Closing Bell: ASX nears record high; Microsoft probes DeepSeek’s potential data breach

ASX nears record high. Pic: Getty Images

- ASX near record high on inflation drop and rate cut bets

- Tech stocks rally as rate cut expectations rise

- Microsoft probes DeepSeek over data breach

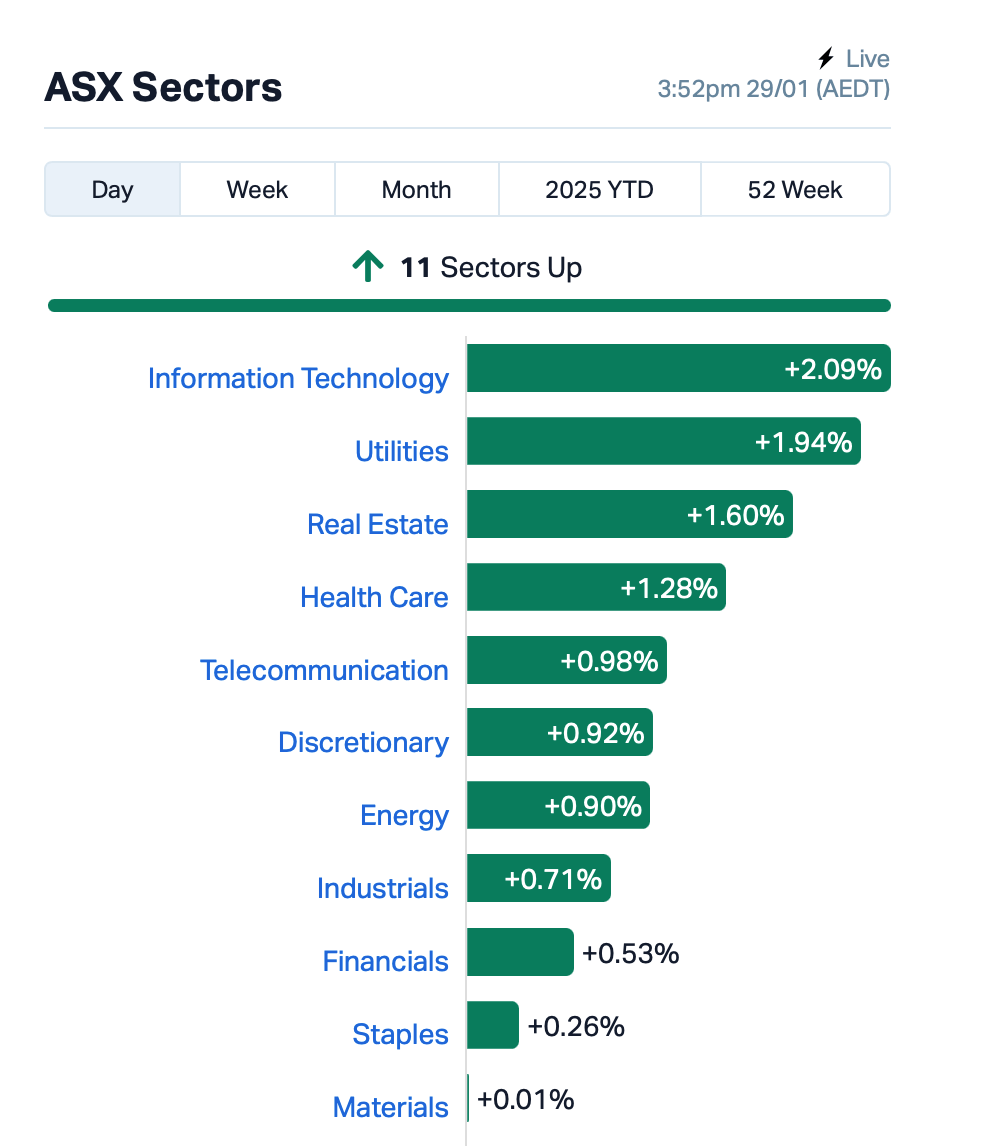

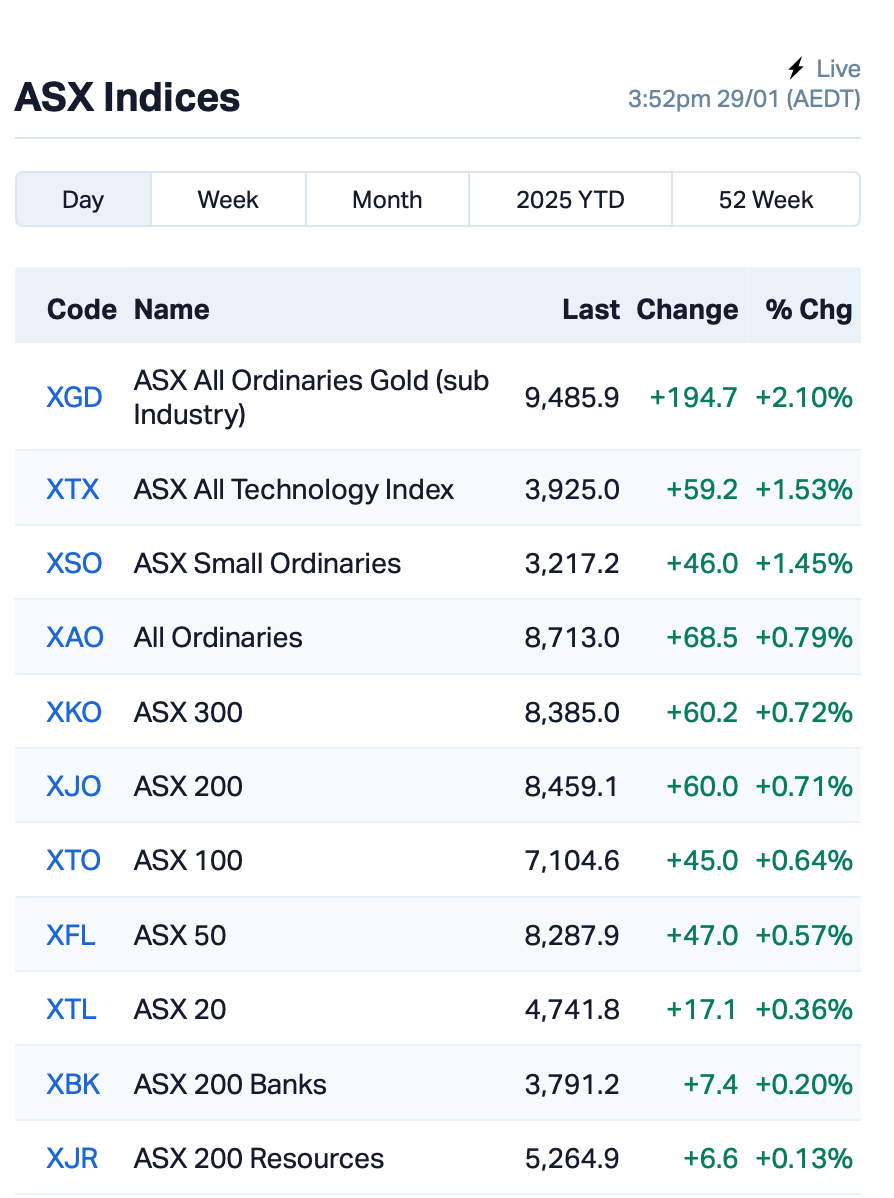

The ASX200 put on a solid show today as it rose by 0.75%, closing just shy of its all-time high.

Driving the action was the latest inflation data, which has surprised to the downside, sparking growing expectations that the RBA could cut rates as early as next month.

RBC and UBS have updated their forecasts after Aussie inflation dropped to 2.4% in the December quarter, down from 2.8% in the previous. Both banks now see the RBA cutting rates in February.

“The rates market is pricing an 80% chance of a 25bp rate cut at the RBA’s Board meeting on February 18th, which would take the official cash rate to 4.10%,” said Tony Sycamore at IG.

The stock market has responded with broad-based gains today, with 10 out of 11 sectors in the green.

Tech stocks led the charge, bouncing back from a rough session yesterday, which was triggered by concerns over China’s DeepSeek AI.

The mining sector was also busy, with several companies releasing their operational updates.

Whitehaven Coal (ASX:WHC) reported a 22% increase in sales for the December quarter, sending its stock up 1%.

Pilbara Minerals (ASX:PLS)’s output dipped in the December quarter, falling to 188,200 tonnes of spodumene concentrate, down from 220,100 tonnes. Shares were nevertheless up by 3.5% as production and pricing beat consensus estimates.

Boss Energy (ASX:BOE) was riding high, up by 5.6% after announcing it was on track to meet its production guidance of 850,000lb U3O8 drummed for the year.

Gold stocks rose as well after Aussie dollar prices crossed $4400/oz overnight. Perseus Mining (ASX:PRU), Vault Minerals (ASX:VAU), Ramelius Resources (ASX:RMS) and Gold Road Resources (ASX:GOR) were among the goldies to report quarterly results.

There were few surprises aside from PRU, which hit the upper end of production (502,189oz) and bottom end of cost guidance (US$1147/oz) in CY2024, announcing the development of the CMA underground mine at its Yaoure project in Cote d’Ivoire, and Vault trimming the top end of its guidance from 390,000-430,000oz to 390,000-410,000oz for FY25.

