Closing Bell: ASX slides as Qantas’ profit takes big dip; MC Mining triples on Chinese coal deal

Mineral Resources fell on big profit drop, while Qantas' profit dropped 28pc. Picture GettyGame of chess. pieces on a chessboard.

- The ASX lagged on Thursday after Nvidia’s disappointing Q3 guidance

- Mineral Resources fell 8pc off a major profit drop

- Qantas saw a 28pc drop in profit but saw modest share price gains

The ASX was sluggish on Thursday, down 0.33%, following a weak lead from Wall Street and a 7% drop in Nvidia Corp’s shares after its disappointing Q3 guidance.

In arguably the season’s most eagerly awaited report, Nvidia was dumped despite reporting strong Q2 earnings with revenue of US$30.4 billion and a 168% increase in net income.

The company’s Q3 revenue guidance of US$32.5 billion also exceeded expectations, but ultimately disappointed investors who had much loftier expectations.

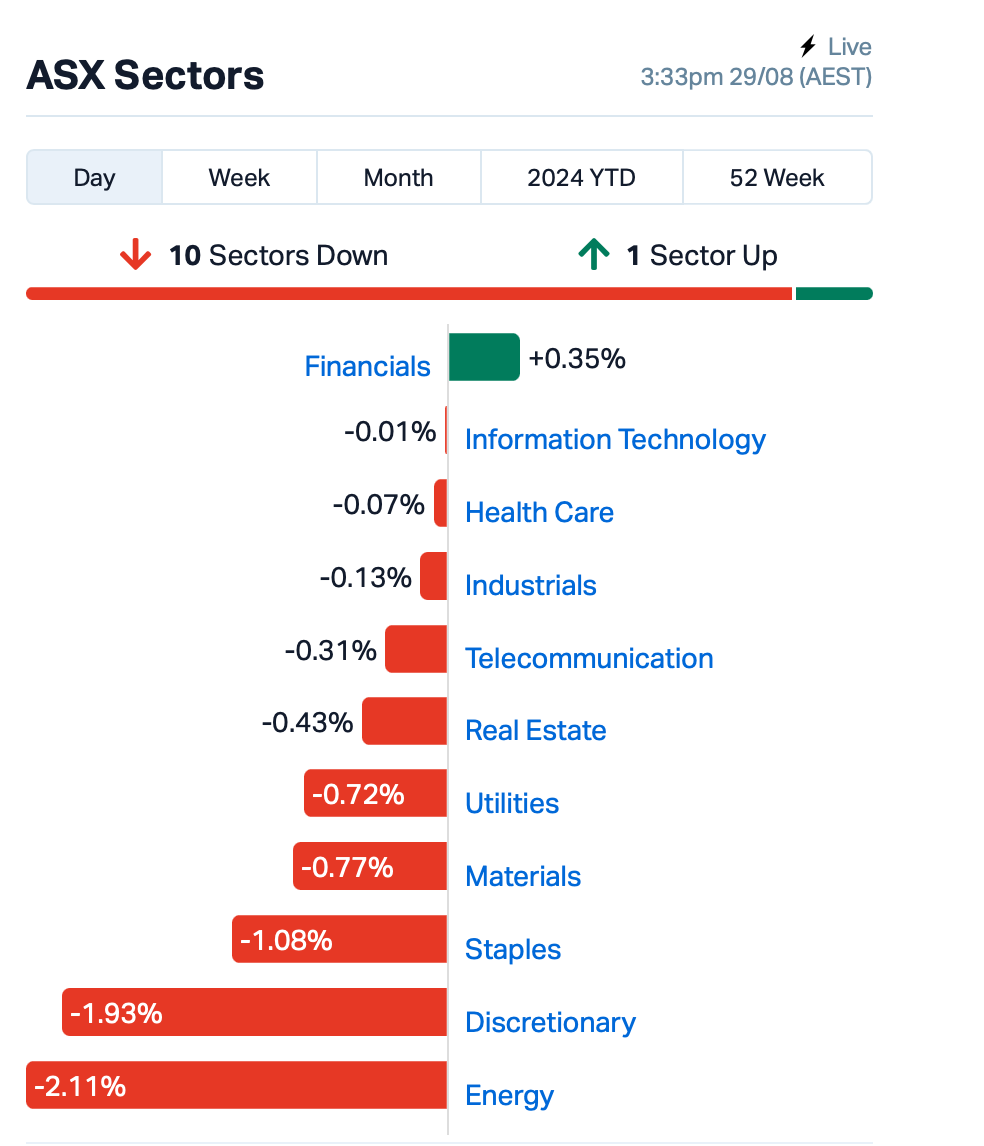

On the ASX today, it was a sea of red with 10 out of 11 ASX sectors seeing losses, led by declines in Energy, Consumer Discretionary and Staples.

