Closing Bell: ASX slumps but gold shoots over US$3115 amid increasing tariff fears

Gold has hit new records again. Picture via Getty Images

- ASX takes a hit on tariff fears

- Gold hits new records again

- RBA rates decision in focus

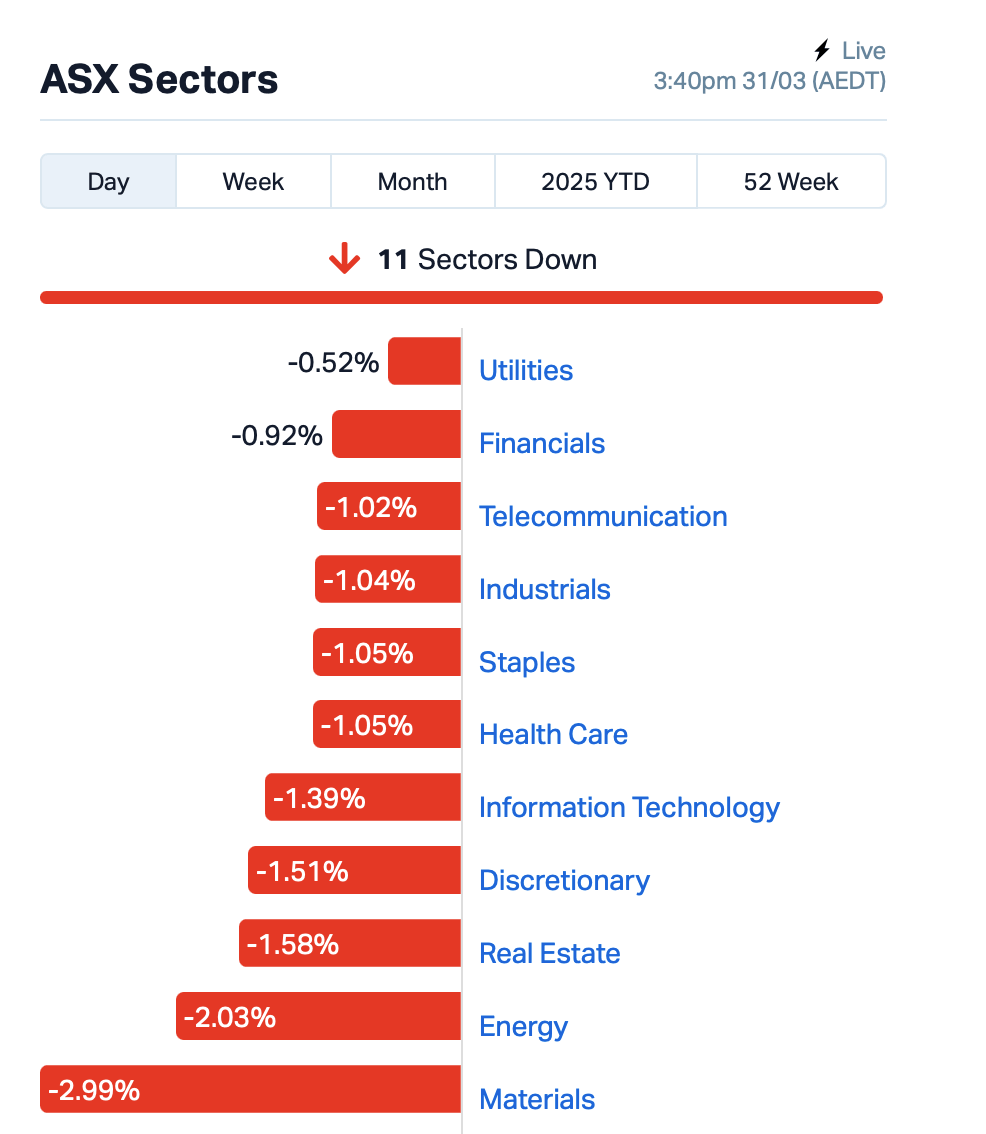

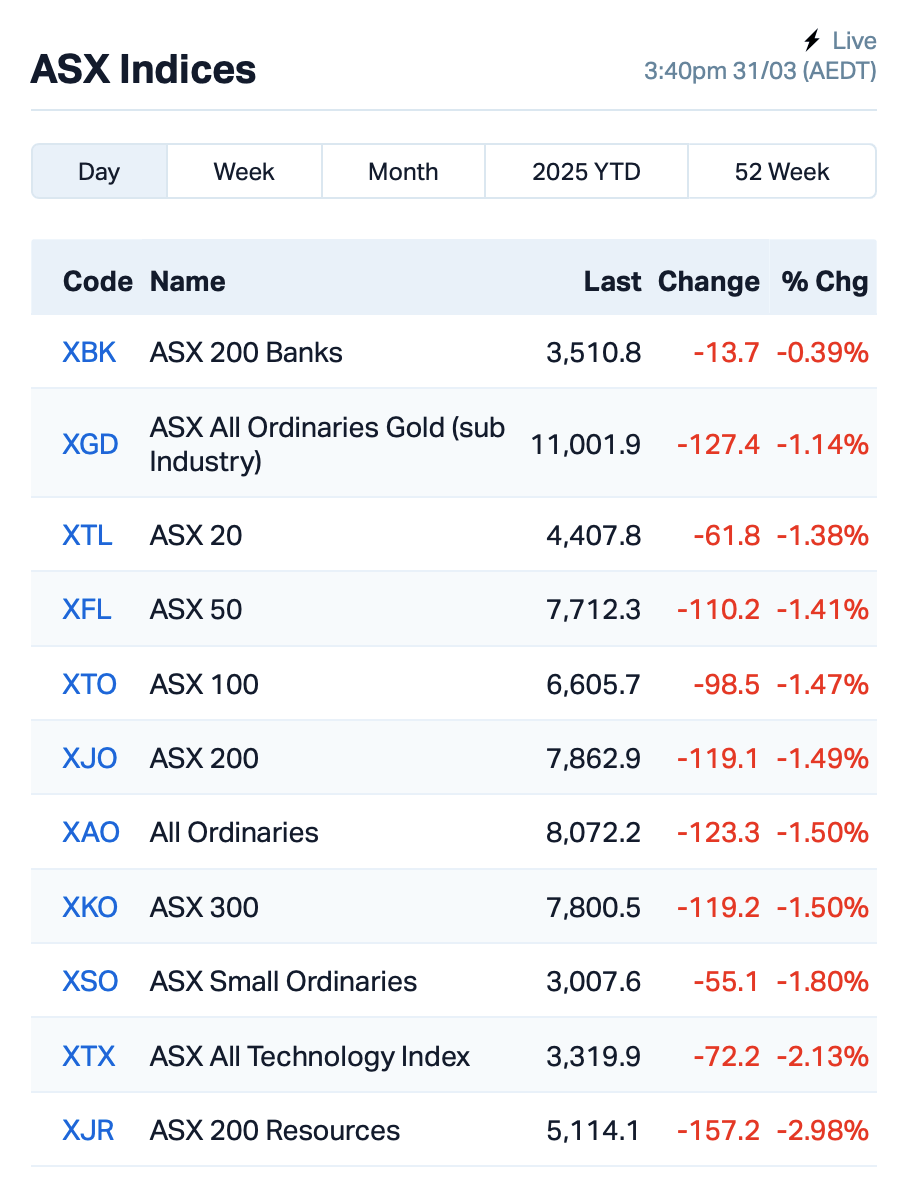

The ASX copped a big blow on Monday, falling by 1.6% and wiping out more than $30 billion in market value as concerns over the looming US tariffs rattled investors.

From Sydney to Hong Kong, markets slid, with Japan’s Nikkei hitting a six-month low. US and European futures also fell again in Asian hours.

Investors are on edge ahead of “Liberation Day” this Wednesday, when President Trump’s tariffs are expected to kick in, but not much is known about what exactly those tariffs will look like.

Money managers everywhere are playing it cautious, with concerns rising over the tariffs’ potential to slow the global economy.

Goldman Sachs is now predicting the US Fed will cut interest rates three times this year due to the trade war’s impact.

“It’s a concerning picture we’re going into,” said Katrina Ell at Moody’s Analytics.

On top of the new US tariffs, economists reckon the real damage will come from companies pulling back on hiring and expansion, particularly in the Asia-Pacific region including Australia.

But as market fears unfolded, gold hit a new high of US$3,115 in the past hour.

Gold was already up 18% this year, hitting 15 record highs as fundies turned to it as a safe bet with all the uncertainty.

However, despite the new record high, ASX gold stocks weren’t able to escape the selling pressure today.

Iron ore miners, meanwhile, were hit the hardest, with BHP (ASX:BHP) and Rio Tinto (ASX:RIO) sinking over 3%. Tech stocks like Life360 (ASX:360) also fell more than 5%.

