Closing Bell: ASX party continues with six days of gains; NAB, A2Milk in winners’s circle

ASX gained for the sixth day, boosted by strong US retail sales. Picture Getty

- ASX gained for the sixth day, boosted by strong US retail sales

- NAB’s revenue fell slightly; Domain’s profits soared

- RBA’s Bullock downplayed the chances of an RBA rate cut this year

The ASX has notched its sixth consecutive day of wins after posting a 1% gain on Friday. For the week, the index was up by 2%.

Stocks rose on the back of strong rally on Wall Street overnight after US retail sales data surprised on the upside, rising by 1.0% for July against expectations of 0.3%.

Weekly new unemployment claims also lifted sentiment, coming in at 227,000 against expectations for 235,000.

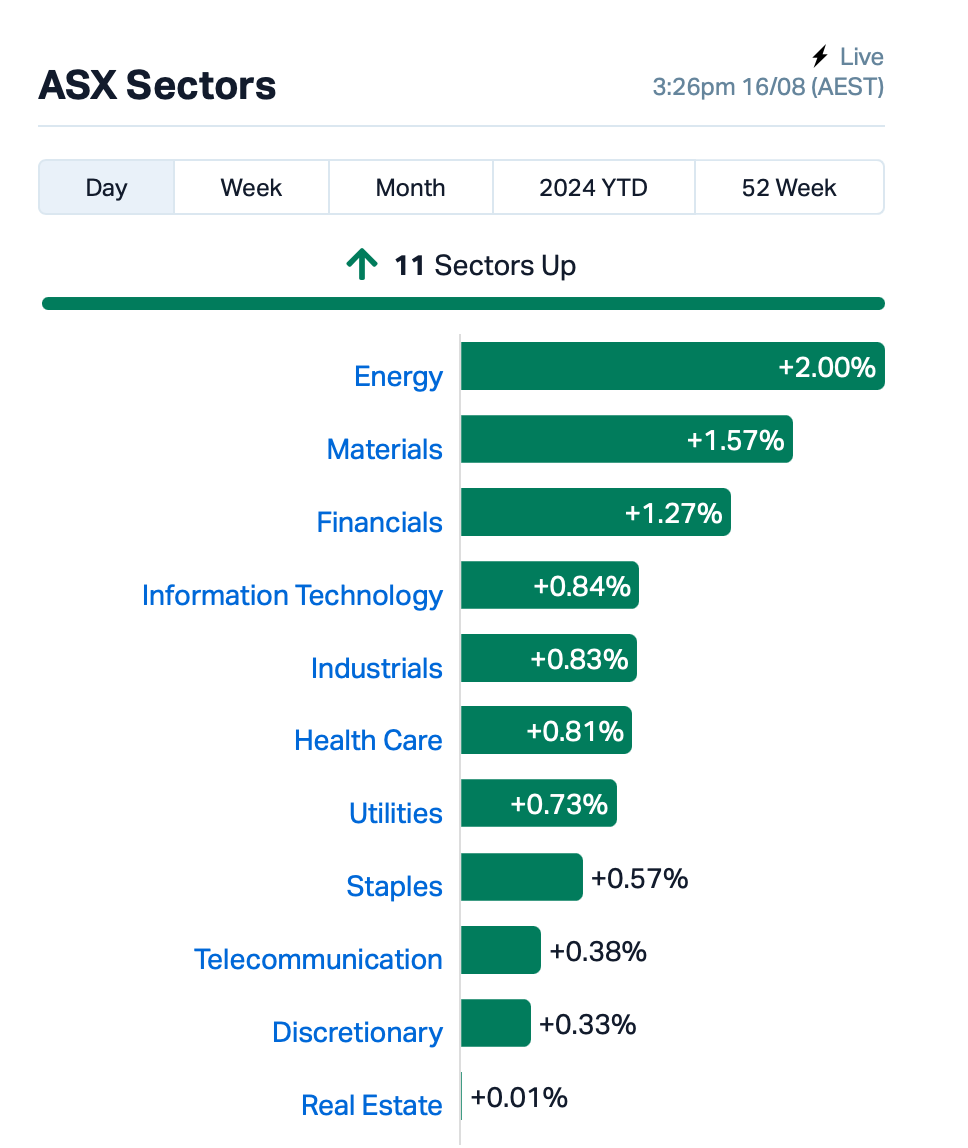

On the ASX today, all 11 sectors were flashing green, with Energy and Mining leading the pack.

