Closing Bell: ASX flat as Kogan stock crashes after cheap TV delivered on time

KGN drops on 2nd straight FY loss. Delivers empty box on time. Via Stockhead

- ASX 200 benchmark ends big day of earnings near parity, Small Ordinaries (XSO) climbs 0.5%

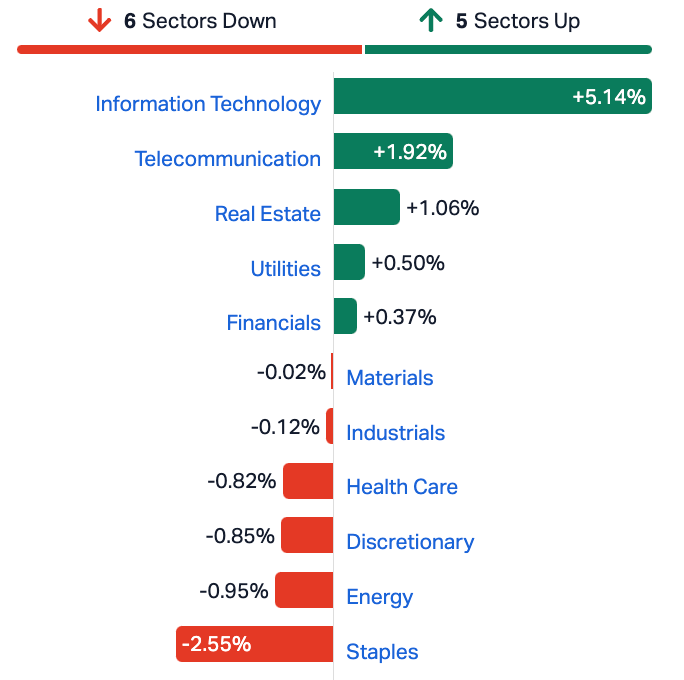

- Tech Sector surge offset by Consumer stocks and Energy

- Small cap gains led by resources and explorer names, WYX continues climb

Just an enormous amount of reporting season action has ended in a terrific – if also deflating – stand-off.

The ASX200 has ended Tuesday awfully flat – up by 0.05%, at 4.05PM after Monday’s heroes, largely the Consumer (staples, not discretionary) and Energy Sectors turned villain.

Weak consumer confidence reads in the AM might’ve weighed on traders’ hearts after local markets couldn’t capitalise on an unexpectedly positive session on Wall Street overnight.

Down by barely 4 points at lunchtime, the Aussie benchmark was fighting dammit with unlikely support from the Telcos and IT in the green corner.

InfoTech took some strong sentiment from the Nasdaq overnight and put it to good work this morning, up almost 6% by lunch.

Telstra (ASX:TLS) apparently can’t get the internet to work in inner-western Sydney suburb Sydenham, but can pick itself off a mat. TLS has had its best day in ages after a hat-trick of losses in the wake of last week’s sober FY23 report.

Altium (ASX:ALU), which dropped its earnings report after market close on Monday and jumped over 27%, pushing its market cap well beyond $6.1 billion.

Next door Megaport’s (ASX:MP1) dropped its first ever FY profit and gained almost 22% before some busy arvo profit taking.

In a season notable for its widespread dummed-down forward guidance, it was these lines which had investors pumped and should make MP1 a fascinating prospect over the next 12-24 months:

“(MP1) expects FY24 EBITDA growth to be between 152% and 182% year on year.

This upgrades the previous EBITDA guidance to a range of $51 million to $57 million , and includes the planned incremental growth in sales headcount.

Revenue in fiscal 2024 is expected to be in the range $190 million to $195 million, an increase of 24% to 27% on fiscal 2023.

Megaport is in a strong financial position and expects to be net cash flow positive, for the full year FY24 after the investment in sales roles and planned capital expenditure.”

It’s also a warm welcome back to the winners circle to the sometime tragi-comic Aussie software builder Nuix (ASX:NXL) which has jumped almost 8% this arvo after saying it’s settled out of court with ex-CEO Edward Sheehy.

The two parties have been in the Supreme Court over the more than 450,000 NXL shares Sheehy has under his bed since the headline IPO back in 2020.

“Nuix can confirm that it has resolved the proceedings with Mr Sheehy on the basis that the appeal be dismissed, Mr Sheehy’s share options in NXL will be cancelled and that Mr Sheehy make a contribution of $700,000 towards Nuix’s legal costs associated with the proceedings. The resolution reached brings this matter to a close.”

Not for long-suffering shareholders, one thinks.

In more welcome news, we have a new ovarian cancer diagnostics company on the local bourse, with Cleo Diagnostics kicking off its new life on the ASX as a public company this morning a few cents above its 20c issue price.

The debut shared centre stage with the handily timed revelation that Cleo just won a patent in the states, for its flagship novel ovarian cancer biomarker.

