Closing Bell: ASX slips as Fed decision looms

The ASX fell in the final session. Picture via Getty Images

- ASX gives back gains ahead of Fed decision

- Vulcan and DigiCo rise

- MinRes completes $780m gas deal with Hancock Prospecting

The ASX gave back its earlier gains this afternoon as investors adopted a more cautious approach ahead of the US Federal Reserve’s rate decision later tonight (US time).

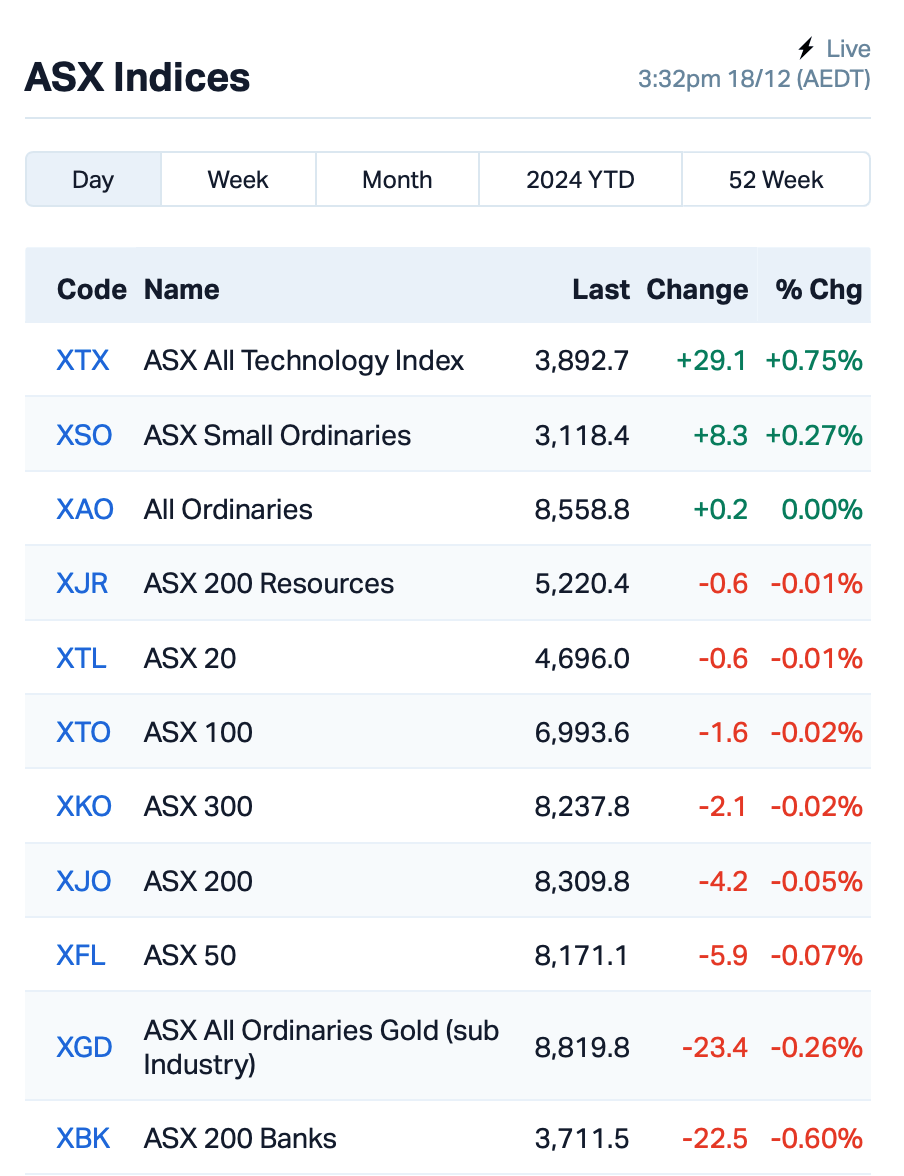

The benchmark ASX 200 ended up flattish after earlier rising by about 0.30% at lunch time.

Overnight, Wall Street closed lower as investors braced for the Fed’s final policy meeting of the year.

While a 25 basis point rate cut is widely expected, investors are being urged to act with caution.

“Policymakers can’t risk further stoking inflation, especially as President-elect Trump’s proposed agenda of tax cuts, deregulation and large-scale infrastructure spending is expected to drive inflation higher in the coming months,” said de Vere’s Nigel Green.