Energy was lifted by a 2% gain from Woodside Energy Group (ASX:WDS), while Mining was led by Pilbara Minerals’ (ASX:PLS) 3% gain.

Meanwhile, RBA boss Michele Bullock spoke at the House of Representatives economics committee hearing today.

Bullock says that people are spending less and choosing cheaper brands due to higher mortgage repayments. She also said that rising interest rates aren’t causing rent increases. Instead, she explained that rents are going up due to a lack of housing supply.

Bullock also downplayed the chances of an RBA rate cut this year.

“Financial markets are still pricing in a rate cut by the end of the year. The board’s message, though, was that it is premature to be thinking about rate cuts.”

Today’s earnings season highlights

National Australia Bank (ASX:NAB) rose by over 1% today after posting its quarterly report.

NAB’s revenue fell 1% in the quarter due to weakness in its Markets & Treasury business, but grew 1% excluding that segment. The bank’s net interest margin remained stable, with cash earnings coming in at $1.75 billion.

Domain (ASX:DHG)fell almost 3% after reporting a flat final dividend of 4 cents per share, fully franked.

DHG’s full-year NPAT surged by 62.5% to $42.42 million, and revenue increased by 13.1% to $391.11 million.

New ‘for sale’ listings in July rose by 4% year-on-year. But investors sold down the shares after the company said it expects costs for FY25 to increase by a low double-digit percentage.

Packaging company Amcor (ASX:AMC) fell 3% after its full year NPAT dropped to $730 million from $1.048 billion in the previous year.

Amcor declared a June quarter dividend of 12.5 cents per share, up slightly from 12.25 cents last year.

What else happened today?

Across the region, Asian stocks also surged as traders grew optimistic about the US economy avoiding a recession.

Japanese stocks headed for their biggest weekly advance since April, gaining from a weaker Yen, which helps their exporters.

Elsewhere, China’s central bank head promised additional support for the country’s economic recovery but warned that the measures will not be “drastic.”

Stocks in focus today include Alibaba, which rose 4% in HongKong as positive sentiment towards tech stocks overshadowed earnings worries.

JD.com Inc also surged 9%, which was the most since March after surpassing profit expectations in its late Thursday results.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| IEC | Intra Energy Corp | 0.002 | 100% | 430,000.00 | $1,690,782 |

| RIL | Redivium Limited | 0.005 | 67% | 22,760,373.00 | $8,192,564 |

| HLX | Helix Resources | 0.003 | 50% | 10,699,378.00 | $6,528,387 |

| AUK | Aumake Limited | 0.011 | 38% | 21,165,293.00 | $15,425,928 |

| BCT | Bluechiip Limited | 0.004 | 33% | 250,000.00 | $3,546,119 |

| JAV | Javelin Minerals Ltd | 0.002 | 33% | 773,602.00 | $6,415,269 |

| RGT | Argent Biopharma Ltd | 0.220 | 33% | 302,238.00 | $7,986,924 |

| JAY | Jayride Group | 0.012 | 33% | 101,800.00 | $2,126,782 |

| NMT | Neometals Ltd | 0.079 | 25% | 3,491,041.00 | $39,263,580 |

| ARV | Artemis Resources | 0.015 | 25% | 25,701,508.00 | $23,002,589 |

| 1CG | One Click Group Ltd | 0.010 | 25% | 179,513.00 | $5,625,431 |

| 1TT | Thrive Tribe Tech | 0.003 | 25% | 356,636.00 | $1,223,243 |

| EEL | Enrg Elements Ltd | 0.003 | 25% | 1,503,898.00 | $2,019,930 |

| EMT | Emetals Limited | 0.005 | 25% | 106,000.00 | $3,400,000 |

| VML | Vital Metals Limited | 0.003 | 25% | 145,229.00 | $11,790,134 |

| LRV | Larvottoresources | 0.155 | 24% | 9,939,096.00 | $38,494,308 |

| IMI | Infinitymining | 0.016 | 23% | 100,000.00 | $1,543,794 |

| SM1 | Synlait Milk Ltd | 0.338 | 23% | 715,947.00 | $60,109,957 |

| NAG | Nagambie Resources | 0.011 | 22% | 12,301,450.00 | $7,169,721 |

| KOB | Kobaresourceslimited | 0.140 | 22% | 166,692.00 | $18,234,586 |

| APX | Appen Limited | 1.095 | 21% | 16,549,425.00 | $201,816,487 |

| DTR | Dateline Resources | 0.006 | 20% | 3,257,020.00 | $11,087,566 |

| KPO | Kalina Power Limited | 0.006 | 20% | 5,571,358.00 | $12,431,970 |

A2 Milk (ASX:A2M) jumped almost 5% after telling investors that it has settled a long-standing dispute with Synlait Milk (ASX:SM1), allowing it to start producing its own infant formula. The deal, which involves a $22.6 million payment, ends an exclusivity agreement and resolves their complex relationship, where Synlait previously supplied most of A2 Milk’s formula.

