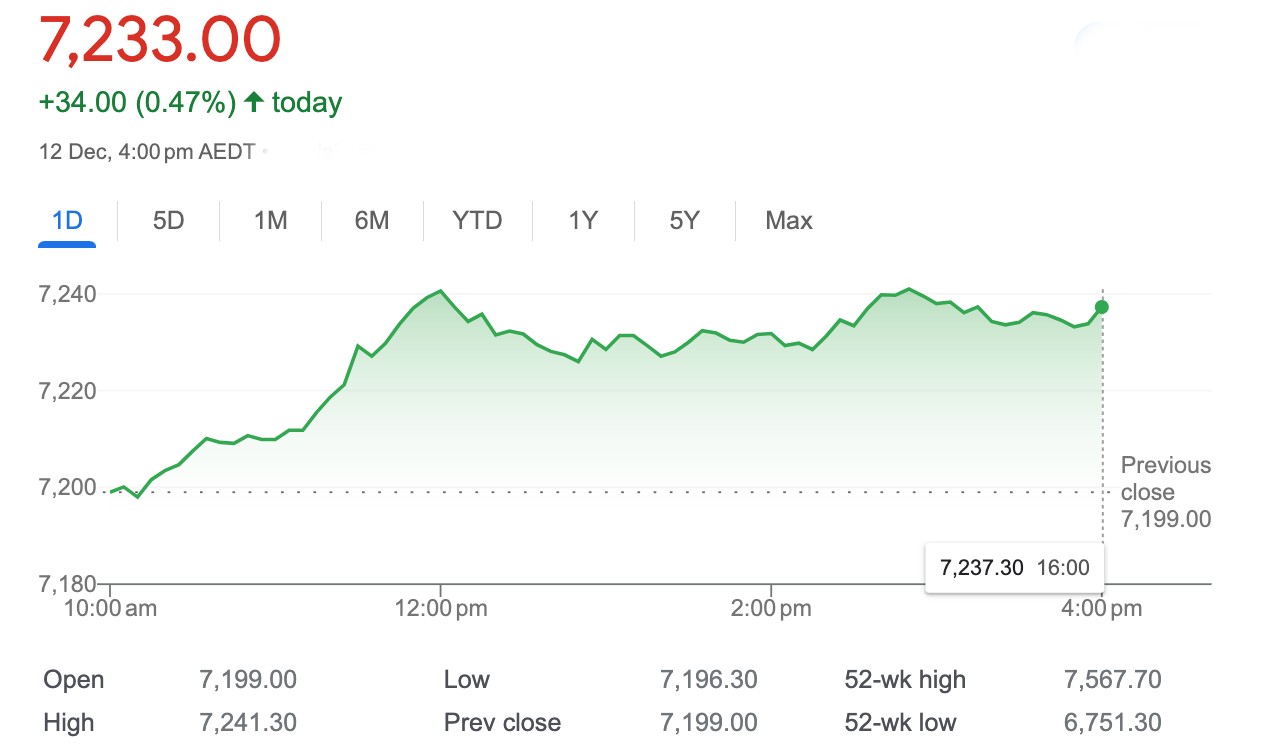

Closing Bell: ASX highest it’s been in three months

Via Getty

- The ASX benchmark rises circa 0.5pc

- IT Sector jumps more than +2.1pc

- Small caps led by DOC

Local markets have clocked a three-month intraday high on Tuesday, with the bulk of buying taking place around the more rate sensitive stocks led by names in the IT, Healthcare, Consumer Staples and Property sectors.

At 4pm on Tuesday December 12, the S&P/ASX 200 (XJO) index was up 34 points, or +0.47%.

All 11 sectors were in the green at 3.30pm, although Materials was on borrowed time at just +0.02% in the happy zone.

Around lunchtime in Sydney, Energy and Utilities were the laggards, although both were part of an all-green, broad-based morning rally.

But with 20 minutes of play on the board, both had joined six sectors ahead between +0.4% and +0.5%.

Things have evened out at 4pm, with traders cycling out of the more defensive sectors and betting on IT.

