Closing Bell: ASX stays on the defensive to finish flat as US government shutdown begins

A rotation into defensive sectors has played out well for the ASX today, with the market ending flat despite more chaos out of the US. Pic: Getty Images

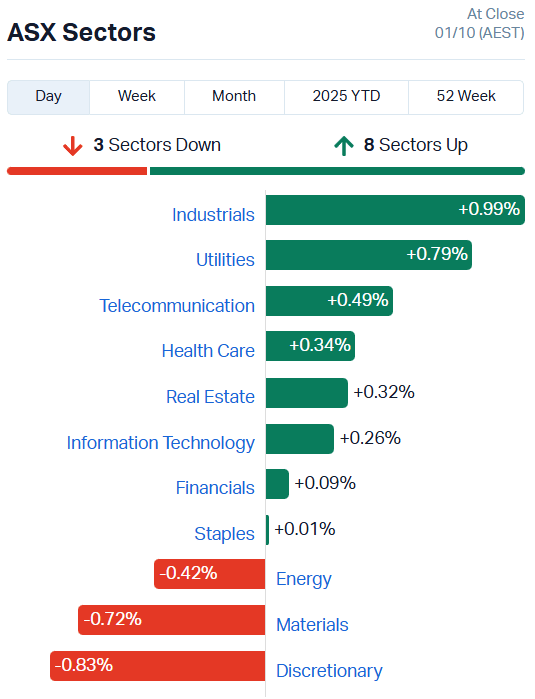

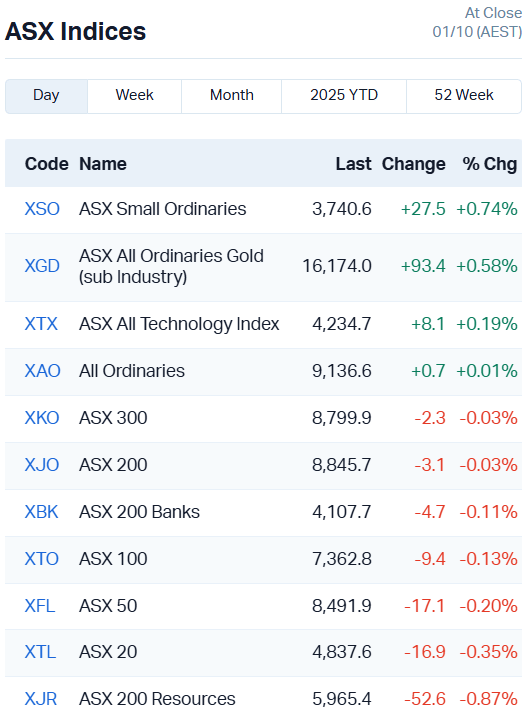

- ASX 200 down just 3 points, All Ords up 0.7 points

- Defensive stocks bulwark ASX against US government shut down

- China-BHP stoush and lithium losses weigh on materials sector

ASX plays it safe as US government shutdown kicks off

The ASX 200 managed to navigate the day pretty much unharmed, finishing trading down just 3 points.

Trump certainly didn’t chicken out this time. The US government is officially shutdown, with no clear plan in place to restore it.

While that won’t mean much for global markets in the short term, the SEC is effectively shuttered during a shut down. That means no new applications for stock offerings, mergers and acquisitions on Wall Street.

Back home, support came from our defensive sectors in industrials, utilities and health care, with some help from the gold index.

Actual defence stocks – that is, military-relevant companies – are also on the up, with several stocks making powerful moves.

Elsight (ASX:ELS), a defence tech stock based in Israel, just locked in a US$5.35 million contract with a European defence customer for its drone connectivity Halo platform.

The company surged 28% today, with revenue in July and August alone exceeding its H1 totals to bring total CY25 numbers to US$11.6 million as investment in drone technologies ramps up globally.

DroneShield (ASX:DRS) continued its dizzying bull run, up 21% on no news. The stock has rocketed more than 500% in the last six months.

Some of the love ricocheted toward peers Electro Optic Systems (ASX:EOS) and Austal (ASX:ASB) which lifted 0.88% and 6.33% respectively.

Materials pulls in both directions

The materials sector was 0.72% lower today.

BHP (ASX:BHP) was the main culprit. The iron ore heavyweight has been temporarily locked out of Chinese ports, cutting its share price 2.49%.

Analysts aren’t terribly concerned about the long-term risks. BHP currently supplies about 16% of China’s iron ore imports, according to RBC Capital Markets. Beijing simply won’t be able to play hard ball for long without severely impacting its steel industry.

Lithium was also out of favour as China’s supply forecast lifted.

