Closing Bell: ASX falls, Santos drags on energy; Stakk plays a 500pc winning hand

Stakk nabbed a winning deal with Robinhood. Pic: Getty Images

- ASX falls 0.83% tracking weaker US markets despite Fed rate cut

- Santos falls 12% after $30 billion takeover offer withdrawn

- Fintech Stakk stacks on 500% following US Robinhood deal

The ASX closed lower today, tracking a weaker Wall Street despite the US Fed’s rate cut.

Contributing, too, was the fact oil and gas stocks sold off following news a state-owned Abu Dhabi National Oil Company (ADNOC)-led XRG consortium had withdrawn its indicative takeover offer of $8.89 per share for Santos (ASX:STO) overnight.

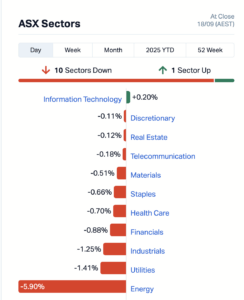

The ASX 200 slipped 0.83% to 8745.20 points, pulled down by a lack of spark in the energy sector, which was the ASX’s biggest laggard down ~6%. The final stats for today’s game weren’t pretty with 10 of the 11 sectors in the red with tech showing just a green tinge, up 0.20%.

Santos falls 12pc as chair seeks to reassure investors

Along with lower oil prices the failed STO takeover bid weighed heavily on the energy sector, with shares in STO closing down more than 12%.

Just 48 hours before a binding deal for an all-cash offer for STO was due, valuing Australia’s second largest oil and gas producer at ~$30bn, the XRG consortium pulled out.

XRG, which also included private equity firm Carlyle, cited concerns over the commercial value of STO.

Chairman Keith Spence moved to assure investors STO had a “clear strategy, strong leadership and high-quality growth opportunities across its global portfolio”.

“The board is confident these strengths will deliver long-term value for shareholders,” Spence said in an ASX announcement.

Other stocks in the sector felt the fallout with Woodside Energy Group (ASX:WDS) slumping 6%, Beach Energy (ASX:BPT) down ~4% and Karoon Energy (ASX:KAR) falling 3.53%.

Fed cuts rates by 25bps, signals more to come

In the US overnight, the Fed cut interest rates by 25bps to a range of 4% to 4.25%, in line with expectations and has kept the door open for more reductions this year. It was the first cut in borrowing costs since December 2024 with US rates now at their lowest level since late 2022.

On Wall Street, the Dow Jones closed 0.6% higher after a volatile session, while the Nasdaq fell 0.3% and the S&P 500 finished flat.

Jobless rate slightly up to 4.3pc

Australia’s unemployment rate rose slightly in August to 4.3% from 4.2% in July, according to data released today by the Australian Bureau of Statistics (ABS).

The data showed a fall of 40,900 full-time jobs in August, partly offset by a 35,500 rise in part-time employment. The participation rate held steady at 66.8%.

The figures will be closely watched by the RBA ahead of its board meeting later this month, with the next rate decision due on September 30. The cash rate is currently 3.6%.

ASX Leaders

Today’s best performing stocks (including small caps):

| Code | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| SKK | Stakk Limited | 0.036 | 500% | 326,931,919 | $12,450,478 |

| BMO | Bastion Minerals | 0.002 | 100% | 3,750,000 | $2,204,953 |

| PAB | Patrys Limited | 0.002 | 100% | 2,455,254 | $4,583,757 |

| CCE | Carnegie Cealn Energy | 0.19 | 81% | 8,494,389 | $42,350,923 |

| VFX | Visionflex Group Ltd | 0.003 | 50% | 8,522,529 | $6,735,721 |

| PUR | Pursuit Minerals | 0.115 | 34% | 1,574,604 | $8,677,454 |

| CHM | Chimeric Therapeutic | 0.004 | 33% | 3,199,999 | $9,763,676 |

| HTG | Harvest Tech Grp Ltd | 0.026 | 30% | 9,176,093 | $18,180,366 |

| TRI | Trivarx Ltd | 0.014 | 27% | 2,866,773 | $6,818,090 |

| KGD | Kula Gold Limited | 0.015 | 25% | 15,245,432 | $12,439,660 |

| DTM | Dart Mining NL | 0.0025 | 25% | 350,000 | $2,749,052 |

| GTE | Great Western Exploration | 0.02 | 25% | 4,389,426 | $9,084,127 |

| WBE | Whitebark Energy | 0.005 | 25% | 379,752 | $2,814,051 |

| FXG | Felix Gold Limited | 0.485 | 24% | 8,752,045 | $171,164,296 |

| SMM | Somerset Minerals | 0.013 | 24% | 32,310,220 | $8,466,682 |

| ZLD | Zelira Therapeutics | 0.47 | 24% | 5,174 | $4,520,919 |

| OCN | Oceanalithiumlimited | 0.11 | 24% | 635,409 | $14,818,178 |

| MDX | Mindax Limited | 0.064 | 23% | 1,301,366 | $122,130,989 |

| DMG | Dragon Mountain Gold | 0.011 | 22% | 150,397 | $3,552,045 |

| AIV | Activex Limited | 0.017 | 21% | 95,569 | $3,017,036 |

| TZL | TZ Limited | 0.047 | 21% | 410,177 | $10,934,200 |

| PXX | Polarx Limited | 0.018 | 20% | 30,725,363 | $40,720,335 |

| EV1 | Evolutionenergy | 0.012 | 20% | 2,007,532 | $5,077,107 |

| HT8 | Harris Technology Gl | 0.012 | 20% | 26,418 | $3,289,652 |

Stakk (ASX:SKK) closed up 500% after securing a two-year deal with US trading platform Robinhood to supply image capture, authentication and transaction processing for its new Robinhood Banking service. The extendable agreement positions Stakk as a key vendor as Robinhood expands into full-service banking with checking and savings accounts. Stakk said the partnership was material, noting Robinhood’s scale and significant commitment to the rollout, though revenue will depend on the venture’s success.

