Closing Bell: ASX rebounds as Eagers revs up with a 21pc surge

Automotive company Eagers drives ASX surge. Picture via Getty Images

- Coles and Qantas drive ASX surge

- Eagers, Ramsay, Medibank and Neuren rise

- MrBeast eyes $5b valuation

The ASX had a good run on Thursday, with the market lifting 0.2% as key players like Coles Group (ASX:COL) and Qantas (ASX:QAN) reported some impressive numbers.

Coles rose 3% after announcing a net profit increase of 6.4% to $666 million in the first half of FY2025, and paying a 37-cent dividend. A little bit of luck was involved too, as the supermarket giant benefited from rival Woolworths’ strike in December.

Qantas jumped 4% after revealing a $1.4 billion half yearly profit and deciding to return some of that cash to shareholders with a special dividend.

Unlisted Virgin Australia was also making headlines after Qatar Airways was allowed by regulators to buy a 25% stake in the airline.

In other corporate action, Eagers Automotive (ASX:APE) was a standout, shooting up 21% despite reporting a 25% drop in net profit for the full year of FY24 to $222.9 million.

But the $3bn auto company’s stock jumped mainly because its secondhand car business, easyauto123, smashed records.

Eagers’ CEO Keith Thornton reckons the company’s still doing better than the overall market, and with over 200 showrooms in the ANZ, size is giving Eagers a leg up in the industry, he said.

The $8bn hospital network Ramsay Health Care (ASX:RHC) also climbed 8% after reporting strong performance in its Aussie and UK hospitals during the half.

Medibank Private (ASX:MPL) got a nice 10% boost after upping its dividend, despite challenges like cost of living pressures making people switch funds.

Neuren Pharmaceuticals (ASX:NEU) jumped 8% as sales in its Rett syndrome treatment, DAYBUE, nearly doubled.