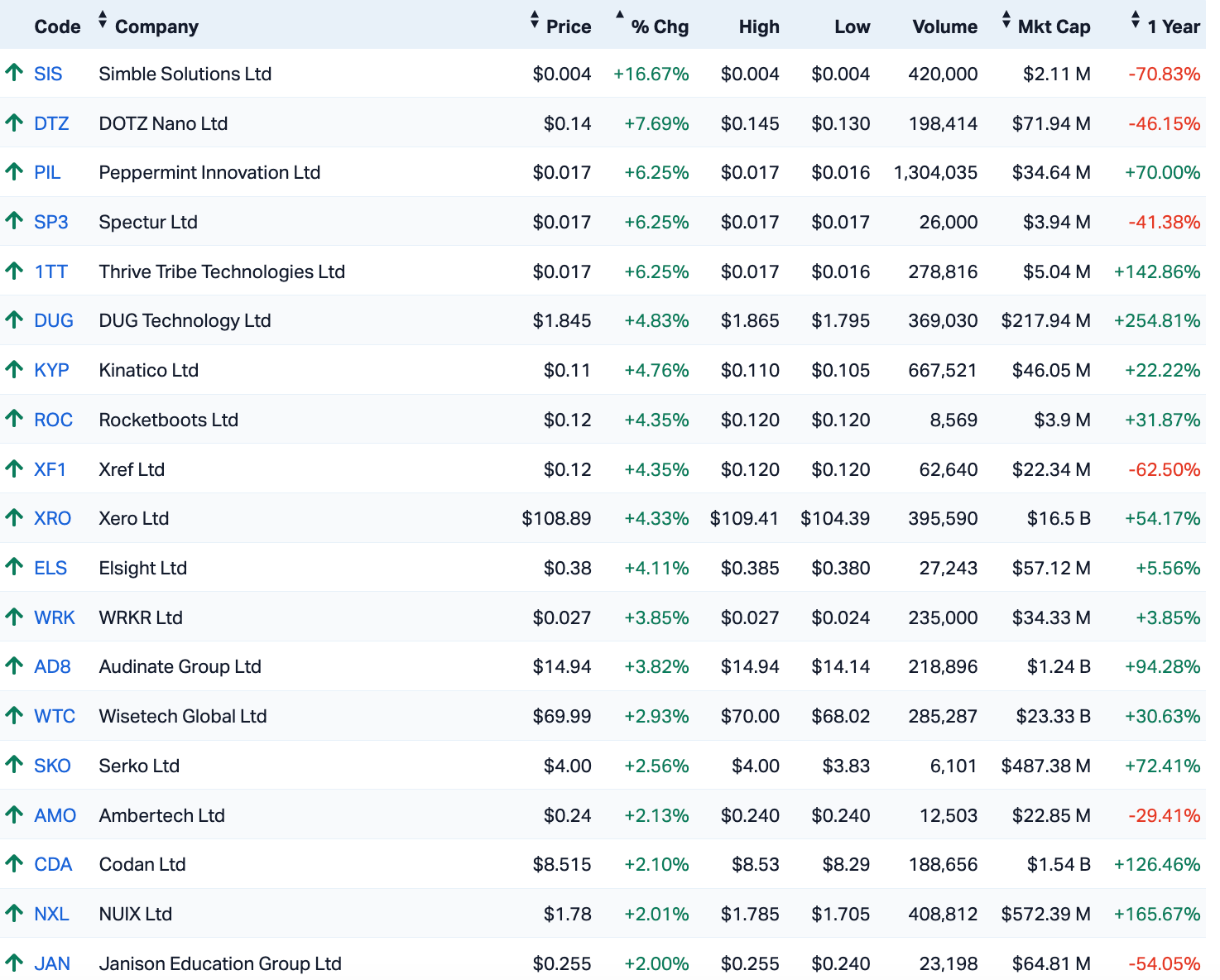

Here are Tuesday’s money-makers in the IT Sector:

ASX Sectors on Tuesday

Elsewhere, everyone with skin in the game is very pleased China has lifted a ban on three Aussie abbatoirs, originally suspended by Chinese trade officials due to breaching COVID-19 regulations during the pandemic.

The reinstatement for export has the tick of approval of the Australian Meat Industry Council, with CEO Patrick Hutchison telling The Australian, it “hopes this move represents the first step in addressing a number of remaining access issues for Australian meat processors”.

Hutchison says there’s still a number of meat plants in China’s bad books, “despite significant corrective actions and steps taken to assure compliance with Chinese requirements”.

The Minister for Trade and Tourism Don Farrell says it’s ‘another positive step’ toward trade stabilisation with China.

“I will continue to press for the re-entry into China of Australian live lobster, and those red meat establishments which remain suspended.

“I am confident the dialogue we have with China will present pathways for other restrictions to be removed, and more Australian produce reaching Chinese consumers.”

Meat from two of the abattoirs was banned by China in mid-2020, and from a third in 2022, just as bilateral ties were flatlining prompting most analysts to suggest the bans were just more of China’s punitive political campaign against Australia.

Oh, and NAB’s regular measurement of business conditions and confidence fell again in November.

According to NAB’s chief economist Alan Oster, apart from during the pandemic this is as glum, shy, afraid, scared, nervous, unsure, tentative, insecure hesitant and downright self-doubting and all-up mousy that Aussie business has been outside of a decade. I am elaborating, naturally, but his point was clear:

“Business confidence is now its weakest since around 2012.”

