Closing Bell: ASX holds ground near all-time high as defence stocks soar

While the ASX may not have gained any ground today, the bulls don’t look ready to give up their run just yet. Pic: Getty Images

- ASX slips just 12.3 points, remaining near all-time high

- Healthcare leads losses as Trump raises tariff spectre

- Gains in gold and consumer discretionary soften losses

Profit takers stay their hands

When markets hit new closing highs, it’s common for traders to see it as an opportunity to capitalise on gains.

Stocks are – theoretically – at their highest. What better time to cash in?

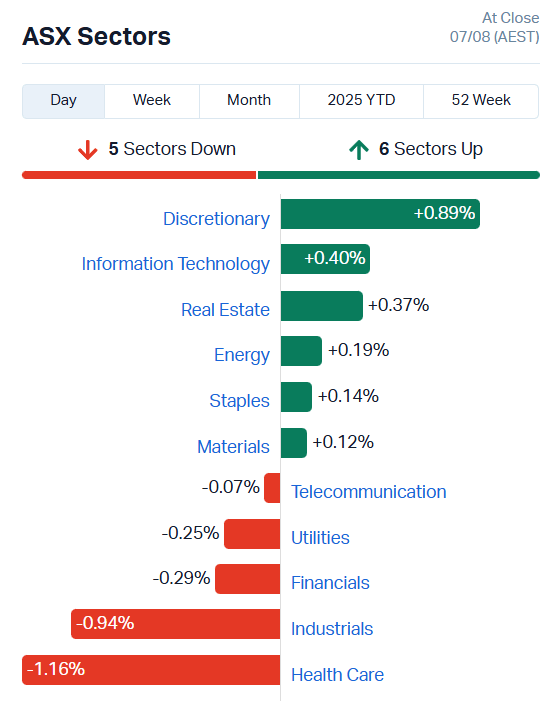

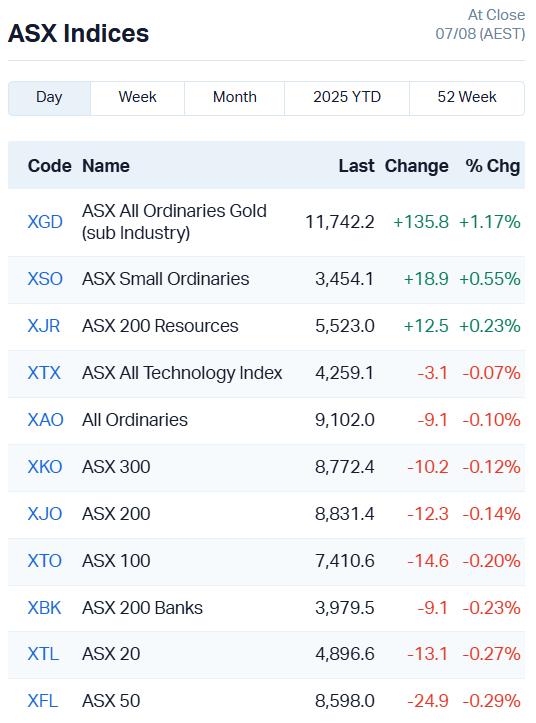

While the ASX 200 fell 0.14% today, the bulls are looking very much in control.

Losses were limited to a small 12.3-point loss, a sniff in the wind compared to the almost 200 points the market has gained in just three days.

That’s not to say we won’t see a bigger dip tomorrow – volatility is the name of the game these days, and Trump is continuing to fan the flames with another tariff hit on India just yesterday.

As for today, six of 11 sectors were down with particular weakness in healthcare stocks. Materials slid marginally lower but gains in gold stocks and the consumer discretionary sector stemmed the bleeding.

Healthcare and defence stocks move in opposite directions

Trump’s recent comments that big tariffs are on the horizon for the industry are likely playing a part in healthcare’s woes today.

“In one year, one and a half years maximum, it’s going to go to 150% and then it’s going to go to 250% because we want pharmaceuticals made in our country,” the US President told CNBC in an interview.

Clarity Pharmaceuticals (ASX:CU6) fell 5.8%, Tetratherix (ASX:TTX) 6.2% and PYC Therapeutics (ASX:PYC) 4.6%.

Health small cap IDT Australia (ASX:IDT) plunged 17.8% after the abrupt resignation of its CEO with immediate effect. The company’s net losses are also increasing, up 38% to $7.5m year-on-year. Management says the losses are due to one-off bad debts and expenses related to new contracts.

Moving against the tide, Imricor Medical Systems (ASX:IMR) added 8.7%.

Perhaps a little ironically considering healthcare’s losses, two defence industry stocks were among the biggest upward movers today.