Pilbara Minerals (ASX:PLS) shed 6.35%, Liontown Resources (ASX:LTR) 10.66% and Mineral Resources (ASX:MIN) 3.91%.

Gold stocks were mixed despite the near all-time high gold price.

St George Mining (ASX:SGQ) shed 12%, Brightstar Resources (ASX:BTR) 4.4% and Firefly Metals (ASX:FFM) 3.75%.

On the other hand, Lindian Resources (ASX:LIN) surged 15%, Larvotto Resources (ASX:LRV) added 8.67% and their larger cousin Westgold Resources (ASX:WGX) jumped 10.7%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TMB | Tambourahmetals | 0.125 | 205% | 81372478 | $6,846,123 |

| BMO | Bastion Minerals | 0.0015 | 50% | 3273076 | $2,204,953 |

| ADG | Adelong Gold Limited | 0.01 | 43% | 70316180 | $17,967,855 |

| EXT | Excite Technology | 0.01 | 43% | 72343199 | $14,508,494 |

| DBO | Diabloresources | 0.054 | 42% | 32342435 | $6,715,620 |

| LMS | Litchfield Minerals | 0.16 | 33% | 706812 | $5,285,527 |

| NVA | Nova Minerals Ltd | 0.585 | 33% | 9265946 | $176,942,443 |

| FGH | Foresta Group | 0.039 | 30% | 14762332 | $79,587,194 |

| ELS | Elsight Ltd | 2.15 | 28% | 5517986 | $365,927,053 |

| GA8 | Goldarc Resources | 0.038 | 27% | 5593260 | $17,025,579 |

| ERA | Energy Resources | 0.0025 | 25% | 117215 | $810,792,482 |

| FAU | First Au Ltd | 0.01 | 25% | 45328445 | $20,931,878 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 4834515 | $13,655,414 |

| MEG | Megado Minerals Ltd | 0.04 | 25% | 3545626 | $20,661,864 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 5341356 | $13,483,725 |

| ZMI | Zinc of Ireland NL | 0.01 | 25% | 4251860 | $4,656,086 |

| SVG | Savannah Goldfields | 0.026 | 24% | 37679804 | $29,737,265 |

| HIQ | Hitiq Limited | 0.021 | 24% | 50000 | $8,025,788 |

| OMG | OMG Group Limited | 0.011 | 22% | 23897894 | $8,018,943 |

| TBN | Tamboran | 0.22 | 22% | 9810998 | $250,284,780 |

| DRO | Droneshield Limited | 5.68 | 22% | 40030018 | $4,076,189,860 |

| CAE | Cannindah Resources | 0.04 | 21% | 2183678 | $34,037,738 |

| LPM | Lithium Plus | 0.115 | 21% | 684657 | $12,619,800 |

| NAE | New Age Exploration | 0.003 | 20% | 394170 | $6,764,779 |

| SER | Strategic Energy | 0.006 | 20% | 2546952 | $5,494,667 |

In the news…

Tambourah Metals (ASX:TMB) has identified the Beatty Park South project as an emerging gold system with potential for growth after hitting 24m at 18.8g/t gold from 20m. The drill bit struck both oxide and fresh rock gold targets, with results peaking at 4m at 92.2g/t gold.

TMB is keen to follow up with reverse circulation drilling, having only tested 25% of the 500-metre-long gold-in-soil anomaly.

Excite Technology (ASX:EXT) has knocked it out of the park with record monthly sales totalling $7.14 million in September.

The cybersecurity and digital forensics company points to the strength of its contract partnerships as the core driver of its growth. EXT has more than doubled its monthly sales value since its last record month of July, when the company pulled in $3 million.

Diablo Resources (ASX:DBO) is preparing to make its play into the US antimony and critical mineral supply chains with the acquisition of the Star Range silver-antimony project in Utah.

DBO is cashed up to make the purchase after securing $2 million in a capital raise. The company will now look to fast track the 2,100-acre project alongside its Phoenix copper project.

Litchfield Minerals (ASX:LMS) has managed the unusual – its share price rose sharply today on what would normally be bad news.

LMS was planning to kick off a drilling program at its Oonagalabi project today, but a mechanical failure on the drill rig chucked a spanner in the works.

