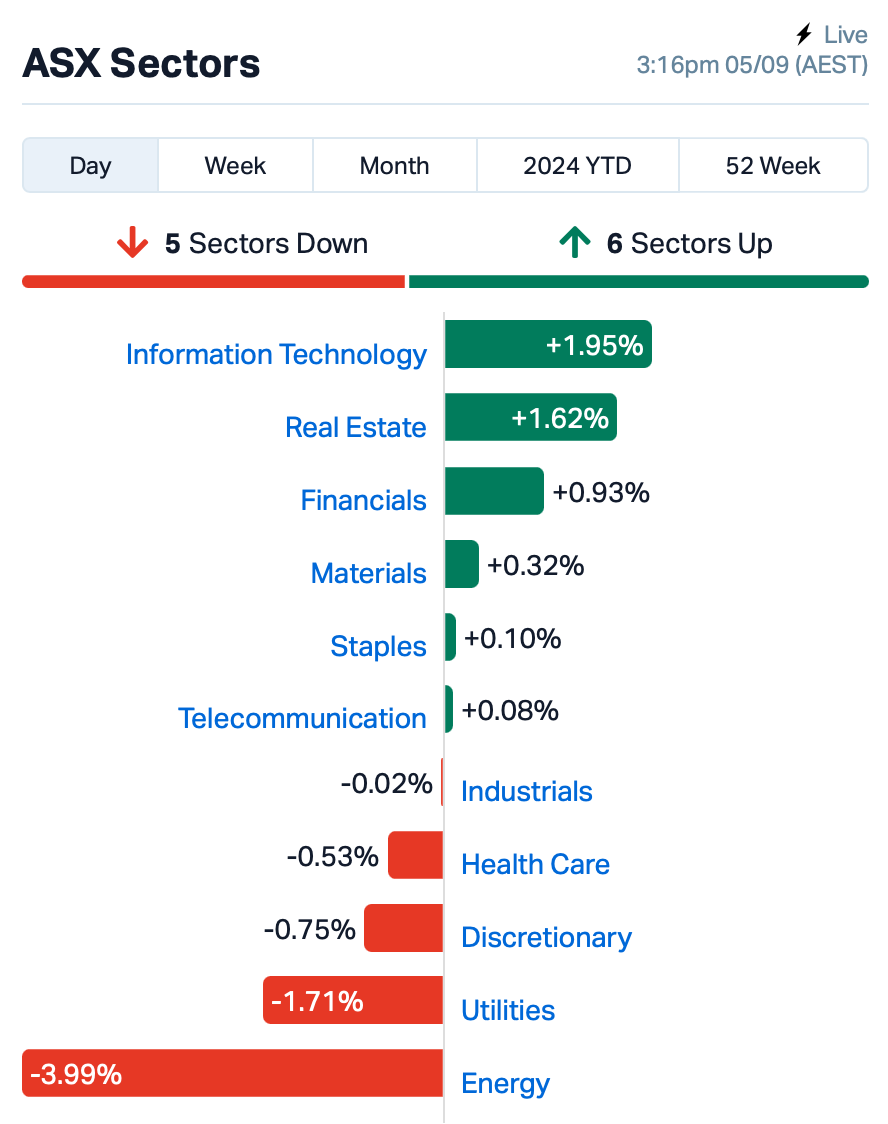

On the ASX today, Tech was the best performer, while Energy slumped.

Woodside Energy (ASX:WDS) is dragging down the gains, plummeting 6% due to a Citi downgrade and falling oil prices, plus it’s trading ex-dividend.

Crude prices have dropped to their lowest in over a year as worries about weaker demand overshadowed talk of OPEC+ delaying supply increases.

The data centre boom, meanwhile, is boosting NextDC (ASX:NXT) share price today, which surged 9% as it claimed top spot in the large caps space.

This follows Blackstone’s $24 billion acquisition of AirTrunk, which has put the spotlight on data centre stocks amid rising demand for data storage driven by AI and cloud computing.

Still in the large caps space, metallurgical coal producer, Coronado Global Resources (ASX:CRN), sank 16% after saying that it expects saleable coal production for FY24 to be lower, between 15.4 and 16 million tonnes, down from earlier estimates of 16.4 to 17.2 million tonnes.

At the same time, its mining costs are rising to $105-$110 per tonne, up from $95-$99. The company cited Queensland’s tough coal royalty rules and recent production cuts caused by rain for the downgrade.

Financial stock Challenger (ASX:CGF) was also sold off by 10% today after revealing that asset manager Apollo has cut its stake in Challenger from 20.1% to 9.9%.

Elsewhere, iron ore prices have dropped to $US90 a tonne, their lowest since late 2022, as China’s property crisis hits steel production hard.

Iron ore prices have fallen more than a third this year and are down 10% just this week, putting related ASX stocks under pressure.

What else is happening?

Asian stocks and US futures dipped as traders waited for Friday’s US payrolls report.

The MSCI Asia Pacific Index lost most of its earlier gains, with Japan’s Nikkei 225 down over 1%, while South Korea and Hong Kong indexes also fell.