Losses in Energy were led by Santos (ASX:STO) and Whithaven Coal (ASX:WHC).

The Mining sector also faced pressure from falling base metal prices, with BHP (ASX:BHP) and Rio Tinto (ASX:RIO) falling around 1% each.

Financial sector was the only one to see gains after CEOs of the big four banks attended a parliamentary inquiry.

Investors were also assessing fresh reports from companies like Qantas, Wesfarmers and Mineral Resources – see more below.

Today’s earnings season highlights

Mineral Resources (ASX:MIN) was the biggest laggard, down 9% after a disappointing earnings report.

Although revenue rose by 10% to $5.278 billion for FY24, MIN saw a 40% drop in underlying EBITDA and a 79% fall in net profit after tax.

The stock also suffered after a dividend cut and persistent high production costs.

Read more on that here: ‘No one is making money in lithium’, says big dog Ellison as MinRes cuts back

Qantas (ASX:QAN) rose modestly despite full year profit dropping 28% to $1.25 billion in FY24 due to lower fares, increased spending, and reduced freight revenue. The airline’s main profit measure fell 16% to $2 billion.

Despite higher revenue of $21.9 billion and Jetstar’s improved earnings, Qantas saw declines in both domestic and international earnings.

Vanessa Hudson, in her first set of full year results in the role of chief executive, noted increased demand for corporate and international travel, Jetstar’s success with price-sensitive travellers, and the positive impact of new initiatives like Classic Plus and fleet upgrades.

Looking ahead, Qantas said it expects stable travel demand and positive revenue growth in the first half of FY25.

Wesfarmers (ASX:WES) slipped 3% despite reporting an increase in annual net profit, reaching $2.557 billion for the year.

The company’s operating cash flow rose by 9.9% to $4.594 billion, boosted by strong performance at Bunnings and improved inventory management. Wesfarmers also reduced its debt-to-EBITDA ratio.

What else is happening?

Stocks across Asia dropped as Nvidia’s earnings failed to impress investors, leading to a decline in shares of Asian chipmakers TSMC and SK Hynix.

Nvidia’s sales forecast sparked concerns that the AI-driven tech boom might be cooling off.

Chinese tech stocks struggled today, while EV maker Li Auto saw its share price plunge nearly 10% in Hong Kong after missing earnings estimates.

Later tonight on Wall Street, focus will turn to crucial US data such as personal consumption, and weekly jobless claims.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MCM | MC Mining Ltd | 0.140 | 278% | 5,651,835 | $15,318,494 |

