Closing Bell: ASX misfires but Bitcoin takes off, hitting new highs

While the ASX failed to launch today, Bitcoin is soaring to new heights. Pic: Getty Images.

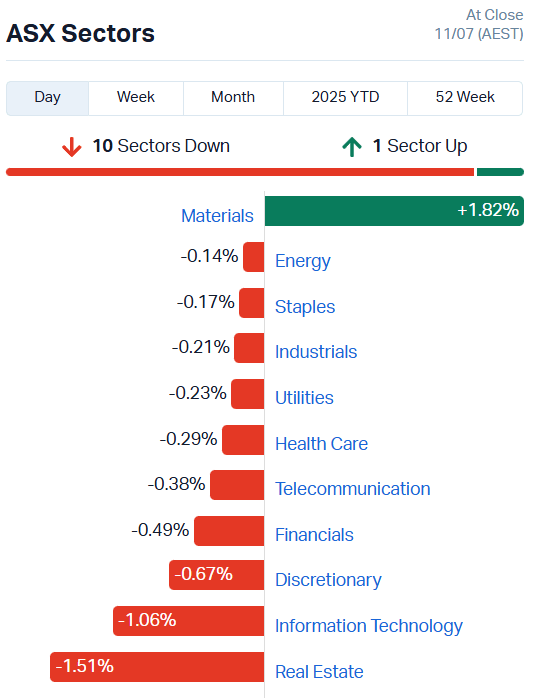

- ASX closes trade down 0.11pc

- Resources only sector on the up, adding 1.82pc

- Bitcoin smashes new all-time high twice in 24 hours

ASX gives up the ghost in the last hour

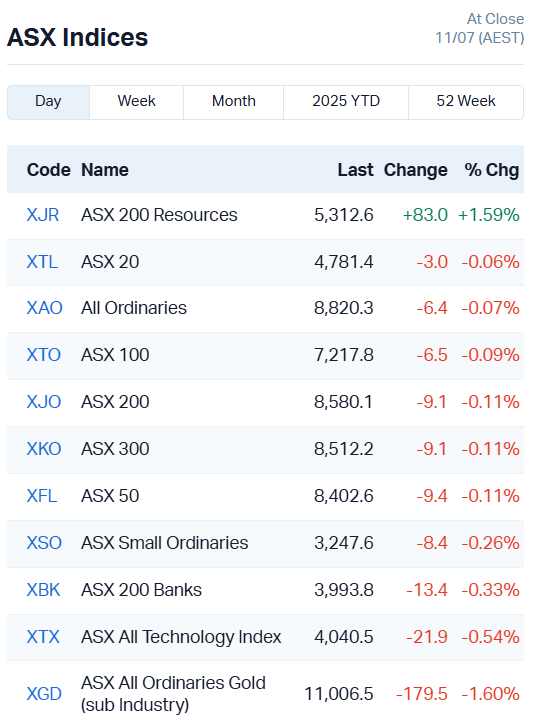

Despite a valiant struggle back into positive territory by about 2pm AEST, the ASX ran out of steam, falling 0.11% by the end of the day.

The materials sector (+1.82%) lost all support as energy flipped into negative territory, remaining the only silver lining in an otherwise pretty dismal day of trading.

There were no points of interest to be found in the indices either – the ASX 200 Resources added 1.59%, but it was all on its lonesome in that regard.

A combination of a US$400m direct investment in US-based rare earth miner MP Minerals from the Pentagon and threats to impose a 35% tariff on Canadian goods drove rare earth and battery metal stocks higher.

Iluka (ASX:ILU) and Lynas (ASX:LYC) stayed the course, adding 22% and 16% respectively. Brazilian Rare Earths (ASX:BRE) also held onto most of its gains, adding 4% while Arafura Rare Earths (ASX:ARU) lifted 8%.

They were joined by Meteoric Resources (ASX:MEI) which added 12%, Iperionx (ASX:IPX) up 15%, Ioneer (ASX:INR) 5% and Mineral Resources (ASX:MIN) gaining 7.7%.