Concerns about the global tech sector, particularly Nvidia’s recent plunge, are also weighing on sentiment.

Looking ahead to tonight’s US session, we’ll see July income and spending data, the PCE price index, the Chicago PMI, and the final August consumer sentiment report from the University of Michigan.

Meanwhile, the Euro zone will release its preliminary August CPI inflation figures.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LPD | Lepidico Ltd | 0.002 | 100% | 8,706,381 | $8,589,125 |

| CRB | Carbine Resources | 0.004 | 33% | 277,292 | $1,655,213 |

| EDE | Eden Inv Ltd | 0.002 | 33% | 500,373 | $6,162,314 |

| SMM | Somerset Minerals | 0.004 | 33% | 250,075 | $3,092,996 |

| EMD | Emyria Limited | 0.048 | 33% | 2,205,615 | $14,723,618 |

| AIV | Activex Limited | 0.009 | 29% | 310,000 | $1,508,518 |

| EME | Energy Metals Ltd | 0.088 | 26% | 4,455,774 | $14,677,832 |

| 1CG | One Click Group Ltd | 0.010 | 25% | 97,800 | $5,625,431 |

| ECT | Env Clean Tech Ltd. | 0.003 | 25% | 218,047 | $6,343,621 |

| FGH | Foresta Group | 0.005 | 25% | 617,225 | $9,421,516 |

| IVX | Invion Ltd | 0.003 | 25% | 231,500 | $13,275,731 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 134,481 | $8,846,989 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 200,000 | $13,151,701 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 2,513,110 | $16,634,713 |

| H2G | Greenhy2 Limited | 0.006 | 20% | 1,000,226 | $2,990,921 |

| SVG | Savannah Goldfields | 0.025 | 19% | 115,589 | $5,902,783 |

| PBL | Parabellumresources | 0.045 | 18% | 62,940 | $2,367,400 |

| SES | Secos Group Ltd | 0.021 | 17% | 216,544 | $10,738,980 |

| TAT | Tartana Minerals Ltd | 0.029 | 16% | 71,595 | $4,566,147 |

| M2R | Miramar | 0.015 | 15% | 8,547,843 | $5,132,134 |

| RSH | Respiri Limited | 0.030 | 15% | 1,446,797 | $33,403,992 |

| EVS | Envirosuite Ltd | 0.062 | 15% | 6,263,130 | $68,486,699 |

| MME | Moneyme Limited | 0.120 | 14% | 473,673 | $84,008,240 |

| SGI | Stealth Grp Holding | 0.340 | 13% | 1,898,698 | $34,618,663 |

| NOX | Noxopharm Limited | 0.130 | 13% | 776,198 | $33,607,364 |

Surefire Resources (ASX:SRN) was up on on news that a detailed soil sampling programme has turned up highly anomalous copper and zinc assays, with values up to 1000ppm Nickel, 310ppm Copper; 100ppm Zinc, 100ppm Cobalt and 452ppm Sulphur at the company’s Yidby gold project in the mid-west of Western Australia.

Earlier, Matsa Resources (ASX:MAT) was up on news that it has executed an extension to the Confidentiality Agreement it had previously executed on 31 July 2023 with AngloGold Ashanti Australia, granting it a 45-day extension as talks continue about the future of of the Lake Carey gold project.

Nova Minerals (ASX:NVA) was up on news that the company has sent off two bulk samples for testing for antimony content. Nova has sent 2,500kg from its Stibium prospect and another 500kg from its Styx prospect off to the lab, along with other samples sent to ALS Laboratories, with results expected in the coming weeks.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| LSR | Lodestar Minerals | 0.001 | -50% | 6,704,316 | $5,301,560 |

