Closing Bell: ASX sheds 2.5pc for the week as volatility hits hard

The ASX 200 is up just 3.18% for the year to date, after copping a 2.5% haircut for the trading week. Pic: Getty Images.

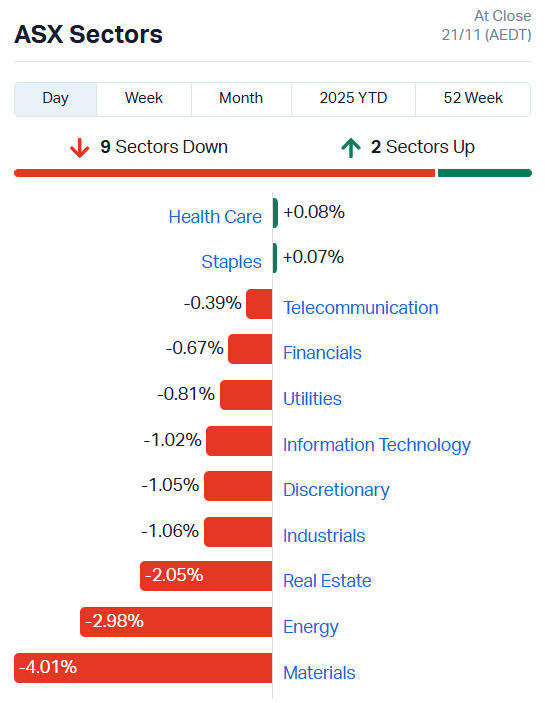

- ASX plummets 1.59% or 136.2 points

- Materials hit hardest, with gold and lithium stocks in retreat

- Defensive sectors in favour; healthcare and staples crawl into green

Nvidia rally turns into dead cat bounce

Things were looking almost rosy yesterday, with Nvidia’s results soothing fears of an imminent AI bubble burst.

Today, everything is a much deeper shade of red.

It’s not entirely clear why Wall Street pulled back so deeply overnight.

Higher-than-expected US employment data and a lessening chance of another interest rate cut before the FY ends certainly had something to do with it.

Analysts speculate the post-Nvidia optimism also faded quickly in the face of incredibly stretched valuations.

Bitcoin’s tumble – down to US$86,023 per BTC by trade’s end – coupled with another small pullback in gold futures is highlighting just how volatile the mood is at present.

The VIX’s uncertainty index hit 23.6 today, climbing six points since the beginning of the month.

The VIX isn’t an indication of whether the market is turning bearish, but rather marks an increase in volatility and uncertainty. The higher the VIX, the greater the market swings in either direction tend to be.

Either way, the chaos made for a truly bruising day of trade on the ASX 200.

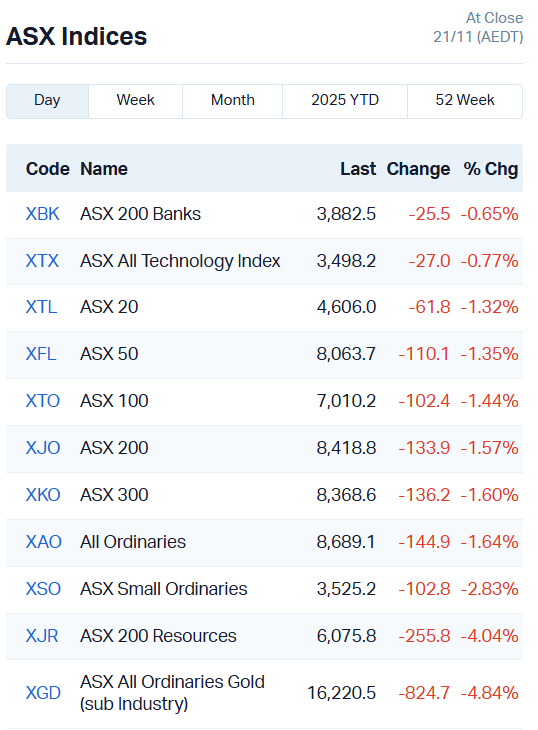

The index fell 136.2 points or 1.59% to 8416. Just 28 companies managed to gain, while 164 followed the market lower.

Materials and the XGD gold index took particularly heavy damage.

Yesterday’s lithium gains have translated to sell downs today:

- Core Lithium (ASX:CXO) -15.69%

- European Lithium (ASX:EUR) -16.22%

- Elevra Lithium (ASX:ELV) -11.11%

- Pilbara Minerals (ASX:PLS) -6.56%

- Liontown Resources (ASX:LTR) -7.98%

- IGO (ASX:IGO) -6.07%

- Mineral Resources (ASX:MIN) -3.89%

- Rio Tinto (ASX:RIO) -3.44%

Gold stocks were also in the crossfire:

- Meteoric Resources (ASX:MEI) -12.16%

- Catalyst Metals (ASX:CYL) -8.57%

- Nova Minerals (ASX:NVA) -11.59%

- Saturn Metals (ASX:STN) -8.51%

- Kingsgate (ASX:KCN) -6.4%

- Newmont (ASX:NEM) -6.19%

- Evolution Mining (ASX:EVN) -5.09%

- Northern Star Resources (ASX:NST) -4.14%.

