Closing Bell: ASX fleeced as retail stocks plunge; Alliance Nickel soars on great big grant

ASX accelerated losses after sluggish updates from retailers. Picture Getty

- ASX losses accelerate after sluggish retail sector updates

- Baby Bunting, Temple & Webster, JB Hi-fi all under pressure on soft sales

- Alliance Nickel soars on fat federal grant

After opening modestly higher this morning, the ASX quickly switched to sell mode as sales updates from retail companies left the market in no doubt that rising living costs are affecting people’s purchases.

The ASX200 index closed lower by more than -1%.

JB Hi-Fi (ASX:JBH)’s stock fell by -4% to $56.98 as sales remained stagnant in the March quarter.

Baby Bunting (ASX:BBN) plunged -23% as sales in the second half declined by -7.7%, following a similar -7% decline in the first half. Baby reckons it will now only make between $2 million to $4 million in NPAT for the full year, which is a big drop from the $14.5 million it made in 2023.

Another retailer Temple & Webster (ASX: TPW) also plunged, by -12%, despite the company saying that trading has remained strong, with sales from 1st Jan to 5th May up 30% vs pcp2.

Super Retail (ASX:SUL), which owns Rebel Sports and Supercheap Auto, also dropped -5%, along with Nick Scali (ASX:NCK) and Harvey Norman (ASX:HVN), which also fell around -5% each.

In the big end of town, Commonwealth Bank (ASX:CBA) fell -2% as cash profit dropped by 5% vs pcp to $2.4 billion in the March quarter.

The good news is, CBA’s home loan lending volumes went up by 3.1% from the previous quarter; although the bank noticed that more people are falling behind on their loans.

Westpac (ASX:WBC) was also taking a beating this morning – a far worse one than the CBA. Westpac had surged mightily earlier in the week after it managed to post a better looking quarterly (+5% NPAT of $3.3 billion with a fat, glistening divvy and everything).

Neuren Pharmaceuticals (ASX:NEU) was similarly down, on news this morning that its partner Acadia Pharmaceuticals (Nasdaq: ACAD) reported Q1 net sales of Daybue (trofinetide) in the United States of US$75.9 million, just shy of the low end of expectations.