In the large end of town, Qantas (ASX:QAN) slid 3.5% after the news that long-time director Todd Sampson was stepping down, and WiseTech Global (ASX:WTC) edged up 0.6% after appointing two new non-executive directors.

David Di Pilla’s HMC Capital (ASX:HMC) dropped 6% after making a takeover offer for Healthscope, Australia’s second-largest hospital group, including taking on $1.6 billion of its debt.

Packaging firm Orora (ASX:ORA) rose 4% after clearing up an investigation by French regulators into price hikes by its subsidiary Saverglass, which came after complaints from some beverage companies.

And finally, looking ahead, the RBA is expected to keep rates steady tomorrow, despite the growing hope of a rate cut in May.

“The Federal Election date call for May 3rd may throw a question mark on a rate cut in May, but markets still see a 70% chance of a cut,” said Josh Gilbert at eToro.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | 50% | 597,203 | $2,031,723 |

| HCD | Hydrocarbon Dynamics | 0.003 | 50% | 1,445,248 | $2,156,219 |

| JAY | Jayride Group | 0.004 | 33% | 1,750,250 | $2,227,037 |

| MRQ | Mrg Metals Limited | 0.004 | 14% | 750,000 | $9,542,815 |

| RLG | Roolife Group Ltd | 0.004 | 33% | 16,125,342 | $4,263,094 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 251,500 | $7,254,899 |

| NFL | Norfolk Metals | 0.160 | 28% | 2,197,708 | $5,114,492 |

| ADD | Adavale Resource Ltd | 0.003 | 25% | 1,039,000 | $4,574,558 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1,534,182 | $12,314,111 |

| LNR | Lanthanein Resources | 0.003 | 25% | 179,341 | $4,887,272 |

| TOU | Tlou Energy Ltd | 0.026 | 24% | 108,639 | $27,270,271 |

| HTG | Harvest Tech Grp Ltd | 0.016 | 23% | 671,777 | $11,538,808 |

| IXR | Ionic Rare Earths | 0.009 | 21% | 35,920,008 | $36,668,998 |

| LGM | Legacy Minerals | 0.230 | 21% | 2,735,672 | $23,733,532 |

| ROC | Rocketboots | 0.120 | 20% | 4,233,966 | $11,662,585 |

| ADG | Adelong Gold Limited | 0.006 | 20% | 1,542 | $6,987,431 |

| INF | Infinity Lithium | 0.024 | 20% | 1,693,121 | $9,251,842 |

| LSA | Lachlan Star Ltd | 0.065 | 18% | 190,644 | $13,891,526 |

| JLL | Jindalee Lithium Ltd | 0.240 | 17% | 211,273 | $15,086,329 |

| RLL | Rapid Lithium Ltd | 0.004 | 17% | 37,500 | $3,734,834 |

| TMX | Terrain Minerals | 0.004 | 17% | 9,199,650 | $6,010,670 |

| BTM | Breakthrough Minsltd | 0.087 | 16% | 6,839,405 | $3,589,462 |

| CBL | Control Bionics | 0.045 | 15% | 713,121 | $11,489,833 |

Norfolk Metals (ASX:NFL) has secured an earn-in deal for the Carmen copper project in Chile’s Atacama region, covering 46.6km² with a historical NI 43-101 copper oxide resource of 5.6Mt at 0.6% copper. The project features both oxide and sulphide mineralisation, with strong drill hits and potential for resource expansion in a world-class copper-producing area.

Infinity Lithium (ASX:INF) has secured some promising exploration assets in eastern Victoria that haven’t been explored much in recent years. With gold prices strengthening, the plan is to move quickly and cost-effectively to test these assets. At the same time, Infinity is still pushing forward with its mining licence application for the San Jose lithium project in Spain. The company is aware of the downturn in the lithium market, and some delays with the San Jose permitting process.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| EDE | Eden Inv Ltd | 0.001 | -33% | 638,027 | $6,164,822 |