Miramar Resources (ASX:M2R) announced the commencement of the maiden drilling campaign within the Company’s 100%-owned Bangemall Project portfolio in the Gascoyne region of WA, co-funded through the WA Government’s Exploration Incentive Scheme (EIS) to test several airborne +/- ground EM anomalies at Mount Vernon and Trouble Bore highlighted by Miramar’s exploration programs.

Poseidon Nickel (ASX:POS) was climbing after the company refiled news of gold mineralisation, “very similar to nearby gold mines including Kanowna Belle and Gordon Sirdar”, at the company’s Black Swan prospect in the WA Goldfields. Poseidon refiled the announcement after it tripped over the rules around announcing visual gold during early exploration while showing off some of the 52 gold nuggets with a combined weight of 17.9g the company has picked up.

Elixir Energy (ASX:EXR) was also up Friday after delivering an update on its Daydream-2 program in the 100%-owned Grandis Project in Queensland’s Taroom Trough. Elixir says the flow test of the Lorelle Sandstone post stimulation is complete, with work moving on to the stimulation of the 5 upper zones. Lorelle Sandstone flows gas at stabilised flow rates of 2.1 and 2.5 MMSCFPD, which is approaching requirements for the entire project to clear the modelled pre-production economic hurdle

Larvotto Resources (ASX:LRV) was up on China’s news. Targeting first ore in 2026, LRV’s Hillgrove gold-antimony project in NSW has a maiden 606,00oz AuEq reserve, yet it’s the antimony that could really be the economic kicker, with 39,000t of the material.

Priced conservatively at US$15,000/t and including the gold endowment, the project is expected to have a capex of $73m and an NPV8 of $157m, according to a PFS.

At spot prices though, the NPV8 sits at $383m and an eye-whopping IRR of 114%. Those numbers are huge, and China’s export restriction announcement could see antimony prices spike considerably.

Adriatic Metals (ASX:ADT) was up no news, but the company did announce earlier a fatality at its Rupice deposit, part of its 65,000tpa Ag and 90,000tpa Zn Vares silver-zinc mine in Bosnia and Herzegovina, when an employee of a local Bosnian sub-contractor’s vehicle overturned. The incident didn’t occur near any mining operations but ADT secured the mine for 24 hours just in case.

It follows a tumultuous time for Adriatic, which saw its CEO and MD Paul Cronin resign, stepping down and returning to Australia ‘for family reasons’. He was replaced by interim CEO Laura Tyler who yesterday said ADT was ‘deeply saddened’ by the ‘tragic incident’.

Hard rock lithium explorer Patriot Battery Metals (ASX:PMT) was up on recent news. PMT is trundling along with exploration of the 80.1 Mt at 1.44% Li2O indicated resource at its Shaakichiuwaanaan (formerly Corvette) project in Canada. It’s just hired Alex Eastwood as a senior mining executive to help drive commercialisation efforts downstream. Eastwood is a Pilbara Minerals (ASX:PLS) alumni, rejoining his former-coworker and PMT MD Ken Brinsden.

Wildcat Resources (ASX:WC8) is up almost 20% this week as it continues to prove up its Tabba Tabba lithium project in the Pilbara, which is surrounded by the world-class 414Mt Pilgangoora and 259Mt Wodgina hard rock lithium mines. It’s Leia deposit continues to bring in the hits, with 67m at 1.9% Li2O, including 46m at 2.5% registered to the market on August 5.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| SVL | Silver Mines Limited | 0.099 | -36% | 58,468,186 | $233,745,620 |