Unmanned drone (UAV) firm Elsight (ASX:ELS) added 10.9% alongside remote weapon system specialist Electro Optic Systems (ASX:EOS), which climbed 9.3%.

Outside of the weapons and armament subsector, SKS Technologies (ASX:SKS) lifted 8.1% after exceeding profit guidance by more than 15% for FY25 last week.

Tolling and service provider EROAD (ASX:ERD) also continued its hike, soaring 31.6% and up a whopping 99% for the year to date.

All in all, it’s been a solid week for the ASX so far, up more than 1% over the past five trading days.

ASX rival Cboe muscles in on Aussie share market

The Australian Securities Exchange itself finished out the day a full 8.6% lower.

A one-two punch of self-inflicted blunders and rising competition set the bourse operator reeling.

Yesterday’s mix-up with TPG Telecom and TPG Capital was bad enough, but today ASIC flagged it was in the final stages of consideration for a listing market application for Cboe Australia.

The subsidiary of Cboe Global Markets is looking to end the ASX’s monopoly on Aussie stock listings, and ASIC seems to be in full support.

The company already accounts for about 20% or $1.5 billion of our total equity trading volume as a trading market operator.

ASIC chair Joe Longo said that Australian capital markets are facing intensifying global competition for capital and listings but remain healthy and hale.

“As superannuation funds grow and investors seek opportunities, our actions will help keep our markets efficient, innovative and attractive, supporting economic growth for all Australians,” he said.

Perhaps it won’t be too much longer until we’re tracking multiple share markets here on the daily wrap. Yay?

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| RLG | Roolife Group Ltd | 0.007 | 75% | 1.54E+08 | $6,371,125 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | 1000000 | $6,447,446 |

| BMG | BMG Resources Ltd | 0.011 | 38% | 24298471 | $6,755,177 |

| RHY | Rhythm Biosciences | 0.13 | 37% | 9529722 | $26,987,659 |

| ROG | Red Sky Energy. | 0.004 | 33% | 205896 | $16,266,682 |

| LIN | Lindian Resources | 0.125 | 33% | 30664878 | $111,241,690 |

| KM1 | Kalimetalslimited | 0.15 | 30% | 202308 | $9,527,457 |

| SHO | Sportshero Ltd | 0.035 | 30% | 5311325 | $21,686,238 |

| IFM | Infomedia Ltd | 1.675 | 27% | 34845066 | $499,513,991 |

| ALV | Alvomin | 0.029 | 26% | 457314 | $4,491,091 |

| ERA | Energy Resources | 0.0025 | 25% | 703738 | $810,792,482 |

| H2G | Greenhy2 Limited | 0.02 | 25% | 1107248 | $11,006,589 |

| TMX | Terrain Minerals | 0.0025 | 25% | 500000 | $5,063,629 |

| WBE | Whitebark Energy | 0.005 | 25% | 100200 | $2,802,231 |

| BTM | Breakthrough Minsltd | 0.13 | 24% | 505828 | $7,220,923 |

| TOU | Tlou Energy Ltd | 0.026 | 24% | 3465 | $27,270,271 |

| WTM | Waratah Minerals Ltd | 0.56 | 22% | 7708511 | $107,415,642 |

| LMS | Litchfield Minerals | 0.12 | 20% | 15390 | $2,904,606 |

| AJX | Alexium Int Group | 0.006 | 20% | 408907 | $7,932,143 |

| ALM | Alma Metals Ltd | 0.006 | 20% | 581771 | $9,253,686 |

| AN1 | Anagenics Limited | 0.006 | 20% | 209032 | $2,481,602 |

| CZN | Corazon Ltd | 0.003 | 20% | 74871454 | $2,961,431 |

| TEG | Triangle Energy Ltd | 0.003 | 20% | 7123662 | $5,223,085 |

| JAN | Janison Edu Group | 0.2025 | 19% | 287252 | $44,181,003 |

| AZ9 | Asianbatterymet PLC | 0.038 | 19% | 2732082 | $13,814,328 |

In the news…

Building efficiency provider EPX (ASX:EPX) has lifted its annual recurring revenue by 14% in the 2025 financial year, now $15.5m. The company also expanded its annual contract value (an indication of potential future revenue) by 10% to $17.6m.

The growth was based on a 35% expansion in site numbers, lifting from 547 in June 2024 to 740 sites this year following a strategic restructure of EPX’s sales sector.

Augmented reality training provider XReality Group (ASX:XRG) has locked in two new contracts for its Operator XR AI training solution.

The first contract comes in the form of a merit-based grant with the Australian government’s Industry Growth Program. The government is offering $2.1m over 24 months, with the goal of accelerating XRG’s virtual reality training offering.