The Fed’s decision will be announced Thursday AEDT.

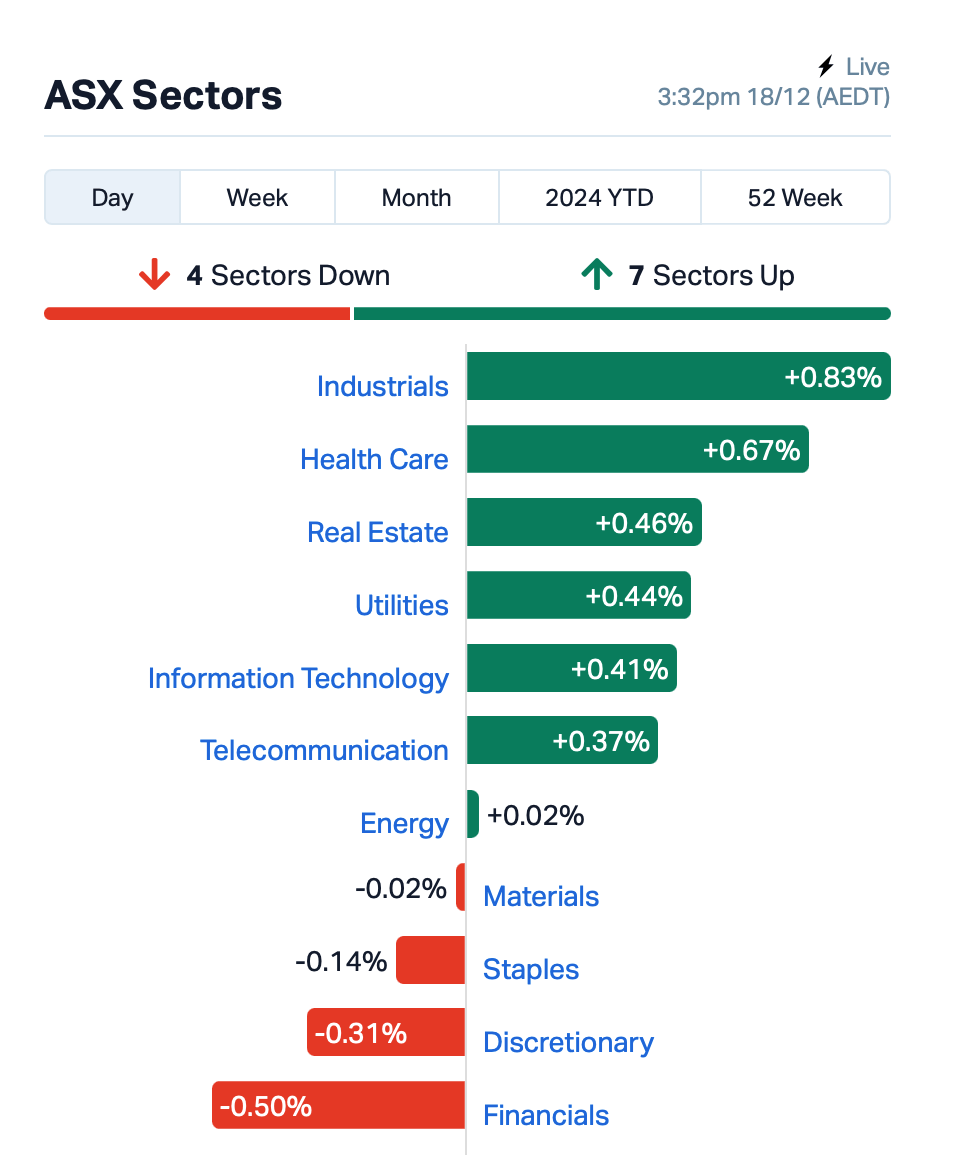

Back on the ASX, four of the 11 sectors were in the red today:

In the large caps space, Mineral Resources (ASX:MIN) has completed its $780 million gas deal with Gina Rinehart’s Hancock Prospecting in the Perth Basin and Carnarvon Basin in WA. Shares were down 0.1%.