Bitcoin breaks through to new highs

Bitcoin has been simmering along in the background ever since Trump took office and the GENIUS act was put before US lawmakers, quietly gaining steam as a flurry of central banks engage in stablecoin and tokenisation experiments.

As Rob Badman wrote earlier today, “Bitcoin’s also having a sky-high, market-cap-bolstering moment. It’s been extraordinarily resilient of late, pretty much maintaining above a US$2 trillion market cap for the past two months.”

At about 3 pm AEST today, the fan favourite cryptocurrency broke through to a new high again, rocketing all the way up to US$118,239.2 per bitcoin.

“Bitcoin’s new all-time high is being driven by relentless institutional accumulation – major players are scooping up supply and drying up liquidity on exchanges,” Joshua Chu, co-chair of the Hong Kong Web3 Association, told Reuters.

Bitcoin’s breakthrough moment comes right before Crypto Week – starting July 14, US lawmakers will be debating a slew of bills that will redefine America’s cryptocurrency framework, the GENIUS act among them.

In the meantime, stablecoin issuers and crypto trading platforms alike are reaping the rewards.

Circle (NYSE:CRCL) was up 1% overnight, while Robinhood (NASDAQ:HOOD) jumped 4.4% and Coinbase (NASDAQ:COIN) lifted 4% in trade before surging another 7.7% afterhours.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| TD1 | Tali Digital Limited | 0.002 | 100% | 5543076 | $4,095,156 |

| FAL | Falconmetalsltd | 0.37 | 95% | 8465053 | $33,630,000 |

| ATH | Alterity Therap Ltd | 0.015 | 67% | 91442987 | $82,146,336 |

| CMB | Cambium Bio Limited | 0.3 | 40% | 105206 | $3,930,773 |

| RMI | Resource Mining Corp | 0.019 | 36% | 2284175 | $10,282,347 |

| AOA | Ausmon Resorces | 0.002 | 33% | 564100 | $1,966,820 |

| RNX | Renegade Exploration | 0.004 | 33% | 380012 | $3,865,090 |

| CMG | Criticalmineralgrp | 0.13 | 31% | 75986 | $8,963,892 |

| GLA | Gladiator Resources | 0.009 | 29% | 1006500 | $5,308,078 |

| NPM | Newpeak Metals | 0.027 | 29% | 18461697 | $6,763,506 |

| BCA | Black Canyon Limited | 0.225 | 25% | 1265719 | $23,337,125 |

| LKY | Locksleyresources | 0.085 | 25% | 49159594 | $12,466,666 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 1750040 | $13,655,414 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 616451 | $3,665,173 |

| TON | Triton Min Ltd | 0.005 | 25% | 249329 | $6,273,555 |

| HIQ | Hitiq Limited | 0.016 | 23% | 1804743 | $5,976,073 |

| JGH | Jade Gas Holdings | 0.032 | 23% | 818972 | $43,857,688 |

| MGU | Magnum Mining & Exp | 0.008 | 23% | 5645972 | $15,067,241 |

| NSB | Neuroscientific | 0.16 | 23% | 1341795 | $43,234,842 |

| OZM | Ozaurum Resources | 0.08 | 21% | 2082477 | $15,120,724 |

| WR1 | Winsome Resources | 0.23 | 21% | 2608917 | $46,339,756 |

| PH2 | Pure Hydrogen Corp | 0.099 | 21% | 2965887 | $30,625,427 |

| GBZ | GBM Rsources Ltd | 0.018 | 20% | 29618855 | $21,237,917 |

| BMM | Bayanminingandmin | 0.06 | 20% | 9761188 | $5,147,770 |

| 1AI | Algorae Pharma | 0.006 | 20% | 83299 | $8,436,974 |

Making news…

TALi Digital (ASX:TD1) has added just over $131k to the coffers in an entitlement offer at 0.1 cents a share for a total cap raise of $931k after also closing out a share placement.

In June TD1 acquired the ‘You Can Do It!’ program, a social-emotional learning program aimed at improving the social, emotional, and academic outcomes of young people.

Management reckons it’s a strategic fit with Tali’s existing ReadyAttentionGo! Platform, which is targeted at improving early childhood cognitive attention and engagement outcomes.

