Closing Bell: ASX edges lower as traders wait for Israel-Iran clarity

ASX traders are taking cover as tensions continue to simmer between Israel and Iran, driving the market 0.15pc lower. Pic: Getty Images

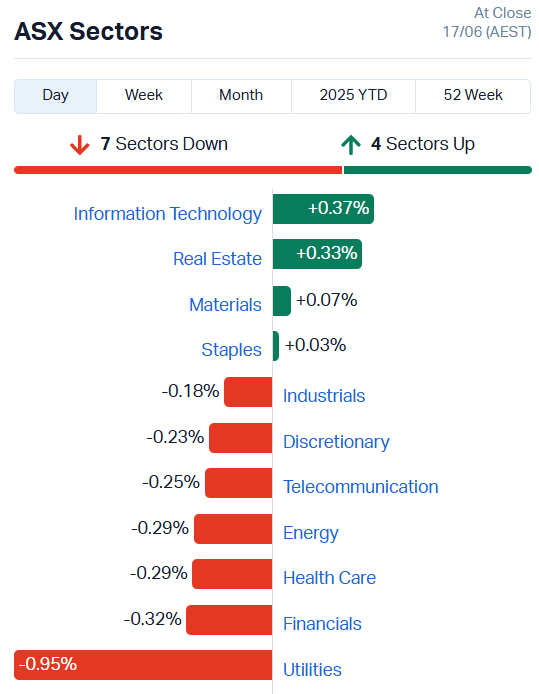

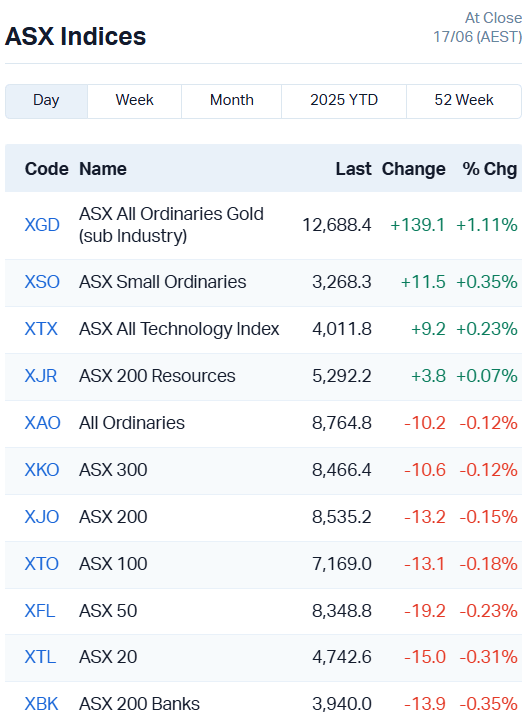

- ASX slips 0.04pc, pushed lower by utilities sector

- Gold index props up materials sector, adding 1.11pc

- Uranium stocks continue to climb

The Australian market slid in the face of global headwinds today, losing 0.04%.

Most of the sectors were dragging, particularly utilities which shed 0.95%.

The energy sector also moved lower despite another round of outsized gains in ASX uranium stocks, up once again after making double digit moves yesterday.

Bannerman (ASX:BMN) added 11%, Lotus (ASX:LOT) 10%, Deep Yellow (ASX:DYL) 5%, Paladin (ASX:PDN) 4% and Boss (ASX:BOE) just under 3%.

The rally was sparked by Sprott, a Toronto-based asset management firm, signalling it intends to buy US$200 million of yellowcake through its Sprott Physical Uranium Trust.

That’s double what the firm originally intended to raise for the purchase, having accepted US$100 million in oversubscribed offers – a reflection of strong investor interest in uranium.

Uranium’s spot market is fairly illiquid, with most purchases being made through long-term contracts directly between producers and utility companies. But that means on-market purchases can have pronounced impacts on spot prices, which in turn influence prices paid under contracts.

The only other spots of optimism on the market today came in resources, where gold stocks pushed the materials sector into the green after posting a 1.11% gain.

Oil tanker companies feel the heat of Iran-Israel conflict

A report on X from Oilprice.com claims tanker firms are already feeling the pressure from open hostilities between Israel and Iran despite the Strait of Hormuz remaining open at present.

Tanker firms are pulling back from Gulf routes—even without a Hormuz closure. Freight rates +20%, war-risk insurance up $3–8/bbl, and VLCC bookings plummet. This isn’t just a headline scare—real volatility is brewing. #oiltankers #StraitOfHormuz #shippingrisk #energysecurity…

— OilPrice.com (@OilandEnergy) June 17, 2025

With US President Trump cutting his G7 appearance short and taking to Truth Social to suggest civilians should evacuate Tehran, a ceasefire certainly doesn’t seem forthcoming.

