Closing Bell: ASX slips, Star crashes 27pc and China faces fresh deflation woes

The ASX slipped as retail data dampened rate cut hopes. Picture via Getty Images

- ASX slips as retail data dampens rate cut hopes

- Star Entertainment crashes 27% on cash burn warning

- Bitcoin dips, China faces fresh deflation fears

After five days of gains, the ASX took a breather on Thursday, dipping 0.24% as retail sales data threw a spanner in the works.

Ten out of 11 sectors on the ASX200 index were in the red, with energy stocks leading the way down as oil prices fell 1%.

Retail sales rose 0.8% in November, but not quite as much as expected, casting doubt on hopes for an imminent interest rate cut.

The bond market shows traders are betting big on a rate cut, with almost a 70% chance the RBA will pull the trigger in February.

Many ASX heavyweights took a bit of a beating today. BHP (ASX:BHP) dipped 0.5% and Commonwealth Bank (ASX:CBA) slid 1%.

In the crypto world, Bitcoin stumbled to its lowest since New Year’s Eve earlier today, but clawed its way back above US$94,000 this afternoon.

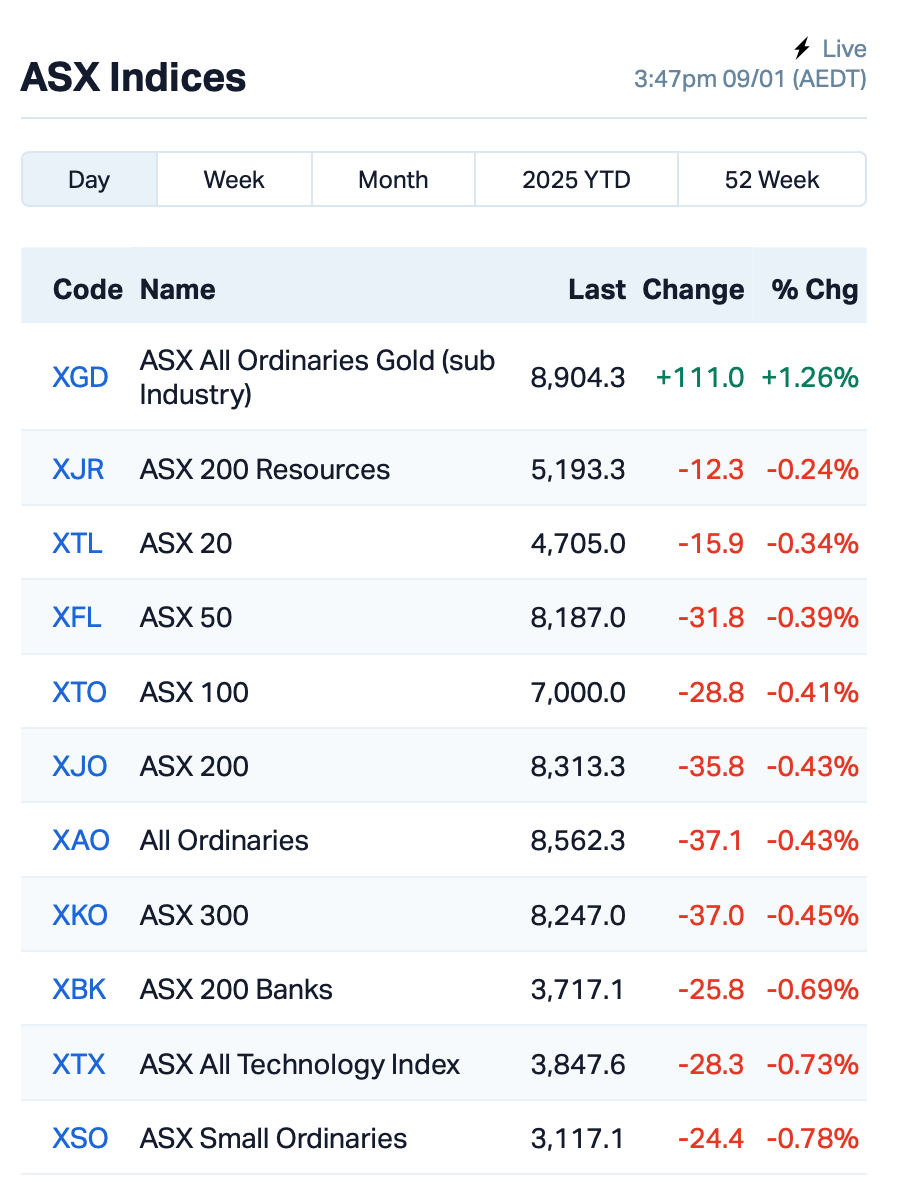

This is where things stood at 15:45 AEDT:

In the large caps space, Star Entertainment Group (ASX:SGR) stunned the market with news that it only had $79 million left in cash after burning through $107 million in just the past three months.

The company’s share price crashed 27% as it warned it may struggle to meet the terms of a $100 million loan.

