Closing Bell: ASX goes missing as new premiums lift health stocks; Bitcoin at US$68k

Healthcare gained after the Albanese government approved an increase in private heath insurance premiums. Picture Getty

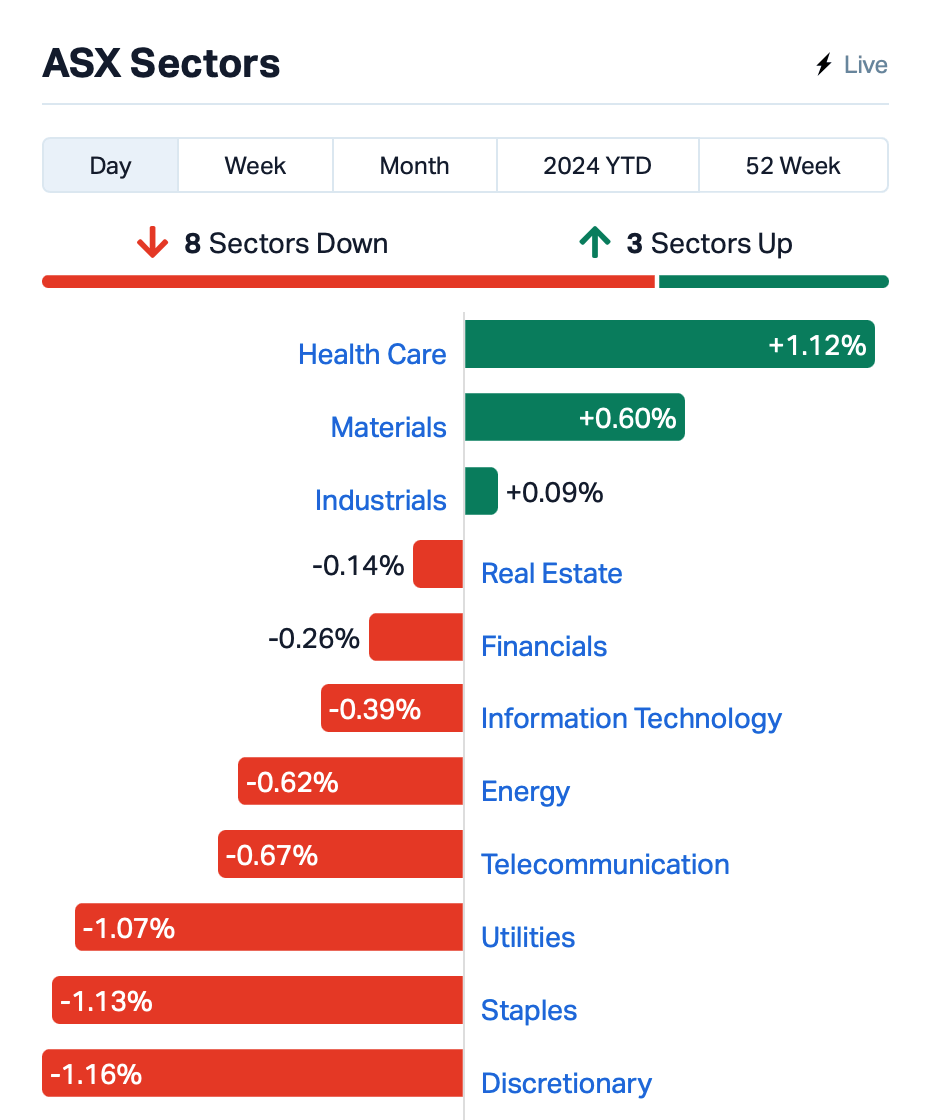

The ASX 200 traded sideways on Tuesday, closing the day flattish as gains in healthcare stocks were offset by losses in other sectors.

Healthcare gained after the Albanese government approved an increase in private heath insurance premiums of 3.03%, effective April 1. This will impact around 15 million Aussies who are paying for private health insurance.