And big news from Star Entertainment Group (ASX:SGR): It’s selling off several Sydney assets, including the Star Sydney Event Centre, for $60 million as it undergoes a liquidity crunch. Shares jumped 17%.

Meanwhile, in the latest saga surrounding Chinese startup firm DeepSeek, Microsoft and OpenAI are apparently digging into a potential data breach made by a group linked to the company.

Microsoft said that its security team had spotted something back in the fall of 2024, suspecting that someone was pulling a massive chunk of OpenAI’s data.

The news comes on the heels of DeepSeek’s big AI launch this week, claiming it can outperform the likes of OpenAI on key benchmarks.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| BGT | Bio-Gene Technology | 0.059 | 84% | 22,298,988 | $6,443,570 |

| NRZ | Neurizer Ltd | 0.003 | 50% | 11,964,471 | $5,929,741 |

| NAE | New Age Exploration | 0.004 | 33% | 1,029,124 | $6,431,697 |

| WAK | Wakaolin | 0.079 | 32% | 204,106 | $31,418,048 |

| DMG | Dragon Mountain Gold | 0.005 | 25% | 15,000 | $1,578,687 |

| ENV | Enova Mining Limited | 0.005 | 25% | 8,710,799 | $3,939,717 |

| EOF | Ecofibre Limited | 0.036 | 20% | 89,324 | $11,366,217 |

| KAL | Kalgoorliegoldmining | 0.018 | 20% | 1,447,549 | $4,096,626 |

| REM | Remsensetechnologies | 0.042 | 20% | 1,855,387 | $5,805,089 |

| ALV | Alvomin | 0.060 | 20% | 200,002 | $5,857,944 |

| CUL | Cullen Resources | 0.006 | 20% | 70,473 | $3,467,009 |

| IPB | IPB Petroleum Ltd | 0.006 | 20% | 169,692 | $3,532,015 |

| LNR | Lanthanein Resources | 0.003 | 20% | 1,258,756 | $6,109,090 |

| OSL | Oncosil Medical | 0.006 | 20% | 2,478,324 | $23,032,901 |

| WZR | Wisr Ltd | 0.037 | 19% | 2,858,609 | $43,150,509 |

| SVG | Savannah Goldfields | 0.020 | 18% | 234,765 | $4,778,444 |

| AZI | Altamin Limited | 0.027 | 17% | 70,000 | $13,213,567 |

| TKM | Trek Metals Ltd | 0.027 | 17% | 494,565 | $11,962,826 |

| SGR | The Star Ent Grp | 0.135 | 17% | 44,062,820 | $329,898,301 |

| FHS | Freehill Mining Ltd. | 0.004 | 17% | 293,672 | $9,235,583 |

Bio-Gene Technology (ASX:BGT)’s shares popped after scoring two grants from the US Department of Defense worth a total of $3 million. The first grant, $1.6m, will help develop a wearable device using Bio-Gene’s Flavocide to control mosquitoes and other disease-carrying insects. The second, $1.4m, will fund a sprayable version of Qcide to tackle flies and bed bugs. These grants are part of the US military’s effort to protect troops from insect-borne diseases.

RemSense Technologies (ASX:REM) had a solid Q2 FY25, posting a positive cash flow with $431K in the bank. Customer receipts shot up 78% from the previous quarter, hitting $1.18m, plus another $1.08m came in after the quarter ended. The company nailed multiple global contracts in the quarter, all on time and budget, including a subscription renewal from Newmont for its Virtualplant platform.

Trek Metals (ASX:TKM) also had a strong December quarter, with high-grade gold hits at the Christmas Creek Project in WA. Drilling at the Martin Prospect revealed impressive intercepts, including 10m at 12.66g/t Au and 10m at 7.34g/t Au, with some exceptional 1m and 3m sections hitting over 29g/t Au. The drilling has confirmed gold over a large area, with two major trends extending over 1km.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Voltgroupltd | 0.001 | -50% | 1 | $21,432,416 |

