Closing Bell: ASX ends Friday in style; NoviqTech explodes 180pc

ASX rallies, NoviqTech shares surge on blockchain funding. Picture via Getty Images

- ASX rises, but MinRes drops over transparency issues

- Fed boss Powell’s cautious rate cut stance cools market optimism

- NoviqTech shares surge after securing blockchain funding

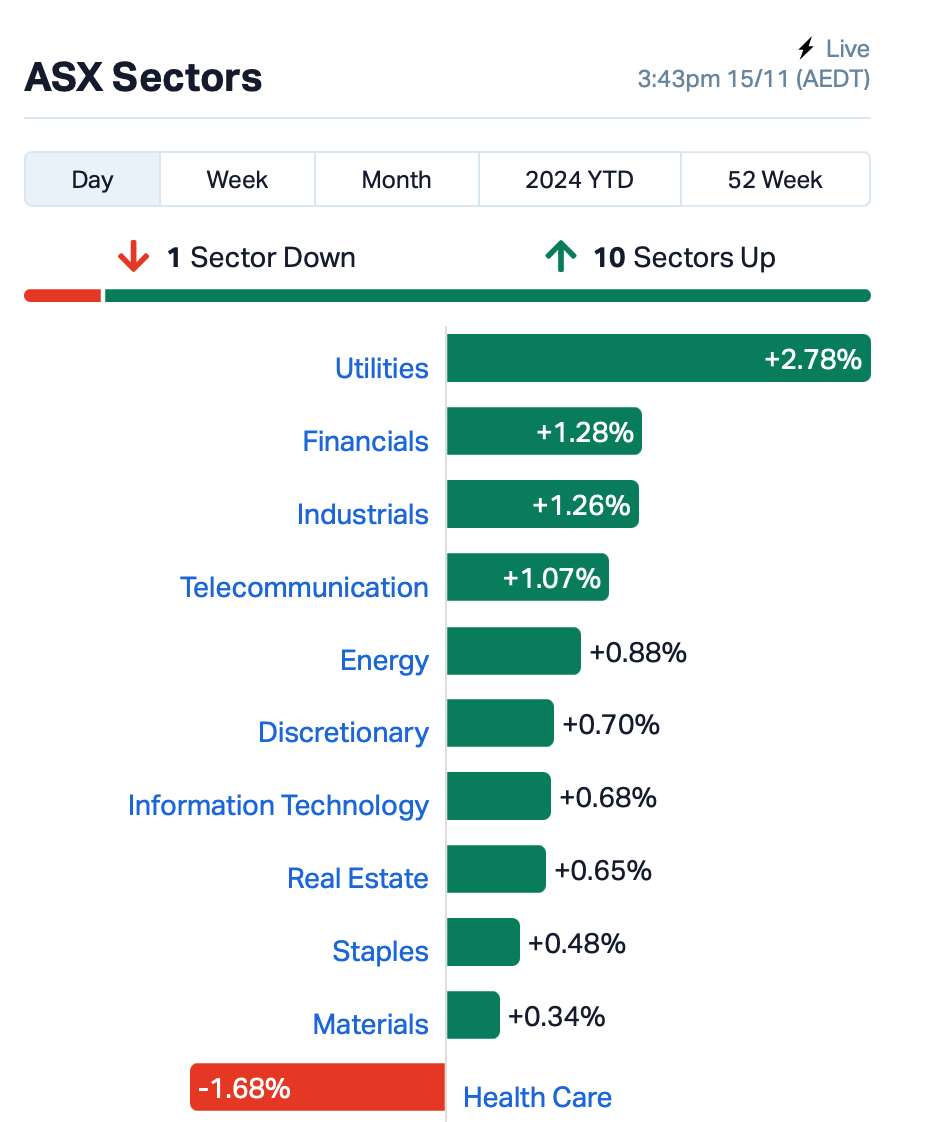

The ASX rose by 0.74% on Friday, with 10 out of 11 sectors finishing in the green. For the week, however, the benchmark S&P/ASX 200 Index lost 0.2%.

Today’s rally came despite a soft session on Wall Street overnight, where comments from Federal Reserve Chairman Jerome Powell shifted market sentiment.

Powell signalled a cautious approach to rate cuts and emphasised the need for careful decision making. Bets were shaved down from an 82.5% chance of a rate cut next month, to a 59% chance after his remarks.

“The reality is, markets could pull back as traders come to terms with less chance of a 0.25% US rate cut in December,” said Jessica Amir at moomoo Australia.

Meanwhile, in Adelaide, the AFR’s Sohn Australia conference is underway, drawing high-profile investors.

Perpetual (ASX:PPT) and Corporate Travel Management (ASX:CTD) got a nice boost – both up around 2.5% – after Chris Kourtis from Ellerston Capital and Rikki Bannan from IFM Investors singled them out as their top stock picks.