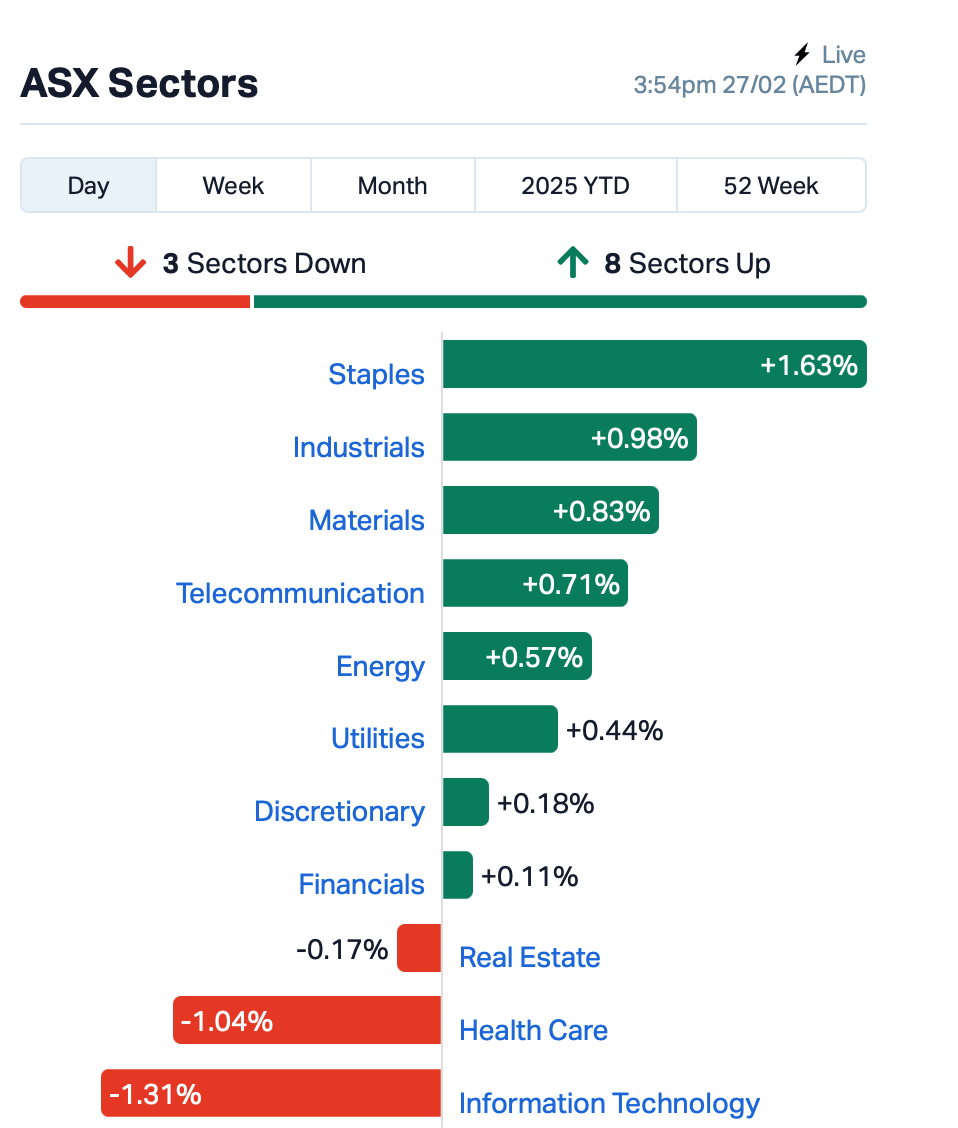

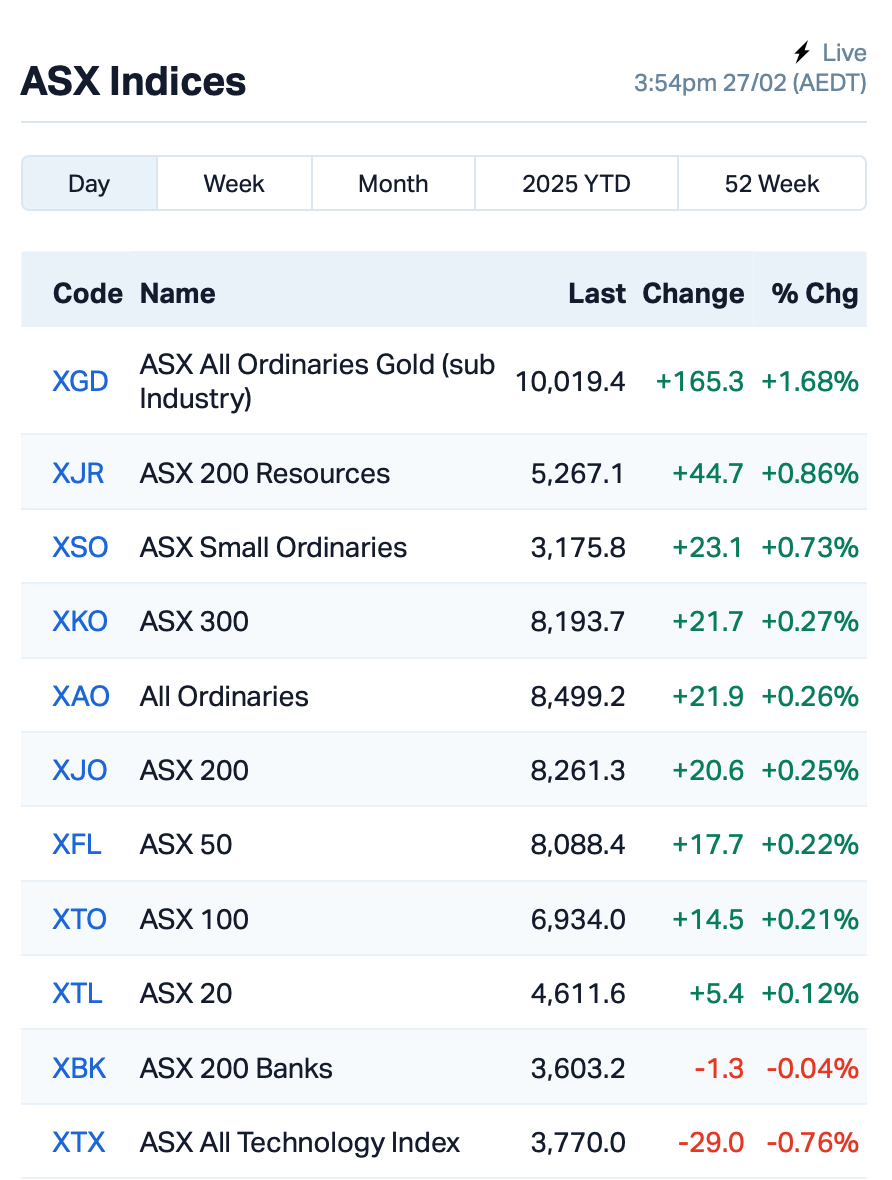

This is where things stood leading up to Thursday’s close:

Meanwhile, American YouTube sensation MrBeast is reported to be raising cash to fuel his ever-expanding empire, with reports suggesting he’s eyeing a US$5 billion valuation.

