You might be interested in

Mining

Resources Top 5: Lightning could strike twice in West Arunta as Encounter drills high grade niobium next door to WA1

News

ASX Lunch Wrap: ASX flattens as Webjet, Accent tumble; Nvidia disappoints

News

News

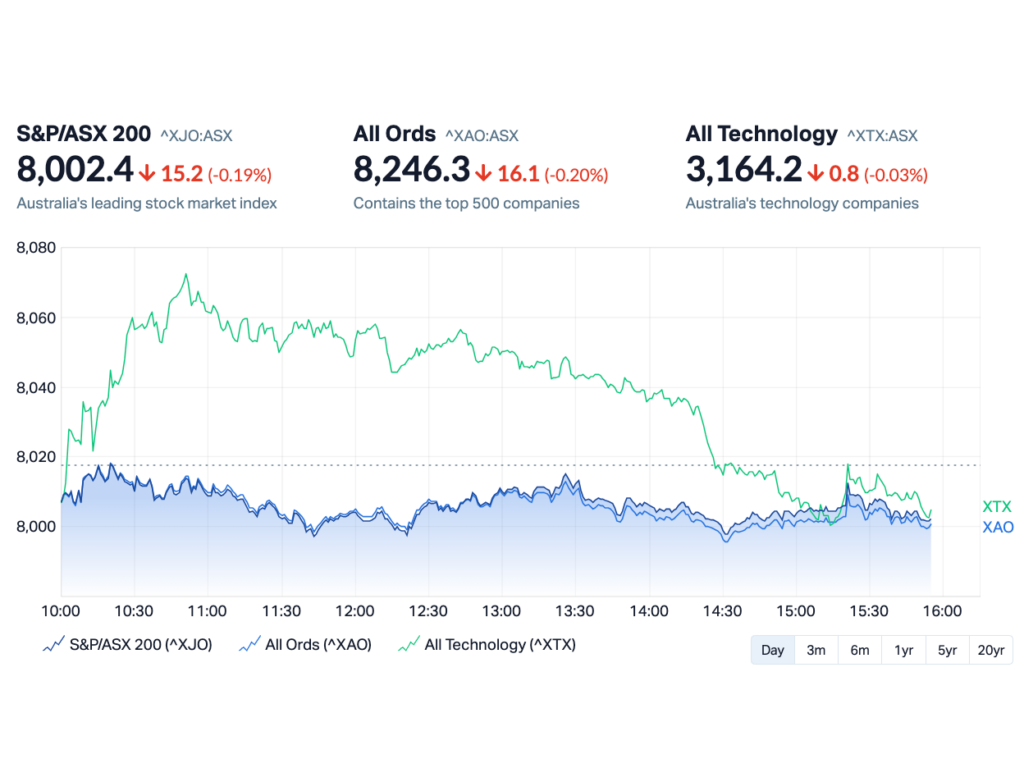

On Tuesday local markets walked screaming from Monday’s record highs, weighed down by almost everyone and everything.

At about 3.55pm, 20 minutes before match out, the S&P/ASX200 was 15.20 points or 0.19% lower, to 8,002.4.

In the end the benchmark shed 18.30 points or -0.23% to 7,999.30. So good bye to 8,000pts already. and we’ve wasted a pretty good lead out of New York today.

The Dow Jones ended up in new record territory after adding more than 0.5% overnight. The Americans are now pricing in a third rate cut before Christmas to the tune of 60%.

In Australian markets all we’ve done this afternoon is watch the thin gains get trimmed and the tech sector give up its handsome gains from the last few sessions.

The miners have been a disgrace. let’s just call a spade a mining truck.

Iron ore futures are down, but that doesn’t mean % and steel-making ingredient is now worth $US107 per tonne for the August contract.

Rio Tinto (ASX:RIO) received approval from Guinean and Chinese authorities to invest in its Simandou high-grade iron ore project and is expected to put $US6.2 billion ($9.2 billion) into it and surrounding infrastructure. Rio also said it had produced 157.4 million tonnes of iron ore in the first half of 2024, down 2 per cent from a year earlier. Iron ore shipments fell by the same amount to 158.3 million tonnes.

Rio’s down -2.5%, BHP (ASX:BHP) lost -1.35% and Champion Iron (ASX:CIA) lost -2%. Fortescue (ASX:FMG) rose 0.5%.