Somerset Minerals (ASX:SMM) was up 25% today after announcing it had intersected broad zones of visible copper in the first two Jura North drill holes, which form part of the company’s flagship Coppermine Project in Canada, extending mineralisation beyond its earlier 42.7m at 2.69% Cu hit. Hole JURC006 recorded multiple mineralised intervals across 85.4m, while JURC005 returned 56.4m. Assays are expected within two weeks, with recent geophysics to guide the next exploration phase along the 7km Jura fault zone.

ASX Laggards

Today’s worst performing stocks (including small caps):

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ERA | Energy Resources | 0.002 | -33% | 1,515,005 | $1,216,188,722 |

| HLX | Helix Resources | 0.001 | -33% | 10,314,594 | $7,569,436 |

| IRX | Inhalerx Limited | 0.028 | -22% | 52,208 | $7,684,136 |

| SRL | Sunrise | 4.02 | -20% | 1,120,579 | $619,730,819 |

| AQX | Alice Queen Ltd | 0.004 | -20% | 4,998,009 | $6,923,481 |

| MSI | Multistack Internat. | 0.004 | -20% | 200,001 | $681,520 |

| RFT | Rectifier Technolog | 0.004 | -20% | 10,730 | $6,909,920 |

| IXC | Invex Ther | 0.105 | -19% | 9,000 | $9,770,000 |

| COY | Coppermoly Limited | 0.013 | -19% | 1,000,068 | $14,122,519 |

| RIM | Rimfire Pacific | 0.013 | -19% | 3,766,266 | $43,598,302 |

| ALM | Alma Metals Ltd | 0.005 | -17% | 3,844,597 | $11,143,423 |

| BLZ | Blaze Minerals Ltd | 0.0025 | -17% | 512,446 | $8,625,000 |

| MMR | Mec Resources | 0.005 | -17% | 1,115,762 | $11,231,939 |

| RLC | Reedy Lagoon Corp. | 0.0025 | -17% | 20,000 | $2,330,120 |

| TMX | Terrain Minerals | 0.0025 | -17% | 2,756,640 | $8,045,443 |

| ZMM | Zimi Ltd | 0.01 | -17% | 3,344,206 | $7,768,526 |

| TG1 | Techgen Metals Ltd | 0.026 | -16% | 4,716,318 | $10,083,206 |

| ABX | ABX Group Limited | 0.076 | -16% | 8,379,867 | $22,669,336 |

| BRX | Belararoxlimited | 0.093 | -15% | 1,766,100 | $17,819,887 |

| RML | Resolution Minerals | 0.051 | -15% | 55,341,997 | $75,274,209 |

| LRD | Lord Resources | 0.036 | -14% | 13,131,820 | $6,510,085 |

| 1AD | Adalta Limited | 0.003 | -14% | 11,589,500 | $5,110,719 |

| ANX | Anax Metals Ltd | 0.006 | -14% | 3,572,100 | $6,179,653 |

| AZL | Arizona Lithium Ltd | 0.006 | -14% | 2,669,612 | $37,662,201 |

| CUL | Cullen Resources | 0.006 | -14% | 150,713 | $4,853,813 |

In Case You Missed It

A Renascor Resources (ASX:RNU) purified spherical graphite demonstration plant in South Australia has received a $5 million government grant to help reach commissioning next quarter.

A scoping study for producing high purity alumina from refined kaolin products from the Andromeda Metals (ASX:ADN) Great White Project in South Australia has highlighted its potential to become a leading low-cost, low-carbon producer.

The Resolution Minerals (ASX:RML) success in advancing its Horse Heaven gold-antimony-tungsten project in Idaho has been recognised by high net worth and global institutions in the form of firm backing for a $25.1m share placement.

Western Gold Resources (ASX:WGR) has completed more than 16,000m of infill and grade control drilling, with results expected to de-risk operations and enhance mine scheduling for its Gold Duke project in WA.

Neurizon Therapeutics (ASX:NUZ) has secured firm support for a $5m placement and R&D tax incentive advance and entered a position of financial strength to advance innovative treatments for neurodegenerative diseases.

QMines (ASX:QML) has mobilised two rigs for 5000m of drilling, looking to find other instances of spectacular historical results, extend mineralisation and grow the resource base at its advanced Mount Mackenzie gold and silver project in Queensland.

Trading halts

Environmental Clean Technologies (ASX:ECT) – materials+acquisition and cap raise

Lunnon Metals (ASX:LM8) – deal on Lady Herial deposit processing

Memphasys (ASX:MEM) – cap raise

Omega Oil & Gas (ASX:OMA) – cap raise

QEM (ASX:QEM) – testwork results pending

Swift Media (ASX:SW1) – agreement with material customer

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Disclosure: The journalist held shares in Woodside at the time of writing this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.