| BNL | Blue Star Helium Ltd | 0.004 | -33% | 7,937,638 | $11,669,312 |

| BP8 | Bph Global Ltd | 0.002 | -33% | 483 | $1,189,924 |

| GCM | Green Critical Min | 0.002 | -33% | 4,850,000 | $4,405,628 |

| FAL | Falconmetalsltd | 0.220 | -27% | 2,540,090 | $53,100,000 |

| BCT | Bluechiip Limited | 0.003 | -25% | 5,314,298 | $4,728,158 |

| MTL | Mantle Minerals Ltd | 0.002 | -25% | 2,022,225 | $12,394,892 |

| WBE | Whitebark Energy | 0.007 | -22% | 960 | $2,271,001 |

| ADG | Adelong Gold Limited | 0.004 | -20% | 1,022,000 | $5,589,945 |

| AHN | Athena Resources | 0.004 | -20% | 16,529 | $5,352,338 |

| EOF | Ecofibre Limited | 0.025 | -19% | 11,985 | $11,745,091 |

| EMS | Eastern Metals | 0.026 | -19% | 1,170,717 | $3,637,640 |

| SPQ | Superior Resources | 0.009 | -18% | 2,055,334 | $22,013,425 |

| ICI | Icandy Interactive | 0.023 | -18% | 1,410,341 | $37,655,547 |

| OPL | Opyl Limited | 0.015 | -17% | 102,180 | $3,072,863 |

| HOR | Horseshoe Metals Ltd | 0.005 | -17% | 3,747,290 | $3,979,690 |

| PUR | Pursuit Minerals | 0.003 | -17% | 750,000 | $10,906,200 |

| ROG | Red Sky Energy. | 0.005 | -17% | 15,889,954 | $32,533,363 |

| TX3 | Trinex Minerals Ltd | 0.003 | -17% | 410,000 | $5,485,957 |

| CRN | Coronado Global Res | 0.915 | -16% | 11,946,573 | $1,835,716,834 |

| 8VI | 8Vi Holdings Limited | 0.057 | -16% | 30 | $2,849,977 |

| LLI | Loyal Lithium Ltd | 0.105 | -16% | 322,827 | $11,591,633 |

| HMD | Heramed Limited | 0.022 | -15% | 65,000 | $16,464,495 |

| TSI | Top Shelf | 0.050 | -15% | 270,924 | $19,181,334 |

| KPO | Kalina Power Limited | 0.009 | -15% | 2,228,913 | $24,863,940 |

On the downside, Falcon Metals (ASX:FAL) has seen a setback to the expected date of re-commencing drilling to test the extent of the high-grade Farrelly Mineral Sands Deposit, initially targeted for Q4 2024. Landowners at the site have reportedly decided not to allow access to the site, and Falcon says negotiations are continuing with the hope of finding a resolution soon.

IN CASE YOU MISSED IT

Aura Energy (ASX:AEE) has lodged an exploitation permit application for its Häggån polymetallic project in Sweden, which will give it a 25 year tenure if granted. This comes as the Swedish Government moves to lift its ban on uranium extraction.

Brazilian Critical Minerals (ASX:BCM) has signed a non-binding memorandum of understanding with the SENAI Regional Department of Minas Gerais, Brazil, to jointly research and produce rare earths magnets.

Earths Energy (ASX:EE1) has expanded the scope of an initial techno-economic assessment of its flagship Paralana and Flinders West geothermal projects in South Australia into a comprehensive feasibility study. This will provide a clear path to maximise energy production and integration of potential CCUS technologies.

Elevate Uranium (ASX:EL8) has advised that its partner Energy Metals (ASX:EME) has drilled two holes at their Bigrlyi joint venture project in the Northern Territory that intersected multiple zones of high-grade uranium mineralisation within the A4 sub-deposit.

BRD2408 returned a 10.6m intersection grading 0.86% (8600 parts per million) eU3O8 from a down-hole depth of 529.1m including multiple zones exceeding 1% eU3O8 while BRD2409 returned 5.3m at 0.61% eU3O8. The mineralised zone remains open at depth and resource extension drilling is continuing. EL8 holds a 20.8% interest in the Bigrlyi JV.

Far East Gold (ASX:FEG) has signed a conditional agreement for an investment of more than $14m from Chinese silver miner Xingye Silver & Tin Mining Co. at a 21% premium to its last traded price. This gives Xingye a 19.99% stake in the company.

Sun Silver (ASX:SS1) has been shortlisted for a US$60m tax credit from the US Federal Government’s Qualifying Advanced Energy Project Allocation Program for its Silver Paste project. This offers a 30% investment tax credit to projects that support advanced energy manufacturing and enhance US competitiveness in clean energy.

Blue Star Helium (ASX:BNL) has received firm commitments to raise $3m via an institutional investment of 750m new ordinary shares to institutional and sophisticated investors at an issue price of 0.4c.

Funds raised from the placement will allow BNL to progress helium development and exploration evaluation activities across its Las Animas acreage in Colorado, including the Galactica/Pegasus and Serenity projects.

“We are very pleased to have received such encouraging support from existing shareholders and look forward to an exciting quarter of activity across multiple projects culminating in production early in H1 2025,” BNL managing director and CEO Trent Spry said.

TRADING HALTS

Elevate Uranium (ASX:EL8) – to enable the release by the Company of significant drilling results reported by a joint venture partner.

Global Data Centre (ASX:GDC) – pending an announcement concerning its indirect interest in AirTrunk.

Echo IQ (ASX:EIQ) – pending an announcement with regards to a proposed capital raising.

WIN Metals (ASX:WIN) – pending the release of an announcement regarding a capital raising.

Sunstone Metals (ASX:STM) – pending the release of an announcement regarding a proposed capital raising.

Keypath Education (ASX:KED) – pending the outcome of the special meeting of Keypath stockholders to approve to the merger between Keypath and Karpos Merger Sub.

At Stockhead, we tell it like it is. While Blue Star Helium, Aura Energy, Brazilian Critical Minerals, Earths Energy, Elevate Uranium, Far East Gold and Sun Silver are Stockhead advertisers, they did not sponsor this article.

Today’s Closing Bell is brought to you by Webull Securities. Webull Securities (Australia) Pty. Ltd. is a CHESS-sponsored broker and a registered trading participant on the ASX.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.