MrBeast, whose real name is Jimmy Donaldson, wants to expand his business which includes his chocolate brand Feastables, snack company Lunchly, and video production company.

Despite his massive success, the man behind viral challenges has had his fair share of losses, notably on Amazon’s Prime Video series, which he said cost him tens of millions.

And finally elsewhere, US President Trump has just signed an executive order expanding Elon Musk’s “Doge” program.

The executive order asks agencies to team up with a DOGE to review contracts and grants, and adjust or cut them where needed.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Code Description Last % Volume MktCap WWG Wiseway 0.220 63% 709,289 $22,592,681 88E 88 Energy Ltd 0.002 50% 3,240,455 $28,933,812 VML Vital Metals Limited 0.002 50% 2,215,673 $5,895,067 WBE Whitebark Energy 0.007 40% 307,241 $1,541,046 WNR Wingara Ag Ltd 0.007 40% 320,000 $877,713 EPX Ept Global Limited 0.042 31% 388,965 $20,998,656 BB1 Blinklab Limited 0.440 28% 964,050 $21,126,474 BXN Bioxyne Ltd 0.034 26% 3,527,230 $55,329,176 MEM Memphasys Ltd 0.008 23% 4,282,064 $11,511,596 EGN Engenco Limited 0.215 23% 726,015 $55,298,749 AEF Australian Ethical 6.130 21% 593,345 $575,038,259 APE Eagers Automotive 15.005 21% 3,469,571 $3,213,023,006 ASP Aspermont Limited 0.006 20% 20,534 $12,350,058 RLF Rlfagtechltd 0.043 19% 2,571,321 $12,619,076 GAL Galileo Mining Ltd 0.155 19% 139,971 $25,691,241 MAT Matsa Resources 0.063 19% 22,406,159 $38,828,362 BLU Blue Energy Limited 0.007 17% 1,942,804 $11,105,842 GLL Galilee Energy Ltd 0.007 17% 400,000 $3,343,157 RAN Range International 0.004 17% 125,000 $2,817,871 RFT Rectifier Technolog 0.007 17% 1,380,092 $8,291,904 TMK TMK Energy Limited 0.004 17% 1,065,196 $27,976,695 GRV Greenvale Energy Ltd 0.082 15% 815,869 $34,568,006 BMG BMG Resources Ltd 0.015 15% 11,372,158 $10,899,163 NC6 Nanollose Limited 0.023 15% 246,852 $3,940,127 BYH Bryah Resources Ltd 0.004 14% 142,857 $2,193,803

Agricultural producer Wingara AG (ASX:WNR) has signed a deal to sell its Export Hay Press and related equipment for $750,000 plus GST. This decision comes after market conditions made it tough to operate efficiently, and the current equipment couldn’t achieve the needed scale. The sale price is seen as fair given the current market situation.

Engineering company Engenco (ASX:EGN) posted solid results for H1 FY25, with net profit before tax up 72.8% to $3.5 million. EBIT rose 43.9% to $4.6 million, thanks to better margins and cost management. While revenue dropped 3.3% to $104.8 million, Engenco made moves to cut unprofitable parts of the business.

Fund manager Australian Ethical Investment (ASX:AEF) had a cracking first half of FY25, with profits and revenue all up. Funds Under Management (FUM) hit a record $13.26 billion, up 27% from June 2024, and NPAT jumped 50% to $9.3 million. The company’s growth strategy is clearly paying off, all while expanding through the acquisition of Altius Asset Management.

