CLOSING BELL: ASX eases to +0.39pc, led to greener pastures by a surging Health Care market

Winners are grinners on the ASX this arvo. Pic via Getty Images.

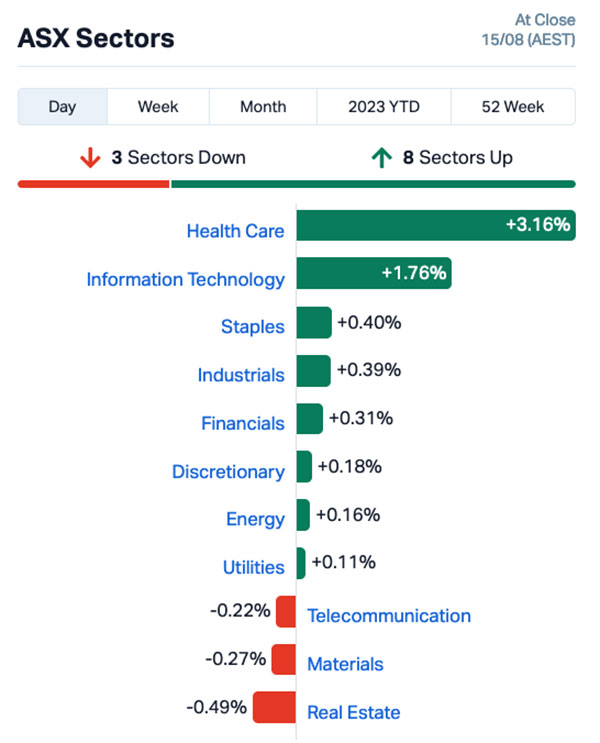

- The ASX 200 benchmark has climbed down from highs at lunch to finish on +0.39%.

- Health Care was well out in front of the market all day, thanks to a chunky bump for CSL.

- Voltaic Strategic Resources won the Small Caps Cup, rising 22.5% for the day.

Local markets put in a respectable day’s work today, backing in a welcome +0.39% rise off the back of a tech surge on Wall Street, and a massive bump for local Health Care mob CSL (ASX:CSL), which saw the big biotech add more than 4.1% to its already super-hefty market cap.

That was enough to push the Health Care sector out to an insurmountable lead, with the local InfoTech sector doing its best to ride a wave of Wall Street positivity in its wake and the rest of the market doing not very much at all, really.

It wasn’t all beer and skittles for the large caps, though – employment website Seek (ASX:SEK) took a beating today, dropping more than 5.2% on news that there aren’t all that many job vacancies at the moment, which means profits for Seek have declined.

And it’s not just by a little bit, either – the company told investors of a full year net profit after tax of $203 million, down 16% on 2022, and that’s despite the site upping its prices to deal with a rapid decline in business since last year, a move that delivered a 10% revenue boost to $1.2 billion.

The good news for shareholders is that Seek has promised a $0.23 per share final divvy, taking the total full year payout to $0.47 – and should the RBA’s predictions and rate hike lever pulling come to fruition, the unemployment rate is likely to rise over the coming 6-9 months as well.

Overseas, it looks like China has had another shocker. I mentioned this earlier in Lunch Wrap, but it bears repeating because what happens in China routinely has a massive impact on how things are travelling here in Oz.

In a nutshell: Beijing released July data that broadly missed expectations, but did include a magic act in the middle of it, with a trick called The Amazing Disappearing Youth Unemployment Statistics.

The unemployment rate for 16-24 year olds in June hit a knee-trembling 21.3% in June – but this time around, it’s been ‘mysteriously’ omitted from the report.

That means either someone’s made a mistake and will be spending the next 20 years compiling spreadsheets in Mongolia, or the data is much, much worse than Beijing’s prepared to put its logo on.

And in the time since reporting that, the People’s Bank of China (PBOC) has taken a razor to a couple of key interest rates in a bid to put a rocket or two up the national economy’s blurter.

China’s seven-day reverse repo rate, a crucially important source of short-term funding for banks, has been dropped from 1.9 to 1.8%, while the medium-term lending facility (MLF) rate has been taken from 2.65 to 2.5%.

It’s the largest cut to China’s MLF since April 2020, when the world started to realise that The Great Global Head Cold could actually turn into the gigantic Covid ball-ache that most of us would love to forget.