A startlingly high-grade gold hit of 1.2m at 543 g/t has brought Falcon Metals (ASX:FAL) sharply into the spotlight, as the company drills the first wedge hole at the Blue Moon prospect.

FAL was topping ASX charts last week on claims they’d found Bendigo-style gold mineralisation after hitting 0.3m at 48.7 g/t gold at Blue Moon.

These latest results certainly support that assertion – the Bendigo Goldfield has produced 22 million ounces of gold since it was first discovered in 1851, a bounty Falcon is keen to tap into.

Eye and tissue repair biotech Cambium Bio (ASX:CMB) has begun dosing patients in a Phase 3 trial for its Elate Ocula dry eye disease therapy.

Management says it’s an important milestone in the journey to commercialisation, as CMB enters the final stages of developing the therapy in a clinical setting.

Concussion management technology company HitIQ (ASX:HIQ) has expanded into the UK market, launching its PROTEQT system for rugby players and similar ‘collision sports’ like hockey.

HIQ is running a dual business model with both upfront product sales and an ongoing subscription; players receive a new instrumented mouthguard each year that includes the latest innovations.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.001 | -67% | 752314 | $913,534 |

| HLX | Helix Resources | 0.001 | -50% | 4012451 | $6,728,387 |

| BMG | BMG Resources Ltd | 0.0065 | -35% | 20353249 | $8,443,972 |

| AXP | AXP Energy Ltd | 0.001 | -33% | 24501766 | $10,027,021 |

| OB1 | Orbminco Limited | 0.001 | -33% | 5815000 | $5,103,852 |

| PIL | Peppermint Inv Ltd | 0.002 | -33% | 200000 | $6,903,269 |

| TMK | TMK Energy Limited | 0.002 | -33% | 10000000 | $30,667,149 |

| AQX | Alice Queen Ltd | 0.003 | -25% | 88750 | $4,998,560 |

| BLZ | Blaze Minerals Ltd | 0.003 | -25% | 1626948 | $7,113,856 |

| CRR | Critical Resources | 0.003 | -25% | 501305 | $11,080,342 |

| PRS | Prospech Limited | 0.018 | -22% | 4389689 | $8,712,995 |

| IBX | Imagion Biosys Ltd | 0.015 | -21% | 18458755 | $3,825,487 |

| 1AD | Adalta Limited | 0.002 | -20% | 4010 | $2,678,291 |

| AMS | Atomos | 0.004 | -20% | 41442 | $6,075,092 |

| ERL | Empire Resources | 0.004 | -20% | 1636 | $7,419,566 |

| LCY | Legacy Iron Ore | 0.008 | -20% | 173725 | $97,620,426 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1473 | $1,946,223 |

| RCM | Rapid Critical | 0.002 | -20% | 8450000 | $3,539,445 |

| SBR | Sabre Resources | 0.008 | -20% | 442783 | $3,944,619 |

| VEN | Vintage Energy | 0.004 | -20% | 1280785 | $10,434,568 |

| CDE | Codeifai Limited | 0.023 | -18% | 29129279 | $13,131,683 |

| UCM | Uscom Limited | 0.014 | -18% | 25000 | $4,422,501 |

| TX3DA | Trinex Minerals Ltd | 0.1 | -17% | 62368 | $2,090,695 |

| IPB | IPB Petroleum Ltd | 0.005 | -17% | 1288198 | $4,238,418 |

| SER | Strategic Energy | 0.005 | -17% | 1124100 | $4,026,200 |

IN CASE YOU MISSED IT

Gold success story Ora Banda (ASX:OBM) is on track to lift production 60% in FY26 to as much as 155,000oz pa.

TRADING HALTS

- Pharmx Technologies (ASX:PHX) – pending announcement

- Chariot Corporation (ASX:CC9) – cap raising

- Macro Metals (ASX:M4M) – failure to lodge cleansing notice

- DY6 Metals (ASX:DY6) – cap raising

- X2M Connect (ASX:X2M) – cap raising

- Lumos Diagnostics Holdings (ASX:LDX) – pending announcement

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.