Among the lithium majors, IGO (ASX:IGO) said it would log some $300 million in impairments in its upcoming full-year report after a review of its nickel assets. Shares slipped 0.7%

In the ever-lovable small cap defence sector two friends of the show are having mixed fortunes on Tuesday arvo.

On the happier side with a more than 5% bump is Electro Optic Systems (ASX:EOS), which revealed a 1H24 revenue bump some 90% the better than 1H23. No surprise there, they’ve been selling all sorts of things into the war riven Mid East so far this year.

Coming out of a trading halt and down circa 30% is Oleg Vornik’s DroneShield (ASX:DRO).

Here’s what’s happening on that front:

Basically DRO’s saying it was a bit of a snow job on its rep as a butt-kicking scene-stealing drone-killing monster. Also that a Dir of the company cashed in some chips, possibly many.

One can see it’s been an emotional day over there at Droneshield:

But then again, not nearly as emotional as it has been over the last 12 months at DRO and anyone holding it.

No one’s going to miss a lazy 20%…

Not really into currencies. But I am when the Aussie does good. It hasn’t.

The local dollarbuck has fallen back fell below $0.675, down about 0.3% and retreating further from recent six-month highs.

At fault is as the American assassin, who’s gone and solidified bets on a second Trump presidency. That’s been good for the USD.

till, the Aussie remained on a strong footing relative to peers as the Reserve Bank of Australia is expected to ease policy much later than other major central banks. Markets also see a possibility for another RBA rate hike this year given persistent domestic inflationary pressures. Investors now look ahead to Australian employment figures later in the week to gauge the state of the labor market.

More consternation out of China: On our last episode on Breaking Beijing, we learned China endured slower-than-expected growth through another shoddy quarter (this one was Q2 of 2024), amidst an ongoing property market meltdown. Also retail sales and jobs numbers were bad… which means they surely must be terrible.

Today, we’re watching the offshore Yuan’s continued depreciation which Bloomers says was tempered by tight offshore funding conditions, “which hindered investors’ attempts to short the currency”.

And the Third Plenum is on. That’s a showy, high-level bureaucratic nightmare of which runs all week where President Xi turns up and the focus is likely on the Party’s labyrinthine economic and social challenges. Investors await policy insights, but there’s little expectation of a short-term stimulus package for the world’s second-largest economy.

US Futures are higher following the Dovish remarks overnight from Federal Reserve Chair J. Powell who babbled on about a growing confidence US inflation is easing down toward the bank’s 2% long-term target.

Here are the best-performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| DGR | DGR Global Ltd | 0.028 | 211% | 43,059,888 | $9,393,241 |