Matsa Resources (ASX:MAT) has struck a deal with AngloGold Ashanti where the mining giant has the option to buy the majority of the Lake Carey gold project for $101 million. Matsa will be keeping some key assets though, like the Devon Pit Gold Mine and Fortitude North project. The deal includes a non-refundable $8 million upfront, with the bulk of it based on gold price fluctuations, plus a deferred payment of up to $20 million depending on future gold discoveries.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap EDE Eden Inv Ltd 0.001 -50% 250,373 $8,219,762 MOM Moab Minerals Ltd 0.001 -50% 4,258,023 $3,133,999 APC APC Minerals 0.016 -33% 2,598,277 $2,812,154 SIT Site Group Int Ltd 0.001 -33% 33,795,731 $4,886,235 SGQ St George Min Ltd 0.022 -33% 104,561,242 $39,633,294 CHL Camplifyholdings 0.525 -31% 362,028 $54,697,767 CCG Comms Group Ltd 0.058 -28% 3,007,292 $31,149,483 BLZ Blaze Minerals Ltd 0.003 -25% 7,500,020 $6,267,791 BP8 Bph Global Ltd 0.003 -25% 2,837,348 $1,933,233 EAT Entertainment 0.003 -25% 60,000 $5,235,144 ERL Empire Resources 0.003 -25% 161,000 $5,935,653 NES Nelson Resources. 0.003 -25% 2,462,073 $8,687,711 TIG Tigers Realm Coal 0.003 -25% 8,942 $52,266,809 CDR Codrus Minerals Ltd 0.017 -23% 97,860 $3,638,525 5EA 5Eadvanced 0.875 -20% 12,433 $16,115,393 ADD Adavale Resource Ltd 0.002 -20% 18,845 $5,683,198 CRR Critical Resources 0.004 -20% 602,312 $12,321,106 LEG Legend Mining 0.008 -20% 200,000 $29,094,772 MEL Metgasco Ltd 0.004 -20% 1,053,703 $7,287,934 EVZ EVZ Limited 0.160 -18% 186,373 $23,668,304 ALR Altairminerals 0.003 -17% 55,500 $12,890,233 OSL Oncosil Medical 0.005 -17% 6,281,930 $27,639,481 RDN Raiden Resources Ltd 0.005 -17% 26,040,499 $20,705,349 RMI Resource Mining Corp 0.005 -17% 1,904,483 $3,914,087

IN CASE YOU MISSED IT

Ark Mines (ASX: AHK) has received an R&D tax refund of just over $290,000 for work on its Sandy Mitchell REE and mineral sands project in North Queensland during FY24. The company says the refund highlights the project’s unique nature and world-class potential. Ark is also exploring further financial opportunities, including grants and developmental partnerships.

The first half of AnteoTech’s (ASX:ADO) 2025 financial year has been “a period of advancement,” with revenue from ordinary activities jumping 74% from the previous corresponding period to $660,000. The company attributes this growth to its marketing-led, customer-centric approach gaining traction.

Brightstar Resources (ASX:BTR) has received approval to kick off gold mining at its Fish underground project, which will supply ore to the Laverton mill under its agreement with Genesis Minerals. Underground portal development is set to begin in April 2025, with first ore production expected in the June quarter.

CSE-listed American Salars Lithium (CSE:USLI) is building on its fast-growing lithium portfolio with the acquisition of the Leduc East lithium pegmatite project in Quebec. This follows its recent purchase of the Jaguaribe project in Brazil, where rock samples returned high grades of up to 3.72% Li₂O. As for the Leduc East project, it hosts 35 mapped pegmatites and 13 former feldspar and mica mines.

Riversgold (ASX:RGL) is adding another rig to kick off its 2025 drill season at the Kalgoorlie East gold project in WA. The aircore rig will drill 2000 metres to test shallow mineralisation, while a newly added RC rig from Topdrill will complete 1280 metres at depths of 100 to 120 metres, targeting extensions of previous high-grade shallow intercepts.

After executing binding toll milling agreements, Challenger Gold (ASX:CEL) has appointed veteran mining engineer Ubirata (Bira) De Oliveira as general manager of operations for its Hualilan gold project in San Juan, Argentina. Oliveira will lead the operational readiness phase for toll milling, managing the transition from development to full-scale production and overseeing daily mining activities.

European Lithium (ASX: EUR) has announced that Critical Metals Corp has appointed Michael C. Ryan as an independent director to its board. Ryan will also serve as chairman of the Audit Committee, bringing the total number of directors on Critical Metals Corp’s board to five.

At Stockhead, we tell it like it is. While Ark Mines, AnteoTech, Brightstar Resources, American Salars Lithium, Riversgold, Challenger Gold, and European Lithium are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.