Closing Bell: ASX slides lower as info tech losses weigh heavily

The ASX 200 was on a slippery slope, sliding steadily lower through the trading day as the tech sector weighed heavy. Pic: Getty Images.

- ASX sheds 45.5 points or 0.51pc

- Tech leads losses, chasing Wall Street lower

- Near record gold prices pump up All Ord Gold index almost 6pc

Tech pain undercuts gold gains

The tech sector followed its Wall Street counterpart lower, dragging the rest of the ASX with it.

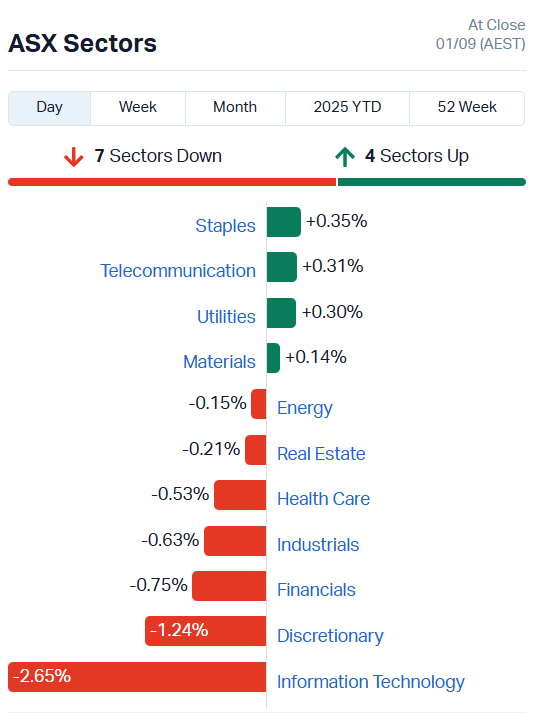

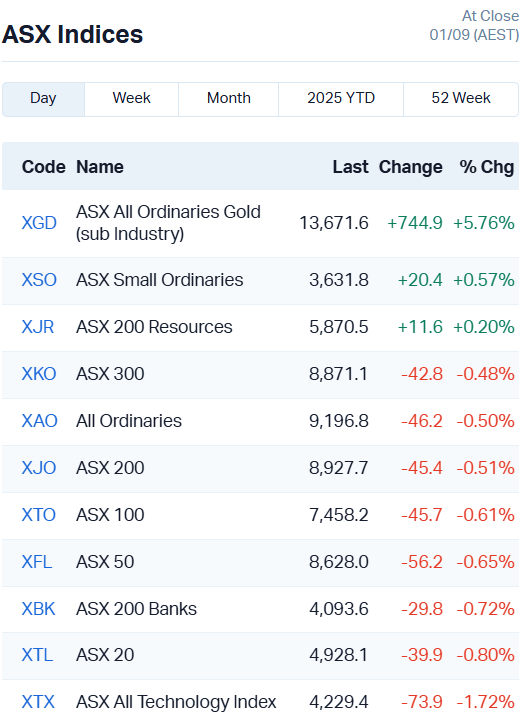

The ASX 200 has fallen 0.51% or 45.4 points, closing at 8927.7 with seven sectors lower.

First day of September trading followed the usual bearish pattern, veering off course from a bullish run through August that saw it set a new all-time high above 9000 points.

Another insistence that US inflation was falling – against all evidence – from US President Trump’s social media account undercut the US dollar.

Trump’s commentary is feeding into fears that the US Federal Reserve will be unduly influenced by the current Administration, weakening trust in the greenback.

The US Dollar Index Futures, the leading benchmark for the international value of the US dollar, has fallen 9.31% in the last six months.

The falling dollar has given gold prices wings, rising another 1% today to US$3552.4 an ounce to set an new all-time high. Spot gold is trading at US$3488 an ounce, also an all-time high.

Normally, a move like that would be enough to drive our market higher but it did give the ASX All Ords Gold index a massive boost, surging 5.76%.

But, with iron ore stocks weighing materials down, and our top banks pushing finance lower, the sparkle wasn’t enough to tempt the bulls back into play.

Still, it’s worth highlighting which gold stocks are on the move with prices at all-time highs despite the general market malaise.

Capricorn Metals (ASX:CMM) and Genesis Minerals (ASX:GMD) surged about 11% each. Greatland Resources (ASX:GGP) added 9.9% and Catalyst Metals (ASX:CYL) 8.5%.