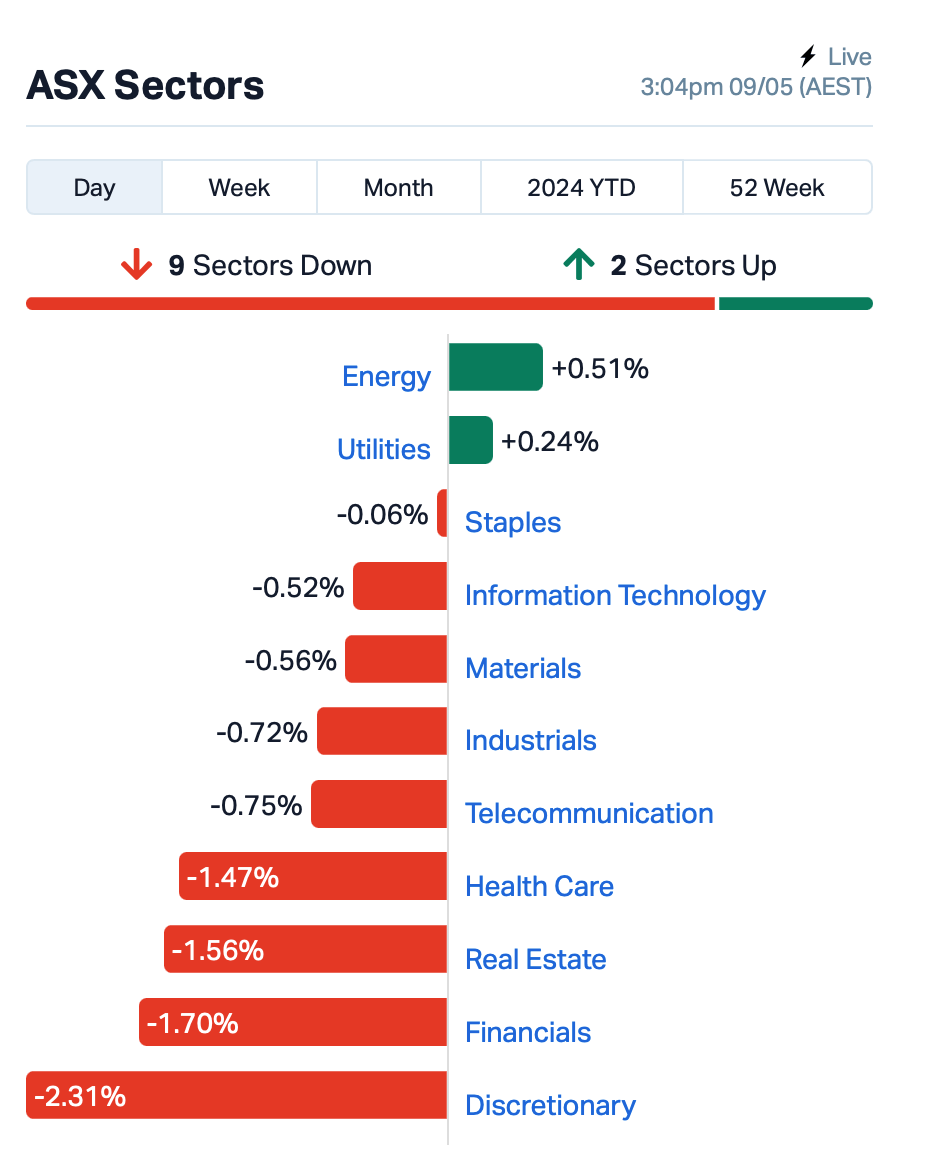

Here’s how the ASX performed on Thursday by sector:

On a more positive note, energy related stocks were mostly higher today on the strength of crude prices. Oil rallied as US crude inventory figures declined more than experts thought it would.

The US stock market also had a bit of a mixed bag overnight. The Dow Jones index was up for a sixth day in a row, but the other main stock market indicators didn’t do as well.

Base metals were mainly down, with copper futures dropping by -1.4% as Indonesia decided to let Freeport Indonesia continue exporting copper, which is kind of good news because it will help with the current copper shortages.

Good news from China

Numbers released today revealed that China’s exports fared well in April, surprising everyone by going up more than expected.

Chinese imports also skyrocketed by 8.4%, leaving China with a trade surplus of US$72.4 billion for the month, much more than economists expected.

Chinese stocks rose broadly on the news, and a key gauge of Chinese stocks listed in Hong Kong rose 1.5% today.

And later tonight, analysts reckon the Bank of England (BoE) will probably leave its interest rates unchanged. But they’ll still pay attention to what the BoE members say after the meeting, and how they voted at the meeting.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| AXN | Alliance Nickel Ltd | 0.078 | 123% | 30,811,950 | $25,404,387 |