“The US is the largest diagnostic market in the world, and represents the company’s primary target market for its potentially lifesaving simple diagnostic blood test,” the company told the ASX.

Cleo plans to bring to market a suite of ovarian cancer diagnostic blood tests based on the novel patented CXCL10 biomarker, which is expressed early or at high levels by ovarian cancers.

Cleo Diagnostics (ASX:COV) CEO Richard Allman told Stockhead that early detection is the name of the game for COV, which is making its debut on the ASX after raising $12 million at 20 cents per share.

There is no accurate, pre-surgical method to diagnose ovarian cancer, or to differentiate between malignant or non-cancerous (benign) disease.

“The average five-year survival is 49% which is heavily skewed by those women who have their disease caught early…

“The reality is that perhaps three quarters of cases are detected at late stage. Their five-year survival is quite dismal, with only 17% of stage four cases surviving more than five years.”

Welcome aboard Richard, we hope you do some good, dammit!

Elsewhere, we’ve been watching Kogan (ASX:KGN) deliver a really big TV to Sydenham and perform another slo-mo share price cliff dive.

Shares in the the Aussie online retailer are down double digits after delivering its 2nd straight fiscal year loss, this time coming up short by $25.85m for the year to June 30.

Founder, namesake and CEO Ruslan would be used to these after a tumultuous few years of fortunes and falls.

COVID-19 bore happier days, the stock took off as many an other shopping spree platform did before a self-made inventory glut ended KGN’s pandemic party.

Since then, Ruslan stock has toiled 50% higher in the last year, culling costs and spraying some WD40 on supply lines.

But, instead of providing any reassuring guidance in the FY23 presso, Ruslan.com just mumbled something about how “adjusted earnings were positive” during July. Not enuf Ruslan. Down 14%.

Finally, you’d think a $1.098bn in total profits, up 4.8% (on the back of higher prices and grosser margins across its supermarket and liquor divisions) would be a good day for Coles Group (ASX:COL).

With Coles and Woolies controlling circa two thirds of the Aussie supermarket sector, we turn again for expert comment to furious ACTU Assistant Secretary Joseph Mitchell:

“The public have been told that supply chain issues and inflation are to blame for the cost-of-living crisis. But when you see the profits like those posted today, it is legitimate to ask whether Australia’s big supermarkets have used the cost-of-living crisis as a smokescreen to push up their profit margins, despite costs decreasing for themselves.

“What this profit season suggests is that some of Australia’s biggest companies are posting significant profits, while either exploiting loopholes to drive down wages, or arguably charging more than is necessary to their customers.”

The ACTU has recently launched a Price Gouging Inquiry where they report some 30% of respondents to the Report a Rip-Off website have already cited supermarkets as their main concern.

Unfortunately, even being part of a bastard-duopoly couldn’t help the COL share price which collapsed 6.67%, after its $1.098bn profit came in under consensus estimates.

Not helping either is the $120 million blowout in time and money for the heavily-spruiked automated warehouses which remain unseen.

With shattered Aussie consumer confidence down by another shattering 2.4 percentage points today (via ANZ-Roy Morgan), the big 2 supermarkets with the big 2 market caps dragged Consumer Staples into the dust.

Sector-wise, as touched on, the ASX energy companies took a hit after crude oil fell overnight.

The ASX Small Ordinaries Index (XSO) was ahead by 0.5% near the close, while the ASX Emerging Companies Index (XEC) was down o.2%.

FROM THE HEADLINES

S&P has joined its ratings agency troublemaker Moody’s in downgrading US banks. While that is news, it should’ve been around Christmas, before anyone had even heard of Silicon Valley bank.

Aussie 10-year bond yields have climbed to around 4.3% today, following last night’s rush on US Treasuries. The 10-year bond yields over yonder hit 4.37% to self-defeating way-more-than decade highs.

Some decent news out of Cambridge, England not involving toffs: the next tech juggernaut – a computer processor and software platform maker called ARM just filed paperwork with the SEC – a Form F-1 registration statement – which paves the way for what will likely be the global initial public offering (IPO) of 2023.

And 2022… and probably 2021. The news helped fuel excitement on the Tech-Heavy which should make for an interesting session tonight.

Snapped up by SoftBank for a bit over US$30 billion in 2016, ARM’s confirmation of a Nasdaq IPO is also a terrific FU to the British government in what would’ve been London’s biggest IPO since forever.

The UK-based chip designer failed to get a US$40 billion sale over to Nvidia (NVDA) last year following grumpiness from the competition authorities in the states and in Europe.

They were probably right. Since then, AI, chips and NVDA have all gone rogue. NVDA which reports on Wednesday NY time is up 200% YTD and hatched itself into a trillion dollar company.