On the ASX, the Utilities sector took the lead today, driven by a 2% jump in Origin Energy (ASX:ORG) and AGL Energy (ASX:AGL), though there was no specific news behind the moves.

The Health Care sector lagged meanwhile, weighed down by a 2% dip in CSL (ASX:CSL), again with no clear catalyst.

Among large-cap stocks, Lendlease Group (ASX:LLC) rose 3.5% after announcing a $500 million share buyback.

The company has also successfully avoided a “second strike” on its exec remuneration report at its AGM today. More than 91% of shareholders voted in favour, a big improvement from last year when nearly 40% voted against it.

Market operator ASX (ASX:ASX) gained 1% following its defence against claims from the Australian Securities and Investments Commission (ASIC) regarding misleading statements about its CHESS replacement project. The ASX maintains it did not breach any laws but acknowledged the delays in the project.

Retail giants Woolworths (ASX:WOW) and Coles Group (ASX:COL) also faced pressure as both companies revealed they were facing class action lawsuits over allegedly misleading discounting practices. Both are preparing to defend themselves against the claims.

Mineral Resources (ASX:MIN) found itself in hot water again, admitting it should have disclosed a rental relief scheme benefitting firms tied to its founder’s daughter.

The scheme, which had been in place for over a decade, wasn’t initially seen as “materially price sensitive” but the company has now recognised the need for greater transparency. MinRes shares dropped almost 4%.

What else happened today?

Some good news out of China as retail sales grew 4.8% in October, the fastest pace in eight months, according to data released this afternoon.

This signals the effectiveness of Beijing’s recent stimulus measures. However, industrial output only grew 5.3%, showing that the stimulus is having mixed results.

Following the data release, most Asian stock markets gained.

Meanwhile, US markets showed signs of fatigue, with the S&P 500 and Nasdaq both slipping last night as inflation worries and strong economic data prompted rate cut caution.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| NVQ | Noviqtech Limited | 0.056 | 180% | 64,142,676 | $3,376,569 |

| EDE | Eden Inv Ltd | 0.002 | 100% | 64,348 | $4,108,209 |

| FAU | First Au Ltd | 0.002 | 100% | 1,667,094 | $1,811,993 |

| CLE | Cyclone Metals | 0.030 | 58% | 27,850,529 | $13,202,635 |

| MTL | Mantle Minerals Ltd | 0.002 | 33% | 720,189 | $9,296,169 |

| BCM | Brazilian Critical | 0.012 | 33% | 10,910,163 | $7,996,594 |

| ERG | Eneco Refresh Ltd | 0.014 | 27% | 31,250 | $2,995,942 |

| IRX | Inhalerx Limited | 0.038 | 27% | 590,000 | $6,335,450 |

| TGN | Tungsten Min NL | 0.068 | 26% | 117,462 | $42,466,371 |

| FHS | Freehill Mining Ltd. | 0.005 | 25% | 3,722,728 | $12,314,111 |

| PRX | Prodigy Gold NL | 0.003 | 25% | 268,613 | $6,350,111 |

| SIT | Site Group Int Ltd | 0.003 | 25% | 19,130,800 | $6,304,980 |

| TAS | Tasman Resources Ltd | 0.005 | 25% | 262,151 | $3,220,998 |

| W2V | Way2Vatltd | 0.010 | 25% | 20,874,163 | $7,315,870 |

| MHK | Metalhawk. | 0.325 | 20% | 506,943 | $27,180,901 |

| FIN | FIN Resources Ltd | 0.006 | 20% | 253,869 | $3,246,344 |

| JRV | Jervois Global Ltd | 0.012 | 20% | 2,431,567 | $27,027,638 |

| SPZ | Smart Parking Ltd | 0.860 | 19% | 1,149,113 | $251,479,588 |

| NOX | Noxopharm Limited | 0.125 | 19% | 34,620 | $30,684,985 |

| DGR | DGR Global Ltd | 0.013 | 18% | 88,008 | $11,480,656 |

| DTZ | Dotz Nano Ltd | 0.085 | 18% | 609,693 | $39,075,990 |

| ASR | Asra Minerals Ltd | 0.004 | 17% | 2,789,950 | $6,756,339 |

| DTR | Dateline Resources | 0.004 | 17% | 2,275,000 | $7,548,781 |

| MLS | Metals Australia | 0.028 | 17% | 394,246 | $17,453,269 |

| SRN | Surefire Rescs NL | 0.004 | 17% | 241,502 | $5,958,923 |

NoviqTech’s (ASX:NVQ) share price surged today after securing a strategic placement to raise $1.05 million to accelerate its blockchain solutions.

The funding was backed by prominent investors, including Antanas Guoga, aka Tony G, a renowned blockchain innovator, whose endorsement bolstered investor confidence. The capital will fast track the development of NoviqTech’s blockchain-powered technology, aimed at supporting sustainability and transparency in business.