| MSG | Mcs Services Limited | 0.003 | 200% | 22,247,325 | $198,100 |

| MCT | Metalicity Limited | 0.003 | 50% | 1,088,318 | $8,971,705 |

| MHC | Manhattan Corp Ltd | 0.002 | 50% | 225,000 | $2,936,980 |

| TD1 | Tali Digital Limited | 0.002 | 50% | 18,500 | $3,295,156 |

| WML | Woomera Mining Ltd | 0.003 | 50% | 246,793 | $2,436,278 |

| FEG | Far East Gold | 0.195 | 39% | 762,569 | $36,062,157 |

| AI1 | Adisyn Ltd | 0.045 | 36% | 2,571,634 | $6,109,356 |

| NAE | New Age Exploration | 0.004 | 33% | 1,409,904 | $5,381,697 |

| SEN | Senetas Corporation | 0.015 | 25% | 1,234,783 | $18,855,400 |

| EMT | Emetals Limited | 0.005 | 25% | 597,926 | $3,400,000 |

| MEL | Metgasco Ltd | 0.005 | 25% | 100,197 | $5,790,347 |

| SLB | Stelarmetalslimited | 0.090 | 25% | 9,150,324 | $4,576,171 |

| TSL | Titanium Sands Ltd | 0.005 | 25% | 20,000 | $8,846,989 |

| ZLD | Zelira Therapeutics | 0.990 | 24% | 54,685 | $9,077,724 |

| 1AE | Auroraenergymetals | 0.097 | 23% | 1,865,385 | $14,146,035 |

| C29 | C29Metalslimited | 0.115 | 21% | 804,812 | $13,269,713 |

| EVG | Evion Group NL | 0.023 | 21% | 419,789 | $6,592,301 |

| AVC | Auctus Invest Grp | 0.650 | 20% | 101,045 | $43,364,740 |

| ASQ | Australian Silica | 0.024 | 20% | 50,000 | $5,637,208 |

| BMM | Balkanminingandmin | 0.085 | 18% | 88,999 | $5,114,917 |

| OSX | Osteopore Limited | 0.066 | 18% | 31,812,881 | $6,435,537 |

| ECG | Ecargo Hldg | 0.007 | 17% | 102,409 | $3,691,500 |

| T3D | 333D Limited | 0.007 | 17% | 111,111 | $716,670 |

| X2M | X2M Connect Limited | 0.036 | 16% | 6,667 | $10,776,570 |

MCS Services (ASX:MSG) went off this morning and was up by some 300% by 11am. MSG provides uniformed security and traffic management services in Western Australia and – that’s about all the info we have at the moment, as the company has since gone into a trading halt to prep a reply to an ASX query.

Resources company creator DGR Global (ASX:DGR) was flying high very early on Wednesday, on news of SolGold’s monster US$750m cash injection for the development of its mega Cascabel copper-gold project in Ecuador. DGR has a 6.8% stake in the once Aussie but now London/Canada-listed miner.

Zelira Therapeutics (ASX:ZLD) this morning confirmed it’s secured patents for HOPE 1 and HOPE 2 formulations from the Ausssie Government’s Commission of Patents and the US Patent and Trademark Office (USPTO).

These are never easy and the purveyor of clinically validated cannabis therapies and meds says the patents cover drugs that are designed to treat cluster symptoms associated with Autism Spectrum Disorder (ASD), with the company saying “the broad patents fortify Zelira’s competitive edge in the central nervous system (CNS) therapeutic space and significantly enhance its patent portfolio.”

Now. Up a lazy 25% is Far East Gold (ASX:FEG) which just installed Aussie legend Justin Werner as its chairman… and also revealed the acquisition of a potentially multi-million-ounce gold project in Indonesia.

But take a bow Chairman Werner, who knows Indo like the back of his hand having been involved in the country’s mining industry for more than two decades. He’s been a non-executive director with FEG since its inception, and has been the MD of global top-10 nickel producer, Nickel Industries (ASX:NIC) since March 2008.

Meanwhile, FEG just signed a binding agreement with PT Iriana Mutiara Idenburg for exclusive rights to explore, develop, and operate the Idenburg Gold Project in Indonesia’s Papua Province.

The Idenburg project covers 95,280 hectares (952.8km2) and is known for high-grade lode gold occurrences characteristic of orogenic gold systems – similar to areas such as the 60Moz-plus Kalgoorlie Goldfields and the Mother Lode district of California.

It’s a region when combined with Papua New Guinea that hosts several multi-million-ounce gold and copper deposits including the world class Grasberg (+70Moz Au), where Werner once worked as a turnaround consultant, Porgera (+7Moz Au), Frieda River (20Moz Au) and Ok Tedi (20Moz Au).

And Titomic (ASX:TTT) has risen today on news that it has hired a seasoned US Defence industry exec Dr Patricia Dare, a former Boeing and Lockheed exec and is on board to further push Titomic into the US Defence sector following some cracking recent contract wins.

Finally, there’s even more momentum than there was at the open and at lunch for ambitious little tech stock Adisyn (ASX:AI1). On Monday AI1 signed a binding thingy with 2D Generation, which is a global semiconductor IP business incorporated in Israel and which is reportedly pretty tight with Nvidia, with AI1 reporting the partnership aims to “generate transformational opportunities in the AI space”.

Here are the least performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 1TT | Thrive Tribe Tech | 0.002 | -50% | 7,590,306 | $1,882,486 |