Vulcan Energy Resources (ASX:VUL) rose 2.25% following the announcement of a €879 million financing deal for its Lionheart project in Germany. The deal involves a group of banks and Export Finance Australia.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| AMD | Arrow Minerals | 0.002 | 100% | 3,270,870 | $13,223,628 |

| AYM | Australia United Min | 0.004 | 100% | 979,323 | $3,685,155 |

| IBG | Ironbark Zinc Ltd | 0.003 | 50% | 2,047,671 | $3,667,296 |

| OBL | Omni Bridgeway Ltd | 1.375 | 42% | 1,643,720 | $272,693,739 |

| FTC | Fintech Chain Ltd | 0.007 | 40% | 202,000 | $3,253,848 |

| NPM | Newpeak Metals | 0.014 | 40% | 3,993,728 | $3,054,051 |

| GTR | Gti Energy Ltd | 0.004 | 33% | 130,000 | $8,888,849 |

| NRZ | Neurizer Ltd | 0.002 | 33% | 5,700,237 | $4,226,791 |

| ASO | Aston Minerals Ltd | 0.009 | 29% | 4,741,457 | $9,065,450 |

| AKN | Auking Mining Ltd | 0.005 | 25% | 100,083 | $1,565,401 |

| T3D | 333D Limited | 0.010 | 25% | 2,008 | $1,409,468 |

| TMK | TMK Energy Limited | 0.003 | 25% | 13,095,666 | $18,651,130 |

| STN | Saturn Metals | 0.205 | 24% | 214,233 | $50,966,006 |

| BDG | Black Dragon Gold | 0.031 | 24% | 3,786,696 | $7,547,068 |

| SBW | Shekel Brainweigh | 0.022 | 22% | 375,000 | $4,105,102 |

| BCB | Bowen Coal Limited | 0.006 | 20% | 24,227,589 | $53,875,163 |

| ERA | Energy Resources | 0.003 | 20% | 6,170,702 | $1,013,490,602 |

| LNR | Lanthanein Resources | 0.003 | 20% | 7,175,640 | $6,109,090 |

| CDR | Codrus Minerals Ltd | 0.019 | 19% | 20,000 | $2,646,200 |

| PR2 | Piche Resources | 0.098 | 17% | 5,306 | $6,744,405 |

| BUY | Bounty Oil & Gas NL | 0.004 | 17% | 516,666 | $4,495,503 |

| OSL | Oncosil Medical | 0.007 | 17% | 7,016,666 | $27,639,481 |

| PAB | Patrys Limited | 0.004 | 17% | 250,000 | $6,172,342 |

| WBE | Whitebark Energy | 0.007 | 17% | 1,921,331 | $1,514,001 |

| TRE | Toubani Res Ltd | 0.150 | 15% | 353,617 | $29,764,795 |

Litigation financing company Omni Bridgeway (ASX:OBL) has agreed with Ares Management to establish Fund 9, acquiring OBL’s co-investment in 150+ assets. Ares will pay $310 million for a 70% stake, with OBL retaining 30%. The deal provides OBL a 3.2x return on invested capital and a 2% management fee from Fund 9. Ares also has the option to buy up to $35 million in OBL equity.

DigitalX (ASX:DCC) has raised $15.4 million through a private placement and rights issue. Tony Guoga joins as strategic advisor to expand digital asset services, investing $4.7 million. DCC expects 41 Bitcoin from Mt Gox in 2025, valued at $7 million, and growth in its Bitcoin ETF.

Clarity Pharmaceuticals (ASX:CU6) said it has developed a new FAP-targeted radiopharmaceutical, SAR-bisFAP, designed for cancer diagnosis and treatment. This product uses copper isotopes for imaging and therapy, showing strong tumour targeting and retention in pre-clinical models. FAP is widely expressed in many cancers, offering a broad treatment potential.

Iceni Gold (ASX:ICL) has signed a farm-in deal with Gold Road Resources (ASX:GOR) worth up to $44 million for exploration on its Guyer Gold Trend in Western Australia. GOR will invest $5 million initially, with the potential to earn up to 80% of the project. GOR is also taking a 9.9% stake in Iceni for $3.05 million. Exploration starts in January 2025.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PER | Percheron | 0.007 | -88% | 302,818,681 | $64,158,820 |

| PGY | Pilot Energy Ltd | 0.005 | -55% | 84,734,632 | $16,420,716 |

| NTD | Ntaw Holdings Ltd | 0.250 | -35% | 2,075,919 | $64,567,430 |

| MTL | Mantle Minerals Ltd | 0.001 | -33% | 167,650 | $9,296,169 |

| PKO | Peako Limited | 0.002 | -33% | 500,000 | $3,285,425 |

| TD1 | Tali Digital Limited | 0.001 | -33% | 1,380,000 | $4,942,733 |

| TKL | Traka Resources | 0.001 | -33% | 12,450 | $2,963,488 |

| VML | Vital Metals Limited | 0.002 | -33% | 1,690,214 | $17,685,201 |

| APC | APC Minerals | 0.013 | -32% | 2,488,683 | $1,941,289 |

| EWC | Energy World Corpor. | 0.017 | -26% | 68,753 | $70,815,189 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 1,600,303 | $57,867,624 |

