Closing Bell: ASX pushed lower by bank stock profit taking; WDS gas project rubber stamped

ASX investors have cashed-in on ASX banking stocks, driving the bourse lower. Pic: Getty Images

- ASX falls as profit taking cuts banking stocks

- Energy sector booms on WDS project green light

- CPI comes in at 2.4pc vs expectations of 2.3pc

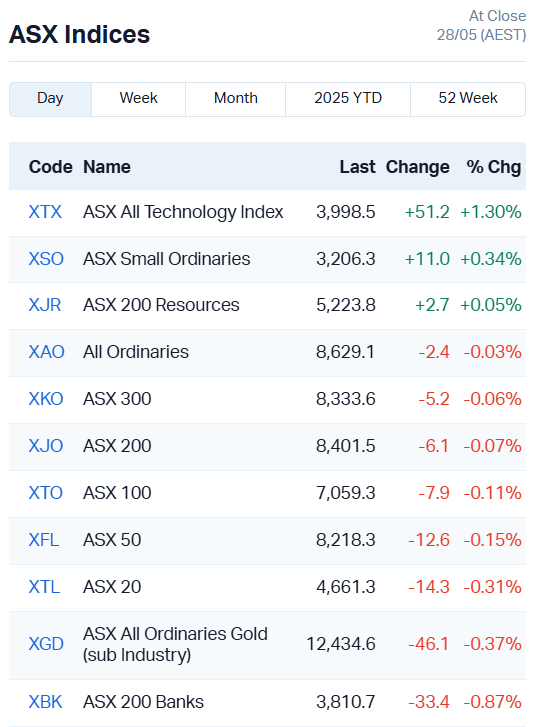

A trend of profit taking in the larger banking stocks has pushed the ASX lower by -0.13%, erasing gains made earlier this morning.

Sticky inflation slightly above expectations didn’t help matters. CPI rose by 2.4% over the year to April, just above hopes of a small dip to 2.3%.

While still firmly in the RBA’s target band, the inflation read has increased uncertainty around the RBA’s July interest rate meeting.

The market is pricing a 25-basis point cut for July, with a probability of about 65%.

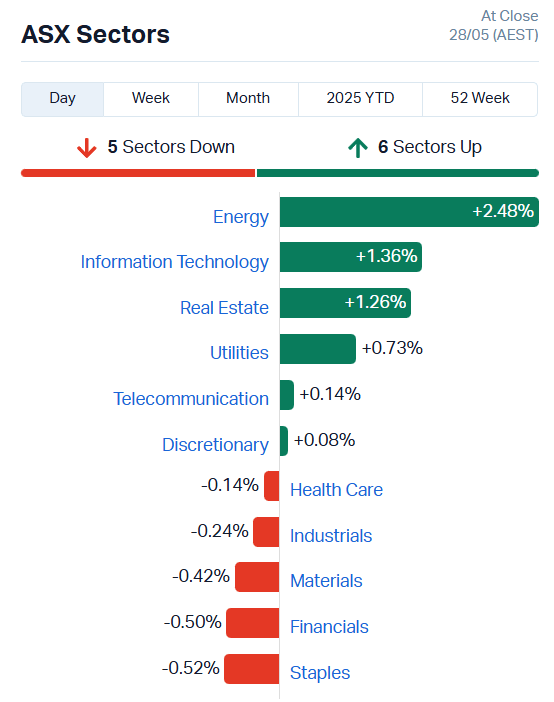

Nonetheless, rate-sensitive stocks were on the up today, with Info Tech and Real Estate sectors both adding more than 1% in trade.

Energy performed even better, adding more than 2% sector-wide despite a 1% fall in the oil price overnight.

A rubber stamp from the federal government for Woodside Energy’s (ASX:WDS) North West Shelf gas project might’ve had something to do with it.

The green light has extended the life of Australia’s largest oil and gas project to 2070 after a six-year period of deliberation.

More on that in a moment.

Back on the ASX, the All Tech index jumped 1.3% despite the dour market mood, while the ASX Small Ords posted a 0.34% lift.

Weebit Nano (ASX:WBT) climbed 4.11%, RPM Global (ASX:RUL) 6.32% and Eroad (ASX:ERD) soared 17.59%.