In a release I dug up from its mesmeric website, the advanced computing company said it’s applied to list American depositary shares (“ADS”) representing its ordinary shares on the Nasdaq Global Select Market under the symbol “ARM”.

Asia-Pacific facing rice-flation

Dust off your global inflation paper panic bag because on Tuesday while you nibbled sushi, rice prices in Asia jumped to more than decade highs years.

India’s got a rice export ban and elsewhere the various tornadoes and End of Days weather systems have been making hay of rice crops.

Usually Asia has enough rice about the place to help insulate prices and production volatility but perhaps not this time.

A report from Nomura suggests the Philippines is likely the most vulnerable country in the Asia-Pacific should prices go nuts. At circa 35%, Manila has the highest share of food in its consumer price inflation basket out of all of us.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| DXN | DXN Limited | 0.002 | 100% | 1,545,923 | $1,721,315 |

| CLE | Cyclone Metals | 0.0015 | 50% | 101,648 | $10,264,505 |

| MTL | Mantle Minerals Ltd | 0.0015 | 50% | 1,208,333 | $6,147,446 |

| MCT | Metalicity Limited | 0.002 | 33% | 54,658,225 | $5,604,129 |

| VAL | Valor Resources Ltd | 0.004 | 33% | 9,881,705 | $11,485,004 |

| KKO | Kinetiko Energy Ltd | 0.12 | 32% | 4,151,847 | $71,031,281 |

| NMR | Native Mineral Res | 0.055 | 31% | 2,688,377 | $6,172,524 |

| HTG | Harvest Tech Grp Ltd | 0.037 | 28% | 433,251 | $19,968,709 |

| ALU | Altium Limited | 46.34 | 26% | 2,092,668 | $4,855,145,011 |

| CTO | Citigold Corp Ltd | 0.005 | 25% | 359,814 | $11,494,636 |

| ENT | Enterprise Metals | 0.005 | 25% | 20,000 | $3,197,884 |

| IBG | Ironbark Zinc Ltd | 0.01 | 25% | 76,326 | $11,734,274 |

| ICN | Icon Energy Limited | 0.005 | 25% | 116,458 | $3,072,055 |

| MXC | Mgc Pharmaceuticals | 0.0025 | 25% | 69,469 | $7,784,719 |

| SRY | Story-I Limited | 0.005 | 25% | 200,000 | $1,505,619 |

| TYM | Tymlez Group | 0.005 | 25% | 4,998,752 | $4,952,781 |

| KRR | King River Resources | 0.011 | 22% | 599,897 | $13,981,725 |

| MRQ | Mrg Metals Limited | 0.003 | 20% | 871,675 | $5,464,797 |

| WYX | Western Yilgarn NL | 0.22 | 19% | 1,089,801 | $9,186,638 |

| LAM | Laramide Res Ltd | 0.58 | 18% | 17,470 | $622,864 |

| SRK | Strike Resources | 0.06 | 18% | 195,180 | $14,471,250 |

| RDM | Red Metal Limited | 0.1 | 18% | 3,071,806 | $20,875,298 |

| BSN | Basinenergylimited | 0.105 | 17% | 145,122 | $5,402,700 |

| AYT | Austin Metals Ltd | 0.007 | 17% | 147,248 | $6,095,248 |

| CXU | Cauldron Energy Ltd | 0.007 | 17% | 212,898 | $5,709,412 |

Punchy explorer Western Yilgarn (ASX:WYX) was up near almost 25% after identifying ‘multiple targets’ for drilling at its Bulga mining project in WA

WYX is on the go for a gaggle of minerals, including nickel, copper, gold and, yep, some lithium, too.

Stockhead’s assistant minister for resources, Robert Badman says the Bulga project is situated in what appears to be a potentially advantageous position, near two Tier 1, world-class nickel projects operated by BHP (ASX:BHP) – the Leinster and Mt Keith operations – as well as several 2Moz+ gold operations including the renowned Agnew, Lawlers and Bellevue mining projects.

It’s is also about 60km north of Delta Lithium’s (ASX:DLI) Mt Ida Lithium Project and roughly 90km south of Liontown Resources’ (ASX:LTR) huge Kathleen Valley Lithium Project. A good spot to be in.

Red Metal (ASX:RDM) just kept rising early on Tuesday, with excitement still-fresh regarding the company’s potential world-first rare earths discovery at its Sybella project in north-west Queensland.

The discovery follows assay results from proof-of-concept drilling regarding 19 percussion holes (for 2,280m) across a large tranche of granite, which suggest high-quality grades inside some substantial width.

RDM describes the find as full of the EV-worthy REE’s like neodymium and praseodymium (NdPr) as well as yttrium (Y) and dysprosium (Dy), and best of all, MD Rob Rutherford says its all near-surface REO mineralisation.