About four hours ago the Israeli Defence Force warned missiles had been launched at Israel from Iran, cautioning citizens to seek shelter.

Reuters reports Tehran has asked several Gulf states to pressure the US to intervene, ostensibly to push Israel to accept an immediate ceasefire.

According to several sources, Iran has signalled its willingness to be flexible in nuclear talks with the US if a ceasefire is reached.

An Iranian source claims Iran is serious in its desire for a ceasefire, fearing an escalation could spread across the volatile region and spark a wider conflict.

Any increase in tensions is likely to have a big impact on oil prices, and potentially drive-up inflationary pressures just as global economies begin to ratchet down monetary policy.

ASX SMALL CAP LEADER

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| PVT | Pivotal Metals Ltd | 0.012 | 100% | 43506549 | $5,443,355 |

| AR9 | Archtis Limited | 0.135 | 61% | 3109544 | $24,189,241 |

| VR8 | Vanadium Resources | 0.022 | 57% | 7796902 | $7,900,086 |

| AXP | AXP Energy Ltd | 0.0015 | 50% | 142500 | $6,684,681 |

| RAN | Range International | 0.0015 | 50% | 416980 | $939,290 |

| FMR | FMR Resources Ltd | 0.295 | 44% | 2463147 | $4,338,891 |

| AQX | Alice Queen Ltd | 0.004 | 33% | 65343 | $3,748,920 |

| SRL | Sunrise | 0.65 | 31% | 705757 | $44,662,612 |

| FDR | Finder | 0.085 | 31% | 3371260 | $18,478,740 |

| T3D | 333D Limited | 0.009 | 29% | 289552 | $1,233,284 |

| BEZ | Besragoldinc | 0.06 | 28% | 1460527 | $19,528,357 |

| E25 | Element 25 Ltd | 0.245 | 26% | 618291 | $44,579,418 |

| VN8 | Vonex Limited. | 0.025 | 25% | 35470 | $15,052,071 |

| ATV | Activeportgroupltd | 0.01 | 25% | 1064983 | $5,479,817 |

| AUK | Aumake Limited | 0.0025 | 25% | 204948 | $6,046,718 |

| ENT | Enterprise Metals | 0.0025 | 25% | 2500000 | $2,362,635 |

| MEL | Metgasco Ltd | 0.0025 | 25% | 496667 | $3,413,768 |

| PRM | Prominence Energy | 0.005 | 25% | 871601 | $1,556,706 |

| SRK | Strike Resources | 0.04 | 25% | 171526 | $9,080,000 |

| TOE | Toro Energy Limited | 0.205 | 24% | 539507 | $19,846,505 |

| CP8 | Canphosphateltd | 0.031 | 24% | 112242 | $7,669,013 |

| APC | APC Minerals | 0.011 | 22% | 1650808 | $2,636,400 |

| GCM | Green Critical Min | 0.022 | 22% | 56289224 | $44,179,709 |

| GRL | Godolphin Resources | 0.011 | 22% | 1004863 | $4,039,860 |

| HTG | Harvest Tech Grp Ltd | 0.018 | 20% | 722268 | $13,439,201 |

Making news…

Vanadium Resources (ASX:VR8) is eyeing a transition to near-term production for its Steelpoortdrift vanadium project, after inking an MoU with China Precious Asia for the supply of magnetite ore.

While non-binding at this stage, VR8 has agreed to provide 100,000 tonnes of vanadium-rich direct shipping magnetite ore per month, subsequently unlocking early-stage revenue to support staged development of Steelpoortdrift.

Metgasco (ASX:MEL) released its monthly gas production results for its assets in the Odin and Vali gas fields, notching an 8% increase on the previous month to produce 100MMscf of raw gas.

Pivotal Metals (ASX:PVT) went into a trading halt today, following a price query letter from the ASX and ahead of release of a new set of exploration results, expected on Thursday.

The company recently identified bonanza grade gold up to 28m at 45.2g/t gold and 3.2% copper from a review of historical underground drilling data at the Lorraine project, part of the company’s Belleterre-Angliers Greenstone Belt project portfolio.

Finder Energy Holdings (ASX:FDR) has signed a strategic alliance with global energy giant SLB to speed up development of its Kuda Tasi and Jahal oil fields.

The deal will cut about 12 months off the project timeline, with SLB already mobilising teams to kick off drilling and subsea design work. The partnership reduces Finder’s upfront costs through a shared contracting model, and creates a joint project team to drive things forward.