| AXP | AXP Energy Ltd | 0.002 | -25% | 1,509,994 | $11,649,361 |

| CR9 | Corellares | 0.003 | -25% | 1,023,116 | $1,860,370 |

| LNU | Linius Tech Limited | 0.002 | -25% | 300,000 | $12,302,431 |

| TX3 | Trinex Minerals Ltd | 0.002 | -25% | 21,989 | $3,657,305 |

| VRC | Volt Resources Ltd | 0.003 | -25% | 6,796,333 | $16,634,713 |

| ERG | Eneco Refresh Ltd | 0.010 | -23% | 80,000 | $3,540,659 |

| VMT | Vmoto Limited | 0.056 | -20% | 3,341,647 | $29,311,256 |

| DDT | DataDot Technology | 0.004 | -20% | 100,000 | $6,054,764 |

| EAT | Entertainment | 0.004 | -20% | 182,325 | $6,543,930 |

| FHS | Freehill Mining Ltd. | 0.004 | -20% | 2,450,235 | $15,392,639 |

| REE | Rarex Limited | 0.008 | -20% | 7,715,241 | $8,008,458 |

| RRR | Revolverresources | 0.029 | -19% | 131,961 | $9,832,473 |

Percheron Therapeutics (ASX:PER) plunged by almost 90% after announcing that its phase IIb trial of avicursen for Duchenne muscular dystrophy (DMD) did not meet its primary endpoint or show significant efficacy in secondary endpoints.

Based on these results, the company has decided to terminate the trial and will conduct a strategic review of its pipeline in early 2025. Percheron said it remains committed to advancing DMD research and will provide further updates in the new year.

IN CASE YOU MISSED IT

Race Oncology (ASX:RAC) has strengthened its leadership team with the appointment of Dr Megan Baldwin as non-executive director. Baldwin brings over 25 years’ experience in therapeutic drug development and is the founder of Opthea, a late-stage biopharmaceutical company.

Everest Metals Corporation (ASX:EMC) has achieved up to 91% rubidium recovery through direct extraction from ore at its 3.6Mt Mt Edon project in WA. This is timely, as rubidium is one of 35 critical minerals identified by several countries globally, with its market expected to grow significantly in the coming years.

In Norway, Kingsrose Mining (ASX:KRM) has uncovered another zone of nickel-copper mineralisation at its Råna project. The company said there’s promising polymetallic sulphide mineralisation, and is now evaluating the potential for further discoveries, considering current nickel market conditions.

Altech Batteries (ASX:ATC) has secured its third offtake agreement for its Cerenergy salt batteries, this time with Axsol, a leading German provider of integrated renewable energy solutions. The deal covers the supply of 10 megawatt-hours (MWh) of Cerenergy energy storage capacity in the first year, with a rise to 30 MWh in years after. This partnership also allows Altech to break into the Western defence sector.

Tungsten Mining (ASX:TGN) has raised $4.5 million through the issue of convertible notes to professional and sophisticated investors. The funds will be used to acquire the Mt Mulgine project and support ongoing project development, with TGN now holding all mineral rights to the project.

Godolphin Resources (ASX:GRL) has struck a 37m-wide sulphide zone in its third drill hole (GLPDD007) as part of a 1,500m drilling program at its Lewis Ponds project in NSW. It follows the success of the previous two drill holes, including a 40m intersection of semi-massive sulphide mineralisation in GLPDD006. Further assay results are expected in late January 2025.

In the US, cleantech company Carbonxt Group (ASX:CG1) has achieved mechanical completion of its cutting-edge activated carbon production plant in Kentucky and increased its ownership stake to 40%. The plant is primed to meet the growing demand for premium activated carbon products in North America, with sample production scheduled for the March quarter, which will allow CG1 to finalise potential offtake agreements.

At Stockhead, we tell it like it is. While Race Oncology, Everest Metals, Kingsrose Mining, Altech Batteries, Tungsten Mining, Godolphin Resources, Carbonnxt Group and Race Oncology are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.