| VPR | Voltgroupltd | 0.001 | -50% | 11,883 | $21,432,416 |

| SIH | Sihayo Gold Limited | 0.002 | -33% | 208,000 | $36,612,769 |

| DRO | Droneshield Limited | 1.860 | -28% | 42,865,485 | $1,982,631,014 |

| EXL | Elixinol Wellness | 0.003 | -25% | 158,809 | $5,284,729 |

| OAR | OAR Resources Ltd | 0.002 | -25% | 67,500 | $6,444,200 |

| SFG | Seafarms Group Ltd | 0.003 | -25% | 94,913 | $19,346,397 |

| TKL | Traka Resources | 0.002 | -25% | 130,000 | $3,501,317 |

| AEV | Avenira Limited | 0.005 | -25% | 1,579,830 | $14,094,204 |

| S66 | Star Combo | 0.110 | -24% | 20,000 | $19,587,032 |

| AGH | Althea Group | 0.023 | -23% | 2,408,077 | $12,159,973 |

| XGL | Xamble Group Limited | 0.020 | -23% | 62,499 | $7,700,085 |

| MXO | Motio Ltd | 0.017 | -23% | 993,051 | $5,900,364 |

| FAL | Falconmetalsltd | 0.240 | -21% | 750,240 | $53,985,000 |

| ADD | Adavale Resource Ltd | 0.004 | -20% | 2,005,002 | $5,326,327 |

| HLX | Helix Resources | 0.002 | -20% | 200,000 | $8,160,484 |

| IVX | Invion Ltd | 0.004 | -20% | 9,876 | $33,022,661 |

| LPD | Lepidico Ltd | 0.002 | -20% | 1,946,900 | $21,472,798 |

| MRQ | Mrg Metals Limited | 0.004 | -20% | 4,292,500 | $13,557,593 |

| RML | Resolution Minerals | 0.002 | -20% | 415,200 | $4,025,055 |

| RNE | Renu Energy Ltd | 0.004 | -20% | 3,005 | $3,630,670 |

| AUG | Augustus Minerals | 0.077 | -17% | 5,184,106 | $7,939,410 |

| AMD | Arrow Minerals | 0.003 | -17% | 5,886,198 | $31,618,095 |

| AVE | Avecho Biotech Ltd | 0.003 | -17% | 1,169,015 | $9,507,891 |

MCS Services (ASX:MSG) – to allow the company to announce a reply to a price query from ASX.

Quantum Graphite (ASX:QGL) – pending an announcement in relation to correspondence relating to applications for Letters of Interest to the US EXIM Bank.

Pacific Nickel Mines (ASX:PNM) – pending an announcement in relation to the operations and funding of the Kolosori Nickel project.

Tesoro Gold (ASX:TSO) – pending an announcement on a proposed capital raising.

Labyrinth Resources (ASX:LRL) – pending an announcement regarding an asset acquisition and capital raising activities.

Altech Batteries (ASX:ATC) has made excellent progress on manufacturing prototypes of its solid-state sodium chloride batteries with all cells for one of the two 60kWh CERENERGY® prototypes completed. It has also made improvements to the cell design that improve energy capacity and reduce nickel content while lowering unit cost.

Earths Energy (ASX:EE1) has appointed energy consulting business GLJ to its team to conduct a technology assessment of the company’s two South Australian projects. This will review both the geothermal and CCUS potential at Paralana and Flinders West.

Haranga Resources’ (ASX:HAR) termite mound sampling work has boosted its portfolio of auger drilling targets at the Saraya uranium project in Senegal to 11. Most of these targets are located on the contacts between granite and Birimian age volcano-sedimentary units that are known to have potential to host mineralisation.

Intra Energy (ASX:IEC) is preparing to kick off a maiden 2000m drill program at its Maggie Hays Hill project at Lake Johnston, WA, after completing a crucial heritage survey. The drilling will focus on the 2.5km-long southern pegmatite lithium target as well as multiple gold targets.

Marmota (ASX:MEU) has started drilling the previously untested Goolagong gold target in South Australia that was initially found by a reconnaissance aircore hole that intersected significant gold grades in the last 2m. After Goolagong, the company plans to start major exploration programs at Aurora Tank and Campfire Bore.

RareX (ASX:REE) has restructured its board to streamline operations and reduce costs, promoting CEO James Durrant to managing director as it assesses the Cummins Range rare earths development and prepares to start exploration at the Khaleesi niobium acquisition.

Victory Metals (ASX:VTM) has updated resources for its North Stanmore rare earths project with 63% of the 235Mt resource, or 149Mt, now residing in the higher confidence indicated category. A scoping study will be completed in Q3 alongside partnership and offtake discussions.

At Stockhead, we tell it like it is. While Altech Batteries, Earths Energy, Haranga Resources, Intra Energy, Marmota, RareX and Victory Metals are Stockhead advertisers, they did not sponsor this article.