TODAY’S ASX SMALL CAP LEADERS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| CCE | Carnegie Cln Energy | 0.0015 | 50% | 4,922 | $15,642,574 |

| XTC | Xantippe Res Ltd | 0.0015 | 50% | 98,501 | $11,480,100 |

| INP | Incentiapay Ltd | 0.007 | 40% | 64,314 | $6,325,318 |

| VSR | Voltaic Strategic | 0.05 | 25% | 27,485,367 | $18,052,009 |

| CCO | The Calmer Co Int | 0.005 | 25% | 1,633,368 | $3,268,477 |

| DCX | Discovex Res Ltd | 0.0025 | 25% | 33,333 | $6,605,136 |

| GTG | Genetic Technologies | 0.0025 | 25% | 406,246 | $23,083,316 |

| LSA | Lachlan Star Ltd | 0.01 | 25% | 1,335,064 | $10,552,102 |

| AVM | Advance Metals Ltd | 0.006 | 20% | 1,318,000 | $2,942,794 |

| ELE | Elmore Ltd | 0.006 | 20% | 4,648,750 | $6,996,919 |

| OPN | Oppenneg | 0.012 | 20% | 453,174 | $11,166,796 |

| PRX | Prodigy Gold NL | 0.006 | 20% | 351,000 | $8,755,539 |

| SI6 | SI6 Metals Limited | 0.006 | 20% | 716,666 | $9,969,297 |

| LGM | Legacy Minerals | 0.155 | 19% | 14,324 | $6,997,571 |

| LKE | Lake Resources | 0.25 | 19% | 64,592,250 | $298,713,388 |

| HPC | Thehydration | 0.042 | 17% | 710,221 | $6,490,021 |

| OEL | Otto Energy Limited | 0.021 | 17% | 30,716,914 | $86,310,176 |

| AAU | Antilles Gold Ltd | 0.028 | 17% | 1,276,773 | $14,167,994 |

| ATH | Alterity Therap Ltd | 0.007 | 17% | 500,180 | $14,639,386 |

| EMP | Emperor Energy Ltd | 0.014 | 17% | 1,532,608 | $3,226,350 |

| HOR | Horseshoe Metals Ltd | 0.014 | 17% | 18,040 | $7,721,744 |

| 1TT | Thrive Tribe Tech | 0.031 | 15% | 542,210 | $8,008,781 |

| GUD | G.U.D. Holdings | 11.7 | 14% | 2,014,539 | $1,439,943,793 |

| AVE | Avecho Biotech Ltd | 0.008 | 14% | 744,610 | $15,135,146 |

| BEX | Bikeexchange Ltd | 0.008 | 14% | 1,888,783 | $8,324,051 |

The afternoon saw a changing of the guard at the top of the Small Caps Cup, after Voltaic Strategic Resources (ASX:VSR) came storming out of nowhere to pile on 22.5% (or thereabouts) for the day.

It’s late and I’m tired, and I can’t immediately put my finger on why VSR’s gone up so much today – but my best guess would be that it might have something to do with an odd after-hours transaction of a large chunk of next-door neighbour Delta Lithium last night.

Some 60 million Delta shares, worth $56m, and representing roughly 11% of the company – traded at a hefty 23% premium late yesterday, with the buyer remaining unknown at this stage… so either there’s something afoot that most of us don’t know about, or someone’s playing 4D Chess and snapping up Voltaic on a classic Predictive Nearology hunch.

Voltaic’s rush for the top of the podium was enough to displace lunchtime leader Lake Resources (ASX:LKE), which has ended the day up 19% after the company revealed “successful testing that has proved the concept of extraction and injection to support the production of high purity battery grade lithium carbonate at the Kachi lithium brine project in Catamarca Province, Argentina”.

“The tests represent a significant milestone for the project, as they provide important data and higher confidence for our modelling, which is essential for the completion of our DFS for Phase 1,” Lake CEO David Dickson said, adding: “The results are indicative of high-yield, production-scale, extraction wells in the core resource area.”

And in third place this arvo, it’s Otto Energy (ASX:OEL), up 16.7% on no hugely significant news, other than the company receiving a US$5.8 million chunk of a previously announced insurance payout.

The insurance claim relates to damage that occurred during the recompletion of the Green Canyon 21 (GC 21) “Bulleit” well in September 2022, and while the process of the insurance claim review is ongoing, there’s no clear indication of when it might be completed, and how much (if any) of the US$8.7 million claim will eventually be settled.