| PLY | Playside Studios | 0.200 | -47% | 9,359,854 | $155,504,412 |

| LYN | Lycaonresources | 0.155 | -37% | 2,409,048 | $12,981,282 |

| CZN | Corazon Ltd | 0.002 | -33% | 913,041 | $3,553,717 |

| CLG | Close Loop | 0.130 | -26% | 10,985,652 | $93,073,727 |

| 88E | 88 Energy Ltd | 0.002 | -25% | 4,484,472 | $57,867,624 |

| BYH | Bryah Resources Ltd | 0.003 | -25% | 1,119,395 | $2,013,147 |

| CRB | Carbine Resources | 0.003 | -25% | 116,000 | $2,206,951 |

| RLL | Rapid Lithium Ltd | 0.003 | -25% | 1,250,000 | $3,129,779 |

| ARX | Aroa Biosurgery | 0.620 | -23% | 1,844,149 | $275,920,205 |

| XPN | Xpon Technologies | 0.011 | -21% | 1,916,821 | $5,074,181 |

| TMX | Terrain Minerals | 0.004 | -20% | 448,800 | $9,053,477 |

| TSL | Titanium Sands Ltd | 0.004 | -20% | 45,692 | $11,058,736 |

| YAR | Yari Minerals Ltd | 0.004 | -20% | 1,321,990 | $2,411,789 |

| CUF | Cufe Ltd | 0.009 | -18% | 3,371,286 | $14,703,424 |

| T3D | 333D Limited | 0.009 | -18% | 198,697 | $1,938,018 |

| CDT | Castle Minerals | 0.003 | -17% | 338,356 | $5,690,442 |

| CNJ | Conico Ltd | 0.010 | -17% | 454,350 | $2,849,848 |

| FRX | Flexiroam Limited | 0.005 | -17% | 1,484,624 | $4,713,863 |

| GMN | Gold Mountain Ltd | 0.003 | -17% | 71,937 | $13,737,670 |

| TEG | Triangle Energy Ltd | 0.005 | -17% | 3,732,473 | $12,535,404 |

| LGP | Little Green Pharma | 0.105 | -16% | 81,531 | $37,859,124 |

Recycling company Close the Loop (ASX:CLG) crashed 31% after private equity firm Adamantem Capital pulled out of a bid to acquire the company. The two sides couldn’t reach an agreement on commercial terms. The company had been in talks to go private since November.

IN CASE YOU MISSED IT

Explorer White Cliff Minerals (ASX:WCN) has received all remaining permits and approvals to kick off drilling at its Rae copper project in Canada’s Nunavut region.

This maiden drilling campaign follows on from the discovery of high-priority targets generated from a field program, where WCN uncovered impressive rock chips assaying beyond 60%. Drilling is expected to begin in March, initially focusing on the Hulk Sedimentary prospect and the Danvers project area.

Strata Minerals (ASX:SMX) is set for first drilling at its Penny South gold project in Western Australia for mid-February after securing a programme of work.

While yet to award a contract to a lead driller, Strata plans to burrow 13 reverse circulation holes for roughly 2,800m to test two priority targets. This exploration will take place immediately south of the high-grade Penny West and Penny North gold deposits currently being mined by Ramelius Resources (ASX:RMS) for nearly 400,000oz.

Previously unrecognised gold mineralisation has hit the radar of New World Resources (ASX:NWC) due to an ongoing geological review of its Antler copper project.This mineralisation is occurring outside of the existing Antler copper resource and is also close to existing plans for underground mining infrastructure development. NWC says the newly discovered mineralised zone may potentially enhance Antler’s mineable inventory, economic returns and funding options.

Brightstar’s (ASX:BTR) production plans for 2025 are well and truly underway after the company commenced ore haulage today from its Laverton Hub to Genesis Minerals’ (ASX:GMD) Laverton mill. Brightstar management says its expects first gold pour in March while the company remains debt and hedge free with full exposure to the current record gold prices.

Rare earths developer Ark Mines (ASX:AHK) has dual listed on the OTCQB – an investment platform focused on early-stage and developing companies – under ticker AHKMF. As AHK is already listed on the ASX, the company is privilege to reduced compliance costs while also expanding its exposure to the US market.

A new batch of assays from Antipa Minerals’ (ASX:AZY) Minyari Dome copper-gold project in WA’s Paterson region have impressed the formidable goldie, revealing significant gold-copper-silver-cobalt intersections within the main Minyari deposit.

The 36-hole program burrowed more than 4,600m via reverse circulation drilling and nearly 1,000m in diamond drilling. Standout hits encompassed 86m at 1.7g/t gold and 0.41% copper from 121m downhole, including 28m at 4g/t gold, 1% copper, 3g/t silver and 0.10% cobalt.

Many Peaks Minerals (ASX:MPK) has its sights set on new drilling targets at its Ferké gold project in Côte d’Ivoire following an auger campaign which hit 948 drill holes for more than 6,700m.

The company has defined multiple undrilled targets, including 340m and 650m wide gold anomalies – 1.9km and 3.8km, respectively, north of the Ouarigue prospect. The company plans to kick off aircore and RC drilling on the priority targets in March.

At Stockhead, we tell it like it is. While White Cliff Minerals, Strata Minerals, New World Resources, Brightstar Resources, Antipa Minerals, Ark Mines and Many Peaks Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.