Closing Bell: ASX slips ahead of US rate call, Droneshield higher on contract wins

The ASX slipped ahead of US rate decision. Pic via Getty Images

- ASX 200 closes in red ahead of US Federal Reserve interest rate decision

- Energy sector jumps as Ukraine strikes on Russian oil refineries lift global oil prices

- DroneShield up 3% after announcing nearly $8 million in new contracts with the US Defence Department

Australian stocks closed in the red today before the US interest rate decision overnight. The ASX 200 dropped 59.20 points or 0.67% to 8818.50 points.

A 25bps cut is anticipated by the US Federal Reserve when the central bank’s policy committee releases a statement at 4am (AEST) on Thursday.

Overnight the The S&P 500 and Nasdaq composite both declined by ~0.1%, while the Dow Jones Industrial Average was 0.3% lower.

Mining giant BHP (ASX:BHP) fell 1.18% after announcing plans to slash 750 jobs from its Queensland operations, blaming the impact of high royalties imposed by the state government.

Queensland Liberal Deputy Premier Jarrod Bleijie criticised BHP’s decision to cut mining jobs and review its Mackay training centre as “un-Australian”. Bleijie reaffirmed the government had no plans to change the royalty regime, introduced under the previous Labor government.

“We have an election commitment not to adjust the royalty regime, and we’ve stuck by the election commitment,” Mr Bleijie told a press conference in Brisbane.

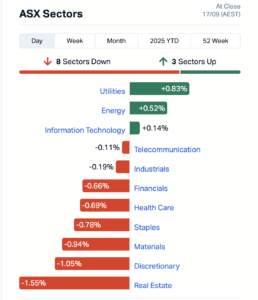

Eight of 11 sectors were in the red with real estate, discretionary,and materials leading the declines. Utilities, energy and tech were the top performers and only sectors in the green today.

The rise in global oil prices as Ukrainian drone strikes continue to hit Russian oil refineries boosted local players with Woodside Energy Group (ASX:WDS) up 0.9%, Beach Energy (ASX:BPT) up 2% and Karoon Energy (ASX:KAR) jumping ~3%.

In the tech space, the bright spot was DroneShield (ASX:DRO), up 3% after announcing nearly $8 million in new contracts with the US Defence Department.

The company’s now got more than 4000 devices in service, selling kit that jams drones out of the sky with radio signals.

Cryptocurrency beast Bitcoin is trading slightly higher at the time of writing, at about $US117,200, while the Aussie dollar is trading around US66.77 cents.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| LRD | Lord Resources | 0.045 | 96% | 80,584,762 | $3,565,047 |

| RCM | Rapid Critical | 0.053 | 56% | 98,457,192 | $21,719,711 |

| HLX | Helix Resources | 0.0015 | 50% | 46,435 | $5,046,291 |

| JAV | Javelin Minerals Ltd | 0.003 | 50% | 51,796,721 | $12,504,450 |

| LNU | Linius Tech Limited | 0.0015 | 50% | 550,000 | $6,589,514 |

| TMK | TMK Energy Limited | 0.003 | 50% | 230,016 | $20,444,766 |

| TMX | Terrain Minerals | 0.003 | 50% | 511,963 | $5,290,295 |

| CYQ | Cycliq Group Ltd | 0.007 | 40% | 1,543,057 | $2,302,583 |

| CCE | Carnegie Cln Energy | 0.105 | 38% | 7,314,714 | $30,654,001 |

| IS3 | I Synergy Group Ltd | 0.011 | 38% | 1,674,808 | $13,767,923 |

| RLG | Roolife Group Ltd | 0.0055 | 38% | 2,529,281 | $7,513,982 |

| CNQ | Clean Teq Water | 0.35 | 35% | 397,290 | $18,782,999 |

| CZN | Corazon Ltd | 0.004 | 33% | 1,200,000 | $3,703,717 |

| FHS | Freehill Mining Ltd | 0.004 | 33% | 130,000 | $10,241,561 |

| PIL | Peppermint Inv Ltd | 0.004 | 33% | 130,000 | $7,415,472 |

| SFM | Santa Fe Minerals | 0.285 | 33% | 182,617 | $15,656,040 |

| KGD | Kula Gold Limited | 0.014 | 27% | 6,746,708 | $11,403,021 |

| AUZ | Australian Mines Ltd | 0.015 | 25% | 118,737,962 | $21,737,565 |

| AN1 | Anagenics Limited | 0.005 | 25% | 74,950 | $1,985,281 |

| CNJ | Conico Ltd | 0.005 | 25% | 636,119 | $1,088,583 |

| MMR | Mec Resources | 0.005 | 25% | 10,094,993 | $7,487,959 |

| WEL | Winchester Energy | 0.0025 | 25% | 1,125,000 | $2,726,038 |

| DBO | Diabloresources | 0.036 | 24% | 4,349,320 | $5,125,078 |

| ILA | Island Pharma | 0.365 | 24% | 1,945,010 | $74,864,144 |

| AVE | Avecho Biotech Ltd | 0.008 | 23% | 1,683,363 | $20,627,514 |

Lord Resources (ASX:LRD) closed 96% higher after intersecting a 20.2m zone of visible copper at its Ilgarari project in Western Australia, with chalcocite and native copper logged in drill hole 25IRC006D. The interval lies 60 m down-dip and 100 m along strike from historic hits. Drilling continues with assays forecast in October and LRD is considering extending the program.

Rapid Critical Metals (ASX:RCM) closed 56% higher today after raising $14 million through a two-tranche placement at 3.5 cents per share, led by cornerstone investors Eric Sprott, Jupiter Asset Management, and Tribeca, who together contributed $10.5 m. Funds will be used to acquire the Webbs Consol silver project in NSW, repay facility notes, and advance exploration in Australia and Canada.