TODAY’S ASX SMALL CAP LAGGARDS

Here are the best performing ASX small cap stocks:

Swipe or scroll to reveal full table. Click headings to sort:

| Code | Company | Price | % | Volume | Market Cap |

|---|---|---|---|---|---|

| APC | Aust Potash Ltd | 0.004 | -47% | 11,320,126 | $7,790,093 |

| MAY | Melbana Energy Ltd | 0.07 | -33% | 100,554,273 | $353,871,431 |

| KEY | KEY Petroleum | 0.001 | -33% | 4,000 | $2,951,892 |

| MCT | Metalicity Limited | 0.0015 | -25% | 1,687,385 | $7,472,172 |

| BPP | Babylon Pump & Power | 0.004 | -20% | 532,000 | $12,288,857 |

| PEC | Perpetual Res Ltd | 0.023 | -18% | 4,310,470 | $15,273,551 |

| BXN | Bioxyne Ltd | 0.015 | -17% | 261,626 | $34,229,617 |

| MXR | Maximus Resources | 0.03 | -17% | 1,586,634 | $11,529,208 |

| MRQ | Mrg Metals Limited | 0.0025 | -17% | 17,000,000 | $6,557,756 |

| TTT | Titomic Limited | 0.021 | -16% | 3,314,972 | $21,638,214 |

| MRL | Mayur Resources Ltd | 0.24 | -16% | 547,864 | $93,312,658 |

| BNO | Bionomics Limited | 0.011 | -15% | 225,861 | $19,093,561 |

| EXL | Elixinol Wellness | 0.012 | -14% | 852,351 | $6,397,879 |

| LRL | Labyrinth Resources | 0.006 | -14% | 483,478 | $8,312,806 |

| BMR | Ballymore Resources | 0.13 | -13% | 38,626 | $14,447,618 |

| CTP | Central Petroleum | 0.054 | -13% | 149,040 | $45,223,127 |

| AD1 | AD1 Holdings Limited | 0.007 | -13% | 1,196,577 | $6,580,551 |

| CHK | Cohiba Min Ltd | 0.0035 | -13% | 10,000 | $8,852,977 |

| MTB | Mount Burgess Mining | 0.0035 | -13% | 12,607,112 | $4,062,587 |

| RIE | Riedel Resources Ltd | 0.007 | -13% | 1,649,253 | $16,475,256 |

| TAS | Tasman Resources Ltd | 0.007 | -13% | 610,000 | $5,701,354 |

| FRB | Firebird Metals | 0.105 | -13% | 57,524 | $8,769,000 |

| MIO | Macarthur Minerals | 0.185 | -12% | 106,300 | $34,871,232 |

| MEM | Memphasys Ltd | 0.015 | -12% | 1,732,705 | $16,311,846 |

| CUS | Coppersearchlimited | 0.24 | -11% | 48,619 | $14,254,622 |

LAST ORDERS

First cab off the rank this afternoon is Azure Minerals (ASX:AZS), which went into a trading halt yesterday to give the company some time to prep a response to “media speculation”, which was all very mysterious and intriguing.

Azure says that it felt it should confirm that the company had, indeed, previously received expressions (note: more than one) of interest from Sociedad Química y Minera de Chile (SQM), regarding a possible change of control transaction.

The most recent of the approaches was received by Azure on 12 July this year, at a price of $2.31 cash per Azure share – at the time, AZS was trading at $1.72 per share, so the offer represented a hefty 34% premium for existing AZS shareholders.

However, Azure says it’s been knocked back, “following careful consideration of the content of these approaches and in light of our rapidly evolving understanding of the potential of the Andover Lithium Project”.

“Azure determined that the approaches did not warrant further engagement by the Company and no further discussions have occurred.”

It looks like that was a wise decision – at the time of writing today, AZS is up more than 10% for the day to $2.59 a bite.

Meanwhile, over at NewPeak Metals (ASX:NPM) headquarters, the company’s rejuvenation plans are looking set to take another step forward, through a proposed joint venture with ENEXD Group, having its offices in UAE, Mauritius, Switzerland to continue exploration on its gold projects in Finland.

Under the terms of the agreement, ENEXD will pay NPM the amount of €3,000,000 ( aboutAID$5 million) and expend €9,000,000 (AID$15 million) on the further exploration of NPM’s Finland gold permits to acquire a 75% interest in NPM’s wholly owned subsidiaries NewPeak Finland Oy and Kultatie Holding Oy.

“The Company has been working hard over the last 18 months on rejuvenation and this is the second major part of that strategy,” NPM CEO, Boyd White said. “NPM’s assets in Finland have always been attractive and the proposed deal will fully fund the continuation of exploration.”

TRADING HALTS

Fonterra (ASX:FSF) – Implementation of pro rata return of capital to shareholders by way of a court-approved scheme of arrangement.

FINEOS (ASX:FCL) – Capital raising.

Bellavista Resources (ASX:BVR) – Capital raising.

Environmental Clean Technologies (ASX:ECT) – A capital raising and a board restructure.

Pointerra (ASX:3DP) – Capital raising.

Green Critical Minerals (ASX:GCM) – Announcement regarding a previously announced capital raising.

Kinetiko Energy (ASX:KKO) – Project update announcement.

Lunnon Metals (ASX:LM8) – Capital raising.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.