| ERW | Errawarra Resources | 0.060 | 54% | 1,435,816 | $3,740,906 |

| AIV | Activex Limited | 0.006 | 50% | 538,354 | $862,010 |

| CNJ | Conico Ltd | 0.002 | 50% | 1,000,687 | $1,805,095 |

| RMX | Red Mount Min Ltd | 0.002 | 50% | 500,000 | $2,673,576 |

| CRS | Caprice Resources | 0.029 | 45% | 21,239,349 | $4,468,406 |

| HOR | Horseshoe Metals Ltd | 0.013 | 44% | 2,614,524 | $5,830,008 |

| IRI | Integrated Research | 0.570 | 43% | 2,634,536 | $69,843,452 |

| ERL | Empire Resources | 0.004 | 33% | 5,035,617 | $3,338,805 |

| HYT | Hyterra Ltd | 0.026 | 30% | 6,069,281 | $14,387,248 |

| HTA | Hutchison | 0.038 | 29% | 104,657 | $393,602,749 |

| SGC | Sacgasco Ltd | 0.009 | 29% | 3,040,886 | $5,457,810 |

| PEC | Perpetual Res Ltd | 0.014 | 27% | 13,622,048 | $7,040,324 |

| MCT | Metalicity Limited | 0.003 | 25% | 4,000,000 | $8,970,190 |

| MTL | Mantle Minerals Ltd | 0.003 | 25% | 11,698,222 | $12,394,892 |

| CDT | Castle Minerals | 0.006 | 20% | 171,322 | $6,122,465 |

| HTG | Harvest Tech Grp Ltd | 0.024 | 20% | 92,500 | $16,237,157 |

| IVX | Invion Ltd | 0.006 | 20% | 2,654,000 | $32,122,661 |

| ME1 | Melodiol Glb Health | 0.003 | 20% | 2,915,005 | $1,783,718 |

| RML | Resolution Minerals | 0.003 | 20% | 50,000 | $4,025,055 |

| VRC | Volt Resources Ltd | 0.006 | 20% | 1,571,971 | $20,793,391 |

| CMO | Cosmometalslimited | 0.049 | 20% | 1,348,950 | $5,182,172 |

| ANR | Anatara Ls Ltd | 0.043 | 19% | 91,453 | $6,881,174 |

| PLN | Pioneer Lithium | 0.130 | 18% | 31,728 | $3,126,750 |

| EQN | Equinoxresources | 0.230 | 18% | 181,073 | $19,729,126 |

Way out in front on Thursday was Alliance Nickel (ASX:AXN), soaring deep into triple digit growth on news that the Australian Federal Government has granted its 100% owned NiWest nickel cobalt project “Major Project Status”. As such, the company will get additional support in navigating and coordinating complex Federal and State regulatory approvals for a period of three years, which is nice.The news comes as nickel prices continue to fluctuate broadly, with prices briefly flirting with US$20,000/tonne towards the end of last month.

Caprice Resources (ASX:CRS) was up this morning on news that it has signed a binding option agreement to acquire 90% of the Bantam project, consisting of four tenements (one granted, three applications) in the West Arunta region of Western Australia.

Caprice said it’s planning on hunting for niobium, rare earths and IOCG mineral deposits, with the site immediately adjacent to WA1 Resources’ (ASX:WA1) West Arunta project and it’s world-class Luni niobium-REE discovery.

Errawarra Resources (ASX:ERW) was surging rapidly this morning, up more than +50% on no news, but it looks like the ASX has yanked on the handbrake and trading in ERW was suspended shortly after midday. Check Closing Bell this arvo for an explanation, as there’s nothing more about iot from the announcements list as yet.

Respiratory imaging technology company, 4DMedical (ASX:4DX), announced that its CT LVAS technology has been incorporated into existing Category III Current Procedural Terminology (CPT) codes. From today, CT LVAS scans conducted in a US hospital outpatient facility for Medicare beneficiaries may be billed to Centers for Medicare & Medicaid Services (CMS) with a reimbursement of US$650.50.

Lithium/critical minerals hunter, Perpetual Resources (ASX:PEC)’s main hunting ground is the booming, spodumene-tastic ‘Lithium Valley’ of Minas Gerais in Brazil, where it has secured some 12,000 hectares of highly prospective lithium exploration permits. Its stocks rallied today on news that a very healthy tax rebate from the Australian Government Department of Industry, Science and Resources, granting it an AusIndustry R&D tax incentive of $161,473.

Gold hunter First Au’s (ASX:FAU) says its new exploration lease EL008058 in Victoria includes the historical King Cassilis mine which, according to records, produced over 3,000 ounces of gold at a grade of 14.4g/t.

Rincon Resources (ASX:RCR) has announced today that it’s been successful in its application under Round 29 of the Western Australian Government’s Exploration Incentive Scheme (EIS) for a co-funding grant of up to $180,000. Rincon has been a particularly hot stock this year, cooling off somewhat this week after what appeared to be some profit taking. But it’s back up today with a decent double digit gain.

Caprice Resources (ASX:CRS), a base and precious metals-hunting junior, is also very close to nailing intraday double-bagging status as we type, with a +90% bourse burst. It has acquisition news with a touch of nearology froth – usually a good price rocket launch pad – announcing it’s gaining a promising Niobium-REE project in the minerals-rich West Arunta region of WA. What’s got investors most excited about that, probably, is the fact the newly acquired ground is a stone’s throw – actually quite literally as it shares a 30km-long border – to WA1 Resources’ West Arunta project. That’s an impressive operation host to the world-class Luni Niobium-REE discovery.

Critical minerals exploration minnow, Marquee Resources (ASX:MQR), rallied after announcing some beaut REE drilling results. Marquee has turned up an encouraging assay result from the company’s Redlings project, which is roughly 40km west of Leonora, WA and 77km north of Menzies. Big gun Lynas’ (ASX:LYC) Mt Weld project lies approximately 150km east of the project. The highlight interval drilled was 14m at 980ppm TREO from surface, which follows on from its 2021 drilling at the site that returned results including 5m at 9,100ppm TREO from surface, with 2m at 18,600ppm TREO from 2m.