Harvest Technology (ASX:HTG) says it’s one year ahead of schedule on its 3-year pathway to profitability, already expecting a 50% reduction in EBITDA loss compared to the 2024 financial year.

With its Edge AI-enabled NEON solution due to launch in the first half of FY26, HTG reckons it’s got a strong pipeline with growing interest from global defence integrators.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| REY | REY Resources Ltd | 1.1 | -4211% | 7800 | $4,019,657 |

| ADD | Adavale Resource Ltd | 0.1 | -3333% | 4834834 | $3,430,919 |

| FTC | Fintech Chain Ltd | 0.2 | -3333% | 208442 | $1,952,309 |

| JAY | Jayride Group | 0.1 | -3333% | 2857227 | $2,141,834 |

| PAB | Patrys Limited | 0.1 | -3333% | 1580000 | $3,086,171 |

| SFG | Seafarms Group Ltd | 0.1 | -3333% | 660744 | $7,254,899 |

| SRJ | SRJ Technologies | 0.4 | -3333% | 17087066 | $3,633,468 |

| CLG | Close Loop | 3 | -2857% | 11414567 | $22,337,694 |

| MGU | Magnum Mining & Exp | 0.3 | -2500% | 370080 | $4,486,603 |

| WEL | Winchester Energy | 0.15 | -2500% | 3624645 | $2,726,038 |

| SCP | Scalare Partners | 12 | -2000% | 29369 | $6,275,253 |

| ADY | Admiralty Resources. | 0.4 | -2000% | 350000 | $13,147,397 |

| DGR | DGR Global Ltd | 0.4 | -2000% | 90 | $5,218,480 |

| MRR | Minrex Resources Ltd | 0.8 | -2000% | 2000000 | $10,848,675 |

| OEL | Otto Energy Limited | 0.4 | -2000% | 12561765 | $23,975,049 |

| TFL | Tasfoods Ltd | 0.4 | -2000% | 8628 | $2,185,478 |

| VEN | Vintage Energy | 0.4 | -2000% | 5924095 | $10,434,568 |

| WBE | Whitebark Energy | 0.4 | -2000% | 49851 | $3,436,668 |

| LOC | Locatetechnologies | 10.5 | -1923% | 9935719 | $29,722,769 |

| SMM | Somerset Minerals | 1.9 | -1739% | 17455119 | $9,722,874 |

| PEB | Pacific Edge | 8.7 | -1714% | 152 | $85,251,177 |

| ADG | Adelong Gold Limited | 0.5 | -1667% | 76330475 | $12,412,060 |

| ICR | Intelicare Holdings | 0.5 | -1667% | 143001 | $2,917,129 |

| KPO | Kalina Power Limited | 0.5 | -1667% | 24326 | $17,597,818 |

| RDN | Raiden Resources Ltd | 0.5 | -1667% | 1163221 | $20,705,349 |

TRADING HALTS

Codeifai (ASX:CDE) – potential acquisition

EV Resources (ASX:EVR) – cap raise & board changes

Meeka Metals (ASX:MEK) – cap raise

New World Resources (ASX:NWC) – cap raise

Peak Minerals (ASX:PUA) – awaiting exploration results

Singular Health Group (ASX:SHG) – cap raise & material contract

South Harz Potash (ASX:SHP) – cap raise

Staude Capital Global Value Fund (ASX:GVF) – cap raise

IN CASE YOU MISSED IT

Greenvale Energy’s (ASX:GRV) recent airborne magnetic and radiometric surveys have identified significant uranium anomalies at its Elkedra and Douglas River uranium projects in the NT.

Green Critical Minerals (ASX:GCM) has completed the construction and commissioning phases of its commercial-scale VHD graphite plant with first production imminent.

Western Gold Resources (ASX:WGR) could soon be enjoying the fruits of the high gold price environment after reaching a binding toll milling agreement with WMC for its Gold Duke project in WA’s Northern Goldfields.

MTM Critical Metals (ASX:MTM) has signed a MoU with Meteoric Resources to work on downstream rare earth processing solutions.

Locksley Resources (ASX:LKY) has seen a tidal wave on interest since it began exploration at the Mojave project in California, literally on the doorstep of the US’ only active rare earths mine.

Future Battery Minerals (ASX:FBM) has identified 13 gold targets at its Miriam project in Western Australia’s Goldfields.

Developer of a new class of synthetic anti-infectives, Recce Pharmaceuticals (ASX:RCE) is boosting its balance sheet securing a debt facility of up to ~$30 million to support Phase III registrational trials in Indonesia and Australia.

At Stockhead, we tell it like it is. While Finder Energy is a Stockhead advertiser, it did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.