InhaleRX’s (ASX:IRX) share price surged after the company received ethics approval to begin a phase II clinical trial for its promising pain treatment, IRX-211.

This trial will target breakthrough cancer pain (BTcP), a severe condition affecting many cancer patients, with IRX-211 offering a non-opioid alternative to current fentanyl-based treatments.

Investors are excited by the potential of IRX-211 to provide rapid pain relief without the dangerous side effects of opioids, positioning the company to tap into a multi-billion dollar market for safer pain management solutions.

Findi (ASX:FND) shares also surged after the company announced its acquisition of Tata Communications’ White Label ATM business, Indicash, for $75.7 million.

The deal significantly expands Findi’s presence in India, adding over 4,600 ATMs to its network and providing access to a proprietary payment switch, which will reduce costs and boost scalability.

With expected revenues of $28-30 million and EBITDA of $5-7 million by FY26, Findi said the acquisition is expected to be immediately accretive to its earnings and accelerate its growth in the Indian financial services market.

Real estate stock Aspen Group (ASX:APZ) rose after the company upgraded its FY25 earnings guidance to 16.0 cents per share, reflecting a 5% increase on previous expectations.

The upgrade was driven by stronger-than-expected development profits, particularly from its Lifestyle housing and land sales, which showed solid growth in both volume and margins.

Aspen also announced stronger rental growth in its residential and lifestyle segments, a solid balance sheet, and an increased ability to capitalise on development opportunities, all of which sparked investor optimism.

Cyclone Metals’ (ASX:CLE) share price also surged after announcing a Memorandum of Understanding (MoU) with global mining giant Vale for the development of its Iron Bear iron ore project in Canada.

Under the deal, Vale will invest up to US$18 million to fund initial development activities, with the potential for Vale to earn a 75% stake in the project as it progresses.

The strategic partnership with Vale, a leader in iron ore production, is seen as a major boost for the project, helping to unlock its full potential and bring it closer to a Decision to Mine.

Vection Technologies’ (ASX:VR1) shares jumped following the announcement of a $0.5 million AI contract with The Digital Box (TDB), which will provide a Dell Algho Appliance to a global leader in railway solutions.

According to Vection, this deal highlights the growing market validation of the company’s AI capabilities, particularly after its planned acquisition of generative AI company TDB. The contract is expected to generate recurring revenue, with additional income projected in 2025 and beyond.

Red Sky Energy (ASX:ROG) rose after the company announced that its partner Santos had mobilised a workover rig to the Yarrow 1 well site in the Innamincka Dome.

The re-entry and planned fracture stimulation at Yarrow 1 are expected to boost gas production and significantly enhance future cash flows, said Red Sky. This follows the success of Yarrow 3, which has already generated over $3 million in revenue.

The work is expected to be completed by January 2025, with Yarrow 1 fully operational by mid-2025, further supporting Red Sky’s long-term growth strategy.

Smart Parking (ASX:SPZ) rose 12% after the company announced an ambitious growth plan at the AGM today.

The company aims to have 3,000 new parking sites under management by December 2028. SPZ said it’s also focusing on expanding its sales team and building a strong pipeline of opportunities, with the number of new sites added each year growing steadily (from 123 in FY21 to a projected 312 in FY24).

The company will also focus on expanding into more countries, including the UK, Germany, Denmark, and New Zealand, while continuing to explore expansion in Scandinavia, Europe and the USA.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MTB | Mount Burgess Mining | 0.001 | -33% | 5,405,503 | $1,947,220 |