A twinkle of green amongst the red

As always, there were bright spots of green amongst the crimson.

The healthcare and consumer staples sectors managed to just scrape into positive territory, ticking up less than 0.1% each.

AFT Pharma (ASX:AFP) managed to hold onto its intraday gains a little better today, trading up 9.49%.

Yesterday, the biotech revealed a major 1000-patient phase III study for a new iron deficiency treatment that could compete with CSL’s (ASX:CSL) acquired Vifor arm.

Critical minerals stock Tivan (ASX:TVN) climbed 9.3% after shipping its first acid grade fluorspar samples from the Speewah fluorite project in WA yesterday.

The company is nearing a final investment decision for the project as it wraps up the last stages of a feasibility study.

Gentrack (ASX:GTK) added 5.99% after its new g2 software platform was selected by Pennon Water Services to enhance operations and customer experience.

It’s the first UK customer for the tech, a pretty big win since Pennon is one the UK’s largest business water and wastewater retailers.

Catapult Sport (ASX:CAT) is making somewhat of a recovery after plunging up to 16% in trade yesterday. The stock’s earnings numbers were good, hitting double digit growth in annual contract value (19%) and a 50% increase in operating profit, but investors were expecting more.

CAT ended the day up 5.09%, but down 14.39% for the last five days.

All in all, the ASX has fallen 2.50% over the last five days, now up just 3.18% for the year to date.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RAS | Ragusa Minerals Ltd | 0.036 | 50% | 3739285 | $4,276,771 |

| BLZ | Blaze Minerals Ltd | 0.003 | 50% | 4326681 | $7,187,500 |

| NAE | New Age Exploration | 0.003 | 50% | 5433000 | $8,269,997 |

| QFE | Quickfee Limited | 0.067 | 49% | 1419154 | $17,107,848 |

| FHS | Freehill Mining Ltd. | 0.004 | 33% | 37059614 | $10,552,811 |

| SGR | The Star Ent Grp | 0.1075 | 25% | 43600606 | $246,706,555 |

| BUY | Bounty Oil & Gas NL | 0.0025 | 25% | 2038103 | $3,903,999 |

| CHM | Chimeric Therapeutic | 0.0025 | 25% | 15540477 | $7,284,272 |

| ERG | Eneco Refresh Ltd | 0.016 | 23% | 39473 | $3,540,659 |

| EMT | Emetals Limited | 0.006 | 20% | 33710 | $4,250,000 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 1710888 | $24,866,747 |

| PAT | Patriot Resourcesltd | 0.049 | 20% | 320291 | $6,765,921 |

| MBK | Metal Bank Ltd | 0.019 | 19% | 3280701 | $10,725,476 |

| COV | Cleo Diagnostics | 0.64 | 17% | 890036 | $70,032,501 |

| N1H | N1 Holdings Ltd | 0.17 | 17% | 10104 | $12,768,058 |

| GAS | State GAS Limited | 0.035 | 17% | 997648 | $11,785,526 |

| CRB | Carbine Resources | 0.007 | 17% | 35714 | $7,151,194 |

| ROG | Red Sky Energy. | 0.0035 | 17% | 400000 | $16,266,682 |

| LDX | Lumos Diagnostics | 0.22 | 16% | 6209816 | $149,564,445 |

| XPN | Xpon Technologies | 0.015 | 15% | 4059856 | $6,374,633 |

| ID8 | Identitii Limited | 0.008 | 14% | 46212 | $5,761,095 |

| LCY | Legacy Iron Ore | 0.008 | 14% | 200732 | $68,334,298 |

| VMS | Venari Minerals | 0.016 | 14% | 5169242 | $14,795,429 |

| S2R | S2 Resources | 0.09 | 14% | 698018 | $41,965,846 |

| BLG | Bluglass Limited | 0.0125 | 14% | 658945 | $28,760,773 |

In the news…

Ragusa Minerals (ASX:RAS) is eyeing a 60% controlling interest in the Purple Pansy manganese-gold project in the US state of Arizona.

RAS is working toward a binding heads of agreement to acquire an interest in holding company Pegasus Tel Inc.

It’s another strategic move into the US critical minerals space by an Aussie resources stock, offering exposure to manganese for defence and energy-related markets while also capitalising on high gold prices.

QuickFee (ASX:QFE) is offering a dividend of 7.5 cents per share to shareholders after getting the tick of approval at its AGM. Investors can expect the money to land in their account sometime around December 1.

Star Entertainment Group (ASX:SGR) has obtained the green light to accept a $300 million rescue package from the Bally’s Corporation and Investment Holdings.

Bally’s is buying an executive ticket with a board seat with plans to boost The Star’s financial performance.