| MTB | Mount Burgess Mining | 0.001 | -33% | 237,500 | $1,947,220 |

| RNE | Renu Energy Ltd | 0.002 | -33% | 124,047 | $2,178,402 |

| AUH | Austchina Holdings | 0.003 | -25% | 5,452,030 | $8,401,535 |

| ENT | Enterprise Metals | 0.003 | -25% | 100,000 | $4,413,269 |

| ICU | Investor Centre Ltd | 0.003 | -25% | 1,853 | $1,218,045 |

| LPD | Lepidico Ltd | 0.002 | -25% | 1,137,152 | $17,178,250 |

| MCM | Mc Mining Ltd | 0.105 | -25% | 77,783 | $57,961,869 |

| 8IH | 8I Holdings Ltd | 0.007 | -22% | 86,040 | $3,133,448 |

| IXU | Ixup Limited | 0.023 | -21% | 211,433 | $44,884,825 |

| SRJ | SRJ Technologies | 0.057 | -20% | 2,679,570 | $11,309,905 |

| CRB | Carbine Resources | 0.004 | -20% | 2,070 | $2,758,689 |

| CTO | Citigold Corp Ltd | 0.004 | -20% | 875,000 | $15,000,000 |

| EVR | Ev Resources Ltd | 0.004 | -20% | 180,800 | $6,981,357 |

| MVL | Marvel Gold Limited | 0.008 | -20% | 1,366,095 | $8,637,907 |

| PUR | Pursuit Minerals | 0.002 | -20% | 62,941 | $9,088,500 |

| RML | Resolution Minerals | 0.002 | -20% | 250,000 | $4,025,055 |

| SFG | Seafarms Group Ltd | 0.002 | -20% | 125,000 | $12,091,498 |

| TTI | Traffic Technologies | 0.004 | -20% | 100,000 | $4,864,426 |

| PPK | PPK Group Limited | 0.435 | -18% | 234,262 | $47,680,124 |

| SVG | Savannah Goldfields | 0.024 | -17% | 13,334 | $8,151,463 |

| MHI | Merchant House | 0.125 | -17% | 44,214 | $14,139,974 |

| CMD | Cassius Mining Ltd | 0.005 | -17% | 1,440,100 | $3,252,027 |

IN CASE YOU MISSED IT

Perpetual Resources (ASX:PEC) has started ground reconnaissance work at the recently acquired Isabella lithium project in Brazil’s prolific Lithium Valley after due diligence activities picked up 5.62% Li2O from outcropping pegmatites.

Belararox (ASX:BRX) has successfully raised $7.7m, positioning the company to mobilise drilling contractors at the TMT copper gold project ahead of a program in September.

Miramar Resources (ASX:M2R) is on the hunt for ‘Norislk’ style targets as it kicks off a maiden drilling program at the Bangemall nickel-copper-cobalt-PGE project in WA’s West Musgrave region.

Victory Metals (ASX:VTM) is looking to undertake a 5000m expansion drilling campaign at the North Stanmore project, focusing on areas adjacent to the existing 149Mt indicated resource, which represents 63% of the total North Stanmore deposit.

Uvre (ASX:UVA) has completed an initial passive seismic program at the Frome Downs uranium project in South Australia to identify potential lithological and structural features which provide ideal trap sites for uranium accumulation.

The company says these features will be priority targets for a maiden drilling program once a native title heritage agreement has been executed.

Finder Energy’s (ASX:FDR) non-underwritten pro-rata non-renounceable entitlement offer is now open with the company’s major shareholder, Longreach Capital Investment, investing its full entitlement of $3.2m.

The entitlement offer allows shareholders to subscribe for 1 new share for every 1.26 shares held on the record date on Tuesday, 13 August at the offer price of $0.049 per new share. FDR’s executive management also intends to fully take up their entitlement.

Golden Mile Resources (ASX:G88) has completed a detailed review of all projects in its current portfolio including Marble Bar and the Murchison projects and has made the decision to relinquish both.

This entails the surrender of granted exploration licences E45/6210, E45/6211 and E20/1005, and the withdrawal of exploration licence application ELA45/6709, allowing G88 to focus on its projects which have the greatest potential including the recent joint venture-acquisition of the highly prospective Pearl copper asset in Arizona, USA.

TRADING HALTS

Andromeda Metals (ASX:ADN) – pending an announcement regarding a capital raising.

Pan Asia Metals (ASX:PAM) – pending the release of an announcement in relation to a proposed equity raise by way of a placement.

African Gold (ASX:A1G) – ending an announcement on a capital raising.

Regis Resources (ASX:RRL) – pending a formal announcement regarding a decision of the Federal Minister for Environment and Water on the application under Section 10 of the Aboriginal and Torres Strait Islander Heritage Protection Act 1984 in relation to the McPhillamys Project.

At Stockhead we tell it like it is. While Uvre, Finder Energy, Miramar Resources. Golden Mile Resources, Perpetual Resources, Belararox, Miramar Resources and Victory Metals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.