Every month the bank does a business survey and this one has bidness confidence down six points to nine points on the NAB scale of bidness confidence.

There is almost certainly a useful, granular context to those numbers, which unfortunately requires the study of a graph, which I am not going to do.

Basically confidence was down across pretty much every Aussie industry in every state.

“Both confidence and conditions declined in the month and after a period of relative stability through mid-2023 appear to be softening further,” according to Alan.

This news, repeated ad nausea by obedient journos like me, is unlikely to do business confidence in Australia any favours.

And we’re still watching gold…

At circa US$1,990 on Tuesday – after two straight sessions of falling prices – it appears bullion is in two minds.

The run on gold has been more than sterling lately. It’s a hard train to get off when kicking record highs.

But, on the other hand traders are at something of a crossroads ahead of the headline US CPI inflation reading, as well as the concomitant rates decisions out of the US Federal Reserve, the European Central Bank (ECB) and the Bank of England (BoE), which will set the direction of monetary policy, risk sentiment and the US dollar.

The US consumer inflation read will drop later tonight while US producer (PPI) inflation drops on Wednesday in New York.

And staying in the US…

Overnight in New York, the Dow Jones Industrial Average and the S&P 500 both found +0.4%, but only the latter closed at its highest level in about 21 months. Among the best S&P 500 stocks – the banks, the healthcare names and the major technology stocks.

The tech heavy Nasdaq, meanwhile, ended +0.2% higher.

At 4pm in Sydney, Futures tied to the 3 major US indices were ahead of the Tuesday open in New York:

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| VPR | Volt Power Group | 0.0015 | 50% | 270,022 | $10,716,208 |

| NGY | Nuenergy Gas Ltd | 0.033 | 38% | 73,000 | $35,542,932 |

| BAT | Battery Minerals Ltd | 0.06 | 36% | 2,571,486 | $5,912,038 |

| WIN | Widgienickellimited | 0.11 | 34% | 2,297,819 | $24,431,494 |

| CYQ | Cycliq Group Ltd | 0.004 | 33% | 216 | $1,072,550 |

| IEC | Intra Energy Corp | 0.004 | 33% | 267,111 | $4,982,345 |

| RMX | Red Mount Min Ltd | 0.004 | 33% | 125,081 | $8,020,728 |

| VRC | Volt Resources Ltd | 0.008 | 33% | 34,787,957 | $24,780,640 |

| DOC | Doctor Care Anywhere | 0.06 | 33% | 785,960 | $16,498,901 |

| BCA | Black Canyon Limited | 0.15 | 30% | 122,028 | $7,836,268 |

| CXU | Cauldron Energy Ltd | 0.024 | 26% | 12,244,668 | $21,511,105 |

| ESR | Estrella Res Ltd | 0.005 | 25% | 2,637,333 | $7,037,487 |

| T3DDB | 333D Limited | 0.005 | 25% | 80,607 | $425,242 |

| REM | Remsensetechnologies | 0.022 | 22% | 121,964 | $1,902,300 |

| KNB | Koonenberrygold | 0.034 | 21% | 48,034 | $3,352,974 |

| TTT | Titomic Limited | 0.04 | 21% | 12,447,311 | $29,443,976 |

| SPQ | Superior Resources | 0.018 | 20% | 1,419,991 | $27,518,306 |

| JAY | Jayride Group | 0.03 | 20% | 28,686 | $5,860,228 |

| NME | Nex Metals Explorat | 0.03 | 20% | 200,000 | $8,813,313 |

| 1MC | Morella Corporation | 0.006 | 20% | 635,000 | $30,893,997 |

| BLY | Boart Longyear | 1.6 | 19% | 8,542 | $396,533,355 |

| DM1 | Desert Metals | 0.059 | 18% | 119,500 | $3,752,054 |

| HIQ | Hitiq Limited | 0.021 | 17% | 561,183 | $5,876,238 |

| FHS | Freehill Mining Ltd. | 0.0035 | 17% | 15,000 | $8,549,503 |

| SIS | Simble Solutions | 0.0035 | 17% | 420,000 | $1,808,852 |

Leading the Small Caps winners on Tuesday was UK-based telehealth company Doctor Care Anywhere Group PLC (ASX:DOC), which is making some decent (and rapid) gains this morning after news broke that the company is set to repay its December 2022 senior loan facility with AXA PPP Healthcare Group.

From what I’ve been able to glean from a rapid scan through the announcement, DOC is looking to raise some to raise £10.6 million under an offer of convertible notes, subject to shareholder approval.