| IVX | Invion Ltd | 0.004 | 100% | 5,007,555 | $13,275,731 |

| LSR | Lodestar Minerals | 0.002 | 100% | 46,091,655 | $2,600,780 |

| ECG | Ecargo Hldg | 0.005 | 67% | 1,221,930 | $1,845,750 |

| HYT | Hyterra Ltd | 0.050 | 61% | 60,791,322 | $28,869,137 |

| NXD | Nexted Group Limited | 0.185 | 54% | 980,231 | $26,582,013 |

| EXL | Elixinol Wellness | 0.004 | 33% | 2,500,043 | $3,963,547 |

| FGH | Foresta Group | 0.004 | 33% | 544,870 | $7,066,137 |

| OAR | OAR Resources Ltd | 0.002 | 33% | 1,818,624 | $4,951,252 |

| TMK | TMK Energy Limited | 0.004 | 33% | 1,440,193 | $20,764,836 |

| UCM | Uscom Limited | 0.016 | 33% | 60,000 | $2,992,134 |

| LGM | Legacy Minerals | 0.275 | 31% | 285,980 | $22,145,549 |

| ASQ | Australian Silica | 0.030 | 30% | 255,315 | $6,482,789 |

| EMN | Euromanganese | 0.057 | 30% | 3,477,707 | $9,590,875 |

| MWY | Midway Ltd | 0.830 | 26% | 101,791 | $57,641,907 |

| AYT | Austin Metals Ltd | 0.005 | 25% | 200,000 | $5,296,765 |

| RGL | Riversgold | 0.005 | 25% | 129,009 | $5,309,850 |

| VML | Vital Metals Limited | 0.003 | 25% | 20,000 | $11,790,134 |

| BTH | Bigtincan Hldgs Ltd | 0.145 | 21% | 2,488,892 | $98,601,112 |

| SNS | Sensen Networks Ltd | 0.042 | 20% | 40,000 | $27,226,806 |

| BM8 | Battery Age Minerals | 0.150 | 20% | 308,018 | $11,628,018 |

| BXN | Bioxyne Ltd | 0.012 | 20% | 3,256,000 | $20,466,454 |

| JAV | Javelin Minerals Ltd | 0.003 | 20% | 283,333 | $10,692,115 |

| ROG | Red Sky Energy. | 0.006 | 20% | 30,662,690 | $27,111,136 |

| SLZ | Sultan Resources Ltd | 0.006 | 20% | 563,817 | $987,932 |

HyTerra Limited (ASX:HYT) surged after announcing a $21.9m investment from Andrew Forrest’s $60 billion resources giant Fortescue (ASX:FMG), which will take a near 40% stake in the hydrogen and helium explorer. The deal will, for starters, treble the scale of a drilling campaign at its Nemaha project in Kansas from two to six wells.

South African coal stock MC Mining (ASX:MCM) surged over 200% after exiting a trading halt and now over 150% after securing a US$90m deal for Chinese coal miner Kinetic Development Group Limited to take a 51% via a two tranche subscription agreement which will back the development of its Makhado steelmaking coal project.

Lodestar Minerals (ASX:LSR) saiddDrilling is about to start at the Ned’s Creek Gold Project. The initial phase will involve drilling two holes, each 250 meters deep, to explore gold deposits in areas identified as high-potential targets. This drilling aims to uncover gold in a geological setting similar to the Wallaby deposit, which has produced millions of ounces of gold. Ned’s Creek is situated in Western Australia’s Yilgarn Craton, an area known for significant gold and copper deposits. The project focuses on four main targets where previous drilling has already revealed high-grade gold.

For FY24, education stock Nexted Group (ASX:NXD) achieved a 9% revenue increase, driven by growth in International Vocational and Go Study segments. EBITDA fell due to fewer Technology & Design students and higher visa rejection rates. Despite a drop in net profit after tax to $0.2 million, the company added 800 students, introduced new accredited courses, and saved costs by reducing leased spaces and non-teaching staff.

OAR Resources (ASX:OAR) said it has discovered significant uranium mineralisation at its Amorinópolis Project in Brazil. Surface scans revealed uranium levels up to 131.5 ppm, with two main prospects identified. Historical drillholes from the 1970s were found, and the company plans to expand sampling to map these anomalies and set drilling targets. The largest prospect covers about 1.9 square kilometers and shows strong uranium readings. OAR intends to conduct detailed soil sampling to further explore these promising areas.

Euro Manganese (ASX:EMN) has applied to have its Chvaletice Manganese Project recognised as a Strategic Project under the EU’s Critical Raw Materials Act. This designation aims to secure essential materials for Europe’s economy and green transition. If approved, the project could benefit from easier access to financing and streamlined permitting processes. The European Commission is expected to announce the initial list of Strategic Projects in December.

Software company, Bigtincan (ASX:BTH), reported a record EBITDA of $11.3 million for FY24, a significant increase from $4.9 million in FY23. Adjusted EBITDA rose to $16.2 million from $8.3 million. The company achieved positive free cash flow of $5.4 million in the second half of the year and an operating cash flow of $6.2 million for the full year. Annual recurring revenue reached $116 million, driven by its Multi-Hub and GenieAI products.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TAS | Tasman Resources Ltd | 0.003 | -40% | 122,000 | $4,026,248 |

| ECT | Env Clean Tech Ltd. | 0.002 | -33% | 19,496 | $9,515,431 |

| ICR | Intelicare Holdings | 0.014 | -30% | 305,475 | $5,819,993 |

| ASH | Ashley Services Grp | 0.195 | -28% | 721,330 | $38,873,494 |

| FTC | Fintech Chain Ltd | 0.006 | -25% | 10,000 | $5,206,157 |

| SIS | Simble Solutions | 0.003 | -25% | 4,943,759 | $3,013,803 |

| VPR | Voltgroupltd | 0.002 | -25% | 869,406 | $21,432,416 |

| SWP | Swoop Holdings Ltd | 0.195 | -22% | 142,657 | $52,052,234 |

| EEL | Enrg Elements Ltd | 0.002 | -20% | 9,729 | $2,612,540 |

| LML | Lincoln Minerals | 0.004 | -20% | 19,846,168 | $10,281,298 |

| LPD | Lepidico Ltd | 0.002 | -20% | 1,044,333 | $21,472,812 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 9,041,668 | $5,294,436 |