| RML | Resolution Minerals | 0.002 | -25% | 500,000 | $3,220,044 |

| SIS | Simble Solutions | 0.003 | -25% | 9,011,417 | $3,013,803 |

| PEN | Peninsula Energy Ltd | 0.064 | -23% | 94,681,417 | $264,529,234 |

| BUY | Bounty Oil & Gas NL | 0.004 | -20% | 2,378,000 | $7,492,505 |

| CAV | Carnavale Resources | 0.004 | -20% | 6,496,200 | $20,451,092 |

| CZN | Corazon Ltd | 0.004 | -20% | 12,290 | $3,339,528 |

| VEE | Veem Ltd | 1.165 | -19% | 481,177 | $194,150,316 |

| EPX | Ept Global Limited | 0.018 | -18% | 70,454 | $13,336,576 |

| OLI | Oliver'S Real Food | 0.009 | -18% | 792,408 | $4,848,051 |

| HLS | Healius | 1.325 | -17% | 7,747,397 | $1,154,551,220 |

| ODE | Odessa Minerals Ltd | 0.007 | -18% | 15,021,800 | $10,780,402 |

| ATC | Altech Batt Ltd | 0.057 | -17% | 12,452,927 | $133,575,014 |

| 3PL | 3P Learning Ltd | 0.800 | -17% | 9,250 | $263,354,794 |

| ERA | Energy Resources | 0.003 | -17% | 10,009,869 | $66,444,898 |

| IVX | Invion Ltd | 0.003 | -17% | 2,741,394 | $20,449,775 |

| PVT | Pivotal Metals Ltd | 0.010 | -17% | 7,397,336 | $10,493,711 |

| EWC | Energy World Corpor. | 0.016 | -16% | 2,303,659 | $58,499,504 |

| BRX | Belararoxlimited | 0.200 | -15% | 1,069,457 | $29,845,442 |

| GTI | Gratifii | 0.006 | -14% | 2,891,332 | $31,539,169 |

| MEG | Megado Minerals Ltd | 0.012 | -14% | 209,579 | $4,094,378 |

| TYX | Tyranna Res Ltd | 0.003 | -14% | 1,990 | $11,507,739 |

| SCP | Scalare Partners | 0.215 | -14% | 62,994 | $8,720,700 |

| MSB | Mesoblast Limited | 1.545 | -13% | 7,191,672 | $2,032,375,723 |

Peninsula Energy’s (ASX:PEN) shares dropped heavily after the company announced delays and cost overruns at its flagship Lance uranium project.

The construction of the Central Processing Plant (CPP) is now expected to cost an additional US$9.5 million, and the production ramp-up for 2025 has been revised downwards to 600,000 lbs of uranium, from the previous forecast of 700,000 to 900,000 lbs.

Also, the company faced challenges with commissioning new systems, causing further delays. Despite having a solid cash balance, these issues, along with management changes, have raised some concerns.

IN CASE YOU MISSED IT

Cyclone Metals (ASX:CLE) has entered a MoU with Vale, one of the world’s largest iron ore producers, to fast-track development of the Iron Bear project. The MoU defines a two-phased investment pathway for Vale to earn a controlling interest in Iron Bear, with the first investment comprising a contribution of up to US$18 million.

Pure Hydrogen (ASX:PH2) is spinning off its Australian natural gas assets into a new ASX-listed company to focus on the commercial rollout of its zero emissions vehicles and hydrogen infrastructure business.

The new company – Eastern Gas – will look to raise between $8m and $10m through an initial public offering to fund near-term works at its Windorah gas project in the Cooper Basin and Project Venus in the Walloon coal seam gas fairway.

Blue Star Helium (ASX:BNL) is now clear to start development drilling this quarter at its Galactica/Pegasus helium project in Las Animas county, Colorado, after securing permits for five additional development wells.

The Colorado Energy and Carbon Management Commission (ECMC) awarded drilling permits for the proposed Jackson 27 SWSE, Jackson 31 SENW, Jackson 29 SWNW, Jackson 2 L4 and Jackson 4 L4 development wells.

Medtech EBR Systems (ASX:EBR) has reported a milestone quarter underpinned by submission of the final module of its premarket approval application to the US FDA for its WiSE CRT system.

The company submitted its final module of PMA application to US FDA in August and a substantive review is now underway.

CuFe’s (ASX:CUF) subsidiary Jackson Minerals has sold its 2% net smelter royalty over the Crossroads gold project to project owner Northern Star. The funds will be used to progress CuFe’s Tennant Creek copper-gold project which hosts a resource of 7.3Mt of copper at 1.7% and 0.6g/t gold.

D3 Energy (ASX:D3E) has begun production testing at the RBD12 well recently drilled at its helium and natural gas ER315 project in South Africa.

The aim is to evaluate reservoir characteristics, flow rates, and pressure responses, as well as gas composition, which will provide critical data to inform the company’s ongoing exploration and development strategy – and plans to eventually submit a Production Right application to South African authorities.

Dimerix (ASX:DXB) has received a $7.9m R&D tax rebate for the 2023/24 financial year, putting the company in a solid financial position as it progresses the ACTION3 phase III clinical trial of its DMX-200 treatment for Focal Segmental Glomerulosclerosis (FSGS) kidney disease.

“We greatly appreciate the support of the Australian government with this invaluable incentive, as Dimerix advances DMX-200 towards potential commercialisation,” CEO and MD Dr Nina Webster said.

Altech Batteries (ASX:ATC) is raising $4m at $0.06 per share to progress its CERENERGY salt-based batteries and Silumina Anodes projects, including securing project finance, bank due diligence processes, securing offtake, and environmental and project permitting.

The funds will also be directed towards the fabrication of second 60kWh battery prototype for CERENERGY project and commissioning of the Silumina Anodes pilot plant in Germany.

At Stockhead, we tell it like it is. While Cylone Metals, Pure Hydrogen, Blue Star Helium, EBR Systems, CuFe, D3 Energy, Dimerix and Altech Batteries are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.