Stocks in the nation’s largest private health funds, Medibank Private (ASX:MPL) and NIB Holdings (ASX:NHF) jumped by 3% each.

Gold stocks also outperformed today as the shiny metal continues to edge toward all time highs, amid expectations that rate cuts in the US would come sooner than expected.

Iron ore heavyweights BHP (AX:BHP) and Fortescue (ASX:FMG)as iron ore prices climbed by 2% overnight.

Meanwhile, Australia’s current account has returned to surplus. Data released by the ABS today showed that the ccurrent account balance increased by $10.5 billion to a surplus of $11.8 billion (seasonally adjusted, current prices) in the December quarter.

The market’s focus now turn towards the GDP figures, which will be released tomorrow.

Meanwhile, Bitcoin continues to rise and is trading at US$68,300 at this time of writing.

“As we approach the halving every four years, there’s a run-up. But you also have these ETFs which have recently been approved and a lot of inflows coming from that,” said Ian Rodgers of Ledger.

China sets 5pc GDP target

In China, the government has today set an ambitious 5% growth target despite a challenging economy hampered by a property slump.

Premier Li Qiang acknowledged it’s now going to be easy to realise those targets, and that “joint efforts from all fronts” are needed.

The announcement came as investors called for stronger action from the world’s second-largest economy to shore up the economy.

Ex-dividend stocks today include:

Coles Group (ASX:COL) is paying 36 cents fully franked

Endeavour Group (ASX:EDV) is paying 14.3 cents fully franked

Embark Education Group (ASX:EVO) is paying 1.5 cents fully franked

Heartland Group (ASX:HGH) is paying 3.764 cents unfranked

Iluka Resources (ASX:ILU) is paying 4 cents fully franked

Kina Securities (ASX:KSL) is paying 5.1 cents unfranked

Lynch Group (ASX:LGL) is paying 4 cents fully franked

Lovisa Holdings (ASX:LOV) is paying 50 cents 30 per cent franked

Orora (ASX:ORA) is paying 5 cents unfranked

Origin Energy (ASX:ORG) is paying 27.5 cents fully franked

Pengana Capital Group (ASX:PCG) is paying 1 cent fully franked

Qualitas (ASX:QAL) is paying 1.1285 cents unfranked

Qube Logistics (ASX:QUB) is paying 4 cents fully franked

Sequoia Financial Group (ASX:SEQ) is paying 2 cents fully franked

SG Fleet (ASX:SGF) is paying 9.6 cents fully franked

Veem (ASX:VEE) is paying 0.77 cents unfranked

Worley (ASX:WOR) is paying 25 cents unfranked

WOTSO Property (ASX:WOT) is paying 1 cent unfranked

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| JAV | Javelin Minerals Ltd | 0.20 | 100.00 | 256,000 | $2,176,231 |