Woodside’s North West Shelf gas project green lit

After six years in limbo, WDS stock jumped 3.22% on news the North West Shelf project had been rubber stamped.

“Following the consideration of rigorous scientific and other advice including submissions from a wide cross-section of the community, I have today made a proposed decision to approve this development, subject to strict conditions, particularly relating to the impact of air emissions levels from the operation of an expanded on-shore Karratha gas plant,” Environmental minister Murray Watt said in a statement.

The government – both federal and state – has received a lot of pushback over this particular development, from a variety of environmental, indigenous and community groups.

In response, Prime Minister Albanese pointed out that there’s a difference between net zero emissions and zero emissions whatsoever.

He argued the firming capacity of natural gas was vital to the renewable energy transition.

“We need to make sure that there is security of energy supply at the same time as we support the transition which reduces our emissions,” he said.

Climate and indigenous groups are already raising concerns, with former chair of the Murujuga Aboriginal Corp and co-founder of Save Our Songlines Raelene Cooper threatening legal action against the project approval.

“See you in court,” she said in response to the news.

The Climate Council argued that a 40-year extension would turn the North West Shelf project into “the most polluting fossil fuel project green-lit by the Albanese government”.

Their modelling predicts emissions from the project over its new life time will equal more than a decade’s worth of annual emissions from Australia as a whole.

WA Premier Roger Cook said gas was a step in the decarbonisation journey, with an important role to play in transitioning from coal-based energy production.

“I’m not going to shackle Western Australia to legislation which damages our efforts to help the globe to decarbonise and reduce emissions,” he said.

Western Australia remains the only state in Australia that has not committed to an emissions target for 2030.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SFG | Seafarms Group Ltd | 0.002 | 100% | 2859739 | $4,836,599 |

| CTN | Catalina Resources | 0.0035 | 75% | 34046776 | $4,852,038 |

| AYM | Australia United Min | 0.003 | 50% | 9691768 | $3,685,155 |

| CZN | Corazon Ltd | 0.0015 | 50% | 500000 | $1,184,572 |

| MOM | Moab Minerals Ltd | 0.0015 | 50% | 500000 | $1,733,666 |

| PAB | Patrys Limited | 0.0015 | 50% | 1750000 | $2,057,447 |

| SKN | Skin Elements Ltd | 0.003 | 50% | 185172 | $2,150,428 |

| BMO | Bastion Minerals | 0.002 | 33% | 500000 | $1,355,441 |

| CCO | The Calmer Co Int | 0.004 | 33% | 35965065 | $9,033,947 |

| PVT | Pivotal Metals Ltd | 0.008 | 33% | 8902191 | $5,443,355 |

| TFL | Tasfoods Ltd | 0.004 | 33% | 123592 | $1,311,287 |

| YAR | Yari Minerals Ltd | 0.008 | 33% | 2840445 | $3,328,269 |

| NWM | Norwest Minerals | 0.012 | 33% | 4676283 | $7,464,168 |

| CDE | Codeifai Limited | 0.007 | 27% | 5750 | $1,793,175 |

| ODE | Odessa Minerals Ltd | 0.007 | 27% | 7038366 | $8,797,429 |

| BYH | Bryah Resources Ltd | 0.005 | 25% | 3275000 | $3,479,814 |

| CR9 | Corellares | 0.0025 | 25% | 106667 | $2,011,213 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 4621189 | $7,943,347 |

| JAV | Javelin Minerals Ltd | 0.0025 | 25% | 2360775 | $12,092,298 |

| OLI | Oliver'S Real Food | 0.005 | 25% | 4168 | $2,162,928 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 1200000 | $6,350,111 |

| SHP | South Harz Potash | 0.005 | 25% | 207400 | $4,410,915 |

| LKY | Locksleyresources | 0.061 | 24% | 90149790 | $7,186,667 |

| T92 | Terrauraniumlimited | 0.037 | 23% | 1005654 | $3,057,462 |

| CCM | Cadoux Limited | 0.039 | 22% | 66708 | $11,869,363 |

Making news…

Pivotal Metals (ASX:PVT) said it has uncovered bonanza-grade gold at its Lorraine prospect in Quebec, with one historical channel sample hitting 28 metres at 45.2g/t gold. A deeper drill hole pulled 0.97m at 56.2g/t, including a spicy 0.15m at 233.9g/t.