| NC6 | Nanollose Limited | 0.017 | -19% | 355,511 | $3,612,134 |

| SPA | Spacetalk Ltd | 0.030 | -19% | 1,384,181 | $17,559,935 |

| AUK | Aumake Limited | 0.007 | -19% | 2,565,351 | $15,425,928 |

| DES | Desoto Resources | 0.110 | -19% | 82,158 | $8,580,938 |

| FFG | Fatfish Group | 0.009 | -18% | 1,409,674 | $15,472,303 |

| POD | Podium Minerals | 0.027 | -18% | 771,643 | $15,006,644 |

| CTT | Cettire | 1.090 | -18% | 9,965,039 | $507,046,833 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 2,040,439 | $11,669,312 |

| LNR | Lanthanein Resources | 0.003 | -17% | 33,064 | $7,330,908 |

| W2V | Way2Vatltd | 0.010 | -17% | 1,089,594 | $10,591,410 |

| S2R | S2 Resources | 0.105 | -16% | 51,572 | $56,607,249 |

Melbourne-based luxury retailer Cettire (ASX: CTT) crashed 18% today after reporting a 34% fall in net profit to $10.47 million for FY24, despite a big 81% rise in gross revenue, which nearly reached $1 billion.

The company’s marketing expenses more than doubled to $75.7 million, and other costs also increased.

Cettire has been under scrutiny and has hired Grant Thornton for a deeper audit, including a review of its revenue recognition practices.

TRADING HALTS

Change Financial (ASX:CCA) – pending an announcement to the market in relation to a capital raising.

ReNu Energy (ASX:RNE) – pending the release of an ASX announcement regarding a proposed capital raise.

Enlitic (ASX:ENL) – for the purposes of undertaking a proposed equity raising.

Narryer Metals (ASX:NYM) – pending an announcement in relation to a potential capital raising.

IN CASE YOU MISSED IT

D3 Energy (ASX:D3E) has reported a 52% increase in measured gas flow rates from its RBD10 well due to the use of its more fit for purpose and accurate metering equipment. This gas flow includes world-class helium concentrations of 4.7% along with 87.7% methane.

Finder Energy (ASX:FDR) has completed the acquisition of a 76% stake in PSC 19-11 offshore Timor-Leste, which hosts 34MMbbl of net discovered oil. The company will now fast-track development of the Kuda Tasi and Jahal fields which have appraised gross 2C contingent resource of 22MMbbl oil.

Harvest Technology Group (ASX:HTG) has raised $2.2m via sophisticated investors since July 1 to refocus on growth with the company completing most of a restructuring program as part of its three-year plan to profitability.

HyTerra (ASX:HYT) has drawn a $21.9m investment from Fortescue that allows it to upgrade its planned two well program to a six well campaign to test for ‘white’ hydrogen and helium in Kansas. Subject to shareholder approval, FMG will become the company’s largest shareholder with a 39.8% strategic interest.

Indiana Resources’ (ASX:IDA) reverse circulation drill program targeting the Minos prospect in South Australia’s Gawler Craton has returned gold grades of up to 25.9g/t with multiple target zones intersected.

MoneyMe (ASX:MME) has reported a 23% increase in loan originations to $574m and NPAT up 85% to $23m for FY2024 with higher credit quality reducing credit losses. Operating costs have fallen by 7% to $48m while secured assets now make up 55% of the loan book.

Pursuit Minerals’ (ASX:PUR) second drillhole at the Sal Rio 2 tenement within its Rio Grande Sur project in Argentina has hit significant high-grade lithium brine at shallow depths of about 161m. Drilling also returned multiple drill hole intercepts above 500mg/L lithium.

The final batch of assays from Trinex Minerals’ (ASX:TX3) rock chip sampling at the Halo-Yuri project in Canada have returned strong grades of between 1.2-4.1% Li2O. The result from the OIG prospect is indicative of scope for significant lithium mineralisation.

At Stockhead, we tell it like it is. While D3 Energy, Finder Energy, Harvest Technology Group, HyTerra, Indiana Resources, MoneyMe Pursuit Minerals and Trinex Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.