| PRX | Prodigy Gold NL | 0.50 | 66.67 | 2,100,077 | $5,253,323 |

| AUQ | Alara Resources Ltd | 5.10 | 37.84 | 6,519,005 | $26,569,239 |

| PGC | Paragon Care Limited | 28.00 | 36.59 | 6,670,545 | $136,912,977 |

| AUH | Austchina Holdings | 0.40 | 33.33 | 9,634,087 | $6,233,651 |

| AUK | Aumake Limited | 0.40 | 33.33 | 1,785,300 | $5,743,220 |

| TRE | Toubani Res Ltd | 14.00 | 33.33 | 118,995 | $14,055,895 |

| DYM | Dynamicmetalslimited | 21.00 | 31.25 | 8,417,482 | $5,760,000 |

| FIN | FIN Resources Ltd | 1.90 | 26.67 | 720,944 | $9,739,031 |

| ARD | Argent Minerals | 1.20 | 26.32 | 3,519,273 | $12,271,711 |

| VBS | Vectus Biosystems | 25.00 | 25.00 | 10,000 | $10,641,872 |

| AL8 | Alderan Resource Ltd | 0.50 | 25.00 | 6,340,936 | $4,427,445 |

| EDE | Eden Inv Ltd | 0.25 | 25.00 | 1,000,000 | $7,356,542 |

| PUA | Peak Minerals Ltd | 0.25 | 25.00 | 200,448 | $2,082,753 |

| AI1 | Adisyn Ltd | 2.60 | 23.81 | 669,517 | $3,703,341 |

| WWI | West Wits Mining Ltd | 1.60 | 23.08 | 10,582,329 | $31,595,091 |

| CYL | Catalyst Metals | 60.50 | 21.00 | 766,915 | $110,078,772 |

| NHE | Nobleheliumlimited | 10.50 | 20.69 | 2,632,009 | $31,848,243 |

| FTC | Fintech Chain Ltd | 2.40 | 20.00 | 80,734 | $13,015,392 |

| GCM | Green Critical Min | 0.60 | 20.00 | 526,170 | $5,682,925 |

| AAR | Astral Resources NL | 6.10 | 19.61 | 601,898 | $40,447,974 |

| HTA | Hutchison | 3.10 | 19.23 | 28,554 | $352,885,223 |

| AWJ | Auric Mining | 16.50 | 17.86 | 3,454,323 | $18,320,343 |

| AVE | Avecho Biotech Ltd | 0.35 | 16.67 | 17,125 | $9,507,891 |

| TAR | Taruga Minerals | 0.70 | 16.67 | 449,969 | $4,236,161 |

Alara Resources (ASX:AUQ) has completed the commissioning and the commencement of concentrate production at its Wash-hi – Majaza Mine and copper concentrate plant in Oman.

AUQ says production will ramp up to full capacity over the next two to three months.

The sale of the first shipment – approximately 1000 dry metric tons of copper concentrate – to Trafigura is expected in April 2024.

Dynamic Metals (ASX:DYM) has entered a lucrative farm-in and joint venture agreement with Mineral Resources (ASX:MIN) over the lithium rights to its Widgiemooltha project in the WA Goldfields. The Chris Ellison-company is eligible to earn up to 80% of the tenements via a total exploration spend of $20 million, through to a decision to mine.

Fin Resources (ASX:FIN) has been buoyed by a review of work carried out historically on its Ross project in Quebec which identified highly anomalous uranium in soil sampling, including up to 1,486ppm U3O8 associated with low thorium.

Noble Helium (ASX:NHE) says its plans to monetise the helium potential of its North Rukwa project in Tanzania have received a major boost after further detailed analysis and integration of well data indicates the probable free gas cap at Mbelele to be six times larger than originally mapped.

Telix Pharma (ASX:TLX) rose 2% after proposing to acquire Canada-based diagnostic imaging isotope specialist ARTMS for $US42.5M worth of TLX shares upfront, and a further $US15m in earnouts.

And Nova Eye Medical (ASX:EYE) has reported a record sales month for February with US$0.99 million (A$1.52 million) in the bank following improved uptake of its iTrack Advance glaucoma surgical devices.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MSG | Mcs Services Limited | 0.40 | -55.56 | 3,730,162 | $1,782,897 |