Investors seem to have been impressed by LMS’ quick solution. The company has already leveraged its “strong industry relationships” to secure a new rig, which will begin drilling on Friday, October 3. LMS has also mobilised a second rig to begin drilling within seven days to recover lost time. Talk about turning a problem into an opportunity.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| HLX | Helix Resources | 0.001 | -33% | 122000 | $8,019,436 |

| IXRR | Ionic Rare Earths - Rights | 0.002 | -33% | 7093092 | $1,138,891 |

| SRN | Surefire Rescs NL | 0.001 | -33% | 689375 | $5,860,289 |

| 1TT | Thrive Tribe Tech | 0.003 | -25% | 6020154 | $1,649,964 |

| JAV | Javelin Minerals Ltd | 0.003 | -25% | 15771086 | $30,280,900 |

| LNU | Linius Tech Limited | 0.0015 | -25% | 42945 | $13,179,029 |

| MOM | Moab Minerals Ltd | 0.0015 | -25% | 10442076 | $3,749,332 |

| IFG | Infocusgroup Hldltd | 0.018 | -22% | 6983044 | $10,067,353 |

| BLZ | Blaze Minerals Ltd | 0.002 | -20% | 16356 | $7,187,500 |

| PIL | Peppermint Inv Ltd | 0.002 | -20% | 248000 | $6,179,560 |

| EM2 | Eagle Mountain | 0.009 | -18% | 6889862 | $12,485,410 |

| RMX | Red Mount Min Ltd | 0.029 | -17% | 37146467 | $22,438,067 |

| G88 | Golden Mile Res Ltd | 0.01 | -17% | 789317 | $7,510,620 |

| OEL | Otto Energy Limited | 0.005 | -17% | 10614325 | $28,770,059 |

| WIN | WIN Metals | 0.047 | -16% | 8121566 | $38,504,146 |

| IVG | Invert Graphite Ltd | 0.032 | -16% | 412673 | $13,015,670 |

| LML | Lincoln Minerals | 0.006 | -14% | 619070 | $18,045,558 |

| MOH | Moho Resources | 0.006 | -14% | 500000 | $5,217,898 |

| AKO | Akora Resources | 0.086 | -14% | 550213 | $17,342,475 |

| MGL | Magontec Limited | 0.2 | -13% | 15325 | $13,101,220 |

| SSH | Sshgroupltd | 0.135 | -13% | 231763 | $14,274,001 |

| WGR | Westerngoldresources | 0.135 | -13% | 1624547 | $35,650,979 |

| BNL | Blue Star Helium Ltd | 0.007 | -13% | 6973922 | $28,823,082 |

| C7A | Clara Resources | 0.0035 | -13% | 750000 | $2,973,180 |

| OVT | Ovanti Limited | 0.007 | -13% | 11437960 | $37,972,471 |

In Case You Missed It

Diablo Resources (ASX:DBO) has raised $2 million to acquire the Star Range silver-antimony project in the mining friendly region of Utah.

Axel REE (ASX:AXL) has defined a 233Mt rare earths resource that highlights the scale and strategic importance of its Caladão Project in Brazil’s prolific mining province of Minas Gerais.

Rumble Resources (ASX:RTR) is kicking off a major 20,000m diamond drilling program at Western Queen this week.

Petratherm (ASX:PTR) says drilling at its Rosewood Heavy Mineral Sands project has extended high-grade mineralisation and flagged a new HMS zone at the Echo deposit.

Australian Mines (ASX:AUZ) is funded for its scandium and gold hunt after raising $4 million to support Brazilian and Australian exploration.

Pursuit Minerals (ASX:PUR) is spreading its wings with a binding deal to acquire the Sascha Marcelina gold and silver project in the Deseado Massif region of Argentina’s Santa Cruz province

Kingsland Minerals (ASX:KNG) locked in fresh backing to take its Leliyn graphite project in the NT to the next stage, securing $1.6m in a strongly supported capital raise.

Victory Metals (ASX:VTM) signed a non-binding letter of intent with Sumitomo, one of Japan’s biggest and most diversified trading giants.

Argent Minerals (ASX:ARD) has planned 330m of diamond drilling to extend the high-grade silver-polymetallic zone at its Kempfield project.

Nova Minerals (ASX:NVA) secures US$43.4m under the US Defense Production Act to accelerate antimony production.

Micro–X (ASX:MX1) completes its first Head CT imaging test system for the Australian Stroke Alliance to install in a hospital and start phase I imaging trials.

Belararox (ASX:BRX) is deepening its ties with Argentina with managing director Arvind Misra appointed to the Advisory Council of ArCham Australia.

Trading halts

Advance Metals (ASX:AVN) – cap raise

Brazilian Critical Minerals (ASX:BCM) – cap raise

E79 Gold Mines (ASX:E79) – cap raise and asset acquisition

Eagers Automotive (ASX:APE) – cap raise

Investigator Resources (ASX:IVR) – cap raise

Theta Gold Mines (ASX:TGM) – funding transaction

Western Yilgarn (ASX:WYX) – cap raise

Xenora Minerals (ASX:XNR) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.