Javelin Minerals (ASX:JAV) was up 50% after securing a right to mine agreement with MEGA Resources for the Eureka gold project near Kalgoorlie, paving the way for early cash flow. MEGA will fully fund up to $25 million in development, operate mining and haulage, and split profits 50/50, while Javelin receives $250,000 per month in pre-payments once revenues begin. Mining is scheduled for June 2026. JAV has also secured $4.5m via a placement to professional and sophisticated investors at $0.0025 per share, cornerstoned by MEGA with a $1m equity commitment.

Investors have reacted positively to the Clean Teq Water (ASX:CNQ) 2025 annual report released today with the stock closing 35% higher. The report showcased its delivery of advanced water technologies that support sustainable practices and regulatory compliance, It highlighted the company’s commitment to net-zero emissions and sustainable supply chains, strengthening its market position and appeal to environmentally conscious stakeholders.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PAB | Patrys Limited | 0.001 | -50% | 2000000 | 9167513.16 |

| BMO | Bastion Minerals | 0.001 | -33% | 3050000 | 3307429.64 |

| PYC | PYC Therapeutics | 0.87 | -28% | 10009344 | 708661443 |

| MTL | Mantle Minerals Ltd | 0.0015 | -25% | 1966948 | 12894891.7 |

| VAR | Variscan Mines Ltd | 0.006 | -25% | 16157939 | 7202290.9 |

| ORP | Orpheus Uranium Ltd | 0.03 | -25% | 374048 | 11267885 |

| NGX | NGX Limited | 0.155 | -23% | 35096 | 18122368 |

| NWM | Norwest Minerals | 0.011 | -21% | 9169173 | 14421497.3 |

| G88 | Golden Mile Res Ltd | 0.008 | -20% | 1378774 | 6258850.33 |

| RDS | Redstone Resources | 0.004 | -20% | 50000 | 5171336.78 |

| NUC | Nuchev Limited | 0.125 | -17% | 1387 | 23337925.2 |

| KLR | Kaili Resources Ltd | 0.28 | -16% | 2725224 | 49379121.6 |

| EVR | Ev Resources Ltd | 0.011 | -15% | 25752981 | 28957543.5 |

| KTA | Krakatoa Resources | 0.011 | -15% | 10401380 | 10115742.3 |

| KNG | Kingsland Minerals | 0.14 | -15% | 196781 | 11972550.3 |

| BIT | Biotron Limited | 0.003 | -14% | 50000 | 4645360.45 |

| BLU | Blue Energy Limited | 0.006 | -14% | 352164 | 14900337.4 |

| C7A | Clara Resources | 0.003 | -14% | 6 | 2601532.69 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 50000 | 8394800.06 |

| ICR | Intelicare Holdings | 0.025 | -14% | 2708605 | 14099456.2 |

| ANX | Anax Metals Ltd | 0.007 | -13% | 1361005 | 7062460.54 |

| FRX | Flexiroam Limited | 0.007 | -13% | 194504 | 12139188.8 |

| RGL | Riversgold | 0.0035 | -13% | 6188 | 6734850.37 |

| VKA | Viking Mines Ltd | 0.007 | -13% | 1293222 | 10751590 |

| BMN | Bannerman Energy Ltd | 3.285 | -12% | 1526197 | 770262225 |

In Case You Missed It

Southeast Asian-focused digital commerce fintech company Ovanti (ASX:OVT) is bolstering its foray into the Nasdaq after signing non-disclosure agreements with US special purpose acquisition companies and is revising its deal with EAS Advisors as it chases a potential $300m transaction.

Future Battery Minerals (ASX:FBM) has kicked off a Phase 2 RC drilling program at its Miriam project in Western Australia’s goldfields region. The 3,000m program follows on from “significant” gold prospectivity identified in recent Phase 1 drilling.

Health-tech company PainChek (ASX:PCK) has ticked some major boxes following an aged care trial in Scotland. The company’s flagship product is a smart-device based pain assessment and monitoring application – particularly useful for patients with trouble communicating.

West Australian gold explorer Norwest Minerals (ASX:NWM) has hit gold in the majority of holes in a Phase 1 drilling program at its Bulgera project. Phase 2 drilling is expected to take place next month.

Brazilian explorer St George Mining (ASX:SGQ) has discovered high-grade rare earths and niobium east of its Araxá project.

Drilling in Queensland has confirmed for explorer True North Copper (ASX:TNC) mineralisation beyond the current resource estimate at its Wallace North project.

Aldoro Resources (ASX:ARN) is re-focusing its portfolio after a divestment of non-core assets yielded $3.3m. The company will continue to work on its Kameelburg niobium and rare earths project in Namibia. Sultan Resources (ASX:SLZ) snapped up three of the gold and critical minerals projects.

Auravelle Metals (ASX:AUV) , formerly Sipa Resources, has finished up a 51-hole drilling campaign for gold in South Australia.

OzAurum Resources (ASX:OZM) has taken full control of the feasibility study for its Mulgabbie North gold project.

Last Orders

Asra Minerals has completed its rebrand to GoldArc Resources (ASX:GA8), effective today, following shareholder approval last month.

Company management says the driver behind the name change is to communicate the primary objective of making new discoveries in Western Australia’s Leonora and Kookynie gold districts.

“The name GoldArc defines our operational focus on the highly prospective geological ‘arc’ that hosts our projects, while the consolidated capital structure provides a stronger platform for future growth and is designed to be more compelling to institutional and long-term investors,” managing director Paul Stephen said.

The company has also completed a $3.m placement and a 10-for-1 share consolidation.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Disclosure: The journalist held shares in BHP and Woodside at the time of writing this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.