| 1MC | Morella Corporation | 0.30 | -25.00 | 723,890 | $24,715,198 |

| AHN | Athena Resources | 0.30 | -25.00 | 1,703,597 | $4,281,870 |

| IS3 | I Synergy Group Ltd | 0.60 | -25.00 | 1,132,723 | $2,432,643 |

| MRQ | Mrg Metals Limited | 0.15 | -25.00 | 89,550 | $4,942,682 |

| OPN | Oppenneg | 0.60 | -25.00 | 1,246,633 | $9,033,437 |

| SUH | Southern Hem Min | 3.60 | -23.40 | 150,000 | $27,754,711 |

| STM | Sunstone Metals Ltd | 1.00 | -23.08 | 18,274,208 | $45,508,470 |

| X2M | X2M Connect Limited | 4.10 | -21.15 | 259,018 | $13,120,219 |

| JPR | Jupiter Energy | 1.90 | -20.83 | 90,830 | $30,567,653 |

| AN1 | Anagenics Limited | 1.20 | -20.00 | 699,129 | $6,286,993 |

| CTO | Citigold Corp Ltd | 0.40 | -20.00 | 3,962,224 | $15,000,000 |

| LRL | Labyrinth Resources | 0.40 | -20.00 | 178,526 | $5,937,719 |

| NAE | New Age Exploration | 0.40 | -20.00 | 135,856 | $8,969,495 |

| ROG | Red Sky Energy. | 0.40 | -20.00 | 530,375 | $27,111,136 |

| SI6 | SI6 Metals Limited | 0.40 | -20.00 | 7,414,996 | $9,969,297 |

| TMK | TMK Energy Limited | 0.40 | -20.00 | 31,664 | $30,612,897 |

| ODY | Odyssey Gold Ltd | 1.70 | -19.05 | 1,854,384 | $18,876,294 |

| NMR | Native Mineral Res | 2.20 | -18.52 | 323,879 | $5,663,264 |

| CBY | Canterbury Resources | 2.70 | -18.18 | 147,902 | $5,667,450 |

| HAL | Halo Technologies | 11.50 | -17.86 | 23,150 | $18,129,330 |

| ABE | Ausbondexchange | 1.50 | -16.67 | 234,641 | $2,028,026 |

| AQI | Alicanto Min Ltd | 3.00 | -16.67 | 1,284,260 | $22,152,125 |

| HT8 | Harris Technology Gl | 1.00 | -16.67 | 876,234 | $3,589,626 |

| JTL | Jayex Technology Ltd | 0.50 | -16.67 | 1,489,300 | $1,687,671 |

In Case You Missed It – PM Edition

PEY Capital has entered an arrangement with Magnis Energy Technologies (ASX:MNS) to source the complete US$320 million in funding needed for full development of the Nachu graphite project in Tanzania.

Magnetic Resources (ASX:MAU) has increased the contained gold at its flagship Lady Julie 4 North deposit by 11% to 948,200oz, lifting the overall precious metal inventory across its Laverton and Homeward Bound South projects to 24.9Mt @ 1.66g/t gold, or 1.33Moz of contained gold.

Mako Gold (ASX:MKG) is sending its top brass to the company’s Napié project in Côte d’Ivoire to evaluate two parallel artisanal mining sites named ‘Double Zone’ where rock chip samples returned up to 22.46g/t gold.

Ongoing work by Strickland Metals (ASX:STK) has demonstrated the Bronco and Konik prospects in its Horse Well project area are actually part of the same structure and could represent a large bulk tonnage target.

Charger Metals (ASX:CHR) has intersected further high-grade stacked spodumene-bearing pegmatites, including lithium grades of up to 3.21%, from deeper drilling into the Medcalf prospect within its Lake Johnston project.

Pantera Minerals (ASX:PFE) now has another 3,553 acres (14.37km2) under its wing within the Smackover brine play in Arkansas, boosting its total footprint at the Superbird project to +17,000 acres.

Future Battery Minerals (ASX:FBM) will soon begin the 3,000m Phase 4 RC drill program over the northern targets of its Kangaroo Hills lithium project in South Australia, including the Big Red prospect.

Strategic Energy Resources (ASX:SER) has already started an infill magnetotelluric survey at the Mundi IOCG project in New South Wales with plans to refine the location of the intense conductive anomaly identified at depths of up to 2,500m.

TRADING HALTS

Austchina Holdings (ASX:AUH) – pending announcement release

Prominence Energy (ASX:PRM) – requested extension of voluntary suspension pending a release on project investment component

At Stockhead, we tell it like it is. While Charger Metals, Dynamic Metals, Fin Resources, Future Battery Minerals, Magnetic Resources, Magnis Energy Technologies, Mako Gold, Nova Eye Medical, Pantera Minerals, Strategic Energy Resources and Strickland Minerals are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.