The company says the notes would be due 31 December 2027, with no repayment of principal required until maturity, at a conversion price of Conversion price of $0.0875 per share, which is a whopping 94% premium on the previous DOC closing price.

In second place, it was Widgie Nickel (ASX:WIN), which took off on an uphill sprint late in the day, seemingly of its own accord, as the company hasn’t had much to say to the market for quite some time.

It’s also been on a steady decline in trading price since early October, falling from $0.23 to $0.082 yesterday, so this afternoon’s sudden rush of blood to the head is a little mysterious – the price for nickel did jump overnight to reach US$16,300/tonne, but that’s hardly enough to move Widgie’s needle to the extent that it’s moved today.

Titomic (ASX:TTT) was on a slow burn Tuesday, but managed to squeak into the Top 3 by the close of play, thanks to news that the company has signed on to a strategic manufacturing partnership agreement with Stärke Advanced Manufacturing Group (Stärke), a global, advanced manufacturer headquartered in South Australia.

The announcement makes no specific mention of precisely what the two companies are going to be collaborating on, but it does mention that Stärke is quite heavily into “various high-performance sectors, including defence, aerospace, and automotive” – make of that what you will.

Tuesday’s early leader, Compumedics (ASX:CMP) , gave back some of its gains throughout the rest of the day, after rising sharply on news that the company has added two China-based clients to the business roster.

The company alerted the market that it has received two new orders for its Magnetoencephalography (MEG) tech – from Tsinghua and Tianjin Universities – worth around $9.3 million.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| PBL | Parabellumresources | 0.078 | -77% | 489,011 | $21,493,500 |

| NZS | New Zealand Coastal | 0.001 | -50% | 500 | $3,334,020 |

| SHN | Sunshine Metals Ltd | 0.017 | -43% | 73,845,092 | $36,720,253 |

| TG6 | Tgmetalslimited | 0.465 | -36% | 9,771,506 | $39,482,902 |

| APL | Associate Global | 0.13 | -26% | 40,000 | $9,886,175 |

| 1AG | Alterra Limited | 0.006 | -25% | 400,000 | $5,572,420 |

| AVW | Avira Resources Ltd | 0.0015 | -25% | 169,333 | $4,267,580 |

| VBC | Verbrec Limited | 0.065 | -24% | 86,674 | $21,530,471 |

| AYT | Austin Metals Ltd | 0.007 | -22% | 1,553,863 | $9,142,872 |

| ATH | Alterity Therap Ltd | 0.0055 | -21% | 3,847,908 | $19,616,523 |

| EDE | Eden Inv Ltd | 0.002 | -20% | 1,000,000 | $9,167,534 |

| YOJ | Yojee Limited | 0.004 | -20% | 126,251 | $6,529,926 |

| MHI | Merchant House | 0.041 | -20% | 27,288 | $4,807,591 |

| ZNO | Zoono Group Ltd | 0.043 | -19% | 402,368 | $10,066,167 |

| NPM | Newpeak Metals | 0.015 | -17% | 592,884 | $1,799,131 |

| BMG | BMG Resources Ltd | 0.01 | -17% | 1,083,800 | $7,605,566 |

| LTP | Ltr Pharma Limited | 0.32 | -16% | 4,849,616 | $26,754,085 |

| BCT | Bluechiip Limited | 0.016 | -16% | 3,378,262 | $14,954,673 |

| PRS | Prospech Limited | 0.033 | -15% | 1,897,902 | $8,746,832 |

| AYA | Artryalimited | 0.17 | -15% | 289,561 | $15,729,799 |

| M2R | Miramar | 0.024 | -14% | 190,003 | $4,168,347 |

| NAE | New Age Exploration | 0.006 | -14% | 626,667 | $12,557,292 |

| GLN | Galan Lithium Ltd | 0.5 | -14% | 3,579,243 | $204,868,922 |

| S2R | S2 Resources | 0.1775 | -13% | 1,904,333 | $84,189,712 |

| OEQ | Orion Equities | 0.08 | -13% | 54,446 | $1,439,729 |

TRADING HALTS

Propell (ASX:PHL) – pending an announcement to the market in relation to a capital raising.

Atturra (ASX:ATA) – pending an announcement regarding a fully underwritten Arrow Minerals (ASX:AMD) – halt called in respect of a proposed capital raising and proposed board restructure.

HyTerra (ASX:HYT) – requested for the purposes of finalising an announcement regarding a prospective resources assessment on Project Nemaha in Kansas, USA.

Raiden Resources (ASX:RDN) – pending an announcement by the Company to the market in relation to a pending strategic partnership.

Dome Gold Mines (ASX:DME) – pending the release of an announcement regarding a memorandum of understanding relating to an off-take.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.