| LNU | Linius Tech Limited | 0.001 | -33% | 34,368 | $9,226,824 |

| BLZ | Blaze Minerals Ltd | 0.003 | -25% | 289,231 | $6,267,791 |

| BMO | Bastion Minerals | 0.003 | -25% | 5,996,665 | $3,378,899 |

| EMT | Emetals Limited | 0.003 | -25% | 500,000 | $3,400,000 |

| GGE | Grand Gulf Energy | 0.002 | -25% | 3,867,903 | $4,900,774 |

| M2R | Miramar | 0.003 | -25% | 343,785 | $1,825,387 |

| PKO | Peako Limited | 0.003 | -25% | 395,000 | $5,950,968 |

| KEY | KEY Petroleum | 0.047 | -24% | 61 | $1,561,129 |

| CRR | Critical Resources | 0.004 | -20% | 1,437,248 | $12,321,106 |

| FRX | Flexiroam Limited | 0.004 | -20% | 2,796,843 | $7,586,993 |

| RMI | Resource Mining Corp | 0.004 | -20% | 1,650,000 | $3,327,029 |

| TFL | Tasfoods Ltd | 0.004 | -20% | 5,900,249 | $2,185,478 |

| A1G | African Gold Ltd. | 0.098 | -18% | 7,296,907 | $45,803,642 |

| PUA | Peak Minerals Ltd | 0.009 | -18% | 5,716,156 | $30,880,534 |

| OVT | Ovanti Limited | 0.005 | -17% | 3,258,258 | $16,209,287 |

| EGR | Ecograf Limited | 0.260 | -16% | 717,156 | $140,780,864 |

| FBR | FBR Ltd | 0.009 | -15% | 48,809,091 | $50,598,588 |

| BRX | Belararoxlimited | 0.255 | -15% | 832,941 | $43,189,234 |

| NVU | Nanoveu Limited | 0.036 | -14% | 1,474,540 | $31,182,070 |

| ADX | ADX Energy Ltd | 0.024 | -14% | 646,007 | $16,105,301 |

| ASR | Asra Minerals Ltd | 0.003 | -14% | 360,982 | $8,305,944 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 2,229,948 | $31,932,702 |

| BIT | Biotron Limited | 0.003 | -14% | 29,500 | $3,158,340 |

IN CASE YOU MISSED IT

Terrain Minerals (ASX:TMX) is having a solid run after discovering shallow high-grade gold and silver mineralisation at its Monza gold prospect in Western Australia. Highlights include 11 metres at 6.03 g/t gold and 43.5 g/t silver from 75 metres, with a follow-up RC drilling program set to begin next month.

Medallion Metals (ASX:MM8) has reported high-grade gold and copper drill hits at its Ravensthorpe project in WA, supporting a resource update in June and metallurgical testwork for its development plans. The company is targeting a final investment decision this year, with a bankable feasibility study also due in October.

Besra Gold (ASX:BEZ) has updated the Jugan project resource to 721,000oz gold, incorporating a new underground component to minimise environmental impact and improve feasibility. Next steps include geotechnical drilling by June 2025, metallurgical testwork, and preparations for a bankable feasibility study.

Blue Star Helium (ASX:BNL) has spudded the Jackson 29 development well at its Galactica project in Las Animas County, Colorado. Next steps involve preparing to drill through the intermediate hole section.

Commencing trading on the US-based OTCQB is Vertex Minerals (ASX:VTX) under the ticker VTXXF. The Aussie gold company believes it’ll offer greater exposure to a network of US investors, data distributions and media partners, while also streamlining trading access for US-based investors.

Although still early days, HyTerra Limited (ASX:HYT) believes the Hoarty NE3 well at the Geneva project in Nebraska, USA, could be a “world first”, with double-digit hydrogen and helium values detected from the same well. Through its subsidiary Neutralysis, HyTerra holds a 16% earn-in interest in the venture, with further assessment and appraisal operations required to determine the well’s potential for commercial hydrogen and helium production.

Optiscan (ASX:OIL) has made some management changes, announcing a new CFO along with other executive appointments. The company’s finance manager, Darius Ooi, has been promoted to CFO, while Belinda Williamson and Jessica Ward have been appointed chief commercial officer and Optiscan’s US-based director of clinical and regulatory affairs, respectively.

Pursuit Minerals (ASX:PUR) has completed its previously announced placement of just over $1 million through issuance of 17,166,668 shares at 0.6 cents apiece. The funds will accelerate the ongoing development of Pursuit’s Rio Grande Sur lithium project in Argentina.

Also raising fresh cash is Western Yilgarn (ASX:WYX), tapping investors for $520,000 through a placement to advance exploration at its Julimar West and newly acquired New Norcia bauxite-galium projects in WA. The raise was announced at 0.36 cents a share, with strong support from sophisticated and professional investors.

At Stockhead, we tell it like it is. While Terrain Minerals, Norfolk Metals, Medallion Metals, Besra Gold, Blue Star Helium, Vertex Minerals, HyTerra, Optiscan Imaging, Pursuit Minerals and Western Yilgarn are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.