At present, the company’s NSW licence remains suspended, with NICC-appointed manager Nick Weeks continuing to oversee its operations.

Patriot Resources (ASX:PAT) has snapped up an 80% interest in two large-scale exploration licences within the copper-rich district of Mumbwa in Zambia.

Management says the deal – settled on a 20% free-carry basis without cash consideration – has strengthened PAT’s ownership structure while preserving capital to advance its Kitumba copper-zin-lead project.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JNS | Janus Electric Holding | 0.1025 | -40% | 2270643 | $16,070,559 |

| RFT | Rectifier Technolog | 0.003 | -25% | 436638 | $5,527,936 |

| MYX | Mayne Pharma Ltd | 4.45 | -23% | 432273 | $470,413,338 |

| ASN | Anson Resources Ltd | 0.079 | -21% | 23065163 | $144,352,335 |

| DEV | Devex Resources Ltd | 0.135 | -21% | 4256689 | $75,087,414 |

| AS2 | Askarimetalslimited | 0.012 | -20% | 39691 | $7,030,545 |

| DDT | DataDot Technology | 0.004 | -20% | 9301 | $6,054,764 |

| OEL | Otto Energy Limited | 0.004 | -20% | 2200460 | $23,975,049 |

| RNX | Renegade Exploration | 0.004 | -20% | 3770483 | $10,348,984 |

| TMX | Terrain Minerals | 0.004 | -20% | 6002500 | $14,831,016 |

| RRE | Right Resources | 0.15 | -19% | 250741 | $16,360,909 |

| TG1 | Techgen Metals Ltd | 0.027 | -18% | 3742851 | $10,733,735 |

| DTI | DTI Group Ltd | 0.01 | -17% | 1757435 | $10,765,234 |

| EXL | Elixinol Wellness | 0.01 | -17% | 5851795 | $3,323,897 |

| LNU | Linius Tech Limited | 0.0025 | -17% | 1728351 | $24,089,582 |

| SKN | Skin Elements Ltd | 0.005 | -17% | 517615 | $7,396,285 |

| EUR | European Lithium Ltd | 0.155 | -16% | 26753878 | $303,411,689 |

| CXO | Core Lithium | 0.215 | -16% | 49379637 | $678,431,567 |

| POD | Podium Minerals | 0.056 | -14% | 2981231 | $64,195,725 |

| LOV | Lovisa Holdings Ltd | 29.54 | -15% | 485867 | $3,855,914,361 |

| AXP | AXP Energy Ltd | 0.017 | -15% | 387085 | $7,517,754 |

| NXD | Nexted Group Limited | 0.34 | -15% | 246004 | $88,983,889 |

| LSR | Lodestar Minerals | 0.018 | -14% | 9357232 | $21,292,300 |

| AX8 | Accelerate Resources | 0.006 | -14% | 168750 | $5,818,321 |

| GLA | Gladiator Resources | 0.012 | -14% | 4165577 | $11,393,933 |

In the news…

Mayne Pharma’s (ASX:MYX) return to glory was short-lived. The day after the FIRB extended the deadline on an acquisition by Cosette Pharmaceuticals to November 20, Treasurer Jim Chalmers axed the whole deal, citing national interest grounds. MYX plunged more than 23% before going into a trading halt.

In Case You Missed It

New Age Exploration (ASX:NAE) has kicked off a 4000-metre drill campaign over its Wagyu project to investigate its lofty potential for Hemi-style gold.

Trigg Minerals (ASX:TMG) has stepped into the political spotlight as momentum builds behind its Antimony Canyon project in Utah.

Red Mountain Mining (ASX:RMX) has expanded the footprint of its Yellow Pine antimony project in Idaho’s Stibnite mining district.

Challenger Gold (ASX:CEL) remains on track to start Hualilán gold production in January 2026 with execution of MAPAL mining services contract.

Anson Resources (ASX:ASN) has raised $14 million in a strategic placement to advance its Green River lithium project in Utah.

Alterity Therapeutics (ASX:ATH) has announced a series of board changes ahead of its AGM today, positioning the biotech for its next phase of growth.

Redcastle Resources’ (ASX:RC1) 315-hole grade control drilling will update resources at Redcastle Reef and determine its suitability for early mining.

Trading halts

ABx Group Limited (ASX:ABX) – cap raise

Bougainville Copper Limited (ASX:BOC) – Panguna Project update

Elixir Energy Limited (ASX:EXR) – potential material acquisition

HeraMED Ltd (ASX:HMD) – strategic partnership

Iondrive Limited (ASX:ION) – cap raise

Mayne Pharma Group Limited (ASX:MYX) – proposed acquisition

New Frontier Minerals Limited (ASX:NFM) – cap raise

Omega Oil and Gas Limited (ASX:OMA) – potential material acquisition

Stealth Group Holdings Ltd (ASX:SGH) – cap raise

VHM Limited (ASX:VHM) – cap raise

VRX Silica Limited (ASX:VRX) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.