ASX SMALL CAP LAGGARDS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| WOA | Wide Open Agricultur | 0.032 | -61% | 7,645,706 | $14,858,944 |

| AXP | AXP Energy Ltd | 0.001 | -50% | 1,952,233 | $11,649,361 |

| MRD | Mount Ridley Mines | 0.001 | -50% | 2,234,873 | $15,569,766 |

| SIT | Site Group Int Ltd | 0.002 | -33% | 20,754,473 | $7,807,471 |

| OSX | Osteopore Limited | 0.085 | -32% | 8,667,224 | $13,619,354 |

| SKN | Skin Elements Ltd | 0.003 | -25% | 46,423 | $2,357,944 |

| TMX | Terrain Minerals | 0.003 | -25% | 3,074,183 | $5,726,683 |

| BMO | Bastion Minerals | 0.007 | -22% | 1,377,111 | $3,875,255 |

| BBN | Baby Bunting Grp Ltd | 1.485 | -22% | 2,664,199 | $256,322,329 |

| MPP | Metro Perf.Glass Ltd | 0.070 | -20% | 201,856 | $16,313,272 |

| BLZ | Blaze Minerals Ltd | 0.004 | -20% | 520,470 | $3,142,791 |

| ECT | Env Clean Tech Ltd. | 0.004 | -20% | 44,127 | $15,859,052 |

| EXL | Elixinol Wellness | 0.004 | -20% | 208,001 | $6,505,370 |

| MOH | Moho Resources | 0.004 | -20% | 35,000 | $2,695,891 |

| ROG | Red Sky Energy. | 0.004 | -20% | 13,635,605 | $27,111,136 |

| TIG | Tigers Realm Coal | 0.004 | -20% | 258,201 | $65,333,512 |

| LU7 | Lithium Universe Ltd | 0.022 | -19% | 8,593,387 | $11,115,816 |

| TZL | TZ Limited | 0.018 | -18% | 535,713 | $5,644,829 |

| PAA | Pharmaust Limited | 0.180 | -18% | 5,695,391 | $86,903,007 |

| AGI | Ainsworth Game Tech. | 0.955 | -18% | 219,685 | $392,364,927 |

| TRJ | Trajan Group Holding | 0.748 | -17% | 1,133,634 | $137,755,557 |

| GLL | Galilee Energy Ltd | 0.039 | -17% | 161,000 | $15,967,998 |

| EEL | Enrg Elements Ltd | 0.005 | -17% | 960,000 | $6,059,790 |

| POS | Poseidon Nick Ltd | 0.005 | -17% | 32,173,481 | $22,281,209 |

| PRX | Prodigy Gold NL | 0.003 | -17% | 901,333 | $6,041,322 |

IN CASE YOU MISSED IT

Greentech Metals (ASX:GRE) has completed a high level review which found that three underexplored copper prospects could deliver significant resource growth at its Whundo copper-zinc project in WA’s Pilbara region.

Mamba Exploration (ASX:M24) has started drilling the first of up to four diamond holes at its Canary uranium project in Canada’s Athabasca Basin to test high priority targets identified by Standard Uranium in 2022 and 2023.

Melodiol Global Health (ASX:ME1) and its Canadian subsidiary Mernova have started the quarter on a strong note with additional product launches across various provinces.

Pan Asia Metals (ASX:PAM) has discovered a lepidolite pegmatite field at its KT East lithium prospect exploration licences that shows strong indications of lithium mineralisation. The dyke swarm is +800m long by +350m wide and remains open in all directions.

Raiden Resources (ASX:RDN) has reached an agreement to earn a 75% interest in the gold rights within Mallina’s 223km2 Arrow gold project in WA’s Pilbara region just 32km from the >10Moz Hemi gold deposit.

Renegade Exploration’s (ASX:RNX) high resolution ground magnetic work has successfully defined a discrete magnetic anomaly over the Mongoose West prospect which will be tested by reverse circulation drilling.

A recent geophysical survey at Strategic Energy Resources (ASX:SER) has unlocked two promising, shallow conductive anomalies at the Mundi project in NSW where drilling will be carried out later this year.

Summit Minerals (ASX:SUM) has identified 30 targets via multispectral analysis targeting niobium at its newly acquired Ecuador project in Brazil.

Uvre (ASX:UVA) has secured high-resolution helicopter magnetic and gamma-ray spectrometric geophysical survey data that will help with targeting of high priority prospects at its South Pass lithium project in Wyoming.

TRADING HALTS

Errawarra Resources (ASX:ERW) – pending release of exploration updates and as response to an ASX price query.

Iceni Gold (ASX:ICL) – for the purposes of considering, planning and executing a capital raising.

Jayex Technology (ASX:JTL) – pending an announcement concerning an application to be removed from the official list

Riversgold (ASX:RGL) – pending an announcement regarding a capital raising.

Thor Energy (ASX:THR) – pending an announcement to the market in relation to a capital raising.

Byron Energy (ASX:BYE) – pending an announcement concerning an application to be removed from the official list.

At Stockhead, we tell it like it is. While Greentech Metals, Mamba Exploration, Pan Asia Metals, Raiden Resources, Renegade Exploration, Strategic Energy Resources, Summit Minerals and Uvre are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.