Red Metal’s MD Rob Rutherford told Stockhead on Monday the find shows scope for “vast tonnages of weak-acid soluble rare-earth oxide (REO) mineralisation hosted in low-acid consuming granite rock”.

Also on the up in the mining space was Nimy Resources (ASX:NIM) which bagged itself $2.5 million as a major, cornerstone investment from New York-based Lind Partners, in order to get cracking on its nickel and lithium drilling programs at the Mons project, north-east of Perth, WA.

NIM surged in June after the company intersected lithium-rich pegmatite rocks in eight holes, over 1.3km of strike, at the South Lake and Royale prospects within the Mons project.

The investment is a staged placement over a maximum 24-month period, with the price fixed at $0.208 cents in the first four months then at either the fixed price or a calculated VWAP subscription price.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.001 | -50% | 3,172,872 | $31,285,147 |

| QPM | Queensland Pacific | 0.066 | -29% | 26,930,341 | $162,410,357 |

| BUY | Bounty Oil & Gas NL | 0.006 | -25% | 1,434,286 | $10,964,008 |

| CHK | Cohiba Min Ltd | 0.003 | -25% | 750,000 | $8,852,977 |

| MSG | Mcs Services Limited | 0.021 | -25% | 600,000 | $5,555,702 |

| OSM | Osmondresources | 0.105 | -19% | 66,667 | $6,096,485 |

| DTL | Data#3 Limited | 6.14 | -18% | 2,833,450 | $1,161,039,872 |

| LVT | Livetiles Limited | 0.009 | -18% | 2,780,924 | $12,948,217 |

| PIL | Peppermint Inv Ltd | 0.009 | -18% | 19,523,740 | $22,416,425 |

| KNG | Kingsland Minerals | 0.19 | -17% | 807,369 | $10,285,554 |

| SOV | Sovereign Cloud Hldg | 0.1 | -17% | 30,682 | $40,728,081 |

| BNO | Bionomics Limited | 0.01 | -17% | 2,520,197 | $17,624,825 |

| FAU | First Au Ltd | 0.0025 | -17% | 250,000 | $4,355,980 |

| PNX | PNX Metals Limited | 0.0025 | -17% | 4,051,035 | $16,141,874 |

| KCC | Kincora Copper | 0.036 | -16% | 692,746 | $6,922,409 |

| DCL | Domacom Limited | 0.021 | -16% | 34,347 | $10,887,544 |

| MKL | Mighty Kingdom Ltd | 0.021 | -16% | 371,166 | $8,155,490 |

| PHL | Propell Holdings Ltd | 0.021 | -16% | 25,000 | $3,008,888 |

| RCL | Readcloud | 0.059 | -16% | 20,516 | $8,528,610 |

| GLL | Galilee Energy Ltd | 0.07 | -16% | 977,389 | $28,098,612 |

| GMN | Gold Mountain Ltd | 0.0085 | -15% | 40,829,052 | $22,690,786 |

| CI1 | Credit Intelligence | 0.15 | -14% | 25,426 | $14,612,353 |

| DY6 | Dy6Metalsltd | 0.15 | -14% | 131,491 | $6,748,436 |

| KNM | Kneomedia Limited | 0.003 | -14% | 7,961 | $5,266,749 |

| XST | Xstate Resources | 0.012 | -14% | 73,123 | $4,501,268 |

LAST ORDERS

In the late mail bag, EZZ Life Science Holdings has been keeping fans guessing until late this arvo when it revealed it will release its (unaudited) Preliminary FY23 Results on Monday, the 28 August 2023.

For the keenest beans EZZ will present financial results for FY23 and a business activity update on Tuesday, 29 August 2023 at 11AM AEST.

The webinar will be hosted by EZZ’s Non-Executive Director and Chair, Glenn Cross, and attended by Chief Financial Officer, Tony Guarna.

Pre-registration is required, https://us06web.zoom.us/webinar/register/WN_AGgmPGW7RYyJv5cKjE05Zw and participants can submit questions via email or during the webinar.

TRADING HALTS

Panterra (ASX:PFE): Pending news of a capital raise

Spacetalk (ASX:SPA): Pending news of a capital raise

Balkan Mining and Minerals (ASX:BMM): Regarding a potential capital raise

Battery Age Minerals (ASX:BM8): Pending news of a capital raise

Aldoro Resources (ASX:ARN): Pending an announcement in relation to analysis of drill results for diamond hole 32 (NDD0032)

AVADA Group (ASX:AVD): Pending an announcement in relation to a proposed transaction and a capital raising involving an institutional placement

Grand Gulf Energy (ASX:GGE): Pending news of a capital raise

QMines Limited (ASX:QML): Pending news of a proposed equity raise to be conducted by by way of a placement

Ecofibre (ASX:EOF): Pending news of a capital raise

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.