Closing Bell: ASX starts week down as supermarket giants hit by wages ruling

Coles and Woolies roll into trouble after court wage ruling. Pic via Getty Images

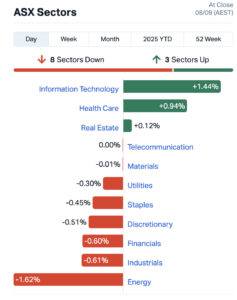

- ASX closes 0.24% lower on Monday with tech leading gainers and energy the laggards

- Asian markets climb higher led by Tokyo after Japanese Prime Minister Shigeru Ishiba announces resignation

- Supermarket giants Coles and Woolworths face hefty staff underpayment bill after federal court ruling

The ASX closed 0.24% lower on Monday to 8849.60 points, trimming losses in the afternoon session after being down 0.35% at lunchtime.

The local bourse mirrored Wall Street’s risk-off finish to last week. US markets retreated after another weak jobs report with just 22,000 new roles added versus 75,000 expected — pushing US unemployment to 4.3% and leaving the US Federal Reserve with little choice but to cut rates at its upcoming September meeting.

In Friday’s session the S&P 500 closed down 0.3%, the Dow Jones index fell 0.5% and the technology-focused Nasdaq ended flat.

On the ASX today tech was the strongest performer up ~1.2% with location app Life360 (ASX:360) surging ~6%, while energy led the laggards, slumping 2% to a two-month low.

Woodside Energy Group (ASX:WDS) shed 3.5% amid continued bearish pressure on oil from plans to boost OPEC+ output, weak US jobs data and global trade tensions.

Gold prices surged through US$3,650 an ounce before easing back under US$3,600, which helped fuel a rally across ASX gold stocks.

Japan leads Asian markets higher

Asian markets climbed higher on Monday led by Tokyo, which jumped nearly 2% after Japanese Prime Minister Shigeru Ishiba announced his resignation less than a year into the role after two election losses.

The Liberal Democratic Party, which has dominated Japanese politics for much of the past 70 years, lost its lower house majority under Ishiba for the first time in 15 years, followed by a defeat in the upper house in July.

Ishiba’s resignation weakened the yen with the Nikkei rising 1.9%, with exporters buoyed by the weaker currency. The yen slipped with one USD buying 148.04 yen, up from 147.07 on Friday.

Coles and Woolies ring up hefty wages bill

In the big-cap aisles, Woolworths (ASX:WOW) and Coles Group (ASX:COL) have rung up a hefty bill — a combined $800 million in wage underpayments after a Federal Court ruling.

Both Woolworths and Coles today issued statements to the ASX updating investors on the continued costs of underpaid wages to staff going back several years.

Woolies is looking at up to $530 million in liabilities, while Coles could be on the hook for around $250m.

Woolies shares showed greater resilience to the ruling today, closing up 0.54% and Coles down 0.83%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| IBX | Imagion Biosys Ltd | 0.035 | 119% | 136,008,603 | $3,941,463 |