Gold and silver companies also dominated the ASX Leaders charts, not particularly surprising when the rest of the market was on a slippery slope all day.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TMK | TMK Energy Limited | 0.003 | 50% | 58784 | $20,444,766 |

| 4DX | 4Dmedical Limited | 0.77 | 35% | 19571855 | $265,390,054 |

| 8CO | 8Common Limited | 0.035 | 35% | 380016 | $5,826,467 |

| AUK | Aumake Limited | 0.004 | 33% | 1772271 | $9,070,076 |

| FRX | Flexiroam Limited | 0.008 | 33% | 5200000 | $9,104,392 |

| S2R | S2 Resources | 0.125 | 33% | 3847158 | $47,138,090 |

| ILT | Iltani Resources Lim | 0.285 | 33% | 2342436 | $14,177,272 |

| JAL | Jameson Resources | 0.12 | 30% | 175781 | $65,387,466 |

| DRE | Dreadnought Resources | 0.0155 | 29% | 37853023 | $60,954,000 |

| ERL | Empire Resources | 0.005 | 25% | 12000 | $5,935,653 |

| RFT | Rectifier Technolog | 0.005 | 25% | 399999 | $5,527,936 |

| VRC | Volt Resources Ltd | 0.005 | 25% | 2027362 | $18,739,398 |

| RUL | Rpmglobal Hldgs Ltd | 4.65 | 23% | 2650093 | $832,151,742 |

| DAL | Dalaroometalsltd | 0.0475 | 22% | 2705426 | $11,495,325 |

| AHK | Ark Mines Limited | 0.42 | 22% | 735022 | $22,825,441 |

| OIL | Optiscan Imaging | 0.105 | 20% | 150532 | $73,010,123 |

| AGD | Austral Gold | 0.048 | 20% | 122765 | $24,492,454 |

| AHN | Athena Resources | 0.006 | 20% | 7932506 | $11,329,785 |

| KAL | Kalgoorliegoldmining | 0.048 | 20% | 3956494 | $15,271,441 |

| MGU | Magnum Mining & Exp | 0.012 | 20% | 15457233 | $23,180,371 |

| RLG | Roolife Group Ltd | 0.006 | 20% | 1340318 | $9,392,478 |

| RRR | Revolverresources | 0.096 | 20% | 1034793 | $22,101,941 |

| SNS | Sensen Networks Ltd | 0.048 | 20% | 2592799 | $31,721,499 |

| VAR | Variscan Mines Ltd | 0.006 | 20% | 1076590 | $4,501,432 |

| ARV | Artemis Resources | 0.0065 | 18% | 12740107 | $15,761,197 |

In the news…

4D Medical (ASX:4DX) has nabbed the US FDA tick of approval for “the world’s first and only non-contrast, CT-based ventilation-perfusion imaging technology”.

Described as ‘historic’ by 4DX, the clearance will allow 4DX to play into an addressable market of US$1.1 billion – one million scans at an average reimbursement rate of about US$1150 per scan.

For more details, have a gander at our regular Health Check column with Tim Boreham.

Iltani Resources (ASX:ILT) has hit its best silver results yet at the Orient silver-indium project in Queensland, drilling 24m at 215.5 g/t silver equivalent from 43m.

That wider intersection included some truly stellar silver results, if at much smaller intervals. High-grade zones included 0.46m at 1267.9 g/t silver, 1.2m at 1612 g/t and 1m at 2141.9 g/t, among several others above 100 g/t silver.

Since the silver results come from about 102.3m of depth or shallower, the Orient East deposit is looking like it could shape up into a potentially lucrative shallow, low-cost open-pit opportunity, especially considering silver’s current prices.

Dreadnought Resources (ASX:DRE) has hit bonanza gold up to 7m at 46.7 g/t gold at the Star of Mangaroon prospect, part of the Mangaroon gold project in WA.

The infill drilling targeted the northern and southern sections of the prospect, producing seven individual hits above 30 g/t gold and topping out at 1m at 162.8 g/t gold from 94m.