The gold sits in a 600-metre corridor of copper-gold quartz veins, just 12km from the historic Belleterre mine. It’s largely untouched ground for gold, with previous efforts focused on copper and nickel.

Pivotal’s now launching a full-blown field program to line up fresh drill targets. It reckons this could be the next big hit in its BAGB project, already home to high-grade copper and nickel.

Locksley Resources (ASX:LKY) has locked in $1.47 million through a well-supported placement at 4 cents a share to fund drilling at its Mojave Project in California.

The cash will go straight into boots-on-ground exploration, with the team already mobilising. Drilling’s planned for the September quarter, targeting rare earths at El Campo (up to 12.1% TREO) and high-grade antimony at the Desert Antimony Mine (up to 46% Sb), pending final permits.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Voltgroupltd | 0.001 | -50% | 5234322 | $21,432,416 |

| UCM | Uscom Limited | 0.012 | -37% | 538265 | $4,759,063 |

| RDS | Redstone Resources | 0.0045 | -36% | 8842279 | $6,477,649 |

| 1AD | Adalta Limited | 0.002 | -33% | 190000 | $1,929,668 |

| OVT | Ovanti Limited | 0.002 | -33% | 38030791 | $8,380,545 |

| ADD | Adavale Resource Ltd | 0.0015 | -25% | 3479942 | $4,574,558 |

| IFG | Infocusgroup Hldltd | 0.006 | -25% | 19387535 | $2,099,415 |

| HCF | Hghighconviction | 0.026 | -21% | 74706 | $640,414 |

| ADY | Admiralty Resources. | 0.004 | -20% | 111653 | $13,147,397 |

| ERL | Empire Resources | 0.004 | -20% | 360334 | $7,419,566 |

| MEL | Metgasco Ltd | 0.002 | -20% | 165112 | $3,643,967 |

| POD | Podium Minerals | 0.03 | -19% | 3477618 | $25,212,193 |

| KGD | Kula Gold Limited | 0.0065 | -19% | 1053433 | $7,370,029 |

| PIL | Peppermint Inv Ltd | 0.0025 | -17% | 500000 | $6,712,918 |

| RFA | Rare Foods Australia | 0.005 | -17% | 524700 | $1,631,899 |

| TON | Triton Min Ltd | 0.005 | -17% | 2758518 | $9,410,332 |

| DES | Desoto Resources | 0.14 | -15% | 2465481 | $30,727,035 |

| TOU | Tlou Energy Ltd | 0.017 | -15% | 164917 | $25,971,686 |

| RLF | Rlfagtechltd | 0.041 | -15% | 407495 | $17,851,431 |

| AQI | Alicanto Min Ltd | 0.024 | -14% | 850634 | $23,748,003 |

| GBE | Globe Metals &Mining | 0.03 | -14% | 153955 | $24,312,855 |

| CR1 | Constellation Res | 0.11 | -14% | 4500 | $8,037,753 |

| THB | Thunderbird Resource | 0.013 | -13% | 2875045 | $5,846,121 |

| MGL | Magontec Limited | 0.17 | -13% | 115882 | $11,107,556 |

| AJX | Alexium Int Group | 0.007 | -13% | 85299 | $12,691,429 |

IN CASE YOU MISSED IT

Titanium Sands (ASX:TSL) has been awarded one-year retention licences for the company’s Sri Lankan heavy mineral sands project, allowing the progression to environmental studies.

Bubalus Resources (ASX:BUS) is looking to sharpen up targets at the Crosbie North gold-antimony prospect ahead of a drilling campaign slated for Q3.

Victory Metals (ASX:VTM) has raised $4 million to accelerate a Pre-Feasibility Study and development of its flagship North Stanmore rare earths project, the largest clay-hosted Heavy Rare Earth deposit in Australia.

Trading halts

- Cardiex (ASX:CDX) – cap raise

- Flagship Minerals (ASX:FLG) – cap raise

- Pacgold (ASX:PGO) – cap raise

At Stockhead, we tell it like it is. While Titanium Sands, Bubalus Resources, Locksley Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.