Over in the jewellery sector, Lovisa Holdings (ASX:LOV) slipped 12% on no specific news, although there is chatter of it being hit with a “sell” rating from UBS.

Avita Medical’s (ASX:AVH) shares have tumbled almost 30% in the last two sessions after revealing that it wouldn’t hit revenue forecasts – a brutal reminder that the market can turn quickly when numbers disappoint.

And just to add a little global flavour, data today shows China’s consumer prices barely budged in December, raising fresh fears of deflation holding back spending and stalling the world’s second biggest economy.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap EAT Entertainment Rewards 0.003 50% 58 $2,617,572 MSI Multistack Internat. 0.006 50% 100,000 $545,216 MTL Mantle Minerals Ltd 0.002 50% 2,900,000 $6,197,446 AAU Antilles Gold Ltd 0.004 33% 4,279,835 $5,573,628 MRQ Mrg Metals Limited 0.004 33% 36,322,310 $8,179,556 TX3 Trinex Minerals Ltd 0.002 33% 105,256 $2,742,978 MRR Minrex Resources Ltd 0.009 29% 3,105,699 $7,594,073 AYT Austin Metals Ltd 0.005 25% 1,604,284 $5,296,765 CDT Castle Minerals 0.003 25% 1,120,036 $3,793,628 EVR Ev Resources Ltd 0.003 25% 3,945,000 $3,625,007 VEN Vintage Energy 0.005 25% 6,941,694 $6,678,125 D3E D3 Energy Limited 0.068 24% 37,295 $4,371,125 AKA Aureka Limited 0.175 21% 575,269 $14,853,060 PIM Pinnacleminerals 0.060 20% 80,000 $2,273,166 HCT Holista CollTech Ltd 0.024 20% 794,663 $5,715,334 LML Lincoln Minerals 0.006 20% 3,154,256 $10,281,298 BDG Black Dragon Gold 0.056 19% 445,895 $14,239,405 NPM Newpeak Metals 0.013 18% 100,000 $3,359,456 NRX Noronex Limited 0.013 18% 3,845,062 $5,496,561 HVY Heavymineralslimited 0.135 17% 329,543 $7,710,013

Trinex Minerals (ASX:TX3) said its recent soil geochemistry program at the Dudley lithium project in South Australia has revealed several promising drilling targets. The project contains thick, lithium-rich pegmatites stretching up to 6 kilometres, and these have never been drilled before. Results from over 1,100 soil samples show encouraging anomalies, which could point to a significant lithium discovery in the area.

First Graphene (ASX:FGR) has just filed a patent for a new process that makes graphene-based electrocatalysts for hydrogen production. The process improves the cost-effectiveness of metal oxide graphene, using base metals like cobalt, iron, and nickel, which were previously tough to work with. The company said this technology opens up big opportunities in the global electrocatalyst market, which is valued at over $1 billion.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap DTR Dateline Resources 0.002 -33% 718 $7,548,781 88E 88 Energy Ltd 0.002 -25% 1,816,858 $57,867,624 NTD Ntaw Holdings Ltd 0.195 -25% 1,302,099 $43,603,979 SGR The Star Ent Grp 0.148 -24% 80,459,242 $559,392,771 SBW Shekel Brainweigh 0.028 -24% 450,986 $8,438,266 SP8 Streamplay Studio 0.008 -20% 130,002 $11,506,238 TEM Tempest Minerals 0.004 -20% 10,801 $3,172,649 CDD Cardno Limited 0.150 -19% 334,693 $7,226,223 GES Genesis Resources 0.005 -17% 297,361 $4,697,048 MTB Mount Burgess Mining 0.005 -17% 1,771 $2,037,225 TKM Trek Metals Ltd 0.021 -16% 130,155 $13,003,072 SCP Scalare Partners 0.170 -15% 623 $6,976,560 ADN Andromeda Metals Ltd 0.006 -14% 134,989 $24,001,094 CRR Critical Resources 0.006 -14% 12,070,152 $17,023,742 EPM Eclipse Metals 0.006 -14% 1,866,666 $16,014,989 IME Imexhs Limited 0.325 -13% 1,312 $17,209,135 ATS Australis Oil & Gas 0.007 -13% 450,000 $10,312,078 BCB Bowen Coal Limited 0.007 -13% 1,171,778 $86,204,221 CTO Citigold Corp Ltd 0.004 -13% 2,000,000 $12,000,000 WOA Wide Open Agricultur 0.007 -13% 68,085 $4,269,493 NXS Next Science Limited 0.105 -13% 45,605 $35,059,228 AVH Avita Medical 3.090 -12% 1,232,064 $243,975,537

IN CASE YOU MISSED IT

Adisyn (ASX:AI1) has finalised the acquisition of semiconductor IP business 2D Generation (2DG), with its founder and CEO, Arye Kohavi, set to join the board as non-executive director.

2DG’s technology is being hailed as a major advancement in semiconductors, positioning Adisyn to seize opportunities in the rapidly evolving market.

At Stockhead, we tell it like it is. While Adisyn is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.