Closing Bell: ASX ends down just 0.11pc after seesawing through trade

The ASX mostly managed to keep its footing today, sliding just 0.11pc after an unsettled day of trading. Pic: Getty Images

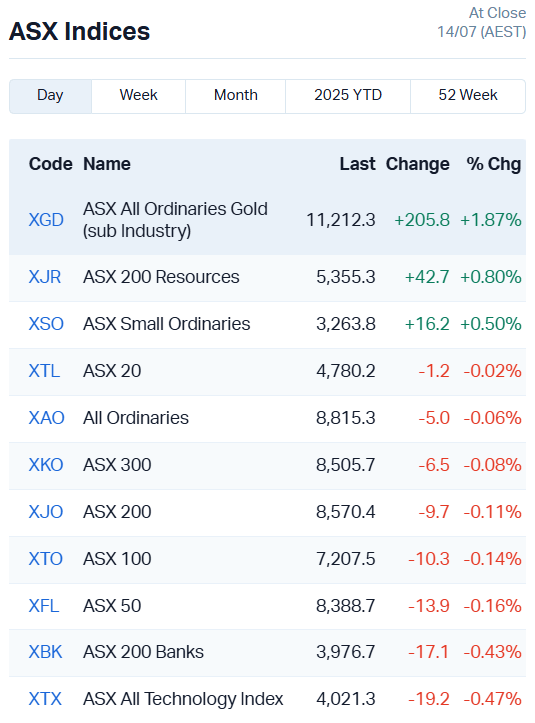

- ASX walks tightrope to slide just 9.7 points

- All Ords gold sub-index climbs 1.87pc

- Iron ore prices boost big cap mining stocks

ASX slides on renewed tariff threats

The ASX 200 finished the day down 0.11%, having plunged a good 20 points in the first hour.

The bourse staged a midday recovery to touch an intraday high of 8592 points before hawing and hemming through trade, finishing 9.7 points lower at 8570.4.

It was a tale of competing global powers, with new tariff threats from Trump’s White House warring with a positive start to a green steel forum between Australian and Chinese companies. The iron ore price has been heading back in the direction of US$100/t despite the tariff uncertainty, buoying Aussie miners who eat the red dirt for breakfast.

Fears over economic fallout from a freshly minted 30% tariff on goods from Mexico and the EU (starting August 1) appear to have won out today.

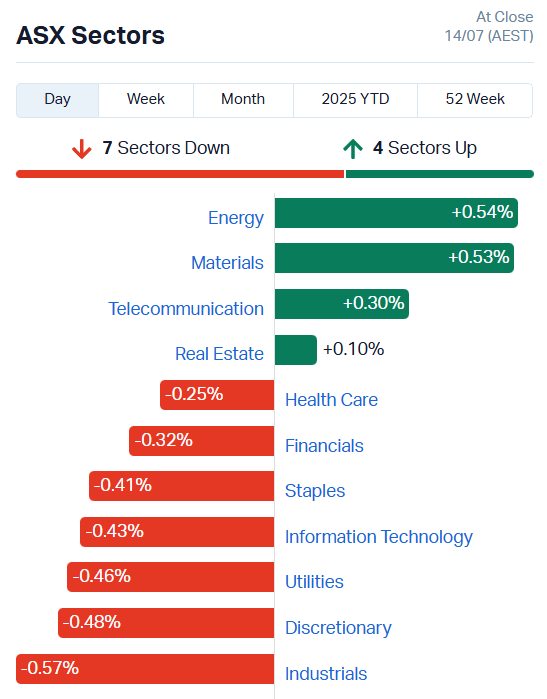

Of our 11 sectors, 7 are down. Only energy (+0.54%), materials (+0.53%), telecoms (+0.30%) and real estate (+0.10%) made headway.

Taking a squizz at our indices for the day, the ASX 200 Resources performed well, up 0.80%. It was supported by a buoyant gold index, which climbed 1.87%.

Is TACO a self-defeating prophecy?

The market reaction to the new tariffs has been fairly muted overall.

The idea that President Trump will usually back down from these sorts of policies has taken root in trader sentiment, dampening alarmist sentiment.

Capital Economics chief North America economist Paul Ashworth is concerned that very assumption could give Trump the confidence to follow through.

“The lack of reaction to this week’s tariff déjà vu is presumably because Trump now has a reputation for backing down from his aggressive tariff threats,” Ashworth noted over the weekend.

“But that creates a dangerous circularity, since the main reason Trump was forced to shelve his Liberation Day plans originally was because of the sell-off in not only the equity market but the Treasury market too.

“Without that pressure, Trump may feel more emboldened to follow through this time, particularly since up to now at least tariffs appear to have had little impact on final consumer goods prices and claims the economy would be plunged into recession have been proven wrong.”