DRE plans to drill another 14 holes at the Star in September, before drumming up a resource estimate upgrade, mine plan and development studies for the project.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| XGLR | Xamble Group | 0.004 | -43% | 1469045 | $791,033 |

| HLX | Helix Resources | 0.0015 | -25% | 4789515 | $6,728,387 |

| OLI | Oliver'S Real Food | 0.009 | -25% | 143336 | $6,488,783 |

| AOK | Australian Oil. | 0.002 | -20% | 12000 | $2,594,457 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 125015 | $6,923,481 |

| DEL | Delorean Corporation | 0.125 | -19% | 1200945 | $34,143,114 |

| ETM | Energy Transition | 0.069 | -18% | 23071086 | $150,318,329 |

| PKD | Parkd Ltd | 0.028 | -18% | 2267181 | $3,536,472 |

| OSX | Osteopore Limited | 0.01 | -17% | 1331516 | $2,847,120 |

| TAR | Taruga Minerals | 0.01 | -17% | 1534873 | $8,565,049 |

| IFG | Infocusgroup Hldltd | 0.031 | -16% | 9424944 | $10,801,750 |

| BRU | Buru Energy | 0.0205 | -15% | 3038053 | $18,705,831 |

| ALM | Alma Metals Ltd | 0.006 | -14% | 1532177 | $12,955,160 |

| AVE | Avecho Biotech Ltd | 0.006 | -14% | 1730147 | $22,214,246 |

| BNL | Blue Star Helium Ltd | 0.006 | -14% | 1389544 | $23,575,197 |

| ENV | Enova Mining Limited | 0.006 | -14% | 11000675 | $11,053,200 |

| OMG | OMG Group Limited | 0.012 | -14% | 5842761 | $10,196,129 |

| PRM | Prominence Energy | 0.003 | -14% | 1399266 | $3,112,117 |

| ROG | Red Sky Energy. | 0.003 | -14% | 397521 | $18,977,795 |

| EZZ | EZZ Life Science | 2.02 | -14% | 299622 | $110,857,020 |

| VHL | Vitasora Health Ltd | 0.025 | -14% | 1279661 | $49,837,772 |

| DTR | Dateline Resources | 0.23 | -13% | 27185735 | $851,922,216 |

| AER | Aeeris Ltd | 0.06 | -13% | 1626533 | $5,081,771 |

| BSN | Basinenergylimited | 0.04 | -13% | 1035438 | $5,650,148 |

| HYT | Hyterra Ltd | 0.02 | -13% | 1980886 | $38,357,279 |

In Case You Missed It

Odyssey Gold (ASX:ODY) has reported strong results from drilling at its Tuckanarra project which suggest resource growth potential.

Sipa Resources (ASX:SRI) starts second drill program in SA with RC at Sheoak, aircore at Tunkillia North and drilling at Arcoordaby.

Redcastle Resources (ASX:RC1) has made a major tenement acquisition for its gold exploration in the Leonora-Laverton region of WA.

Brazilian Critical Minerals’ (ASX:BCM) latest results from two pilot field trial areas at the Ema project in Brazil have returned grades up to 14 times higher than mineralised in-situ values.

Island Pharmaceuticals (ASX:ILA) has lodged a request for a Type C meeting for Galidesivir with the US Food and Drug Administration as part of its open investigational new drug application.

Legacy Minerals (ASX:LGM) has appointed Ausenco to complete metallurgical test work ahead of a Stage 2 scoping study at its Mt Carrington gold-silver project in NSW.

Rapid Critical Metals (ASX:RCM) is acquiring the Webbs Consol project in a move that increases its scale and discovery potential as silver prices soar.

Gold producer Ariana Resources is ready to make its run for the ASX boards after exceeding the minimum $10 million targeted in its IPO.

Locksley Resources (ASX:LKY/OTCQB:LKYRF) has enhanced its executive capacity with Pat Burke appointed non-executive chairman, while Nathan Lude takes on the new role of head of strategy, capital markets and commercialisation.

Lumos Diagnostics (ASX:LDX) has announced two significant milestones, extending its leadership in the US healthcare market.

Last Orders

Buxton Resources (ASX:BUX) is moving to engage with native title holders of the Montello project applications to secure access to exploration on the tenure.

Historical drilling assays from the tenements reveal the high-grade potential of the licence with results up to 3.2m at 9.02% copper and 20.4 g/t silver from 73.15m and a broader intersection of 49m at 0.34% copper, containing 6m at 1.11% copper and 7.7 g/t silver from 81m.

Miramar Resources (ASX:M2R) has wrapped up a share purchase plan, raising $409,000 to fund exploration at the 80%-owned Gidji JV gold project. M2R reckons it’s got the beginning of a gold camp at Gidji, directly along strike from Northern Star Resources’ (ASX:NST) 314koz 8-Mile Dam gold deposit.

Trading halts

Argenica Therapeutics (ASX:AGN) – Phase 2 stroke trial results

EQ Resources (ASX:EQR) – cap raise

PolyNovo (ASX:PNV) – US reimbursement speculation announcement

At Stockhead, we tell it like it is. While Buxton Resources and Miramar Resources are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.