The second is the largest order for Operator XR’s OP-2 systems to date. XRG inked the deal with the Texas Department of Public Safety for a five-year period. The initial order is valued at $4.3m, with a $1.4m option for additional support services down the track.

Sustainable packaging specialist Papyrus Australia (ASX:PPY) is moving into the next stage of commercialisation and product development, appointing Daniel Schmidt as its new CEO.

The company recently completed a successful trial of new banana fibre-based boards and flat paper products in response to commercial interest, and fired up its Rapid Prototyping & R&D Facility in partnership with the University of South Australia.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ATX | Amplia Therapeutics | 0.175 | -27% | 30921029 | $116,754,486 |

| ACS | Accent Resources NL | 0.006 | -25% | 110800 | $3,916,298 |

| AUK | Aumake Limited | 0.003 | -25% | 10170000 | $12,093,435 |

| CR9 | Corellares | 0.003 | -25% | 61335 | $4,029,079 |

| CT1 | Constellation Tech | 0.0015 | -25% | 33229 | $2,949,467 |

| JAY | Jayride Group | 0.003 | -25% | 495111 | $5,711,556 |

| PAB | Patrys Limited | 0.0015 | -25% | 1000000 | $4,731,620 |

| ASE | Astute Metals NL | 0.017 | -23% | 11957646 | $13,599,294 |

| BYH | Bryah Resources Ltd | 0.004 | -20% | 1122958 | $5,142,663 |

| DDT | DataDot Technology | 0.004 | -20% | 1 | $6,054,764 |

| PIL | Peppermint Inv Ltd | 0.002 | -20% | 305 | $5,752,724 |

| ZEU | Zeus Resources Ltd | 0.013 | -19% | 7817111 | $11,478,986 |

| EVR | Ev Resources Ltd | 0.009 | -18% | 349525 | $24,502,537 |

| HMI | Hiremii | 0.043 | -17% | 49090 | $7,855,766 |

| IND | Industrialminerals | 0.125 | -17% | 40006 | $12,048,375 |

| NOX | Noxopharm Limited | 0.1 | -17% | 242338 | $35,068,554 |

| AAU | Antilles Gold Ltd | 0.005 | -17% | 19242149 | $14,274,408 |

| FAU | First Au Ltd | 0.005 | -17% | 2235248 | $12,457,748 |

| JAV | Javelin Minerals Ltd | 0.0025 | -17% | 1561666 | $18,756,675 |

| MEL | Metgasco Ltd | 0.0025 | -17% | 46339 | $5,511,260 |

| EDEDA | Eden Inv Ltd | 0.033 | -15% | 748473 | $8,014,268 |

| CMG | Criticalmineralgrp | 0.14 | -15% | 7757 | $14,939,820 |

| PL3 | Patagonia Lithium | 0.034 | -15% | 515 | $4,776,414 |

| LCL | LCL Resources Ltd | 0.006 | -14% | 1000000 | $8,394,800 |

| PLC | Premier1 Lithium Ltd | 0.006 | -14% | 6853560 | $2,576,424 |

In Case You Missed It

Energy Transition Minerals (ASX:ETM) is moving to acquire the Penouta tin-tantalum-niobium mine in Galicia, Spain, which presents the opportunity to deliver early production and cashflow.

Trigg Minerals (ASX:TMG) is expanding into tungsten, acquiring the Tennessee Mountain project in Nevada.

Anson Resources (ASX:ASN) has produced strong flow results from testing at its Bosydaba#1 exploration well in Utah.

TG Metals (ASX:TG6) has combined recent soil sampling results with historical drill results to generate compelling new drill targets at the Van Uden gold project in WA.

Infinity Mining (ASX:IMI) is sketching out a kilometre-long corridor prospective for gold at the Cangai project’s Sir Walter Scott prospect, with rock chip results up to 68.6g/t gold. Nine of 12 graded above 1 g/t gold, consistent with historical results.

Nova Minerals’ (ASX:NVA) ore sorting test work has put the Australian junior on track to potentially become the first fully integrated antimony producer in the US.

Tryptamine Therapeutics (ASX:TYP) has secured a key regulatory approval to supply its IV-psilocin drug to Swinburne University for a world-first binge eating disorder trial.

Xero’s $3.9b Melio deal has eyes turning to the next potential B2B payments star.

Trading Halts

AXP Energy (ASX:AXP) – cap raise

Green360 Technologies (ASX:GT3) – cap raise

Liontown Resources (ASX:LTR) – cap raise

Litchfield Minerals (ASX:LMS) – cap raise

Santana Minerals (ASX:SMI) – cap raise

Wrkr (ASX:WRK) – cap raise

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.