PM hails “successful” green steel roundtable

Prime Minister Anthony Albanese has described a green steel roundtable discussion between Australian and Chinese stakeholders as “very successful” as he spoke to reporters following the meeting.

While the Prime Minister has indicated he believes industry should take the lead in building stronger trade relations within the green steel sector, Albanese has signalled the government will support those efforts.

“What we need are enabling policy environments, extensive investments in research to develop new technologies and collaboration across academia, industry and government,” the Prime Minister said in his roundtable address.

“Australia and China each have major stakes in how the decarbonisation efforts develop.

“As both countries cooperate to advance decarbonisation, we also need to work together to address global excess steel capacity.

“It is in both countries’ interests to ensure a sustainable and market-driven global steel sector.”

The Prime Minister was joined by executives from the top steel players in both China and Australia, including CEOs from Rio Tinto (ASX:RIO), BHP (ASX:BHP) and Fortescue (ASX:FMG).

“Rio Tinto is working closely with our Chinese customers to support the development of low-carbon steelmaking technologies, leveraging Australia’s high-quality iron ore and China’s manufacturing expertise to drive real progress on emissions reduction,” Rio Tinto CEO Kellie Parker said.

Spot prices for iron ore climbed 0.5% over the last 5 trading days to touch US$96.71 a tonne on Friday, adding another 2.9% to reach US$99.60 a tonne today.

Most of our larger iron ore companies have responded as expected – Rio Tinto has added 0.77%, BHP 1.1% and Mineral Resources (ASX:MIN) 1.78%, but Fortescue slid 0.65% lower.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.002 | 100% | 351624 | $304,511 |

| OSX | Osteopore Limited | 0.016 | 60% | 37758327 | $1,830,431 |

| EEL | Enrg Elements Ltd | 0.0015 | 50% | 484000 | $3,253,779 |

| GMN | Gold Mountain Ltd | 0.003 | 50% | 3217402 | $11,239,518 |

| BM1 | Ballardmininglimited | 0.37 | 48% | 8146212 | $45,922,302 |

| NVQ | Noviqtech Limited | 0.038 | 46% | 3591198 | $6,539,950 |

| ODA | Orcoda Limited | 0.088 | 35% | 294298 | $12,188,424 |

| LOC | Locatetechnologies | 0.175 | 35% | 1612899 | $30,440,054 |

| BLZ | Blaze Minerals Ltd | 0.004 | 33% | 200050 | $5,335,392 |

| CRR | Critical Resources | 0.004 | 33% | 29591322 | $8,310,256 |

| RCMDB | Rapid Critical | 0.032 | 33% | 186979 | $2,489,889 |

| SFG | Seafarms Group Ltd | 0.002 | 33% | 36752 | $7,254,899 |

| SHP | South Harz Potash | 0.004 | 33% | 2409259 | $3,849,186 |

| AMS | Atomos | 0.005 | 25% | 532130 | $4,860,074 |

| MOH | Moho Resources | 0.005 | 25% | 25080 | $2,981,656 |

| MRD | Mount Ridley Mines | 0.0025 | 25% | 20343 | $1,556,978 |

| PRX | Prodigy Gold NL | 0.0025 | 25% | 1019762 | $6,350,111 |

| RNX | Renegade Exploration | 0.005 | 25% | 15055892 | $5,153,454 |

| SPQ | Superior Resources | 0.005 | 25% | 2119999 | $9,483,931 |

| TMK | TMK Energy Limited | 0.0025 | 25% | 11732049 | $20,444,766 |

| WBE | Whitebark Energy | 0.005 | 25% | 10090 | $2,802,231 |

| CC5 | Clever Culture | 0.021 | 24% | 4757288 | $30,032,035 |

| WCE | Westcoastsilver Ltd | 0.1 | 23% | 2478393 | $21,069,799 |

| PRS | Prospech Limited | 0.022 | 22% | 107518 | $6,818,866 |

| CMP | Compumedics Limited | 0.305 | 22% | 146188 | $48,054,474 |

Making news…

Osteopore (ASX:OSX) products will soon hit Swiss shelves, after both its custom-made and off-the-shelf 3D printed cranial implants got the green light under European Union Medical Device Regulation.

The tick of approval clears the way to roll out the full suite of biomimetic and bioresorbable implants in Switzerland and the greater European market.

Smart transport company Orcoda (ASX:ODA) has locked in multiple SaaS contracts with community transport providers across Australia, following a successful federal government trial of its transport software.

With an initial 3-year term, ODA expects the new deals to generate $1 million in incremental revenue.

Between the new contracts and upgrades to existing agreements, the company is forecasting an overall annual recurring revenue of about $5m, representing a 23% year-on-year growth in ARR.

Also moving within the software-as-a-service space, Locate Technologies (ASX:LOC) has activated its at-the-market facility agreement with Novus Capital to raise just under $169k within a larger capital raising.

That brings LOC’s total proceeds to just over $1.4m, at an average issue price of $0.161.