| QFE | Quickfee Limited | 0.095 | 76% | 7,134,557 | $20,114,015 |

| ROG | Red Sky Energy | 0.0045 | 50% | 68,461,235 | $16,266,682 |

| PAB | Patrys Limited | 0.0015 | 50% | 4,411,039 | $4,583,757 |

| 4DX | 4Dmedical Limited | 2.31 | 50% | 35,859,969 | $724,399,130 |

| MEM | Memphasys Ltd | 0.005 | 43% | 16,134,644 | $6,942,593 |

| SNS | Sensen Networks Ltd | 0.095 | 38% | 10,442,861 | $54,719,586 |

| WWG | Wisewaygroupltd | 0.18 | 33% | 265,259 | $23,065,181 |

| GUM | Gumtree Australia | 0.13 | 30% | 50,000 | $32,097,258 |

| DRE | Dreadnought Resources Ltd | 0.022 | 29% | 59,410,921 | $86,351,500 |

| DEL | Delorean Corporation | 0.165 | 27% | 580,217 | $28,636,160 |

| BGE | Bridgesaaslimited | 0.025 | 25% | 3,291,804 | $3,997,184 |

| CZN | Corazon Ltd | 0.0025 | 25% | 8,934,957 | $2,469,145 |

| ERA | Energy Resources | 0.0025 | 25% | 119,367 | $810,792,482 |

| GGE | Grand Gulf Energy | 0.0025 | 25% | 1,751,572 | $5,640,850 |

| RMX | Red Mount Min Ltd | 0.01 | 25% | 23,710,494 | $4,761,737 |

| SRJ | SRJ Technologies | 0.01 | 25% | 19,089,037 | $11,033,161 |

| I88 | Infini Resources Ltd | 0.28 | 24% | 383,370 | $11,783,254 |

| IVZ | Invictus Energy Ltd | 0.255 | 24% | 24,005,300 | $328,713,764 |

| DAL | Dalaroometalsltd | 0.059 | 23% | 3,362,953 | $14,148,092 |

| TM1 | Terra Metals Limited | 0.105 | 21% | 5,403,787 | $54,411,608 |

| M24 | Mamba Exploration | 0.018 | 20% | 510,301 | $4,427,484 |

| 4DS | 4Ds Memory Limited | 0.012 | 20% | 326,698,839 | $20,608,987 |

| AVW | Avira Resources Ltd | 0.012 | 20% | 1,867,368 | $2,300,000 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 900,743 | $4,501,432 |

In the news…

Fintech QuickFee (ASX:QFE) closed 70% higher today after announcing it was selling its US Pay Now (ACH card and connect) business to Aiwyn, Inc. for US$26.35 million (A$40m), reflecting a 5x revenue multiple based on FY25 revenue of US$5.3m.

QuickFee will retain its US Finance loan book and product, while most US Pay Now staff are set to transition to Aiwyn, a KKR and Bessemer backed provider of payments and accounting solutions. QFE will retain its US loan book and finance product, but notes it will benefit from a newly established reseller agreement with Aiwyn.

4D Medical (ASX:4DX) closed 49% higher after sealing three deals to advance its global lung health push.

In Brazil, it has rolled out a screening program with a major pharma partner covering up to 10,000 scans.

Back home, Royal Melbourne Hospital will pilot 4DMedical’s full portfolio through 2025 — the first public hospital to do so. Meanwhile in NSW, Spectrum Medical Imaging signed a multi-year contract to deploy the company’s tech in the National Lung Cancer Screening Program through to 2027.

Memphasys (ASX:MEM) closed up 67% after inking a five-year exclusive commercial distribution deal with International Technical Legacy (ITL), a regional leader in the Middle East and North Africa in IVF services for its Felix male fertility sperm preparation system.

The deal has an initial minimum order value of $325,000 – automatically triggered once CE Mark approval is received – spanning 15 countries representing ~353 clinics performing ~140,000 IVF cycles annually.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAY | Jayride Group | 0.004 | -27% | 11,006,428 | $7,853,390 |

| DTI | DTI Group Ltd | 0.006 | -25% | 4,889 | $7,176,823 |

| T3D | 333D Limited | 0.04 | -20% | 3,678,001 | $9,442,691 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 1,820,230 | $13,632,593 |