Clever Culture (ASX:CC5) has deepened its relationship with pharmaceutical giant Novo Nordisk through a new purchase order for an APAS Independence instrument.

The European biotech behemoth is looking at the potential benefits of integrating CC5’s APAS technology into its manufacturing network, particularly focusing on the 90mm and contact plate analysis modules for the reading of culture plates used in pharmaceutical environmental monitoring.

Compumedics (ASX:CMP) has lifted its yearly sales by 22% compared to the 2024 FY, raking in $63.4m in sales orders.

Management says the strong sales numbers are a result of building a more predictable, high-margin business model and a resulting increase in revenue, better margins, and meaningful traction in the US and beyond.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Code | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| MIOR | Macarthur Minerals | 0.001 | -50% | 20000 | $199,666 |

| FTC | Fintech Chain Ltd | 0.002 | -33% | 541727 | $1,952,309 |

| GGE | Grand Gulf Energy | 0.002 | -33% | 1200109 | $8,461,275 |

| TYX | Tyranna Res Ltd | 0.003 | -25% | 2756275 | $13,153,701 |

| PPY | Papyrus Australia | 0.008 | -24% | 343749 | $6,013,158 |

| BUY | Bounty Oil & Gas NL | 0.002 | -20% | 71211 | $3,903,680 |

| CUL | Cullen Resources | 0.004 | -20% | 681 | $3,467,009 |

| TNY | Tinybeans Group Ltd | 0.105 | -19% | 72778 | $19,228,357 |

| OAK | Oakridge | 0.065 | -19% | 4304 | $2,159,833 |

| HWK | Hawk Resources. | 0.018 | -18% | 1118843 | $5,960,448 |

| PFE | Pantera Lithium | 0.019 | -17% | 11551323 | $10,897,025 |

| 1AI | Algorae Pharma | 0.005 | -17% | 18150 | $10,124,368 |

| AUK | Aumake Limited | 0.0025 | -17% | 50000 | $9,070,076 |

| AYT | Austin Metals Ltd | 0.0025 | -17% | 609756 | $4,752,574 |

| BNL | Blue Star Helium Ltd | 0.005 | -17% | 281896 | $16,169,312 |

| MSG | Mcs Services Limited | 0.005 | -17% | 600000 | $1,188,598 |

| PRM | Prominence Energy | 0.0025 | -17% | 24999 | $1,459,411 |

| SLZ | Sultan Resources Ltd | 0.005 | -17% | 21000 | $1,388,819 |

| ADO | Anteotech Ltd | 0.011 | -15% | 4358483 | $35,168,904 |

| PGY | Pilot Energy Ltd | 0.011 | -15% | 17598202 | $28,062,580 |

| RMI | Resource Mining Corp | 0.017 | -15% | 1513958 | $14,689,067 |

| ADY | Admiralty Resources. | 0.006 | -14% | 22640 | $18,406,356 |

| KGD | Kula Gold Limited | 0.006 | -14% | 1625905 | $6,448,776 |

| SHO | Sportshero Ltd | 0.025 | -14% | 1289885 | $21,211,936 |

| ATG | Articore Group Ltd | 0.195 | -13% | 179152 | $64,027,997 |

IN CASE YOU MISSED IT

Trigg Minerals (ASX:TMG) has defined an exploration target of 12.8 to 15.6 million tonnes at 0.75% to 1.5% antimony for the Antimony Canyon Project in Utah.

Asra Minerals (ASX:ASR) will launch a 3000m RC drilling program this week at its Leonora South gold project, targeting the Challenge and Eclipse prospects.

Following a $30 million raise, Ballard Mining (ASX:BM1) begins ASX trading with plans to undertake 130,000m of drilling in gold quest at Mt Ida. BM1 closed 48% up on its 25c IPO price.

Tunsgten Mining (ASX:TGN) will integrate early oxide gold extraction into development plans for Mt Mulgine, de-risking access to the tungsten ore body.

With silver demand forecast to reach a record 680Moz in 2025, Lithium Universe (ASX:LU7) has chosen to prioritise silver recovery using its recently acquired solar panel recycling technology.

St George Mining (ASX:SGQ) has begun drilling at the Araxá project in Brazil, looking to add to the 40.64 million tonnes at 4.13% TREO resource.

WA rare earths play Victory Metals (ASX:VTM) will gain access to the corridors of power in the Pentagon as it chases funding and support for its North Stanmore project.

TRADING HALTS

Babylon Pump & Power (ASX:BPP) – potential acquisition and debt funding

Dalaroo Metals (ASX:DAL) – cap raise

Imugene (ASX:IMU) – cap raise

Saunders International (ASX:SND) – acquisition and equity raise

Scalare Partners Holdings (ASX:SCP) – cap raise

At Stockhead, we tell it like it is. While Clever Culture and Compumedics are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.