| OEL | Otto Energy Limited | 0.004 | -20% | 325,724 | $23,975,049 |

| TKL | Traka Resources | 0.002 | -20% | 333,334 | $6,055,348 |

| XGL | Xamble Group Limited | 0.023 | -18% | 664,000 | $9,492,399 |

| CP8 | Canphosphateltd | 0.054 | -17% | 26,357 | $19,939,434 |

| CCO | The Calmer Co Int | 0.0025 | -17% | 821,431 | $9,034,060 |

| CYQ | Cycliq Group Ltd | 0.005 | -17% | 1,002,515 | $2,763,100 |

| ERL | Empire Resources | 0.005 | -17% | 1,462,162 | $8,903,479 |

| MOH | Moho Resources | 0.005 | -17% | 6,929,060 | $4,472,484 |

| M3M | M3Mininglimited | 0.027 | -16% | 442,330 | $2,681,772 |

| MYX | Mayne Pharma Ltd | 4.49 | -15% | 2,121,486 | $428,977,967 |

| BLU | Blue Energy Limited | 0.006 | -14% | 12,484,978 | $12,956,815 |

| SLZ | Sultan Resources Ltd | 0.006 | -14% | 274,690 | $1,827,585 |

| NSB | Neuroscientific | 0.16 | -14% | 798,341 | $61,526,506 |

| 5GG | Pentanet | 0.026 | -13% | 1,972,298 | $12,995,150 |

| MEG | Megado Minerals Ltd | 0.026 | -13% | 433,895 | $19,370,498 |

| PRO | Prophecy Internation | 0.3 | -13% | 170,327 | $25,444,762 |

| GML | Gateway Mining | 0.055 | -13% | 8,063,675 | $120,255,679 |

| ALY | Alchemy Resource Ltd | 0.007 | -13% | 2,176,175 | $9,424,610 |

| AVE | Avecho Biotech Ltd | 0.007 | -13% | 4,492,429 | $25,387,709 |

| CTN | Catalina Resources | 0.0035 | -13% | 19,072,930 | $9,704,076 |

| ID8 | Identitii Limited | 0.007 | -13% | 53,241 | $6,224,108 |

In Case You Missed It

Imagion Biosystems (ASX:IBX) has begun manufacturing of its MagSense HER-2 imaging agent in preparation of a much-anticipated Phase 2 breast cancer trial set to begin later this year.

Theta Gold Mines (ASX:TGM) is heading into its next stage of life as a gold producer with a refreshed front bench of key operational and corporate experience ahead of an updated feasibility study revising its Transvaal Gold Mining Estates project in the wake of a record bull run.

West Wits Mining (ASX:WWI) has secured approval for a $19m loan facility to advance its Qala Shallows gold project in South Africa, enabling delivery of equipment as the company looks towards its first pour in Q1 of 2026.

Asra Minerals (ASX:ASR) has raised $3.25m from investors new and old, with its chairman and new technical director joining in a show of support for plans to quickly get the cash into the ground at its flagship Leonora gold projects.

Alterity Therapeutics (ASX:ATH) has raised $20m by way of strategic placement to Australian and international professional investors, strengthening the balance sheet to support its ongoing development of a lead drug candidate for a rare and rapidly progressive Parkinsonian disorder.

Orthocell (ASX:OCC) has released interim results from its Remplir Real World Evidence study demonstrating an overall treatment success rate of 81.1% across a variety of nerve repair procedures and confirming its collagen nerve wrap as ideal for connecting severed nerves.

A 30,000m Geopacific Resources (ASX:GPR) drilling program at its 1.67Moz Woodlark Gold Project in PNG continues to deliver, with standout new intercepts at Kamwak hinting at a potentially significant discovery.

Lode Resources (ASX:LDR) has struck its most highly endowed intercept yet at the Montezuma antimony and silver project in Tasmania, with assays returning eye-popping grades of up to 2,730g/t silver equivalent.

IN CASE YOU MISSED IT

Felix Gold (ASX:FXG) has given senior representatives from the US Environmental Protection Agency and the Federal Permitting Improvement Steering Council a tour of its Treasure Creek flagship in Alaska.

Felix showcased the high-level Federal reps a potential solution to antimony supply issues after China’s export bans, and executive director Joe Webb remarked the agencies provided feedback that Treasure Creek was one of the most infrastructure-ready and well-serviced near shovel-ready projects that they had visited.

Trading halts

ABx Group (ASX:ABX) – cap raise

Augustus Minerals (ASX:AUG) – cap raise

Cobram Estate Olives (ASX:CBO) – cap raise

EV Resources (ASX:EVR) ) – cap raise and acquisition

Great Boulder Resources (ASX:GBR) – visual drilling results

Marmota (ASX:MEU) – assay results

TechGen Metals (ASX:TG1) – top-up placement

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.